A quick note before everybody scampers off for the holidays.

The impact of Technology on indices since the GFC is indisputable. But if you want to see exactly what their weight looks like on markets over that decade-plus era, check out the Statista video above.

Or, you can see Invictus applying Bob Farrell’s rules to the Tosteern Slok’s FANGM work:

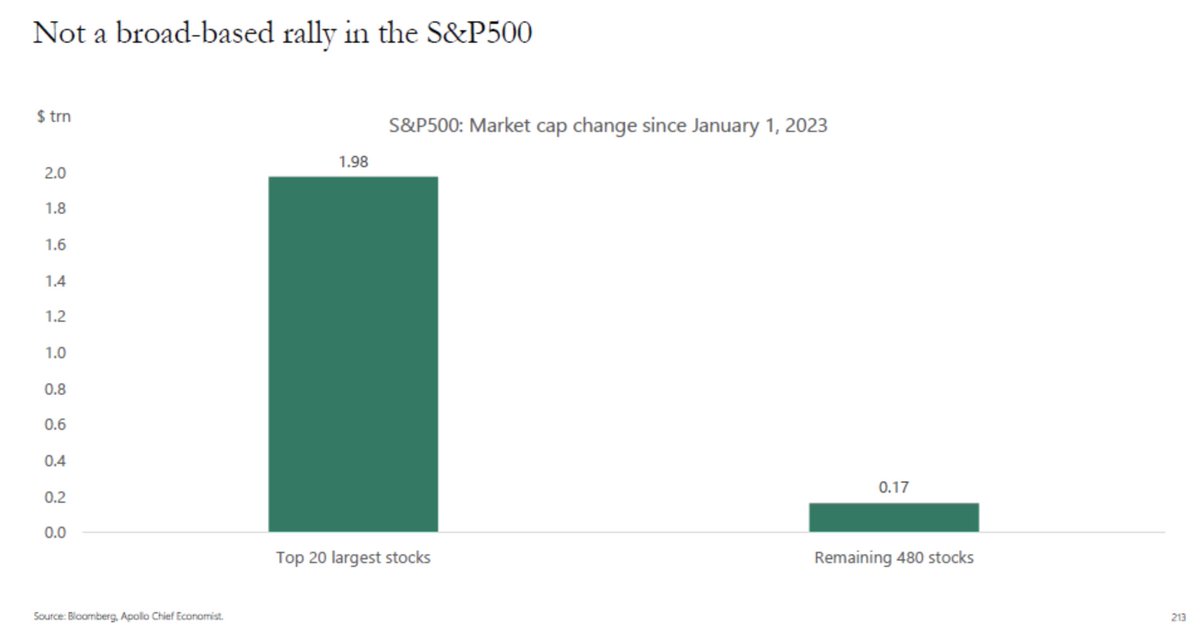

Time to invoke Farrell’s Rule #7? Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names.

Via Apollo’s Torsten Slok: pic.twitter.com/qsWPr9mlAC

— Invictus (@TBPInvictus) April 4, 2023

Ed Yardeni also observed something similar at the end of Q1:

“Eight of the 11 S&P 500 sectors are down ytd, led by an 11.1% drop in Energy and a 9.4% decline in Financials, while only three are up ytd, namely Communication Services (18.4%), Information Technology (17.5%), and Consumer Discretionary (9.6%)”

The three outperforming sectors are doing well because they include the MegaCap-8 stocks, which as a group are up 26.5% ytd based on their collective market cap. Excluding them, the market cap of the S&P 500 is up less than 0.1% ytd…”

Among the professional economist set, Yardeni & Slok are must-reads in my opinion…

The post Big Tech, Big Returns? appeared first on The Big Picture.