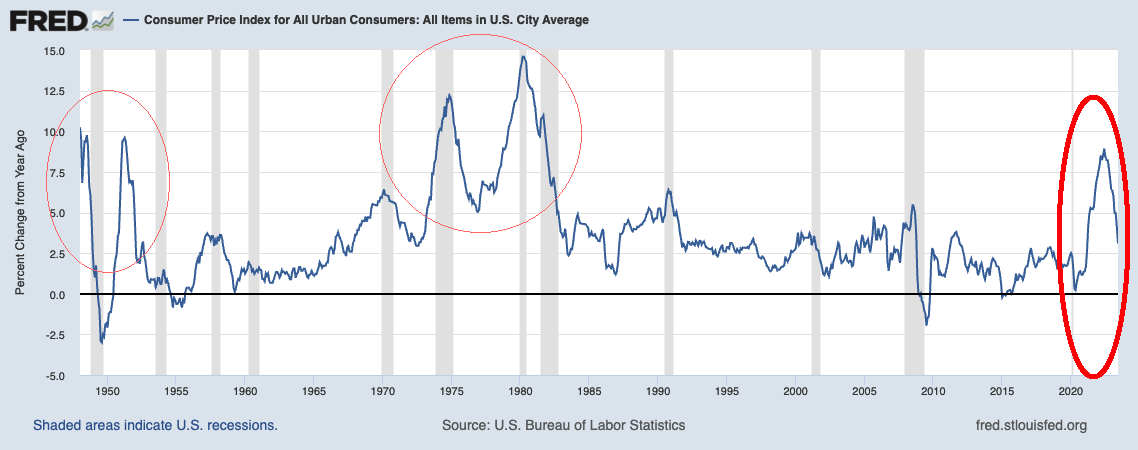

The Consumer Price Index was up 3% year over year in June, as reported by BLS yesterday. The FRED chart above shows the near round trip from the prior decade’s range of 0-2% up to the 9% peak, and now back down to 3%.

Over the past year, I have been writing a lot about inflation — what people get wrong about it, why the FOMC is always late to the party, and what the various causes of inflation — real, modeled, and imagined — actually are.

Here are 12 ideas that are (or were) contrarian thoughts on inflation.

1. Inflation peaked June 2022; After making new highs a year ago, it has been falling rapidly ever since.

This was a contrarian position for most of the past year; after the May and June CPI reports, this idea has moved into the mainstream.

2. “Long and Variable Lags?:” The FOMC rate increases and other Fed policy actions are felt in the broader economy eventually. Exactly how long it takes is the subject of debate.

In the 1970s, when inflation was persistent and home mortgages were double digits, it was fair to assume it may have taken as long as 18 months for FOMC policy to be felt. But that seems longish in a modern economy that runs on credit.

A transparent Fed that tells the market exactly what going it’s going to do should have a much shorter lag — especially coming off of a zero-rate environment where mortgage and car loan rate increases impact the economy much more quickly.

3. Labor Reset: Lagging bottom-half wages over the past 3 decades were deflationary; now, the lowest-paid workers are catching up and it’s inflationary. But the biggest factor in this has been a shortage of workers across numerous industries; what is needed is more workers. (I am at a loss to see how higher rates make that happen).

But economists like Lawrence Summers are stuck in a 1970s mindset. His claim that the only way to end inflation was to throw 5 million people out of work was not just wrong, it relied on an embarrassingly outdated model (and it was unnecessarily cruel). It’s a good thing so few listened to him and a better thing he wasn’t the Fed chairman — the resulting recession would have been disastrous.

4. Transitory wasn’t wrong, it just took longer than expected.

A once-in-a-century pandemic with an unprecedented global lockdown simply took much longer to unwind than expected. There was literally no modern comparison, and everyone was making their best guesses.

That said, 27 months instead of 12-18 is less of a miss than many have made it out to be.

5. Inflation Models are Inaccurate but precise. PCE, CPI, and just about every inflation model I track is flawed but useful. Those that are consistent can be used as a baseline for historical analysis. However, relying on them to make real-time policy decisions is deeply problematic.

They are lagging, they make assumptions that can lead to skewed results, and rely on a complex world that models can only approximate but not depict precisely. For the current situation, they seem to have faltered as novel situations arose.

They may not reflect the real world as it is, but at least they can be consistent. This means modeling errors lead to results that are “wrong but useful.” Any organization that fails to understand this is at risk of making substantial decision-making and policy errors.

6. Inflation Expectation Surveys are Foolish: They are wrong. And dumb. And pretty much useless. Stop relying on them…

7. Higher Home Prices: Three factors have reduced single-family home supply, thereby driving real estate inflation:

A) Big post-GFC decrease in new home construction;

B) Pandemic home purchases without a corresponding sell,

3) 2017-21-era mortgages of 2.75% – 4.0%. Those low rates lock in homeowners who cannot afford to pay 7.5%+ for a new mortgage on another home.

All of this adds up to a huge shortfall in the supply of homes available for sale.

8. The Fed is driving OER higher: Given the shortage of housing, the rapid increase in rates has perversely caused more, not less inflation. At least, in the Owner’s Equivalent Rent (OER) portion of CPI.

I have been railing against OER for nearly two decades; hopefully, this part of BLS model gets updated soon.

9. For lower inflation, lower rates: The main drivers of current inflation NOW are apartment rental costs, shortage of homes, and too few workers. Raising rates won’t fix these issues and arguably, make them worse.

FOMC raising rates from these levels not only makes OER look worse, it reduces single-family home supply, makes houses more expensive, but also sends more people into the rental market — making apartment rentals higher.

10. Consumers drive inflation: Yes, consumers suffer from inflation, but when they willingly pay up for goods and services regardless of price increases they cause inflation. This is true for necessities (food, energy, clothes), in discretionary items (travel, 2nd homes), and most especially luxury goods (Watches, sports cars, bags, jewelry). Excess demand for goods during the pandemic led to goods inflation; excess demand for services post re-opened led to services inflation. Following each of those surges were somewhat different types of Inflation.

11. Lose the 2% Inflation Target: Seriously. After the GFC, the economy was sluggish and ZIRP/QE had driven rates near zero, 2% was a reasonable upside target. But after $5 or 6 trillion in fiscal stimulus, and mortgage rates at 7.5%, perhaps 3% or even 2.5% makes more sense as an inflation target.

12. The Fed has already won: Mission accomplished! Jerome Powell can take the summer off, enjoy fishing at Jackson Hole, and really, just chill out for the rest of the year. There is no need for further increases in rate as the battle is already won.

~~~

To be fair, the Fed was late to get off zero, late to recognize inflation, late to act, and they are now late to recognize inflation has fallen radically. Still, even a blind squirrel finds a nut now and then, and they should take the win and stop here.

They are at risk of snatching defeat from the jaws of victory…

Previously:

Inflation Expectations Are Useless (May 17, 2023)

What the Fed Gets Wrong (December 16, 2022)

How the Fed Causes (Model) Inflation (October 25, 2022)

Why Is the Fed Always Late to the Party? (October 7, 2022)

Transitory Is Taking Longer than Expected (February 10, 2022)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

Deflation, Punctuated by Spasms of Inflation (June 11, 2021)

What Models Don’t Know (May 6, 2020)

Confessions of an Inflation Truther (July 21, 2014)