The 10 consecutive interest rate hikes over the past year have significantly impacted Australians – and the effects are more than just financial, new research has suggested.

A new survey released by the Finance Brokers Association of Australia (FBAA) found that a large percentage of mortgage holders and renters were being forced to cancel holidays, sell assets, take on additional work, reduce spending on groceries and social activities, withdraw savings, and in the case of renters, move to cheaper rental properties, to improve their financial position.

Peter White (pictured above), managing director of the FBAA, said a similar survey conducted by the association in 2021 – six months before the first rate hike – predicted today’s findings, as he warned then that “many Australians are clearly on the brink and are sleepwalking into disaster, living in the false hope that rates will stay this low.”

“Governments and lenders knew this was coming because the global indicators were there, but somewhere along the line there was a failure to prepare Australians who had become complacent after more than a decade without seeing any rate rises,” White said. “We are sadly now seeing the results.”

He said more pain awaits Australians due to potential future rate hikes and as many borrowers will soon be rolling off low fixed rates to more expensive rates.

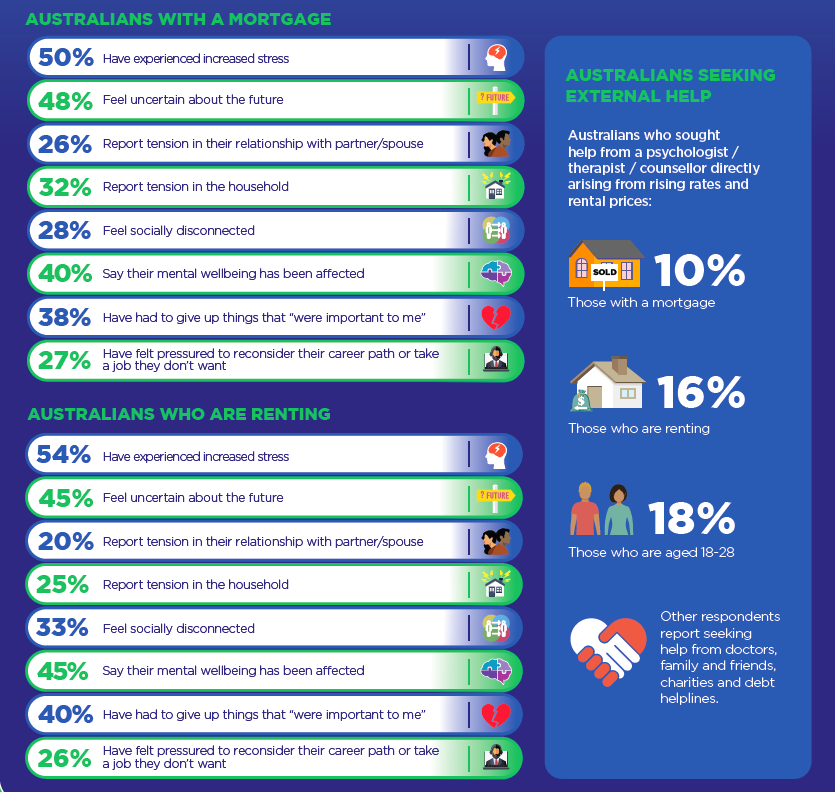

Alarmingly, the survey, which was conducted by research firm McCrindle, also found that aside from the financial challenges, the personal, social, and mental impacts of surging interest rates on borrowers and renters were just as significant.

Data showed that 50% of those with a mortgage have experienced greater stress while more than a quarter reported tension in their relationship with their partner or spouse. Nearly half said they felt uncertain about the future, and there has also been a significant spike in people seeking mental health help, as a direct result of rising rates and rental prices.

White, who has led mental health initiatives for the finance broking industry, said the findings showed that Australia is facing both a financial and mental health emergency.

“It will take a combined approach by government, lenders and the community at large to help people through this,” he said.

White encouraged people to look ahead and seek assistance “before the lender comes knocking and you are forced to.”

“Call your bank, mortgage broker, or landlord the moment you are concerned that you may not be able to handle the increased payments,” he said. “Lenders can often help and mortgage brokers have many options. And if you feel that you can’t handle the pressures please seek help from a health professional. This is a time to look after one another.”

Use the comment section below to tell us how you felt about this.