Introduction: Trouble in the Emerging Market Equities asset class

Emerging Market Equities (EM Eq), as tracked by the iShares MSCI Emerging Market ETF, are up almost 10% this year. That would generally be welcome news for the ignored asset class. But the news is not good enough. I have the distinct sense that investors of multiple stripes are “giving up” on EM Eq. There isn’t a wholesale liquidation as much as the flow of money in EM has slowed down. The long-held conviction that EM Eq is an asset class where one has to be involved has now changed.

I reached out to Andrew Foster, founder of Seafarer Capital Partners, Chief Investment Officer, Lead Portfolio Manager of the Seafarer Overseas Growth and Income Fund, and a Co-Manager of the Seafarer Overseas Value Fund, and no stranger to the MFO readership.

“Is the EM Eq asset class narrative in trouble?” I asked Andrew as if it was a financial 911 call on behalf of curious investors. I’ll cover three topics in my review of that July 2023 call:

- an introduction to Seafarer Capital Partners and its funds

- the problem with “emerging markets” as an asset class

- the rise of EM stock buybacks and their role in portfolio construction

Introduction to Seafarer Capital Partners

Seafarer is a preeminent emerging markets equity investment boutique. Morningstar’s William Samuel Rocco, one of the firm’s longest-tenured analysts, offers these highlights:

The firm, which was founded by Andrew and Michelle Foster in 2011 … is 100% employee-owned and offers two diversified emerging-market strategies. Andrew Foster, who serves as CIO and as a portfolio manager, is a seasoned and skilled investor with considerable emerging-market expertise. Michelle Foster, who serves as CEO, has a strong resume as well. Seafarer has grown its investment and operations/executive teams wisely over the years—and expanded the roles of several individuals along the way—and the firm is well-staffed overall.

The firm, which was founded by Andrew and Michelle Foster in 2011 … is 100% employee-owned and offers two diversified emerging-market strategies. Andrew Foster, who serves as CIO and as a portfolio manager, is a seasoned and skilled investor with considerable emerging-market expertise. Michelle Foster, who serves as CEO, has a strong resume as well. Seafarer has grown its investment and operations/executive teams wisely over the years—and expanded the roles of several individuals along the way—and the firm is well-staffed overall.

The flagship Overseas Growth & Income is managed by Mr. Foster, Paul Espinosa, and Lydia So, with Kate Jaquet serving as long-time co-manager and analyst. It invests roughly one third of the portfolio in value, one-third in core, and one-third in growth. The younger Seafarer Overseas Value Fund is managed (brilliantly) by Paul Espinosa, co-managed by Mr. Foster, and has earned both Morningstar’s five-star rating and MFO’s Great Owl designation. Seafarer’s disciplined approach is reflected in the performance since the inception of both funds. Each substantially outperforms its peers (by 390 and 330 bps, respectively) with lower volatility (measured by the fund’s maximum drawdown, standard deviation, and downside deviation) and higher risk-adjusted returns (measured by the Ulcer Index, Sharpe ratio, Sortino ratio, and Martin ratio).

Seafarer Overseas Growth & Income, Lifetime Performance (03/20120 – 07/2023)

| APR | MAXDD % |

Recvry mo |

STDEV %/yr |

DSDEV %/yr |

Ulcer Index |

Sharpe Ratio |

Sortino Ratio |

Martin Ratio |

|

| Seafarer Overseas Growth and Income | 5.2 | -27.8 | 24+ | 15.1 | 10.3 | 10.5 | 0.29 | 0.42 | 0.41 |

| Lipper Emerging Equity Category Average | 1.3 | -41.8 | 33 | 18.3 | 13.0 | 16.9 | 0.06 | 0.09 | 0.08 |

Seafarer Overseas Value, Lifetime Performance (06/2016 – 07/2023)

| Name | APR | MAXDD % |

Recvry mo |

STDEV %/yr |

DSDEV %/yr |

Ulcer Index |

Sharpe Ratio |

Sortino Ratio |

Martin Ratio |

| Seafarer Overseas Value | 7.2 | -27.1 | 12 | 14.5 | 10.1 | 7.8 | 0.40 | 0.58 | 0.75 |

| Lipper International Small / Mid-Cap Value Category | 5.8 | -35.2 | 34 | 17.4 | 12.2 | 12.4 | 0.26 | 0.37 | 0.38 |

| Emerging Equity Category | 3.9 | -40.3 | 30+ | 19.1 | 13.5 | 16.8 | 0.16 | 0.25 | 0.21 |

Source: Lipper Global Datafeed and MFO Premium. Detailed definitions and complete data for each is available at MFO Premium.

Seafarer’s 17 professionals manage $2.2 billion in assets (as of March 29, 2023).

Five Problems With Emerging Markets as a Passive Asset Class

Together we listed some of the reasons why EM Eq presently feels orphaned:

MARKET PERFORMANCE HAS SUCKED

Over the last 5 years, the passively managed iShares MSCI Emerging Markets ETF (EEM) has returned a total of 3%. Not 3% in dividends, not 3% annualized (which too would be bad), but 3% in TOTAL RETURNS!! The annualized return over the last 10 years is 2.4% a year. Why bother?

The EEM is currently trading at about $41 per share, a price it had also seen in May 2007. For over a decade and a half, the traditional passive market for emerging stocks has been flat. This tests people’s patience in a jarring way.

While the EEM’s 10% returns for the first seven months of 2023 are satisfying, it is still dwarfed by the 19% gains for Vanguard Total Stock Market ETF (VTI), and easily topped by the 14% for iShares Core MSCI EAFE ETF (IEFA)

ECONOMY GROWTH IS WEAKENING

MFO’s April 2023 interview with Lewis Kaufman of the Artisan Developing World Advisor (APDYX) was hugely instructional in learning how his and now consensus views on EM have evolved over the last years. EM growth has slowed down; China and many other countries have settled into the middle-income trap; limited skilled labor and limited capital pools of savings serve as constraints to productivity growth and capital formation. There are no easy answers to the growth trap.

GEOPOLITICAL RISK IS RISING

China and Taiwan stocks combined account for nearly 44% of the MSCI Emerging Market country allocations. That region also happens to be the biggest flash point for geopolitical risk.

Warren Buffett liquidated his $4.1 billion stock position in Taiwan Semiconductor earlier this year, merely months after acquiring it. Even if he is wrong about his assessment of geopolitical risks, the fact that he got out is enough for many who closely follow his actions.

“I feel better about the capital that we’ve got deployed in Japan than in Taiwan. I wish it (Taiwan Semi) weren’t sold, but I think that’s a reality.”

The Russian sanctions (and what that did to Russian equities) as a weapon of geopolitical warfare are relatively new in the hands of Western policymakers. It’s a scenario investors had not planned for.

PASSIVE INVESTING HAS FAILED

This is a conundrum for many investors today. Passive indexing and investing works perfectly fine in US Equities. Unless investors want to invest in specific managers for whatever reason, US investors do not have to pay active managers. Investors tried the same approach abroad. It has not worked well. Over the past 10 years, 24 of the 25 best-performing funds and ETFs, whether measured by total return or by risk-adjusted return, are actively managed.

EMERGING MARKETS NO LONGER PROVIDE THE BETA BOOST

In previous US equity bull markets, EM equities acted as a high beta version of growth and allowed people to juice the returns they would have earned in the US. These days, US technology stocks do the trick. There is even less reason for investors to leave the US Dollar and go abroad.

Yes, there are many problems with EM as an asset class, and yes, we must now look ahead.

Mr. Foster concluded, “Unfortunately, there are no big picture ideas about how to fix EM as an asset class. However, there is a substantial difference between what EM as a passive asset class offers and what active EM fund managers offer.”

Investment Framework for EM for investors still interested in investing outside the USA

A TRACKABLE INDEX VS. WHERE MONEY SHOULD BE INVESTED

“What makes a sound investment versus what is easily trackable are two different things,” says Foster. Seafarer has a research paper titled A Tale of Two Indices that tries to explain this problem.

Let us consider my former employer Goldman Sachs’s contribution in the creation of the BRICs acronym (a group that stands for Brazil, Russia, India, and China).

“On one hand, the BRICS put the Emerging Markets asset class on the map, brought attention to their economies, and brought in dollars into the asset class. But, on the other, there really is no organic connection between these countries to be together as a group,” says Andrew.

“That same problem is evident on a larger scale in the MSCI Emerging Market Index. It’s easy to build an index, to categorize countries as EM and stocks to fill the weights, but there was never a reason why these countries and companies belonged together in one group.”

We talked about how few investors understand this difference (between what is trackable vs. what is investable). He promised to take up the challenge in his conversations with investment committees and other research.

Would investors be better served if we stopped thinking about Emerging Markets as an asset class? What should we track instead even if we could all agree the current notion of bucketing all EM countries in one big bucket never made sense?? No clear answers exist. We must make peace with EM Eq as an asset class while acknowledging that passive investing has not worked well there.

SILVER LINING IN FUNDAMENTALS

“The biggest fundamental change in EM stocks is going to come through the stock buybacks. It’s also one of the most difficult information metrics to capture and track,” said Foster.

Finding details on buybacks, especially in EM, is difficult. The data is buried deep inside balance sheets, if it is reported at all. There is a difference between announced and executed buybacks.

“Dividends are much easier to track, and they are a starting point for our fundamental analysis. Dividends tell us that the company has true power to generate consistent profits. But buybacks is where the story is going to be in the future.”

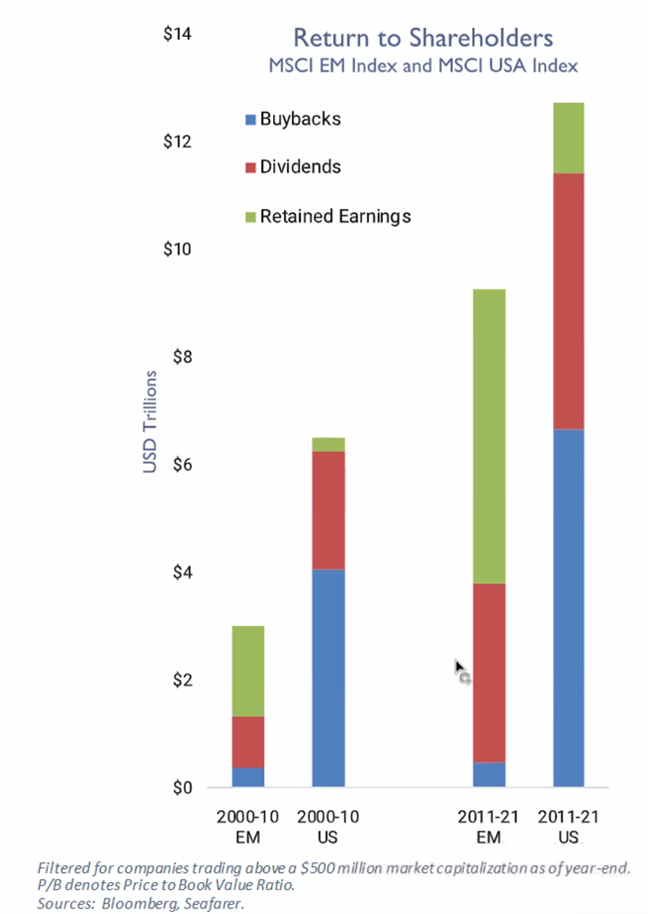

Why are stock buybacks so important? Take a look at this chart from Seafarer. The blue bars represent the actual dollar volume of buybacks by companies in the MSCI EM vs. MSCI USA indices. Buybacks were big in the US from 2000-2010 and got even bigger from 2011-2021. Comparatively, the blue bars in EM were small in the first decade and continued to be small in the second decade. That’s changing now.

Disclaimer from the good folks at Seafarer Capital: “The views and information discussed in this presentation are as of the date of publication, are subject to change, and may not reflect Seafarer Capital Partners’ current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only, and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. Seafarer does not accept any liability for losses, either direct or consequential, caused by the use of this information.”

“Ten years ago, there were zero companies in Seafarer’s portfolio that were engaged in buybacks. Over the last five years, as many as half of our portfolio companies have been involved in buying back shares. Over the last year, over a third of the companies were involved in these share repurchases,” according to Foster. “Maybe I am biased toward our set of portfolio companies and the changing behavior in buybacks, but it is happening as we speak.”

In other words, the blue bar for MSCI EM Equities is going to expand and get bigger, and with that, returns will accrue to the shareholders.

In the US, stock buybacks are now the predominant mechanism through which corporations return capital to shareholders, exceeding substantially the amount committed to dividends. Such buybacks were generally illegal in the US until 1982 because they ran afoul of laws limiting insider stock price manipulation. The CFA Institute (2022) enumerates the advantages of stock buybacks:

There has been much controversy about share repurchases in recent years. On the one hand, proponents of share repurchases say that this payout method provides liquidity and price support, returns excess cash in a flexible way, corrects undervaluation, and conveys information to the market. These aspects of buybacks are also often cited by practitioners as motivations for their share repurchase decisions. Academic research provides evidence that supports this view as well.

They quickly noted that it can also be misused to enrich executives (who could imagine such behavior?) and mislead investors, which means that investors and regulators need to exercise exceptional vigilance in weighing the motivations and impacts of such buybacks.

Perhaps some of the stock bought back in EM corporations is to mop up the Employee Stock Ownership Plan (ESOPs), but it’s interesting that these companies now actually have a culture of employee stock ownership at all. Remember, a majority of EM companies have founding families as controlling shareholders.

“Fundamentally, there is also a process of maturation across many economies right now. Most EM countries have inflation under control due to aggressive hiking before the Fed got into aggressive hiking (except India). Brazil and Mexico’s inflation are under far more control than in the US. Orthodox Central Bank behavior is a sign of political independence and improving institutional strength,” adds Foster.

PATIENCE

To give perspective into the future, Foster spoke about Japan, which is having its moment in the sun. People look at shareholder activism and corporate behavior and laud Japanese companies and the government. Foster says when he was managing Japanese assets at his previous employer, the trend for better shareholder activism was already in place as early as the mid-2000s. They talked a lot about it as they added relevant Japanese companies to the portfolio. But it takes time for the various kinks to be worked out and for the little streams to become a giant wave.

While the macro trends are still against EM, and while anecdotes of buybacks or improving institutional strength are not powerful enough, patience will pay in investing in some of the EM companies.

CONCLUDING ADVICE FROM ANDREW FOSTER:

- Be patient and watch micro behavior.

- Valuations in EM are pretty low.

- I don’t believe in Mean Reversion, but I do believe good things are fundamentally happening across our portfolio companies.

…AND FROM YOURS TRULY:

Successful EM Eq portfolio managers don’t care about the weights of stocks in the MSCI EM Index. Investors might research active managers and start following their work, performance, and portfolio construction carefully. As the accompanying note on the Moerus Worldwide Value fund and the interview with Amit Wadhwaney shows, there are managers out there who are good at their craft. The power of discrimination is required to decide where passive is fine and where active is needed. Use that power carefully but firmly.

Seafarer Capital Partners website.

Disclosure: I own shares of both Overseas Growth & Income and Overseas Value in my personal account.