If you’re paying off a loan (say a home or car loan) and suddenly find yourself with some extra cash, you might be wondering whether to put it towards paying off the loan or investing.

It’s a tricky choice, but we’ve got some insights to help you make the right decision.

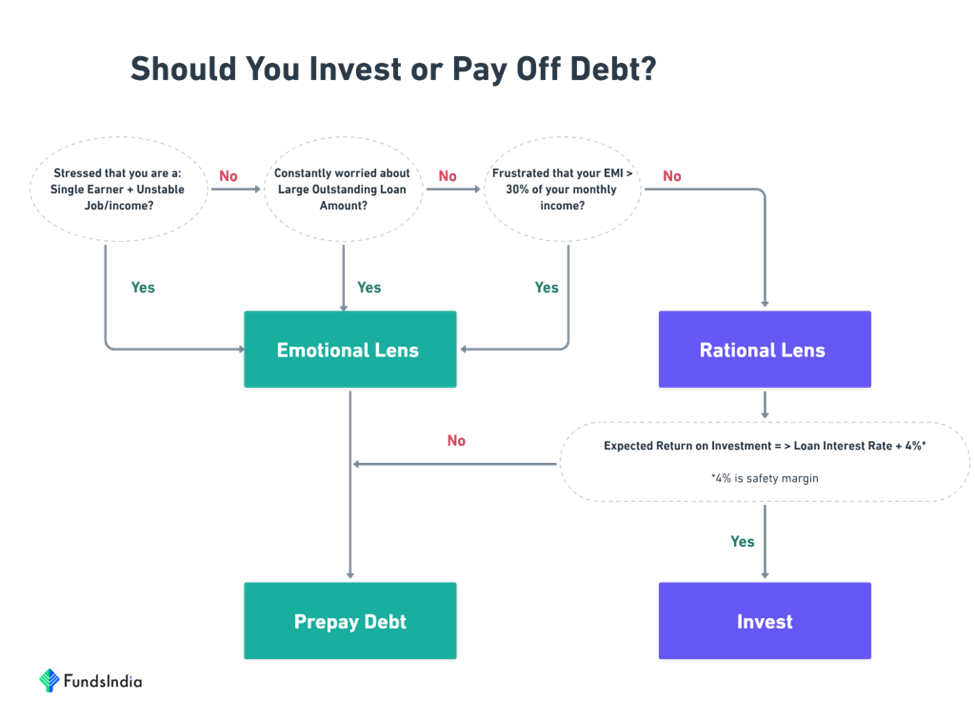

There are basically two lenses that you can use to solve the dilemma:

LENS 1: RATIONAL LENS

The logical starting point is to compare the expected future return from your investment vs your current loan’s interest rate.

If,

Expected Return from Investment >= Loan Interest Rate + Safety Margin (4%) = Invest

Expected Return from Investment < Loan Interest Rate + Safety Margin (4%) = Prepay Debt

Why do we have a safety margin?

- Buffer for rising interest rates – In the last few months the loan interest rates have increased from 6% to almost 8-9%. To provide for such rising rates an additional buffer is required.

- Buffer for unexpected Investment returns – There can be times when the Investment returns do not turn out as expected, for such lower than expected return outcomes a buffer is required.

Here is an example of how this works.

Assume you plan to invest in Equity Mutual Funds and your return expectation is around 12%.

Your current home loan rate is at 9%.

So,

Expected Return from Investment at 12% < 13% (i.e. Loan Interest Rate of 9% + Safety Margin of 4%)

This means from a rational point of view, it’s better to ‘Prepay Debt’

LENS 2: EMOTIONAL LENS

Sure, the rational perspective makes logical sense. But let’s be real, when it comes to making decisions, emotions can play a huge role too. In fact, sometimes our emotions are just as important as the rational side of things, if not more.

So, let us also wear the emotional lens and check how you feel about the outstanding loan and monthly EMIs?

Question 1: Are you stressed that you are a single earner and have an unstable job/income?

- If yes, it is better to prepay debt.

Question 2: Do you constantly worry about your large outstanding loan amount?

- If yes, it is better to prepay debt which helps reduce the stress and burden.

Question 3: Are you frustrated that your monthly EMIs take away a large part (>30%) of your monthly income?

- If yes, it is better to prepay debt.

So, how do we know when to apply which lens?

The decision flowchart below will help understand when to use which lens.

Summing it up

- There are two lenses to evaluate this dilemma of prepaying debt vs investing.

- The Rational lens is where you compare the expected investment returns and the loan interest rate. The Emotional lens is where you make decisions based on how you feel.

- While both lenses are equally important, you can use the above framework to prioritize.

Other articles you may like

Post Views:

194