With today’s current climate of high interest rates and ongoing inflationary pressures, one would expect the ratings of Canada’s structured bonds to be under pressure.

However, Canada’s covered bonds are not expected to see their ratings drop anytime soon, according to a recent report from the credit ratings agency Fitch. In fact, Fitch affirmed the nation’s AA+ Long-Term Foreign Currency Issuer Default Rating (IDR) with a stable outlook in the first week of June 2023.

The report reviewed Canada’s “macroeconomic outlook” along with “sector-specific reviews of Banks, Structure Finance” and other factors.

Bonds holding strong despite housing climate

Fitch noted that while 2022 was a challenging year with falling home prices, high inflation and rising interest rates, bond ratings persisted—maintaining their initially assigned ratings. They continue to have a Stable Outlook and all but one have “AAA ratings.”

Fitch rated bonds from Canada’s Big Six banks, including CIBC, BMO, RBC and Scotiabank, and covered bond programs from HSBC Bank Canada and Equitable Bank.

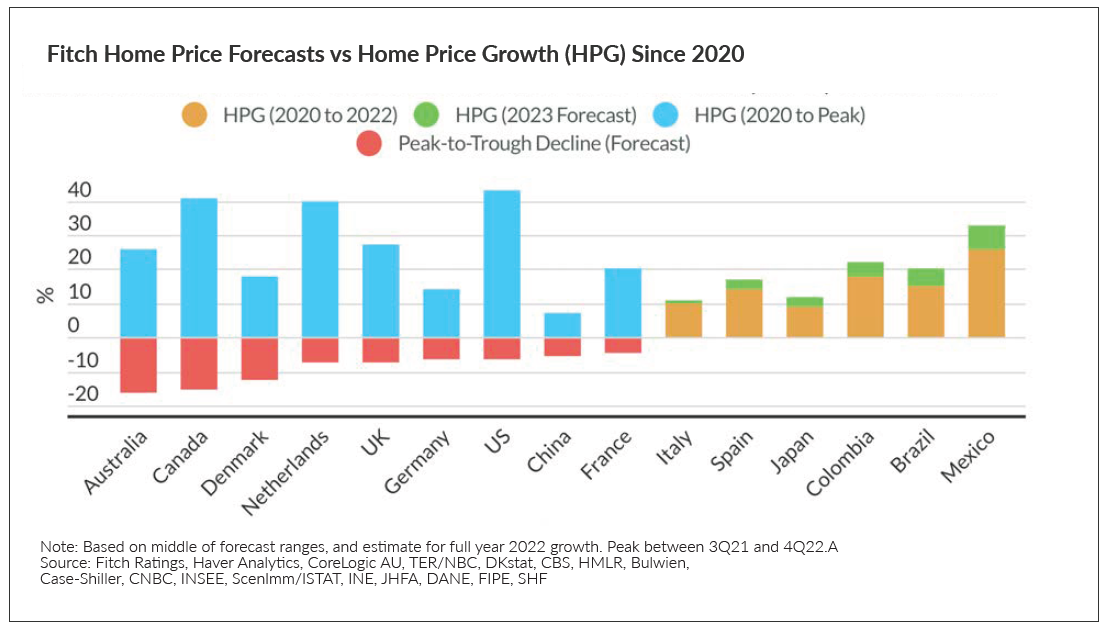

However, house prices are expected to register an annual decline of 5% to 7% for 2023, resulting in an aggregate peak-to-trough fall of roughly 15%.

In spite of this, Canadian covered bonds (CBs) are expected to maintain a positive outlook, largely due to the B-20 guidelines that govern the loans that form the covered bond pool of assets (namely, prime mortgages). These guidelines were set out by the Office of the Superintendent of Financial Institutions (OSFI) to ensure mortgage underwriting practices are both prudential and transparent.

A key part of the B-20 guidelines is the mortgage stress test, which requires potential homebuyers to qualify at an interest rate based on a rate that is currently two percentage points higher than their contract rate.

These regulations, combined with a foundation of borrower home equity and “significant consumer savings” from the pandemic, have at least partly contributed to the lack of a significant rise in mortgage delinquencies—despite mortgage payments increasing an average of $300 to $700 for fixed and variable mortgages, respectively.

Fitch also noted that its rating upticks given to the covered bonds—based on factors such as liquidity protection and over-collateralization—have helped Canada’s CBs ratings stay optimistic.

An unexpected rate hike

One area of interest was Fitch’s take on interest rate hikes for 2023: “We now expect the BoC to keep the policy rate at 4.50% throughout 2023, given that the BoC forecasts headline inflation to fall to 2.6% this year and its preferred inflation measures appear to have peaked.”

The BoC’s June 7 rate announcement, which surprised markets by raising the overnight rate to 4.75%, came as, “underlying inflation remains stubbornly high,” the BoC noted in its release.

Indeed, mortgage borrowers could come under further rate pressure with markets currently assigning a roughly 60% chance of another 25-bps rate increase at the Bank of Canada’s July 12 meeting. If that doesn’t happen, a quarter-point rate hike in September would become a near-certainty, though would remain heavily dependent on forthcoming economic data released before then.

An additional increase would apply immediate pressure to borrowers with adjustable mortgage rates, testing consumers’ ability to continue paying skyrocketing costs. If delinquencies become more common, covered bonds ratings’ are anticipated to be negatively affected.

Canada’s economic review broadly positive

Although Canada’s housing market remains tumultuous, its overall economic health is positive.

Even with the Canadian housing market remaining “29% overvalued” by Fitch’s estimation, Canadians have enough cushion to withstand any potential further price drops. The credit ratings firm also notes how ‘sideline-buying’ has helped support the housing market during the market downturn.

“These areas [Toronto and Vancouver] are now seeing some of the larger price corrections, although demand, driven by local buyers and high immigration, and limited supply are still supportive of net price gains relative to pre-pandemic,” the report reads. “When prices dip, buyers on the sidelines jump in, offsetting downward price pressure…”

Taking into account recent interest rate hikes, overall consumer spending will match the tightness of buyers’ budgets, and excise taxes and real estate transactions will decline to match. Between shrinking inflationary pressures and a near-record low unemployment rate of 5.2%, Fitch notes Canada’s position to withstand the recessionary pressures that are coming.

“Broadly, Canadian provinces have significant cushion to absorb an economic downturn, as they had a solid recovery from the pandemic with strong revenues and lower borrowing needs,” the report says.