Should we switch to hybrid funds from debt funds to avoid tax? What are the risks involved in hybrid funds? Let us discuss this topic in this post.

After the recent shocking taxation rules of debt fund taxation, many are eagerly looking for avenues for their debt products which are in some way tax efficient also. Few are looking for various categories of hybrid funds like balanced advantage funds or equity savings funds as an alternative to debt funds. However, is it worth considering these categories?

Should we switch to hybrid funds from debt funds to avoid tax?

If you look at the SEBI’s categorization and rationalization of Mutual Fund Schemes notification, you will find that there are seven funds listed in the hybrid category. They are as below.

a) Conservative Hybrid Fund – Investment in equity and equity-related instruments – between 10% to 25% of total assets. Investment in debt instruments – 75% to 90% of the total assets.

b) Balanced Hybrid Fund – Equity and equity-related instruments – between 40% to 60% of the total assets. Debt instruments – 40% to 60% of the total assets. No arbitrage would be permitted in this category.

c) Aggressive Hybrid Fund – Equity and equity-related instruments between 65% and 80% of total assets; Debt instruments-between 20% to 35% of total assets.

d) Dynamic Asset Allocation or Balanced Advantage – Investment in equity/debt that is managed dynamically.

e) Multi Asset Allocation – Invests in at least three asset classes with a minimum allocation of at least 10% each in all three asset classes.

f) Arbitrage Fund – Scheme following arbitrage strategy. Minimum investment in equity & equity related instruments-65% of total assets.

g) Equity Savings – Minimum investment in equity & equity related instruments-65% of total assets and minimum investment in debt-10% of total assets. Minimum hedged & unhedged to be stated in the SID. Asset Allocation under defensive considerations may also be stated in the Offer Document.

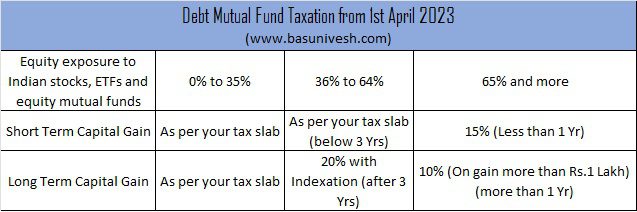

Now let us go back to the changes that happened for debt fund taxation from 1st April 2023.

If you closely watch the above available hybrid categories and also the above new tax rules, you noticed that conservative hybrid funds are out of the question. Because as per the definition, the equity exposure of this category should be between 10% to 25%. Hence, obliviously they are taxed as per your tax slab. Therefore this category is ruled out completely.

Same way, balanced hybrid funds where the equity allocation is to the maximum of 40% to 60% means they are taxed as debt funds but with indexation benefits.

But the rest of the hybrid fund categories like Aggressive Hybrid Funds (Equity between 65% and 80%), Dynamic Asset Allocation or Balanced Advantage Funds (Equity 0% to 100%), Multi-Asset Allocation (if we assume the fund invests in three assets only as it is the minimum criteria to fall in this category, then the equity may go between 10% to 80%), Arbitrage Funds (Equity or equity-related 65%) and Equity Savings (Equity minimum 65%) have a higher range of equity (exception is Balanced Advantage Funds and Multi-Asset).

However, to attract investors because of this new taxation rule, these funds may keep the equity exposure always on or above 65%.

Hence, the risk is of higher equity exposure and the generic definitions of these funds force us to think about whether they are actually an alternative to debt funds. The classification is just based on what % should be in equity and debt. Beyond that, it is completely unknown to us where the fund managers invest.

In such a scenario, even though in plain it looks like allocation to debt and equity (rather than 100% in equity) is safe, as the definition is not clear and a complete freedom for fund managers, they may take the undue risk either in equity (by allocating to thematic, small cap or mid cap) or debt (by allocating towards low rated bonds) to generate higher returns.

I accept that you can run away from the new tax rule which is harsh in nature. But just because of saving the tax, you take one more undue risk which is more dangerous.

Do remember that all debt funds are not safe and at the same time all equity funds are not the same. It is always better to invest in mutual funds where there is a clear mandate of investment rather than generic categorization.

For example, in the aggressive hybrid fund, if the fund is investing around 65% in equity then never assume that your 35% is safe. If you are fond of such funds, then you have to closely watch the portfolio of not only equity but debt also. In the future, if the fund manager takes some undue risk, then the cost of moving away from such funds is heavy.

One more unknown risk that many of us are aware of is INTER SCHEME TRANSFER risk of these hybrid funds. Even though after the 2020 liquidity crunch and few instances of IST by few AMCs, SEBI laid down the rules for such IST (Refer to this SEBI circular in this regard), we can’t outrightly assume that such things will not repeat in the future.

SEBI clearly laid down that IST is not possible in the case of FMPs (Fixed Maturity Plans). However, it is possible in the case of debt funds if there is a real liquidity crunch (after the fund manager pays from its cash, borrows to pay money (borrowing is also restricted), or attempts to sell illiquid securities first).

Certain other restrictions laid down by SEBI in this matter are as below.

- Fund managers should be penalized if they transfer a bond from a credit risk fund to another scheme, and then the bond defaults within a year. But what if default happens after a year?

- If there’s negative news about a company, even “rumors”, then an inter-scheme transfer isn’t allowed.

- If security gets downgraded following ISTs, within a period of four months, the Fund Manager of buying scheme has to provide detailed justification /rationale to the trustees for buying such security. But what if the security is downgraded after four months?

These are certain unanswered risks or uncontrolled risks for common investors. However, why I am bringing this inter-scheme transfer only towards hybrid funds rather than the debt funds is that the definition of hybrid funds and especially with respect to the debt part of hybrid funds are unclear. Hence, inter-scheme transfer risk is more to hybrid funds than debt funds.

Hence, considering all these aspects, I strongly suggest you not use hybrid funds as an alternative to your debt funds (just for saving tax).

You have no choice but to pay tax and just to avoid the tax, don’t take the undue risk of known unknown.