It’s Wednesday and so before we get to the music segment we have time to discuss a few issues. The first relates to the progress Britain is making in its post-Brexit reality. There is now growing evidence that, despite predictions of economists supporting the Remain case, the newly gained freedom that Britain now enjoys as a result of leaving the EU has allowed it to restrict the entry of lower-skilled and lower-paid migrants (from the EU) and attract a large boost in skilled migration from non-EU nations with net benefits to the domestic economy. Second, it seems the mainstream is now discovering the work of Marxist economists from 5 or more decades ago and concluding that it provides a much better explanation of the inflation process than that offered by Monetarists (excessive money supply growth) or the mainstream New Keynesian theories which emphasise “departures from a natural rate of output or employment” (NAIRU narratives). That’s progress even if it took a while. Once you have absorbed all that there is some great improvisational music to soothe your senses.

Britain’s net migration and Brexit

There was a rare admission of error from a British economist yesterday in the UK Guardian article (May 23, 2023) – Why the panic over rising immigration? The post-Brexit system is working.

I have been following the British migration data for the last few years trying to come to a definitive assessment of the impacts of the decision to leave the European Union.

Remember that among the predictions of doom, the Remain lobby claimed Britain would be unable to maintain a viable labour supply because of the new border restrictions that would accompany Brexit.

Jonathan Portes was a notable critic of the decision to leave.

We also disagreed (diametrically) on the British Labour Party’s use of the fiscal credibility rules, of which he played a part in the drafting.

The next lot of migration data from the Office of National Statistics will be released tomorrow and I am awaiting it with interest.

But from the data we already have available – up to June 2022 – Long-term international migration, provisional: year ending June 2022 (released November 24, 2023) – we already have a good idea of what is happening and the direction that the migration is taking.

And it supports Brexit rather than ratifying the Remain camp’s predictions.

The ONS notes that the June 2022 data was “unique” because there were many unusual factors influencing the data:

… this included the continued recovery in travel following the coronavirus (COVID-19) pandemic, a number of migration events including a new immigration system following transition from the EU, and the ongoing support for Ukrainian nationals and others requiring protection.

Some of those factors will decline in influence obviously (the Ukraine situation for example).

Add into that the Hong Kong situation also, which has produced one-off flows of people into the UK.

The data showed that:

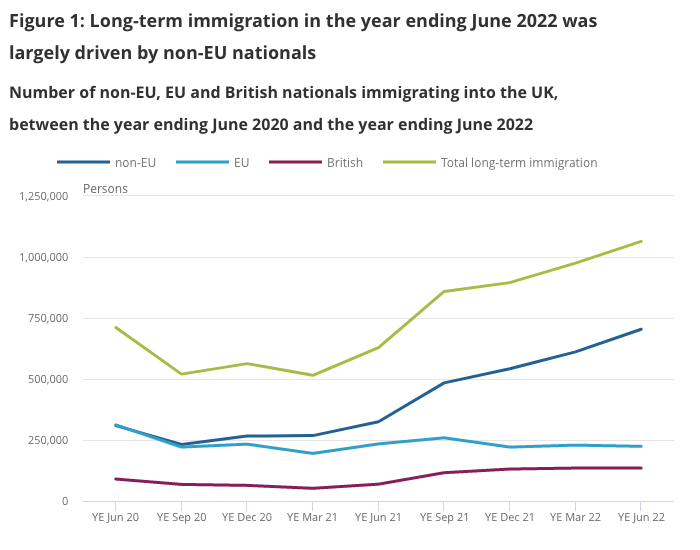

Overall, net migration continued to add to the population in the YE June 2022, with an estimated 504,000 more people arriving long-term to the UK than departing; net migration of non-EU nationals was estimated at 509,000 in the YE June 2022, compared with negative 51,000 and 45,000 for EU and British nationals respectively.

That is quite a large net inflow of non-EU nationals.

Some of that flow was because the travel restrictions relating to Covid were relaxed and students came back into the UK to study.

But the growth in long-term immigration in the UK is being driven by non-EU nationals (66 per cent of total).

And, significantly:

The immigration of EU nationals remained broadly stable in the last year, accounting for 21% of total immigration (224,000).

So while Britain has retained the people flows with the EU, despite Brexit, it has picked up strong growth from the non-EU nations (a rise of 379,000 in the year to June 2022).

The following graph (from the ONS publication) tells the story.

The interesting aspect of this surge in non-EU net migration is the response of both major political parties, which have played into the hands of the crazy anti-migrant Right.

Both the relevant minister and her shadow in the Labour Party have indicated they will come down hard on migration.

But those who have studied this, including Jonathan Portes, know that one of the consequences of Brexit is that the British government can now control the people flows across its borders much more than when the nation was a supplicant Member State of the EU and bound to take direction on a range of things from Brussels as part of the single market.

Jonathan Portes correctly notes that:

In fact, the migration statistics reflect something that is rare indeed in the UK right now – a successful policy implemented efficiently and effectively and, even rarer, the crystallisation of a genuine “Brexit opportunity”.

Who would have thought? Credit to him.

He notes that there are still skill shortages being reported in the UK, in part because the “domestic labour supply constrained by the rise in ill health and early retirement.”

The rise in permanent disability arising from Covid is yet to be fully documented and measured but it will be significant despite all the claims by the mad ‘Covid was a Flu’ gang who have teamed up with the Right to present some weird conspiracy narrative.

But apart from the Covid impacts, Brexit has changed things fundamentally in ways that the Remain camp could never perceive.

The British government is now in charge.

As Jonathan Portes writes:

The government has been forced to make policy choices around which occupations and sectors should be open to migrant workers.

He also notes that most economists believed that the loss of trade and migration flows from the EU as a result of Brexit would dwarf any gains from being more open to the rest of the world.

He now concedes:

We were wrong.

He is acknowledging that the data is now showing that with free movement over, “the flow of relatively lower skilled and lower paid workers to some sectors” has fallen significantly.

At the same time, by opening up to the rest of the world, Britain is now tapping into a substantially increased flow of skilled workers who are:

… coming to work in the NHS, the care sector, and high-skilled and high-paid roles in information and communications technology, finance and professional services.

This will boost British productivity and provide room for higher real wages once all the inflation is settled.

As we get more data on migration and other aspects (trade etc) it is likely that the newly gained freedom that Britain now enjoys as a result of leaving the EU will demonstrate similar net benefits.

Which was my point all along when in 2016 I strongly supported the Leave case much to the angst of people like Jonathan Portes.

But the data is now speaking.

The reinventions of inflation theory

I read a new working paper from the National Bureau of Economic Research (NBER) today – Inflation is Conflict – which has decided that “Inflation is due to conflict, it cannot be explained by monetary policy or departures from a natural rate of output or employment”.

They also conclude that:

Conflict should be viewed as the proximate cause of inflation, fed by other root causes

You can get a non-subscriber version – HERE.

Those conclusions seem rather revolutionary when compared to the mainstream narrative, which is currently pushing central banks to hike interest rates in a vain application of a defunct theory.

A young scholar coming into the world of literature just now might think this ‘new’ idea about conflict is genius, given the failures of mainstream approaches to date.

It rejects the idea that inflation arises because of an excessive growth in the money supply.

So there goes Monetarism and all its derivative ideas – out the window. See ya later.

The authors say that:

… this conflict perspective is both insightful and general.

Genius.

They also realise that that have to “purposefully stay away from standard macroeconomic models, such as the New Keynesian model” in this exposition to avoid being sidetracked by all the micro-foundation nonsense that purports to be science but is really just deep religion – and pretty stupid religion at that.

I will write more about religion in economics tomorrow.

Wait to be astounded.

And then we get to the point.

Those new scholars will then read:

The conflict view on inflation is by no means new, yet this perspective is largely unknown to most economists. It was developed and embraced by a relative minority associated with a Post-keynesian tradition. Rowthorn (1977) provided the seminal contribution …

Note first the acknowledgement of Groupthink among “most economists”.

The literature they refer to is easily available and has a long standing.

But “most economists” – read, those in the mainstream tradition – have not read it nor even become acquainted with it.

Closed minds.

That condition defines my profession – more about which tomorrow.

Second, the seminal contribution did not come from Robert Rowthorn’s 1977 article – Conflict, inflation and money – which was published in the Cambridge Journal of Economics (Volume 1, No. 3, pages 215-239).

This demonstrates to me that these newcomers in the mainstream to the progressive (heterodox) literature have not really fully explored that literature to trace the path that these ideas have taken over time.

It might also demonstrate an unwillingness to acknowledge that the ideas they are now pursuing came out of the Marxist literature.

Robert Rowthorn might be seen as the soft edge of that literature given his previous affiliation with Cambridge University in the UK.

If you read the 1997 book by Susan Strange – Casino Capitalism – (Manchester University Press) – you will find a reference to her assessment that Robert Rowthorn was “one of the few Marxists … who is read in business schools.”

So that might explain these mainstream authors ignoring the vast literature that influenced Rowthorn’s own work.

There was a series of articles in Marxism Today in 1974 which advanced the notion of inflation being the result of a distributional conflict between workers and capital.

One such article by – Pat Devine (1974) – ‘Inflation and Marxist Theory’, Marxism Today, March, 70-92 is worth reading if you can find it.

It is more ‘seminal’ than Robert Rowthorn’s subsequent derivative work.

As an aside, you can view an limited archive of Marxism Today since 1977 which is a very valuable resource.

Conflict theory recognises that the money supply is endogenous (as opposed to the Monetarist’s Quantity Theory of Money which assumes, wrongly, that the money supply is fixed).

In this world, firms and unions have some degree of market power (that is, they can influences prices and wage outcomes) without much correspondence to the state of the economy. They both desire some targetted real output share.

In each period, the economy produces a given real output which is shared between the groups with distributional claims. If the desired real shares of the workers and bosses is consistent with the available real output produced then there is no incompatibility and there will be no inflationary pressures.

But when the sum of the distributional claims (expressed in nominal terms – money wage demands and mark-ups) are greater than the real output available then inflation can occurs via the wage-price or price-wage spiral noted above.

The wage-price spiral might also become a wage-wage-price spiral as one section of the workforce seeks to restore relativities after another group of workers succeed in their wage demands.

That is, the conflict over available real output promotes inflation.

Various dimensions can then be studied – the extent to which different wage contracts overlap and are adjusted, the rate of growth of productivity (which provides “room” for the wage demands to be accomodated without squeezing the profit margin), the state of capacity utilisation (which disciplines the capacity of the firms to pass on increasing costs), the rate of unemployment (which disciplines the capacity of workers to push for nominal wages growth).

Conflict theories of inflation note that for this distributional conflict to become a full-blown inflation the central bank has to ultimately “accommodate” the conflict.

What does that mean?

If the central bank pushes up interest rates and makes credit more expensive, firms will be less able to pay the higher money wages (the conceptualisation is that firms access credit to “finance” their working capital needs in advance of realisation via sales). Production becomes more difficult and workers (in weaker bargaining positions) are laid off.

The rising unemployment, in turn, eventually discourages the workers from pursuing their on-going demand for wage increases and ultimately the inflationary process is choked off.

However, if the central bank doesn’t tighten monetary policy and the fiscal authorities do not increase taxes or cut public spending then the incompatible distributional claims will play out and inflation becomes inevitable.

Pat Devine’s article (noted above) also introduced the notion that inflation was a structural construct. He argued that the increased bargaining power of workers (that accompanied the long period of full employment in the Post Second World War period) and the declining productivity in the early 1970s imparted a structural bias towards inflation which manifested in the inflation breakout in the mid-1970s which he says “ended the golden age”.

In one of my early articles (1987) – in the Australian Economic Papers – The NAIRU, Structural Imbalance and the Macroequilibrium Unemployment Rate – I developed the notion of a macroequilibrium unemployment rate based on inflation as a conflict between labour and capital.

In that work I outlined a conceptual unemployment rate, which is associated with price stability, in that it temporarily constrains the wage demands of the employed and balances the competing distributional claims on output.

So my early work was developing to the view that inflation was the product of incompatible distributional claims on available income.

When nominal aggregate demand is growing too quickly, something has to give in real terms for that spending growth to be compatible with the real capacity of the economy to absorb the spending.

Unemployment can temporarily balance the conflicting demands of labour and capital by disciplining the aspirations of labour so that they are compatible with the profitability requirements of capital.

That was Michał Kalecki ‘s argument which I considered in the blog post – Michal Kalecki – The Political Aspects of Full Employment (August 13, 2010).

In my 1987 article I wrote:

Inflation results from incompatible distributional claims on available income, unemployment can temporarily balance the conflicting demands of labour and capital by disciplining the aspirations of labour so that they are compatible with the profitability requirements of capital … The wage-price spiral lull could be termed a macroequilibrium state in the limited sense that inflation is stable. The implied unemployment rate under this concept of inflation is termed in this paper the MRU and has no connotations of voluntary maximising individual behaviour which underpins the NAIRU concept …

That is a crucial distinction – it is no surprise in a capitalist system that if you create enough unemployment you will suppress wage demands given that workers, by definition, have to work to live.

But you can underpin this notion of equilibrium without recourse to the individualistic and optimising behaviour assumed by the mainstream economists.

I wrote that 36 years ago.

Pat Devine’s initial contribution was 49 years ago.

The mainstream are slowly catching up.

Music – The world at war

This is what I have been listening to while working this morning.

This is from one my favourite Australian bands – The Necks – who are a three-piece, avante-garde jazz band in the post-minimalist tradition (borderline).

If you go to one of their concerts expect to hear about 3 pieces throughout the evening as they lay down a basic theme then improvise on that and go all sorts of places with the sound.

This track – The world at war – comes from their second studio album – Next – which was released in 1990 and remains my favourite.

The Necks are a trio:

1. Chris Abrahams – piano, organ.

2. Tony Buck – drums and percussion (occasional electric guitar).

3. Lloyd Swanton – double bass and electric bass guitar.

But on this track you can also hear the sax playing of Timothy Hopkins and the trumpet of – Mike Bukovsky.

You just put the track on and let your mind go where it goes when listening to the band.

Chilled.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.