What is the RBI Floating Rate Bond July – December 2023 interest rate? The interest rate for RBI Floating Rate Bond for the period of July – December 2023 is 8.05%. As you may be aware the interest rate (coupon) on RBI Floating Rate Bonds changes on a half-yearly basis, so it is important to know the current rate.

RBI Floating Rate Bonds were introduced in June 2020 by replacing the RBI 7.75% Savings Bonds (2018). In floating-rate bonds, the interest rate varies based on the frequency set by the bond issuer. Such bonds will not offer you any cumulative option.

RBI Floating Rate Bond July – December 2023 Interest Rate

As I told you above, the interest rate for RBI Floating Rate Bonds would reset once every six months.

# 1st Reset of RBI Floating Rate Bond (1st January 2021 to 30th June 2021)

The first reset was on 1st Jan 2021. On 1st Jan 2021, the benchmarked National Saving Certificate (NSC) rate was 6.8%. Hence, for the period of 1st Jan 2021 to 30th June 2021, the RBI Floating Rate Bonds interest rate was 35 basis points over the NSC rate. Since the NSC rate was fixed at 6.8%, these bonds fetched 0.35% more = 7.15% returns.

# 2nd Reset of RBI Floating Rate Bond (1st July 2021 to 31st December 2021)

The second reset was from 1st July 2021. On 1st July 2021, the benchmarked National Savings Certificate (NSC) rate was 6.8%. Hence, for the period of 1st July 2021 to 31st December 2021, the RBI Floating Rate Bonds interest rate was 35 basis points over the NSC rate. Since the NSC rate was fixed at 6.8%, these bonds fetched 0.35% more = 7.15%.

# 3rd Reset of RBI Floating Rate Bond (1st January 2022 to 30th June 2022)

The third reset was done on 1st January 2022. Again on 1st January 2022, the NSC interest rate remained at 6.8%, and hence the RBI Floating Rate Interest Rate for the period of 1st January 2022 to 30th June 2022 was 7.15%.

# 4th Reset of RBI Floating Rate Bond (1st July 2022 to 31st December 2022)

The fourth reset was done on 1st July 2022. Again on 1st July 2022, the NSC interest rate remained at 6.8%, and hence the RBI Floating Rate Interest Rate for the period of 1st July 2022 to 30th December 2022 was 7.15%.

# 5th Reset of RBI Floating Rate Bond (1st January 2023 to 30th June 2023)

The fifth reset was done on 1st January 2023. Due to high inflation, the NSC interest rate was increased from the existing 6.8% to 7%. Hence, the RBI Floating Rate Interest Rate for the period of 1st January 2023 to 30th June 2023 was 7.35%.

# 6th Reset of RBI Floating Rate Bond (1st July 2023 to 31st December 2023)

The sixth reset was done on 1st July 2023. Due to high inflation, the NSC interest rate was again increased from the existing 7% to 7.7%. Hence, the RBI Floating Rate Interest Rate for the period of 1st July 2023 to 31st December 2023 is 8.05%. (Refer the latest rates at “Latest Post Office Interest Rates July – Sept 2023“).

Features of RBI Floating Rate Bonds

| RBI Floating Rate Bond 2023 features and Interest Rate from 1st July 2023 to 31st December 2023 | |

| Features and Eligibility | |

| Who can invest? | Resident Indian (Individual, Jointly, Either or Survivor, or on behalf of minor) and HUF. NRIs not allowed to invest |

| Minimum and Maximum Investment | Min. Rs.1,000 and no maximum limit. |

| Face Value of Bond | Rs.1,000 |

| Interest Rate | NSC interest Rate on 1st July 2023 7.7%+0.35%=8.05% (Applicable from 1st July 2023 to 31st December 2023) |

| Term | 7 Yrs |

| How to buy? | Through Cash (Up to Rs.20,000), DD, Cheque or Online. |

| Nomination Facility | Yes |

| Transfer Option | Bonds can’t be transferred (except to nominee in case of the death of the holder). |

| Taxation | Interest is taxable as per your tax slab |

| TDS | Yes |

| Liquidity | NOT tradable and NOT eligble for collateral |

| Interest Payment | Half Yearly |

| Cumulative Option | NO |

In addition to above features, let me share certain important features of this bond.

# If holder of the bond turned NRI, then he can hold the bond up to maturity.

# The Bonds will be issued only in electronic form and held at the credit of the holder in an account called Bond Ledger Account (BLA), opened with the Receiving Office.

# The interest on the bonds will be payable half-yearly from the date of the issue of the bond. Once on 30th June and another on 31st December yearly. As I mentioned above, there is no option of cumulating in this bond.

# The interest will change on a half-yearly basis starting from 1st January 2021. This interest rate is linked to the prevailing interest rate of NSC (Post Office National Savings Certificate)+35 BPS (100 BPS=Rs.1).

# Interest will be payable directly to the bond holder’s account.

# The bonds will be repayable after the completion of 7 years. Premature withdrawal is allowed only for those whose age is 60 years and above subject to the submission of documents relating to the date of birth proof. The minimum lock-in period for the age group 60 Yrs to 70 Yrs is 6 years. For 70 Yrs to 80 Yrs is 5 Yrs and for those whose age is beyond 80 years is 4 years.

# Even though you request redemption as per your age slab, the redemption amount will be transferred with the immediate next interest rate period. Hence, irrespective of your submission for premature withdrawal, Govt will process it either on the 1st of July or the 1st of January every year. Also, in such premature closure, Govt will deduct 50% of the last coupon payment.

How to buy RBI Floating Rate Bonds?

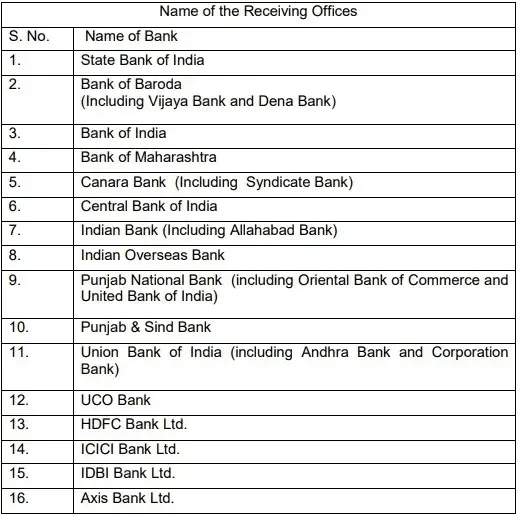

You can buy the RBI Floating Rate Bonds from the below-listed banks.

Where to approach if you have an issue with your bank in Government of India Floating Rate Savings Bonds, 2023 (Taxable)?

In case the issuing bank does not comply with the above, you may lodge a complaint in writing in the form provided at

the counter of the bank and address the same to the nearest office of Reserve Bank of India, as under:

THE REGIONAL DIRECTOR,

RESERVE BANK OF INDIA,

CONSUMER EDUCATION AND PROTECTION DEPARTMENT/ BANKING OMBUDSMAN (LOCATION)

You may also address your complaint to:

THE CHIEF GENERAL MANAGER

INTERNAL DEBT MANAGEMENT DEPARTMENT

RESERVE BANK OF INDIA, 23rd Floor

CENTRAL OFFICE, Shahid Bhagat Singh Marg,

MUMBAI-400 001

MAHARASHTRA

E- mail ID – [email protected]

RBI Floating Rate Bonds – Should you invest?

# Interest Rate Risk:-As your interest is linked to NSC and the feature of this bond is floating, you can’t expect a constant stream of income. It fluctuates as and when there is an up and down in NSC rates. Do remember that the only difference is in the case of NSC, the interest rate will change on a quarterly basis. However, in the case of this bond, it changes once in a half year.

# Liquidity:-Liquidity is the biggest risk in such bonds. Because the tenure is 7 years. Certain premature withdrawal option is available for senior citizens and also with the minimum period of holding 4 years, it turned to a highly illiquid product. Remember that these bonds can’t be tradable or transferable.

# Sovereign Guarantee:-As these bonds are issued by Government, there is no question of default risk. Hence, safety-wise, such bonds carry the highest degree of safety.

# Boon for those who are looking for a constant stream of income:-This bond is a boon for those who are looking for a constant stream of income. However, if you consider the other available options like Post Office Senior Citizen Savings Schemes or Pradhan Mantri Vaya Vandana Yojana (PMVVY), I feel this product is less attractive.

# Taxation:-This bond income is taxable. Hence, this bond is best suitable for those who are at a lower tax bracket. Also, do remember that there is a TDS on the interest that you receive.

Conclusion:-Comparing the Pradhan Mantri Vaya Vandana Yojana (PMVVY) or Senior Citizen Savings Scheme (SCSS), I think this bond is less attractive. However, in the case of PMVVY and SCSS, there is a maximum limit. But in this bond, there is no such maximum limitation. A combination of PMVVY, SCSS, and Government Floating Rate Savings Bonds, 2023 (Taxable) may be the best choice for senior citizens.