The 2017 Tax Cuts & Jobs Act introduced a $10,000 limit on the State And Local Tax (SALT) deduction that was previously available for taxpayers who itemized their deductions. In response to the new deduction limit, many states enacted laws creating a new Pass-Through Entity Tax (PTET) designed to help owners of pass-through businesses (partnerships, LLCs, and S corporations) avoid the limitation and preserve the deductibility of their state tax payments. With IRS giving its blessing to this approach through Notice 2020-75, 33 states now have some sort of PTET available and, as a result, owners of pass-through businesses who live (or do business) in those states may be considering whether to make a PTET election.

At a high level, PTETs work by allowing business owners to elect to pay state taxes on their business income – which are traditionally paid on their individual tax returns – from the business itself. This shifts the business owner’s state tax payments from being a personal expense (and subject to the $10,000 SALT deduction limit for Federal tax purposes) to being a business expense that is fully deductible from Federal income. Finally, the business owner gets a state tax credit against their individual tax liability to partially or completely offset their share of the tax paid by the business.

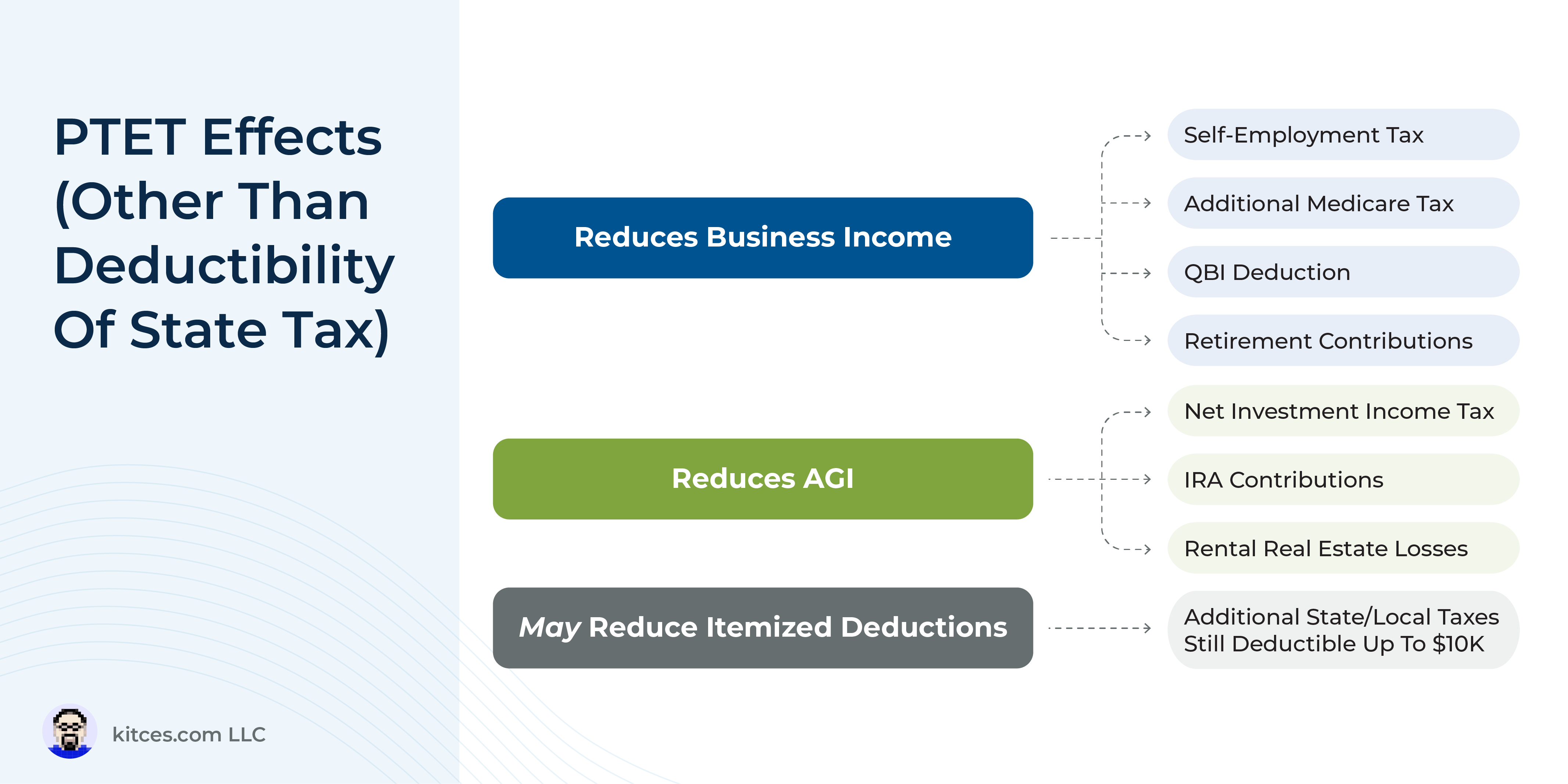

But while the simple description of PTETs might make the decision to elect one seem like a no-brainer, in reality there are myriad considerations at play that mean a detailed analysis is generally required before deciding to make an election or not. First, PTETs often result in paying higher state taxes; while some states tax pass-through entities at a higher rate than individuals, others may not provide a 100% tax credit for taxpayers to fully offset their share of the business’s PTET paid (meaning that a portion of that income is effectively double-taxed). However, even though the PTET can result in higher state taxes, the savings in Federal taxes that can result from being able to deduct the PTET as a business expense (including not just income tax but potentially self-employment taxes, net investment income tax, and additional Medicare taxes as well) might still make the election worth it overall.

Another set of considerations involves owners of businesses that operate in multiple states, which can compound the complexity of electing a PTET. With multiple, often conflicting state laws at play for business owners, deciding whether or not to elect the PTET in any given state involves weighing not only the impact of the state’s PTET on any potential Federal tax savings, but also additional factors involved in electing a PTET across state lines. Some of these can include whether there are additional filing requirements (e.g., a business owner who previously wasn’t required to file a nonresident return in a state where they do business may be required to do so if the business elects that state’s PTET) and whether the taxpayer’s home state will give them credit on their individual tax return for entity-level taxes paid to another state (which might result in the business income being taxed by 2 states at once if the credit isn’t allowed).

Ultimately, for a subset of taxpayers – namely high-income owners of pass-through businesses in high-tax states, who preferably only do business in 1 or a small number of states to reduce the overall complexity – PTETs can provide an opportunity for significant Federal tax savings. Advisors who can help their clients with tax planning strategies to take advantage of PTETs – starting with determining when it’s really worthwhile to do so – can provide significant value given the complexity of the decision. And with the SALT deduction limit currently set to expire after 2025, there’s no time like the present to start delivering that value!