National vacancy rates increased marginally in June, providing renters with some much-needed relief.

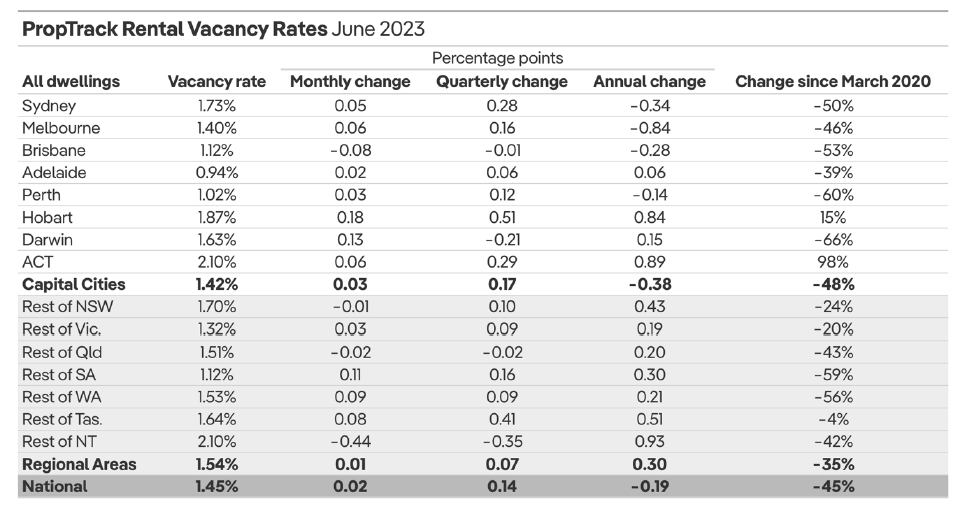

The latest PropTrack Market Insight showed rental vacancy rates lifted 0.02 percentage points to 1.45% nationally and was 0.14ppt higher quarter-on-quarter. Even so, the national vacancy rate remained down 0.19ppt annually and -45% lower than pre-pandemic levels.

“Slowing rental demand has resulted in more rental properties being available for lease,” said Paul Ryan (pictured above), PropTrack senior economist and report author. “But despite the improvements, rental vacancy rates remain low – around half the levels seen before the pandemic – and demand is easing, but still strong.”

Ryan said the rental market conditions in capital cities looked more promising, with vacancy rates up 0.17ppt over the past three months. This was the most significant easing in rental market conditions since early in the pandemic in November 2020.

Amongst the capitals, Hobart and Canberra have seen the strongest rise in rental vacancies over the past three months, up 0.51ppt and 0.29ppt, respectively. Following closely was Sydney, where rental vacancy rates were up 0.05ppt in June and 0.28ppt over the past three months.

In Melbourne, rental markets have continued to stabilise over the past few months, but available vacancies remained at a low level of just 1.4%.

Adelaide (0.94%) and Perth (1.02%) continued to see the tightest rental market conditions with the fewest available rentals of all markets nationally.

Brisbane was the only capital city with tightening rental market conditions, with vacancy rates falling 0.08 ppt to 1.12% in June.

Across the regions, rental vacancy rates fell 0.06ppt over the last month to sit at 1.51% – 0.35ppt above May 2022 levels.

Ryan said despite national vacancy rates easing, “it remains difficult to find a rental across the country,” and rent prices were expected “to continue to grow quickly, placing additional financial pressure on renters.”

Use the comment section below to tell us how you felt about this.