What happened?

Why has the market declined?

Here are some of the factors that have impacted the Indian markets recently

- Concerns on Covid Virus Omicron Variant

- Rising Inflation in US leading to concerns of FED going for earlier than expected rate hikes

- Major Foreign Brokerages raising concerns on Valuations in Indian Equity Markets

- FII Outflows in recent weeks

- Large IPOs hitting the markets and draining liquidity

I am sure all of you have gone through the same sequence of events in the last few weeks.

This leads to the inevitable question…

Is the current market decline a small temporary fall or the start of a large market crash?

An Honest Confession

Let me start with an honest confession…

I don’t know.

Neither does anyone else.

Here is a simple reminder of this truth

With that out of the way…

Let us start with what we know

What does history tell us about market declines?

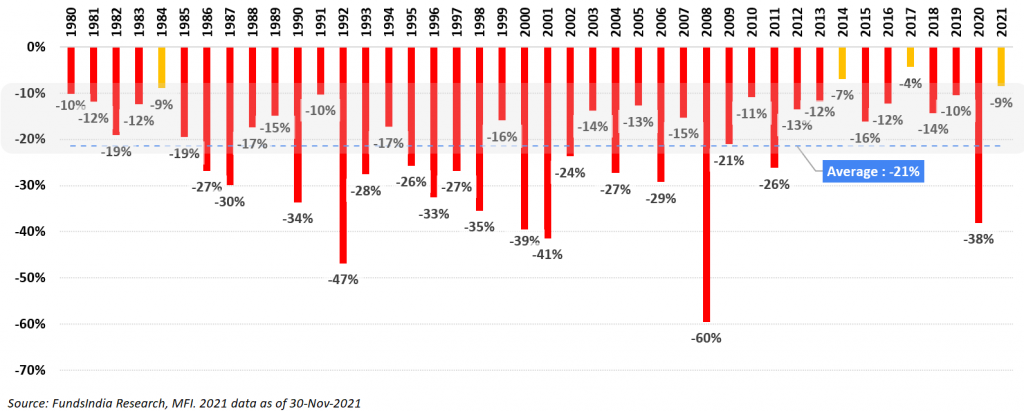

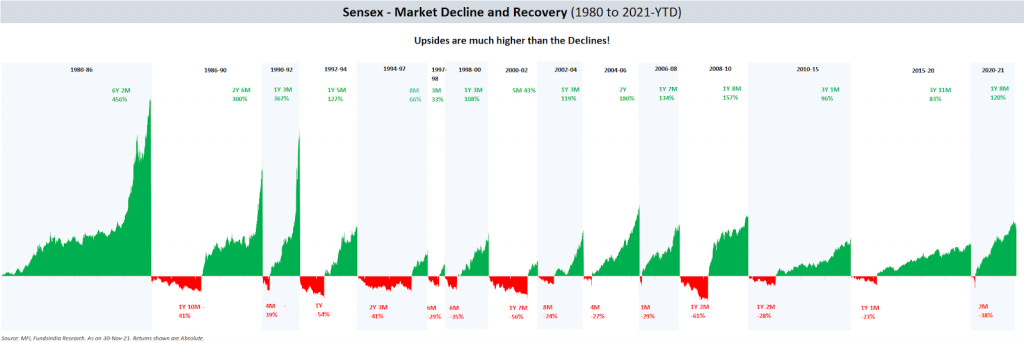

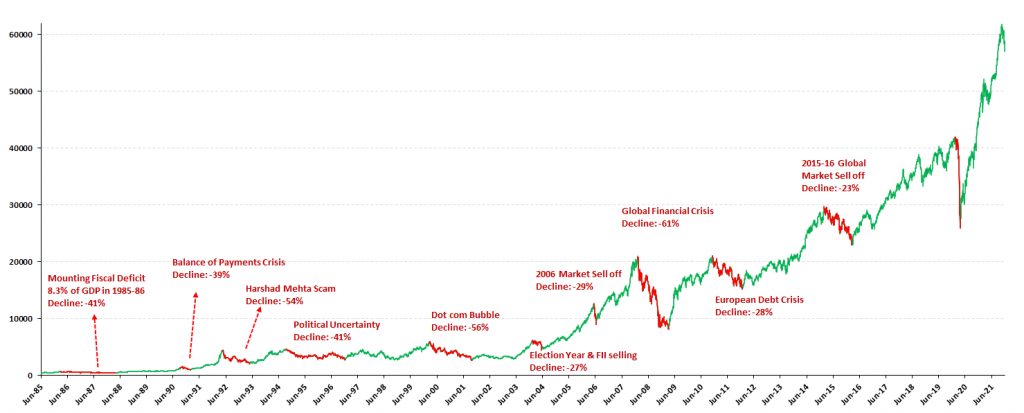

The last 41+ years history of Sensex, has a simple reminder for all of us –

Indian Equity Markets Experience a Temporary Fall EVERY YEAR!

In fact, a 10-20% fall is almost a given every year!

There were only 3 out of 41 years (represented by the yellow bars) where the intra-year fall was less than 10%.

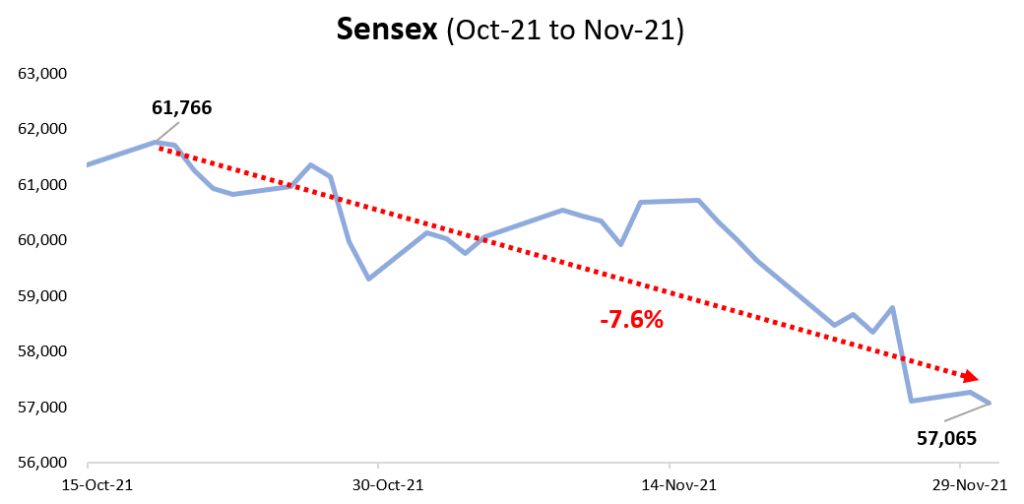

Let us put this in context with the current fall…

It’s ~8% Fall from the peak.

There you go. When viewed from a historical lens, the recent fall of 8% is perfectly normal and there is nothing to be surprised about!

But what about the larger temporary falls (>30%)?

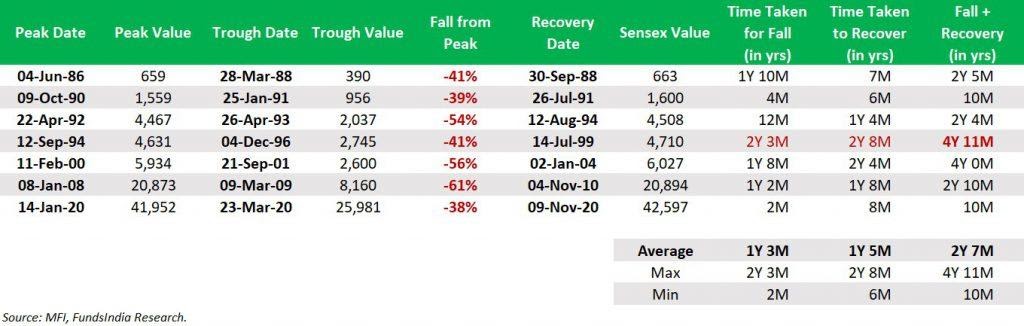

Let us again take the help of history to form a view on how common it is for the market to have a temporary fall of more than 30%.

As seen above, a sharp temporary fall of 30-60% is a lot less frequent than the 10-20% fall. They usually occur once every 7-10 years.

Now that leads to the next important question.

Since every large decline will eventually have to start with a small decline, how do we differentiate between a normal 10-20% fall vs the start of a large fall?

The markets have three phases – Bull, Bubble and Bear

When in a Bubble Phase, the odds of a 10-20% correction converting into a large fall is very high.

How do you check for a Market Bubble?

A Bubble as per our framework is usually characterised by

- Very Expensive Valuations (measured by FundsIndia Valuemeter)

- Top of Earnings Cycle

- Euphoric Sentiments (measured via our FINAL Framework – Flows, IPOs, Surge in New Investors, Sharp Acceleration in Price, Leverage)

We evaluate the above using our Three Signal Framework and Bubble Market Indicator (built based on 30+ indicators)

What is our current evaluation?

Here is how our framework evaluates the current markets

- Valuations are in the Expensive Zone

- Our in-house valuation indicator FI Valuemeter based on MCAP/GDP, Price to Earnings Ratio, Price To Book ratio and Earnings Yield to Bond Yield indicates value of 70 i.e Expensive Zone (as on 30-Nov-2021)

- Earnings Growth – We are in the Bottom of Earnings Growth Cycle – High Odds of Strong Earnings Growth in the next 3-5 years

- Demand Drivers

- Pent up Demand – led by excess savings in CASA + Banks sitting on excess money to lend

- Strong demand for IT services + Salary Hikes

- Acceleration in Manufacturing – China+1, PLI Scheme, Tax incentives

- Banking System Stress – Not as bad as expected + Worst of NPA cycle behind us + expect pick up in credit growth cycle

- Capex Revival led by

- Real Estate Pick up

- Government focus on Infra Spending

- Early Signs of Corporate Capex (Metals, Cement, Renewables etc)

- Global Growth is Supportive

- Low Interest Rates

- Corporate India Well Positioned to Capture the Demand – led by Consolidation and Strong Balance Sheets

- Consolidation of Market Leaders – Big getting Bigger!

- Strong Corporate Balance Sheets – Deleveraging over the last decade has cleaned up Balance Sheets

- Several Key Reforms – PLI, GST, Corporate Tax Cut, IBC, Labour Reforms etc

- Favorable Base

- Subdued earnings growth for the last 10 years

- Return on Equity close to historical lows

- Corporate PAT to GDP (2.6% for FY21) is below long term average

- Credit Growth close to 10Y low

- Demand Drivers

- Sentiment – Neutral – Mixed Signals

- Flows: FII flows (barring recent few months) have remained strong driven by Global liquidity infused by Central Banks. Domestic investor flows have picked up over the last few months and have turned positive on a 12M basis. The increase in DII inflows – may counteract volatility in FII flows led by increasing global yields. Some new NFOs are making record collections.

- IPOs: Early signs of froth – the no of IPOs are picking up and most of them are getting oversubscribed.

- Retail Participation in direct stocks – entering euphoric zone

- Past 3-5Y Returns are around 17% CAGR mark – While on the higher side this is nowhere close to what investors experienced in the 2003-07 bull markets (45%+ CAGR)

Overall, our framework suggests that we are not in an extreme bubble-like market scenario.

Putting all this together – Here is the answer for your question

The likelihood of the current fall converting into a large fall (>30%) is very low.

There is always a ‘BUT…’

As mentioned in the beginning, while the odds of a large fall is very low, there is still a small probability that this becomes a large fall.

If we get a large fall, historically we have seen that markets have eventually recovered and continued to grow (mirroring earnings growth over the long term).

This simple insight can be converted into our advantage if we are able to deploy more money into equities from our debt portion at lower market levels during a sharp market fall.

This can be put into action via the ‘CRISIS’ plan. Here is how it works:

Pre-decide a portion of your debt allocation (say Y) to be deployed into equities if in case market corrects

- If Sensex Falls by ~20% – Move 20% of Y into equities

- If Sensex Falls by ~30% – Move 30% of Y into equities

- If Sensex Falls by ~40% – Move 40% of Y into equities

- If Sensex Falls by ~50% – Move remaining portion from Y into equities

*This is a rough plan and can be adapted to based on your own risk profile

Leave all this. Just tell me what to do in English?

- Maintain original split between Equity and Debt exposure

Rebalance equity allocation if it deviates by more than 5% of original allocation, i.e. move some money from equity to debt and bring it back to original asset allocation split

- If you are waiting to invest new money

- Debt Allocation: Immediately Invest

- Equity Allocation: Invest 30% Immediately and Stagger the remaining 70% via 3-6M STP

- If market fall breaches 20% fall…

Activate the CRISIS Plan!

Summing it up

The simple idea is to accept that short term market movements are not in our control, but how we respond and take advantage of any sharp falls is completely under our control.

This is exactly what we attempt to do by preparing and pre-loading our decisions for different market scenarios. This way you are able to live with the typical 10-20% decline tantrums that the market throws at you without panicking.

At the same time, the not-so-frequent large falls that in hindsight turn out to be opportunities can also be taken advantage of in real time using the CRISIS Plan.

So it’s time for you to deal with the real question –

What action plan do you have in place to deal with different market scenarios?

As always, Happy Investing

Other articles you may like