Consumer credit outstanding grew at a seasonal adjusted annual rate of 5.7% in April 2023 per the Federal Reserve’s latest G.19 Consumer Credit report, as revolving and nonrevolving debt grew at 13.1% and 3.2%, respectively (SAAR). Total consumer credit outstanding stands at $4.8 trillion (not seasonally adjusted), with $1.2 trillion in revolving debt and $3.6 trillion in non-revolving debt (NSA).

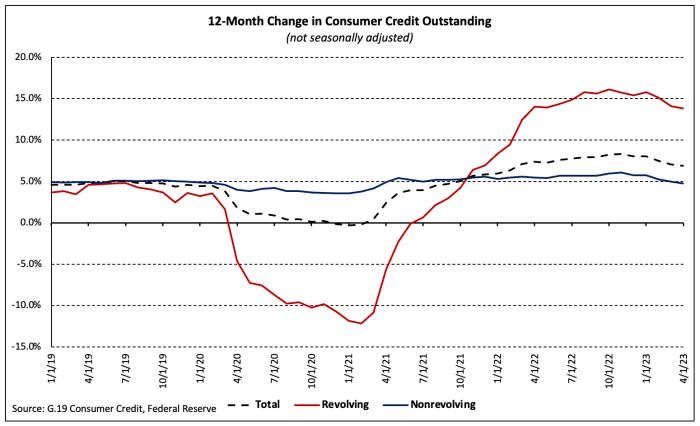

The total balance of consumer credit outstanding grew 6.9% over the 12 months ending April 2023 (NSA). Revolving debt grew 13.8% over the period, nearly three times the growth in nonrevolving debt (4.8%).

The 12-month growth rate of revolving debt exceeded 10.0% in March 2022 and has not fallen below that mark since. The last time growth exceeded 10.0% was from November 2000 through June 2001, a period during which unemployment began to rise and the 2001 recession began.

Revolving and nonrevolving debt accounted for 24.7% and 75.3% of total consumer debt, respectively. Revolving consumer credit as a share of the total fell to 21.8% in April 2021—the smallest share since 1986. At 24.7%, the share is roughly equal to the 10-year average of 25.1%. Between April 2022 and April 2023, revolving consumer credit outstanding as a share of the total increased 1.5 percentage points.

Related