“A new product that offers investors complete downside protection: Investors in the $7.5 trillion ETF universe can now put money behind the Innovator Equity Defined Protection ETF, which began trading under the ticker TJUL on Tuesday. The offering comes from Innovator Capital Management, which launched the first so-called buffer ETFs, also sometimes referred to as defined-outcome funds, in 2018.” –Bloomberg

Let’s get this out of the way: I dislike any product that exchanges a portion of your potential gains in exchange for downside protection.

Let’s discuss why.

First and foremost, products like these are wholly unnecessary. At least, if you are a smart investor who does the right things: Set up a financial plan, manage your own behavior, engage in long-term thinking, and avoid reacting to the endless daily noise that markets + media generate.

Second, follow Charlie Munger’s advice and invert the sales pitch: 70% of the upside (you give up 16.62% per year for 2 years) with none of the downside sounds attractive – unless you think about what you are really giving up and getting in exchange.

Would you accept a trade where for ~32% of the upside, you are freed from having to manage your own behavior? That sounds quite expensive for something that should cost you a) nothing if you do it yourself, or 2) 50-100 bps if you work with an advisor.

That sounds like a terrible deal to me.

Third, when you own a broad index of equities, the upside compounds over the long run while the drawdowns are temporary. Giving up permanent gains to avoid impermanent drops seems like an awful exchange.

My obvious bias is that my advisory firm charges clients to create financial plans and manage their assets. But just do the math: Would you prefer to give up 67 basis points (RWM’s dollar-weighted average fee is ~0.67%) or would you prefer to give up 30% of your gains PLUS pay an annual 0.79% fee for the TJUL ETF? It is the advisor’s job to prevent clients from engaging in the kind of bad investment behavior that drawdowns often cause; I cannot see how trading that for >30% of the upside makes any sense.

Innovator, the firm behind TJUL, manages “more than 50 buffer funds which have collectively drawn over $12 billion in assets since 2018. . . Among the largest vehicles are the Innovator S&P 500 Power Buffer ETF (PAPR), totaling about $687 million in assets, and the Innovator S&P 500 Power Buffer ETF (PJUL), which has roughly $834 million in assets.”

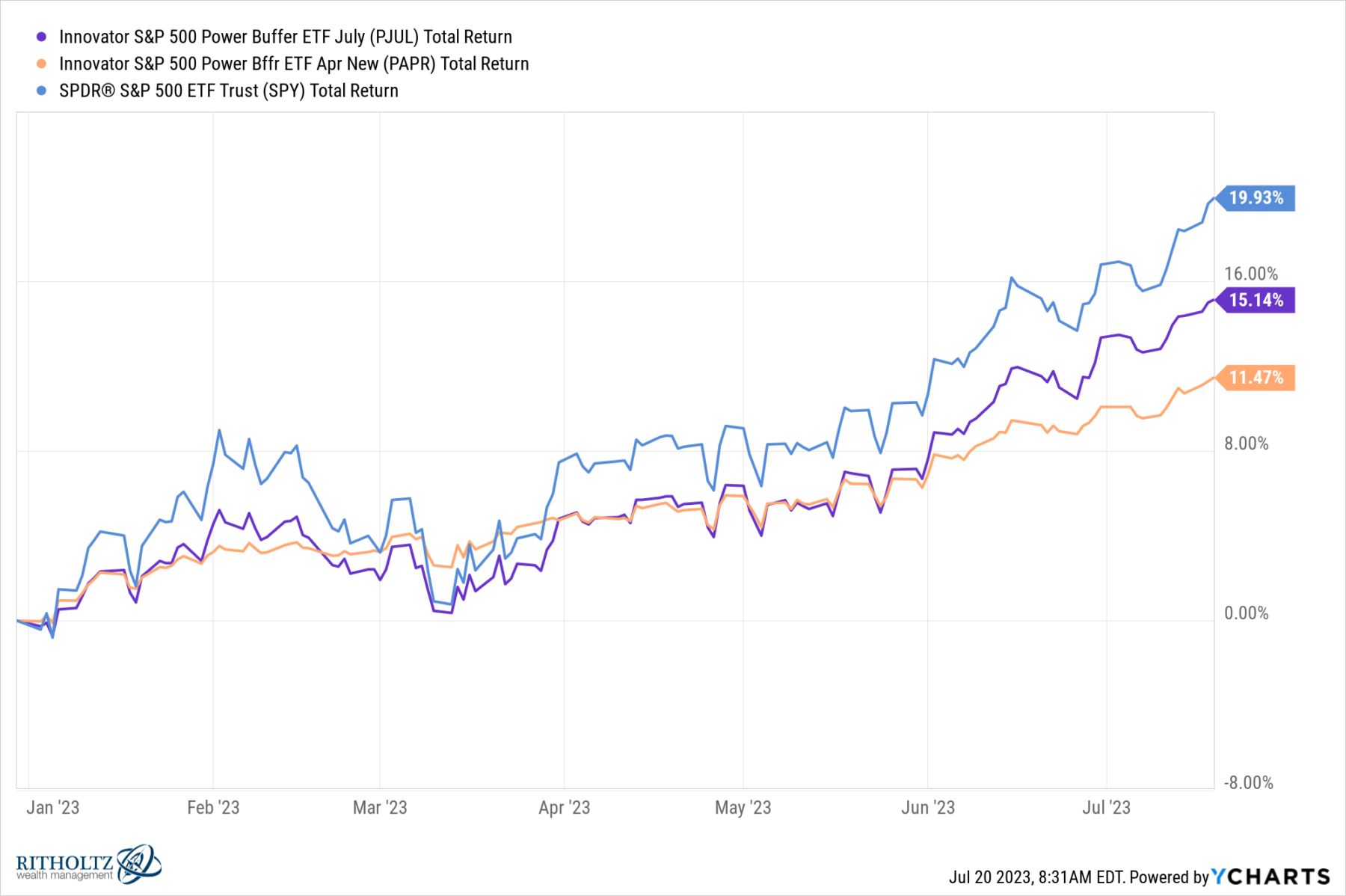

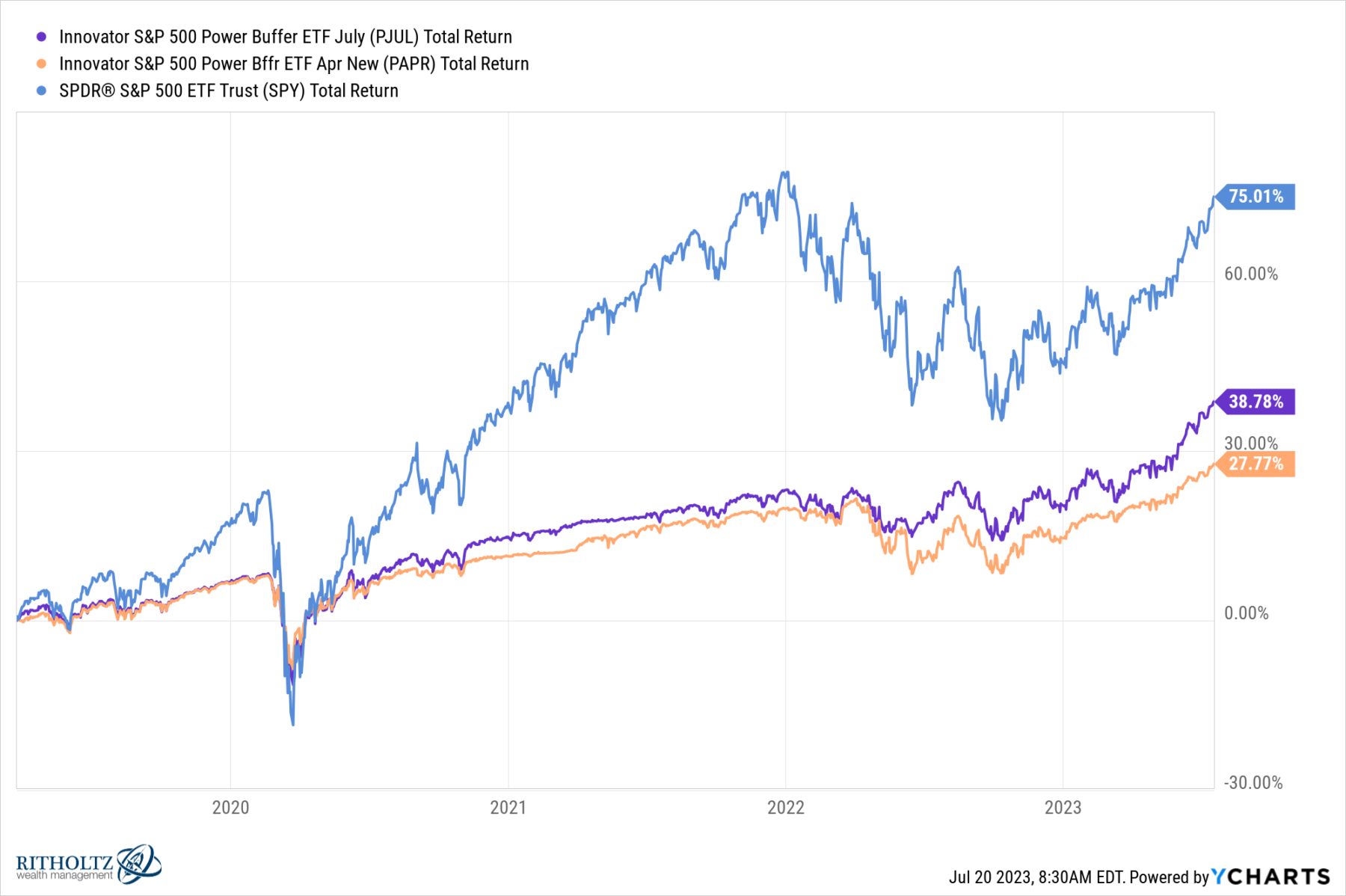

Those funds have a starting upside cap of 14.28% versus TJUL’s 16.62%; the chart above shows how they have done year to date: Up 11.5% and 15.1% respectively this year, versus 19.9% for SPY. Since inception (March 2019), they are up 27.8% and 38.8% respectively, versus 75% for the SPY S&P 500 ETF over the same period. (Chart after the jump).

The performance numbers reveal this is a terrible trade-off for the average retail investor.

See also:

Innovator TJUL

Source:

Wall Street Gets New ETF Offering 100% Downside Protection

By Vildana Hajric, and Emily Graffeo

Bloomberg, July 18, 2023

PJUL, PAPR, SPY March 25 2019 to July 10, 2023 (yesterday’s market close)