Today (March 29, 2023), the Australian Bureau of Statistics (ABS) released the latest ‘monthly’ CPI data – Monthly Consumer Price Indicator – which covers the period to February 2023. On an annual basis, the monthly All Items CPI rate of increase was 6.8 per cent down from 7.4 per cent. While this signals a sharp decline in the annual rate of inflation, it should be noted that for the last month, the growth in the All Items CPI was zero, a point ignored by the media. So expect to see a fairly rapid decline. Yes, it is proving to be a transitory episode and the dynamics have not justified the rapid interest rate increases we have seen.

Inflation in decline

Here is the headline in the Melbourne Age this afternoon after the CPI data was released.

I always love the ‘larger-than-expected’ reference that comes when a data release shows up the mainstream predictive models – which are mostly those of the commercial banks these days.

There is nothing unsurprising about the sharp drop.

Most economists are biased towards thinking that the inflation will be more persistent because they think a shock then feeds into wage and price expectations, which propagate further rises.

When this current period of inflationary pressure emerged a year or so into the pandemic, I was one of the few economists to state that it would be a transitory event – although I made the point that that doesn’t mean it would be necessarily short-lived.

The point was that we could understand what was driving the price pressures and that they would eventually dissipate – as factories resumed operation and ships started going to ports where they were intended.

Clearly the Ukraine situation confounded that assessment but even then it was only a matter of time before the supply chains worked around the constraints that the War had created.

And then OPEC came along to complicate matters more but it was only a matter of time before they relented and energy prices started coming down again.

The transitory narrative recognises that there were not ‘structural’ mechanisms present that would propagate these supply shocks into an entrenched distributional battle between labour and capital.

It was clear that nominal wages growth was to weak and that workers would be taking continuous real wage cuts while the supply pressures remained.

And, once the supply constraints started to ease, the prognosis was that the inflation rate would fall relatively quickly.

And so it has been.

The only other complication has been the profit gouging that corporations have engaged in which has prolonged the fall in price inflation.

The ABS Media Release (March 29, 2023) – Monthly CPI indicator up 6.8% in the year to February 2023 – noted that:

This month’s annual increase of 6.8 per cent is lower than the 7.4 per cent annual rise reported in January 2023. This marks the second consecutive month of lower annual inflation, also known as ‘disinflation’, from the peak of 8.4 per cent in December 2022.

Remember, this is a new series from the ABS as it tries to produce more immediate price level data in between the quarterly CPI releases.

There are limitations with the monthly CPI indicator – it only covers about 60 per cent of the items that appear in the more detailed quarterly release, although the ABS noted that it “is continuing to improve the monthly CPI indicator where possible and has added a new monthly series for electricity prices in the indicator”.

So as time passes, the indicator will get closer to the more accurate standard quarterly measure.

However, as it stands, it still provides good information for assessing where the inflationary pressures are heading.

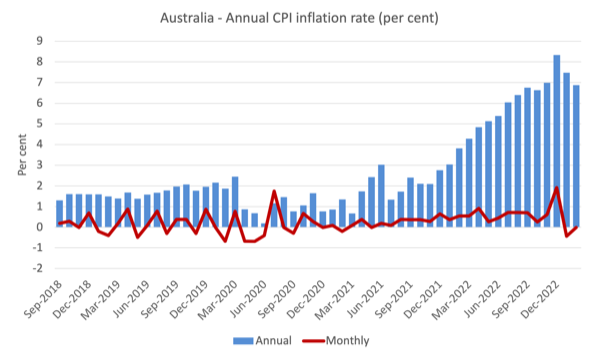

And as the next graph shows, the annual rate of inflation is heading in one direction – down and quickly.

The blue columns show the annual rate while the red line shows the month-to-month movements in the All Items CPI.

1. In December 2022, the annual rate recorded was 8.4 per cent.

2. In January 2023, the annual rate has fallen to 7.5 per cent.

3. In February 2023, the annual rate has fallen to 6.8 per cent.

4. The data over the xmas period was compromised by the spend-up in November (sales), the xmas shopping boom, and the holiday month in January.

So the February result is a more reasonable indicator of where things are at.

And the monthly change in the All Items CPI between January and February 2023 was ZERO!

Zero!

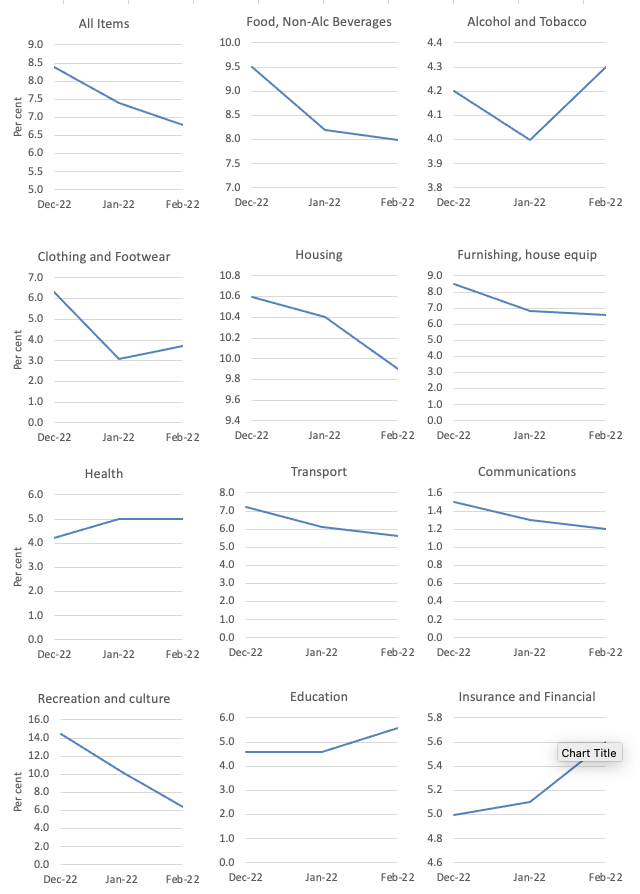

The next graph shows the movements between December 2022 and February 2023 for the main components of the All Items CPI.

In general, the initial sources of the CPI pressure are in rapid decline and some of the derivative components – for example, clothing and footwear (derivative because transport costs were higher for a while).

The rise in education costs are, in part, due to price gouging from the private school operators, sensing they can get well ahead of unit cost rises without anyone noticing.

Electricity prices rose because the government refuses to regulate the large energy companies who have diverted gas supply into the world markets and price gouged the domestic market.

But overall, the inflation rate is declining quite quickly as the supply factors ease.

So is the RBA justified in concluding that conventional monetary policy has worked?

A colleague today noted after the rapid drop in the inflation rate that the mainstream economists and those in the central bank will be claiming success after the 10 consecutive RBA interest rate hikes.

I responded by noting that the RBA strategy required the interest rates to hurt overall spending and thus overall demand for goods and services.

In other words, they were trying to stifle spending because they claimed the inflation was being driven by demand pressures (too much spending).

The problem with that narrative is that only one data series supports it – the rapid drop in the inflation rate.

Other data movements do not marry.

For example, the unemployment rate has not risen very much.

GDP is still growing.

Yesterday (March 28, 2023), the ABS released their – Retail Trade, Australia – data which showed that annual spending fell from 7.5 per cent in January to 6.4 per cent in February.

Is that a large decline?

Not really because the comparison is contaminated by the xmas spending spree.

When we take out the holiday period, we see that total level of spending is around the pre-xmas level and not in decline.

So why is inflation falling quickly?

The answer is because the supply-side factors – that are not influenced by the RBA’s interest rate policy are abating.

The conclusion is that fall in inflation is not the work of the RBA and all the central bank has done is inflict misery on low-income mortgage holders and facilitated one of the largest redistributions of income from poor to rich in our history.

Reading the science on Covid

I still get E-mails that abuse me for advocating strong health restrictions in the face of the on-going Covid-19 pandemic.

Large numbers are still dying premature deaths around the world and we have no idea yet what the ‘long’ implications of infection will turn out to be.

Some of the E-mails claim that if the governments just hand out (or had handed out) the antiparasitic drug used in veterinary medicine – Ivermectin – then all would have been well.

Some even claim they ingested the drug in copious quantities and got better from Covid-19.

Recently, the right-wing magazine, the Spectator published this article (March 14, 2023) – Did the ivermectin ban cost lives? (I won’t link to it to avoid them getting traffic).

The authors claimed bold-faced that Ivermectin was very effective and the failure of the Australian government to make it widely available meant people died unnecessarily.

This is the sort of rot the Right have been pumping out feeding the paranoia of the so-called ‘sovereign citizen movement’ the members who are popularly known among those with some brain cells as ‘cookers’.

Some of the ‘studies’ they cite never really occurred or have been retracted due to scientific fraud.

I am happy that those who were conned into taking the drug, ‘got better’, although, as noted, we don’t know what the long-term implications of infection and its impact on our major organs will be.

But the sound research clearly shows that they spent their cash on a fraud.

In 2021, the UK Guardian reported (September 24, 2021) – Fraudulent ivermectin studies open up new battleground between science and misinformation – which suggested strongly that the claims that Ivermectin was an effective treatment for Covid were based on flawed research.

On February 20, 2023, the he Journal of the American Medical Association (JAMA Network) published an article – Effect of Higher-Dose Ivermectin for 6 Days vs Placebo on Time to Sustained Recovery in Outpatients With COVID-19A Randomized Clinical Trial – which is the best science to date on the question found that:

… the posterior probability that ivermectin reduced symptom duration by more than 1 day was less than 0.1%

In other words, it has no impact.

This JAMA study reinforces the findings of the research published in The New England Journal of Medicine (May 5, 2022) – Effect of Early Treatment with Ivermectin among Patients with Covid-19 – which used “a double-blind, randomized, placebo-controlled, adaptive platform trial” and found “no significant effects of ivermectin” in reducing hospital admissions due to Covid.

Music – Nina Simone

This is what I have been listening to while working this morning.

I am moving house soon and going through all the old records I have has been a really interesting exercise.

So I am having a mini-Nina Simone period where I have been digging out her old albums and listening to them again.

The song – Just Like a Woman – was written around 1965 by – Bob Dylan – and appeared on his 1966 double album – Blonde on Blonde – which is my favourite record from him.

This version was recorded by – Nina Simone – and appeared on her 1971 album – Here Comes the Sun (RCA Victor) – which is where I first heard it.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.