What is the NPS Tier 2 Tax Benefits 2023 – Under New TAx and Old Tax Regimes? Whether one will get the tax benefits like Mutual Funds while withdrawing?

Earlier, I wrote about NPS Tax Benefits 2023 – Under New Tax and Old Tax Regimes, during that time I was unable to get the written information about the NPS Tier 2 Tax Benefits 2023 rules. However, luckily I can find it. Hence, thought to write a separate post on this aspect.

NPS Tier 2 Tax Benefits 2023 – Under New Tax and Old Tax Regimes

Let us first understand the taxation rules at the time of investment.

NPS Tier 2 Tax Benefits 2023 while investing

# NPS Tier 2 Tax Benefits 2023 under the old tax regime

Earlier there was no income tax benefit if you invest in a Tier 2 Account. However, the Government of India changed the rules recently. According to this, if Central Government Employee contributes towards a Tier 2 Account, then he can claim the tax benefits under Sec.80C (The combined maximum limit under Sec.80C will be Rs.1.5 lakh ONLY). Also, if someone availed of such tax benefits, then the invested money will be locked for 3 years (exactly like ELSS Mutual Funds).

# NPS Tier 2 Tax Benefits 2023 under the new tax regime

As Sec.80C is not part of the new tax regime, there is no tax benefit even for Central Government Employees also (if they are contributing towards a Tier 2 Account). Hence, if you adopted the new tax regime, then whether you are a government employee or non-government employee, there is no tax benefits.

NPS Tier 2 Tax Benefits 2023 while withdrawing

If you refer to my earlier post, I have written as below.

“Sadly there is no clarity on this aspect. Few argue that as the structure of Tier 2 is like Mutual Funds, we can pay the tax like mutual funds (debt and equity) based on our holding proportion (either equity or debt).

However, few argue that as in the case of the NPS Tier 2 Account, we are not paying any STT (Security Transaction Tax), we must not consider the taxation of Tier 2 account as like Mutual funds and should be taxed under the head of “Income From Other Sources”. Also, as of now, the NPS Tier 2 account is not qualified as Capital Asset under Section 2.

Personally, I feel the second opinion of considering this as income from other sources looks like a valid reason. However, it must not be considered a rule. I am just airing my views. I know that my view may be harsh. However, as long as there is no clarity from IT Department, it is hard to judge.“

However, as now I got clarity on this, I thought to write a separate post on this.

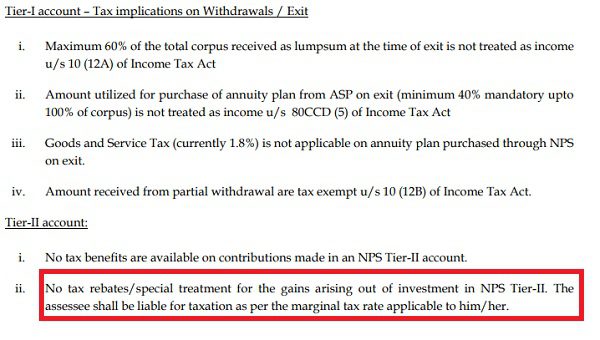

As per this PFRDA’s FAQ of NPS for All Citizen Module of NPS, it is clearly mentioned below (Refer Page No.16).

It is clearly mentioned that there is no special treatment for the gains arising out of the NPS Tier 2 Account. The harsh reality is that you are liable to pay the tax as per your tax slab.

Hence, my below opinion holds good for the NPS Tier 2 Taxation at maturity.

“However, few argue that as in the case of the NPS Tier 2 Account, we are not paying any STT (Security Transaction Tax), we must not consider the taxation of Tier 2 account as like Mutual funds and should be taxed under the head of “Income From Other Sources”. Also, as of now, the NPS Tier 2 account is not qualified as Capital Asset under Section 2“.

I hope I have cleared the doubt about NPS Tier 2 Tax Benefits 2023 – Under New Tax and Old Tax Regimes.