Maintaining control over your finances and staying within budget can sometimes pose a daunting task, especially when you’re constantly on the go. That’s precisely why it’s beneficial to make the most of specialized mobile applications that provide invaluable support for preserving financial stability. Below, you’ll find a selection of five different apps worth considering.

It can be challenging to keep track of where your money goes and how much you can spend risk-free. You can better manage your finances by organising them with the aid of a budget. Using budgeting software is one way to make and stick to a budget.

Top 5 – Best Budgeting Apps

The best budgeting apps has features that match your spending strategy, is inexpensive, simple to use, integrates with your accounts, and is easy to use.

Goodbudget

Goodbudget revolutionizes the traditional envelope budgeting method by offering a digital solution that empowers users to regain financial control. By introducing virtual envelopes for different categories like groceries and entertainment, it enables you to effectively manage your monthly expenses within a designated budget, ensuring you stay financially on track.

With Goodbudget, you can devise a customized financial strategy that maximizes your budgeting capabilities. Effortlessly create multiple budgets and effortlessly track their progress, eliminating the need for tedious manual entries. Seamlessly set up recurring payments to maintain an organized approach to your finances without any unnecessary complications.

Goodbudget also caters to couples and families, providing the convenient “shared envelopes” feature. By collaborating on budget creation, it becomes easier than ever for those who share household expenses to achieve their financial aspirations.

Mint

Mint serves as your ultimate financial powerhouse, catering to budgeters, savers, and investors alike. This comprehensive personal finance app offers a user-friendly toolkit to effortlessly track and manage your spending on both iOS and Android devices. Simply connect your bank accounts, credit cards, loans, and investments for a thorough analysis of your finances.

Mint equips you with the necessary tools to gain a profound understanding of your financial habits. By utilizing Mint’s automatic categorization, budgeting, and progress tracking features, you can make informed decisions on adjusting your spending to align with your overall goals.

Additionally, the app provides a bill tracking service that ensures timely payments and enhances your financial organization. With real-time notifications, it promptly detects any unusual activity that could jeopardize your accounts, allowing you to avoid late fees and maintain financial stability.

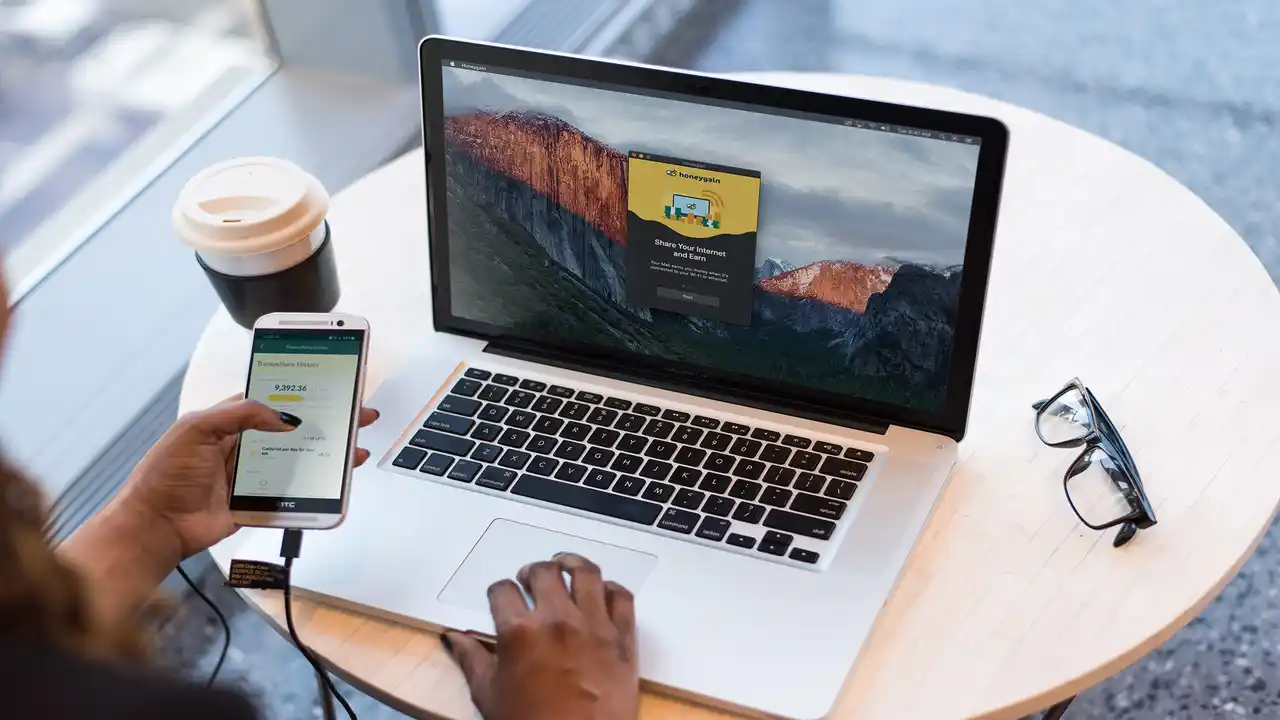

Honeygain

If you’ve discovered that certain small expenses are essential but have a negative impact on your finances while using budgeting apps, the Honeygain app could be the solution. This application allows you to earn passive income without any active involvement.

Getting started is simple: create an account and install the app. Once you’re logged in, the app quietly runs in the background, sharing your internet bandwidth with its network. This means you can continue with your regular work or entertainment without any disruptions while earning extra income.

The app operates on a credit system, where every 10 MB of shared traffic equals 3 credits. For instance, 1000 credits are equivalent to $1. Once you accumulate at least $20 worth of credits in your account, you can request a payout to your PayPal account or crypto wallet. The money will be transferred to you within a few days.

Honeygain prioritizes user safety and is transparent about how your internet bandwidth is utilized. Its use cases include SEO research, brand protection, and price aggregation, among others. The app doesn’t require any permissions on your mobile device, ensuring it cannot access sensitive information.

YNAB

YNAB stands as a finance tracking app in the vast market of budgeting apps that empowers individuals to take charge of their spending and regain control over their finances. Developed by two software developers with the aim of fostering financial independence, this comprehensive money management tool allows users to establish financial goals, track their expenses, and maintain a strong financial position.

With YNAB, you gain access to a complete budgeting solution that covers all aspects of your life, including rent, groceries, utilities, and leisure activities. It facilitates personalized budgets based on projected income and expenses, while offering useful features like bill reminders, debt tracking, savings goals, and reports, providing users with a clear overview of their financial status.

Acorns

Acorns streamlines the process of saving for the future, making it hassle-free and accessible. Whenever you make a purchase, the app automatically rounds up your spare change and invests it in a diverse portfolio of ETFs. You can witness your savings grow steadily over time, all without the need for manual investment management or compromising significant portions of your income.

With Acorns, anyone can easily invest in a well-diversified portfolio and become an informed investor. By providing expert advice and educational resources, Acorns empowers you to maximize your returns from exciting investment opportunities. Simply link one of your cards, and the app takes care of the rest, effortlessly rounding up your purchases with minimal effort required from your end.

If you’re seeking to take control of your finances, these apps offer the ideal answer. Not only are they designed with user-friendliness and convenience in mind, but each one boasts an impressive range of features to assist in refining spending habits and establishing long-term financial goals.

Conclusion

You should determine financial goals at the first place. The best budgeting apps enable you to fully manage your finances by assisting you in understanding your income and expenses. Using a connection to your bank account and credit cards, budgeting apps can download transactions and classify your spending according to the budget you’ve established.