They say that time can heal all wounds. Maybe all of them except for debt—that one just keeps on piling up.

I mean, listen—an average American has a credit card debt of $8,900 for a reason.

That’s why we prepared a comprehensive list of ways to get out of debt with no money and bad credit.

Buckle up, because it’s going to be a long one—

This article will show you:

- How much debt is too much.

- Tips to get out of debt with no money and bad credit.

- How to rebuild your credit score (and why you should).

Relevant articles:

How Much Debt Is Too Much Debt?

Depends on who you ask—your “always juggling multiple debts” best friend, your creditors, or Dave Ramsey. (It’s probably better that you don’t reach out to Mr. Ramsey—but imagine what your great-grandmother would say.)

Here are some key indicators and ratios that can help you find out if your debt level is becoming problematic:

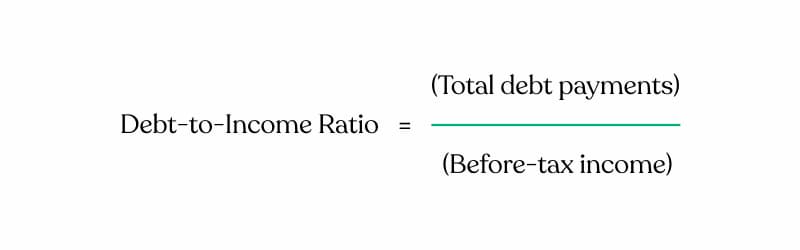

Debt-to-Income Ratio (DTI)

This ratio compares your monthly debt payments to your monthly gross income.

To calculate it, divide your total debt payments by your gross income and multiply by a hundred to get a percentage:

A DTI of 36% or lower is generally considered healthy, while a DTI above 43% may make it hard to secure new credit or loans.

Credit utilization ratio

This ratio measures the amount of credit you’re using compared to your total available credit.

A high credit utilization ratio (above 30%) can negatively impact your credit score and is a signal that you’re relying too heavily on credit.

To improve your credit utilization ratio, you’ll need to reduce your total loan cost.

Difficulty making minimum payments

If you’re struggling to make minimum payments on your debts each month, this is a clear sign that your debt level is too high.

No savings and emergency fund

If your debt is preventing you from saving money or building an emergency fund, it’s a sign that your debt level may be unsustainable.

Stress and impact on quality of life

If your debt is causing significant stress or impacting your ability to enjoy life—well, you know the drill by now.

If you check some (or all) of these boxes, don’t fret. We’ve got you covered.

Tips To Get Out of Debt With No Money and Bad Credit

Assess, assess, assess

Say that three times fast.

But jokes aside, first things first—gather all the data, look through every nook and cranny, and any budgeting apps you may use (or downloaded once, never to be seen again).

Make a list of all your debts, including interest rates and minimum payments. This will give you a clear picture of your financial situation and help you prioritize which debts to tackle first.

As Bruce Sellery puts it,

Paint the picture, even if it isn’t pretty. Write down your debt details—you can’t get where you want to go if you don’t know where you are. Do it on a napkin or in a spreadsheet. Include each debt, the outstanding balance, minimum payment, interest rate, and due date.

Bruce SelleryCEO of Credit Canada

Create a new, detailed budget

Now, I don’t know if you’re already using one. If you are, update it, and use it to your advantage.

If not, create a brand new weekly or monthly budget using our free budget templates (and my favorite tool—a free budget calculator created by our founder, Derek Sall).

Click here for more templates, spreadsheets, and other useful budgeting tools.

Once you have all your income, expenses, and debts in one place, create a visual representation of your debt.

We asked Bruce Sellery for ideas—

Create a paper ‘debt snake.’ This is a fun little craft project to make your debt tangible. You can include a link for every $100 you owe, and then you cut off the amount you’ve repaid. It makes a big difference to see the snake shrink in front of you.

Bruce SelleryCEO of Credit Canada

It may sound weird, but it works.

Create an emergency fund

Now, before you do anything else from the list—save up a mini-emergency fund.

We recommend one month’s worth of expenses (usually $2,000–$3,000, depending on your situation).

You never know what future holds. Having some money aside for emergencies is crucial for your life and your peace of mind.

Debt snowball or avalanche?

So, you have all the data in front of you. Which debts should you pay off first?

Both the debt snowball and avalanche methods are effective strategies for paying off debt, but they cater to different preferences and motivations.

Let’s dive deeper into each method to help you decide which one is best for you—

Debt snowball method

I’ll explain it step by step:

- List your debts from the smallest to the largest balance, regardless of interest rates.

- Make minimum payments on all your debts except for the one with the smallest balance.

- Allocate any extra money towards the smallest debt until it’s paid off (more on that later).

- Once it’s paid off, move on to the next smallest debt, and repeat the process.

- Continue until all debts are paid off.

Pros

The debt snowball method provides quick wins, which can be motivating and help you build momentum. It’s psychologically rewarding to see debts disappear, making it easier to stick to your repayment plan.

Cons

This method may not be the most cost-effective, as you might end up paying more in interest over time compared to the avalanche method. But, as Derek says,

For many, paying off the small debt increases their motivation to keep going, so it’s known that the debt snowball method is best for completing your debt payoff journey (per Harvard). I believe that it’s often the fastest way too, since you’re motivated and want to do more.

Derek SallFinancial expert and creator of Life and My Finances

Debt avalanche method

The debt avalanche is pretty similar:

- List your debts from the largest interest to the smallest interest.

- Make minimum payments on all your debts except for the highest-interest one.

- Put any extra money towards the highest-interest debt until it’s paid off in full.

- Once it’s gone, move on to the next largest interest debt, rinse, and repeat.

- Do it until you pay off all your debts.

Pros

The debt avalanche method is more cost-effective, as it saves you money on interest payments in the long run. By tackling high-interest debts first, you’ll reduce the overall amount you owe more quickly.

Cons

This method doesn’t give you the same level of motivation as the snowball method, as it might take longer to see debts being eliminated.

So, if you’re motivated by quick wins and need a psychological boost to stay on track, the debt snowball method might be the better choice for you.

But if you’re focused on minimizing interest payments and want to pay off your debt in the most cost-effective way, the debt avalanche method is the way to go.

Pamela Capalad adds a fun twist on this,

To get out of debt, it’s important to get creative and be persistent. One approach that has been trending on social media is to try out different savings challenges. You can apply the same principle to paying down debt by creating a 90-day challenge for one debt that you want to focus on. Making it fun and engaging can help keep you motivated.

Pamela CapaladFounder and CEO of Brunch and Budget

To crunch the numbers and choose the right method for you, use our free debt snowball vs avalanche method payoff calculator.

Read more:

(Sidebar: Want to get out of debt in a year or less? Check out our new Get Out of Debt course.)

No money? Then make some!

We don’t mean to be pushy, but if you live paycheck to paycheck and have no money to pay off debts, you need to make more.

Try picking a side hustle to earn some extra dough.

Freelance work or side hustles

Walking dogs, babysitting, virtual assistance, or driving Uber—wherever you look, there’s a side hustle waiting for you.

Read more:

Also, take a look at our list of the best gig apps.

Use apps like Instacart

Put your Rachel Green hat on and shop for others.

You can make a good buck doing so—simply use apps like Instacart, DoorDash, or Postmates.

Sell stuff you no longer need

Yes, that includes your car. (Don’t hate me—blame it on Dave Ramsey.)

Sign up for cashback websites

Cashback websites let users earn cashback or rebates on their purchases made through the site.

They partner with various retailers and get a commission for referring customers to their online stores.

Some popular cashback websites in the US include Rakuten (formerly Ebates), TopCashback, Swagbucks, and BeFrugal. Make sure you compare rates to get the best deal.

This certainly won’t change your life, but every bit helps.

Rent out your space

It’s getting more and more popular to rent out your spaces. Even a spare room can make you a nice extra sum.

Just use Neighbor—it’s easy.

Rent out your driveway/parking space

If you’re not quite ready to rent a room in your house, maybe you can settle for a driveway or a parking space. (I know someone who makes $175 every month doing so. It’s awesome.)

Use windfalls wisely

If you get a bonus, tax refund, or other unexpected cash, put it towards your debt repayment. However small the amount is—even if you find a dollar on the street—it counts.

Use the envelope system

Now that you made some extra dollars, organize and manage it responsibly.

Take the sums you allocated for every expense bucket in your budget and put them into separate envelopes. Once on the go, use only the cash you have in there (no overspending).

Cut expenses (ruthlessly)

No Netflix? No extra guac?

It hurts, I know—but we didn’t say it’s going to be easy.

First, look at the categories that usually eat up a lot of your money as these can have the biggest impact. (We mean things like home expenses, car, food, and so on.)

Trinity Owen, founder and CFO of the Pay at Home Parent, CFEI®, CFLP℠, recommends the following next,

Begin by reexamining your budget for lesser-known opportunities to cut expenses, such as switching to a pay-as-you-go phone plan, making energy-efficient upgrades to reduce utility costs, or using grocery shopping apps to take advantage of cashback and coupons.

Trinity OwenFounder and CFO of the Pay at Home Parent

You’d be surprised how these little pockets of money add up. Now you can redirect those saved dollars towards debt repayment.

Negotiate with creditors

Negotiating with creditors can be a valuable approach to potentially reduce your debt or make it more manageable.

Jack Prenter, CEO of DollarWise, puts it this way,

Reach out to your creditors and explain your financial situation. Many creditors are willing to work with you by lowering your interest rates, extending your repayment period, or even forgiving a portion of your debt. Call them up and ask because normally you can get more help from creditors than you would imagine.

Jack PrenterCEO of DollarWise

Here’s a step-by-step guide with our best tips:

1. Prepare your case

Have an honest look at your finances, figure out affordable payments or settlements, and research creditor policies.

2. Call them

Contact the creditor’s customer service or debt settlement department.

3. Be polite

Respectfully acknowledge your debt and intention to repay.

4. Explain

Describe your financial hardships and their impact on your life.

5. Propose

Confidently come up with a payment plan, reduced interest rate, or lump-sum settlement. We’d suggest first offering to settle for 25 cents on the dollar, as they likely bought the debt for ten cents or less. Then move to 50%, and then 75%.

6. Negotiate

If rejected, counter with another offer—or ask for their suggestion.

7. Document

Get a written confirmation of any agreed-upon terms.

Take Derek Sall’s advice, “Get everything in writing before paying. Then get signed documents saying you’re all paid up. Otherwise, this will pop up again and they’ll still say you owe.”

And finally—

8. Celebrate

Bask in the glory of successful debt negotiation.

Less-recommended ideas that may help

The best scenario is to tackle your debt yourself—just put your head down and pay it off.

If, for some reason, that’s not feasible, consider working with other agencies.

There can sometimes be complications, though. They may reduce your payments, but really save you no money.

Or even worse, they damage your credit—for example, by negotiating on your behalf and potentially taking illegal action (like getting debts cleared by claiming they aren’t yours).

That being said—

Try nonprofit credit counseling

Nonprofit credit counseling is a service provided by accredited organizations that can help you manage your finances, address debt issues, and improve overall financial health.

During the initial consultation, a certified credit counselor will do a comprehensive financial assessment and help you create a realistic budget.

Based on your situation, the counselor may create a tailored debt repayment strategy or recommend enrolling in a formal debt management program.

Before you go, learn a bit more about your options—

Debt management plans

As part of a structured debt management program, credit counseling agencies may negotiate with your credit card issuer to reduce interest rates or waive fees.

Although DMPs don’t directly forgive portions of your debt, they may help make it more manageable.

Credit card debt forgiveness programs

Debt settlement

If you were wondering how to pay off credit card debt when you have no money, you can try this.

You or a debt settlement company can contact your credit card issuer to negotiate a reduced lump-sum payment to resolve the outstanding balance. The creditor may agree to accept an amount that is less than the total debt owed, effectively “forgiving” a portion of the balance.

Hardship payment plan

If you’re having financial difficulties because of unemployment, medical emergencies, or other hardships, some credit card companies offer hardship programs as temporary debt relief.

These programs may involve reducing your interest rate, waiving fees, or coming up with a temporary payment plan to help you get back on track.

Debt loans for bad credit

Consolidation loans for bad credit

These loans let you combine all your debts into one loan, making repayment easier.

Although they might come with higher interest rates, they can provide a more straightforward approach to managing debt with bad credit.

Loans to pay off credit cards with bad credit

If you have bad credit and credit card debt, you can look for loans specifically geared toward paying off credit card balances.

Again—be extra cautious about interest rates, as they can sometimes be higher than your credit card rates.

Personal loans to pay off debt with bad credit

Some lenders, like SoFi, offer personal loans for those with low credit scores, aiming to help pay off accumulated debt.

While these loans can be helpful, remember to compare interest rates and fees before choosing one.

Home equity loans

Home equity loans let you borrow against the equity you’ve built up in your home. Since it serves as collateral, this loan option is generally easier to get, even with bad credit.

Keep in mind, though, that if you can’t make the payments, you risk losing your house.

Use the “Island Approach”

The “Island Approach” is a technique where you use separate credit cards for different spending categories.

You can have one card to manage a balance that you pay off over time and another card for daily purchases that you clear each month. This way, you end up paying less interest, making it easier to become debt-free.

Borrow money from family and friends

Sometimes it’s easier to borrow money from the bank (aka strangers) than from someone you know.

But if you’re in a tough financial spot, you might not have any other options.

And believe me, an awkward encounter with your in-laws is better than acting on my next advice—

Filing for bankruptcy

I know, I know. This is the worst-case scenario, but sometimes you just need to bite the bullet and do what needs to get done.

Consider filing for bankruptcy only when—

- You have unmanageable debt—it’s so overwhelming that even after budget adjustments, negotiations with creditors, or debt consolidation attempts, you still can’t make any progress toward repayment.

- Creditors have started legal actions, such as wage garnishments or bank levies, and these measures significantly impact your financial stability and day-to-day living expenses.

- You’re at risk of losing your home or your car because of debt. If that’s the case, bankruptcy may give you a level of protection, depending on the exemptions available under the specific bankruptcy chapter filed.

Some of these methods can impact your credit score—and not in a good way.

That’s why I feel like it’s worth reminding you how important it is to rebuild your credit. (I added some tips on how to do that, too.)

You Need to Rebuild Your Credit

Why? To name a few reasons—

Lower interest rates

A higher credit score earns you lower interest rates on loans and credit cards, reducing the overall cost of borrowing.

This means you’ll pay less interest while repaying your debt, freeing up more money to put towards the principal balance and helping you get out of debt faster.

Better debt consolidation options

If you’re juggling multiple debts, having a good credit score can give you access to better debt consolidation options (such as balance transfer credit cards with low or zero-interest promotional periods and competitive interest rates on personal loans).

Debt consolidation can simplify debt management and save you money on interest charges.

More refinancing opportunities

A good credit score may make you eligible for refinancing your existing loans, such as mortgages or student loans, at lower interest rates.

Refinancing can help you reduce your monthly payments, save on interest expenses, and pay off your debt sooner.

Better financial stability

As you improve your credit score, not only do you demonstrate responsible financial behavior, but you’ll also gain access to more financial products and services.

This increased financial flexibility can help you better manage and repay your debt while working towards other financial goals.

Repayment negotiations

A higher credit score can give you the upper hand when negotiating repayment terms with your creditors.

They may be more inclined to work with you in terms of waiving late fees, reducing interest rates, or offering extended repayment periods if they perceive you as a low-risk borrower.

Emergency borrowing

If you’re in debt and faced with an unexpected financial emergency, a good credit score can make it easier for you to secure additional credit quickly and at more favorable terms.

This will help prevent further financial setbacks as you continue to work on reducing your debt.

By the way, you can check what your credit score is right now.

Tips for Rebuilding Credit While In Debt

Make timely payments

Your payment history is the most significant factor in your credit score. Ensure you’re making at least the minimum payments on all your debts each month.

Set up payment reminders or automatic payments to avoid missed or late payments.

Reduce credit utilization

Aim to keep your credit utilization ratio below 30% by paying down outstanding balances and avoiding maxing out your credit cards. Consistently keeping your credit card balances low will have a positive impact on your credit score, and will help you avoid having to pay off credit card debt when you have no money.

A cool tip here is to ask your card issuer to increase your limit—staying under it becomes much easier then.

Keep your old accounts

The length of your credit history factors into your credit score.

Keep older credit accounts open, even if they have zero balances, to maintain a longer credit history and contribute to a higher credit score.

Regularly look through your credit report

Regularly review your credit report for inaccuracies or errors that might be reducing your credit score.

Dispute any errors you find with the respective credit bureaus to make sure your credit report accurately reflects your credit behavior.

Build a diversified credit mix

A healthy mix of different types of credit (e.g. installment loans, credit cards, and mortgages) can boost your credit score.

But only take on new debt when your existing debt becomes more manageable, and avoid applying for multiple new credit lines in a short period.

Consider credit counseling

If you’re struggling with managing your debt and rebuilding your credit, consider seeking help from a reputable credit counseling agency.

They can provide guidance on budgeting, debt repayment strategies, and additional resources to help you improve your financial situation.

What’s Next—Where To Start?

It may not be easy to start your debt recovery process, but it’s definitely worth it.

As Trinity Owen says,

Keep your eyes on the ultimate prize—a debt-free life—and remember that resources and support are available to help you on your journey. Embrace the power of creativity and persistence to break free from debt and achieve the financial independence you deserve.

Trinity OwenFounder and CFO of the Pay at Home Parent

In other words—work on your mindset, because it’s a crucial part of getting rid of debt.

At the same time, take time to carefully consider the situation you’re in, and—if you feel like it’s getting out of hand—contact a professional.

Determined to tackle it by yourself? Start with our free debt snowball spreadsheet.

FAQ

How do I get out of debt when I live paycheck to paycheck?

Start by tracking your expenses for a month and categorizing them. Then, identify areas where you can cut back, such as eating out or subscription services. Use the extra money to pay off your debts, either with the debt snowball or debt avalanche.

Consider consolidating your debts with a low-interest personal loan or balance transfer credit card. Avoid taking on new debt and focus on building an emergency fund to prevent future financial setbacks. Remember that every little bit helps, and stay committed to your plan.

Is there a real debt relief program?

Yes, there are legitimate debt relief programs available. To find it, research and compare options, and look for the ones that are accredited by organizations such as the National Foundation for Credit Counseling or the Financial Counseling Association of America.

Avoid programs that require upfront fees or make unrealistic promises. Remember to read the fine print and understand the terms and fees associated with any program before enrolling.

What is a hardship for debt?

To qualify for hardship for debt, you need to prove that you’re experiencing financial difficulties that make it impossible for you to pay your debts. This can include job loss, medical bills, or other unexpected expenses. To apply for hardship, you’ll need to provide documentation of your financial situation, such as bank statements, pay stubs, and bills.

Not all creditors offer hardship programs. If yours does and if you do qualify, the creditor may offer a reduced payment plan or even forgive a portion of your debt. Keep up with the terms of the program, as missing payments could cause the creditor revoking the hardship agreement.

What happens if the debt is never paid?

If you don’t pay your debt, your credit score will suffer, making it harder to get loans or credit cards in the future.

You may also face legal action, such as wage garnishment or property liens. In extreme cases, you could even be forced to declare bankruptcy.

How to pay $20,000 in debt in 6 months?

To learn how much you would have to pay monthly to get rid of debt in six months use our free debt snowball vs avalanche calculator. Then create a budget and stick to it. Cut unnecessary expenses and redirect that money towards paying off your debt. Consider getting a side job or selling items you no longer need to increase your income. Prioritize paying off high-interest debt first to save money in the long run.

For example, if you have a credit card with a 20% interest rate and a personal loan with a 10% interest rate, focus on paying off the credit card first. Finally, avoid taking on any new debt during this time. This will help you stay on track and reach your goal of paying off $20,000 in debt in 6 months.

Is $30,000 in debt a lot?

Yes, $30,000 in debt is a lot. To tackle it, create a budget and stick to it. Cut unnecessary expenses, get a better-paying job or a side hustle, and redirect that money towards paying off the debt.

Use our free debt snowball vs avalanche calculator to crunch the numbers and get out of debt fast.

Also, Consider consolidating the debt with a low-interest loan or balance transfer credit card. Make more than the minimum payments to reduce the interest paid over time.

How can I get my debt erased?

To get your debt erased, you need to negotiate with your creditors. Start by making a list of all your debts and their interest rates. Then, contact your creditors and explain your situation. Ask if they can offer you a debt settlement plan or a payment plan with lower interest rates. Be persistent, and don’t give up until you find a solution that works for you.

Remember to always make your payments on time and avoid taking on new debt. This will show your creditors that you are serious about paying off your debt and can help improve your credit score.

How long does it take to pay off $100 K in debt?

It’s difficult to give an exact timeline for paying off $100,000 in debt as it depends on your interest rates, minimum payments, and income. You can use our free debt snowball vs avalanche calculator to find out quickly.