Disclaimer: This is not investment advice. PLEASE DO YOUR OWN RESEARCH !!!

Collector’s Corner Introduction

I always wanted to introduce this category of stocks that normally I would not buy as a larger position, but for some reason or the other I want to own nevertheless. Many of such stocks I had passed on in the past and they often performed better than I would have thought. So instead of a typical Investment portfolio, that part would rather be a “collection of fine stocks” and this series will therefore be the collector’s corner. The goal here would be a small pocket of “special” stocks that might look not so attractive from a purely financial perspective, but still have are attractive to me. This could be luxury stocks but also some very strange stocks that I find interesting for other reasons. I am now long enough in the stock market that I cannot afford myself a few “guilty pleasures”.

I don’t have a target allocation here but this should stay below 10% overall at portfolio level. Also, don’t expect a super detailed analyis as with bigger positions.

And, by coincidence, I already have the first stock for the “collector’s corner:

The first candidate: Laurent-Perrier SA

For the past 10 years or so, i have frequently looked at the Laurent Perrier share price by mistake, as I actually wanted to look upGerard Perrier, my long term French stock holding. I always told myself to look at the other Perrier stock at some point but never did, despite the much nicer Logo compared to G. Perrier.

More recently however, I read an interesting snippet from the legendary John Train on Laurent Perrier which then made me look into Laurent Perrier again:

Personally, I am not a big Connaisseur of Champagne but I get the concept of a prestigious brand. LVMH, the big luxury Juggernaut has its roots in Champagne as well (the M is for Moet Chandon which was part of the initial merger).

To qualify as Champagne, the following needs to apply:

Champagne, the wine, is named after the region where it is grown, fermented, and bottled: Champagne, France. Nestled in the country’s northeastern corner, near Paris, the only labels that are legally allowed to bare the name “Champagne” are bottled within 100 miles of this region (according to European Law).

That naturally restricts the amount of Champagne that can be planted and harvested. The biggest brands can command prices up to several hundreds of Euros or even thousands for older vintages.

I think what the Champagne Indusry did well is to place Champagne as THE (very expensive) drink to celebrate at special occasions. According to some sources, this tradition started by accident in 1961 in Le Mans. Not sure if it is true, but I guess it is a common custom all over the world to celbrate success with a glass of Champagne. Interestingly, Laurent-Perrier never sponsored the formula One. But Moet & Chandon did for over 30 years. Interestingly, since 2021 an Italian brand is the F1 sponsor (Ferrari Trento).

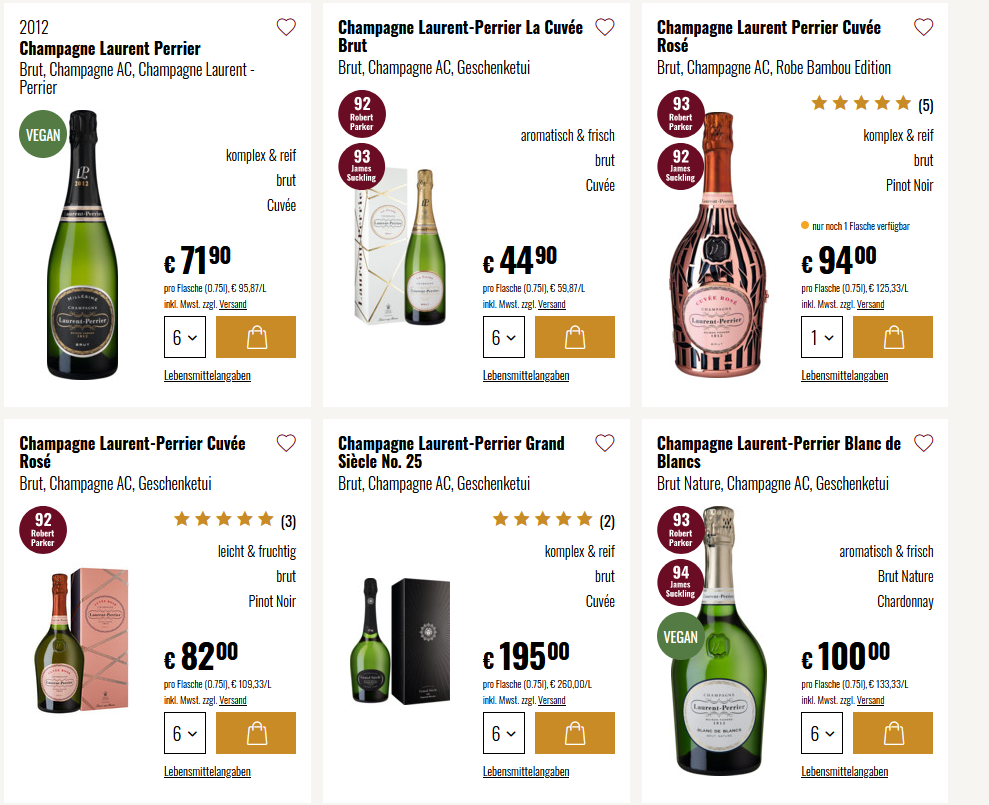

And Laurent-Perrier is clearly one of the most famous and best selling Champagne brands (depending on where you look, they are top 5 or so with a global market share in Champagne of ~5%). Looking at the Hawesko website one can see that the cheapest bottle starts at 45 EUR and goes up to 200 EUR:

Elsewhere I have seen bottles for 300-400 EUR as well.

One of the interesting aspects of Champagne is that despite being mosty white wine, it ages well. In the normal bottle (750 ml), 40 years is no problem, large bottles might have a shelf life of over 100 years when stored well.

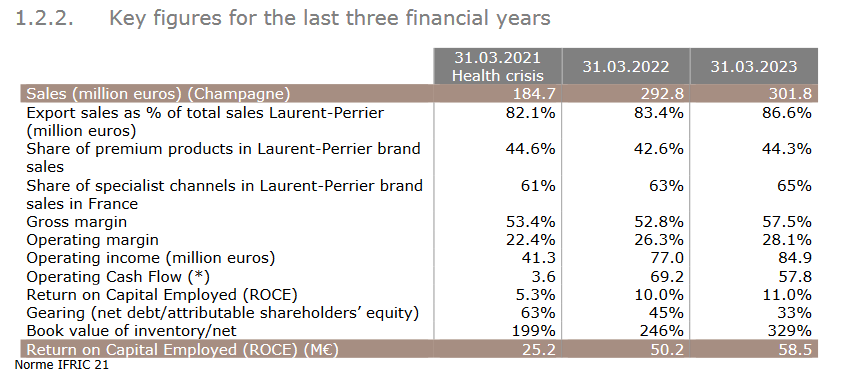

Top Champane is a high margin luxury product, however, the way Champagne is made, means also that it is quite a capital intensive business. This shows in the numebrs.

Whereas EBIT margins (until lately) always have been 17-18%, return on capital and ROE have been only 5-7%. Laurent-Perrier holds on average 2 years of sales inventory which is quite logical as Champagne needs to ripen and ferment for some years in order to be (expensive) Champagne. I assume that the inventory at Laurent-Perrier (and other Champagne producers) contain quite some hidden reserves, as the good vinatages often increase in value which is not shown in the balance sheet or P&L.

Now comes the interesting part : Over the last 10 years, EPS always hovered arond 3-4 EUR per share before suddenly jumping to 8,49 in 2021/2022 and almost 10 EUR per share in 2022/2023.

At the current share price, this values Laurent-Perrier at a very reasonable 12x traillng earnings and around 11xEV/EBIT which is not expensive for a true luxury brand. According to TIKR, LP only traded at that valuation right after the GFC.

The question clearly is: What lead to this drastic increase in profitability ? The main reason has been a strong recovery after Covid and price increases. The year ended in March 2023 clearly shows this: Although volume sales declined slightly, they managed to increase prices by +10%. As they were selling products that haven been bottled 2 years agao, this price increase more or less drops directly to the bottom line.

This table from the registration document summarizes well the last 3 years:

The comprehensive registration document gives also a lot of information on Champagne down to very interesting details.

The share price has reacted positively over tha past 2 years but not so much as reflecting the significant increase in profits over the last 2 years:

In addition, LP has reduced debt from close to 300 mn a few years ago to currently less than 180 mn. So despite less risk, the stock has actually become cheaper. It seems that currently investors do not believe in these high margins to persist.

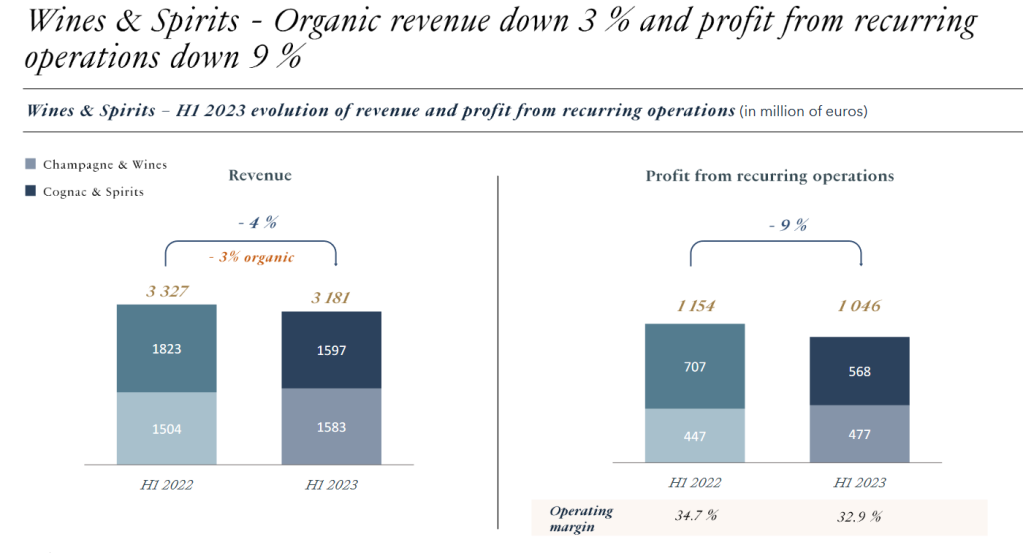

Interestingly, in LVMH’s 6M 2023 report, we can see that within the Spirits & Champagne segment, Champagne is still doing quite well, in contrast to the hard spirits:

The majority of Laurent-Perrier shares are owned by the Nonancourt family (65%) which bought the estate in 1939. US value shop First Eagle owns around 10%.

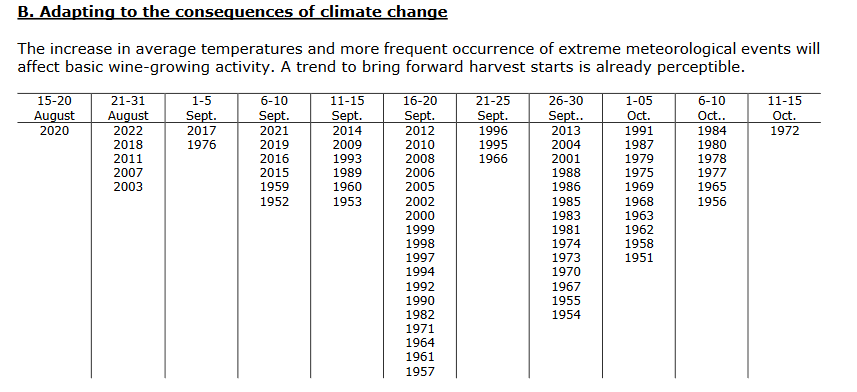

On the risk side, Climate risk is clearly one of the risks that LP is facing. As the area where Champagne can be made is small, an increase in temrperature might harm the product. LP shows this interesting table on the starting dates of the harvest over the last 50 years or so. A trend is clearly visible here:

On the negative side, they don’t pay much dividend, and only ocassionally buy back some stock. In the last years, cashflow was used to pay back mostly debt which, considering the increase in interest rates was maybe a good idea.

The big question of course is if and how Laurent Perrier can hold this level of profitability going forward and how they allocate capital. I honestly don’t know and that’s why I only buy this share for my “collection”.

Summary:

Looking all the years mistakenly at the wrong Perrier share price, I am now very happy to welcome Laurent-Perrier to my “Collector’s Corner”. A pure, high-end Champagne producer is a good start for this series. I allocated 1% of the portfolio at a share price of around 124 EUR into my new “bucket” and hope for the best.