We are aware of the fact that certain Investment (or) Saving schemes have a lock-in period. ‘Lock-in period’ is a common phenomenon especially with popular Tax saving Schemes. These schemes are like PPF, ELSS mutual funds, NSC, 5 year Tax saving Fixed Deposit, Senior citizen Savings Scheme etc.,

What is a Lock-in period? – It is a period during which an investor is restricted from selling or withdrawing a particular investment.

For example: An investment in ELSS Mutual fund has a lock-in period of 3 years. The units allotted under these schemes cannot be redeemed before 3 years. Similarly, the lock-in period that is applicable on PPF (Public Provident Fund) accounts is 15 years.

Another popular product that comes with a lock-in period are ULIP (Unit Linked Insurance Plan);

Example: Shetty bought a ULIP plan to save money for his long-term goal. A ULIP policy comes with the lock-in period of 5 years. During this time, Mr Shetty cannot withdraw the invested funds. The lock-in period kept him motivated to continuously pay the premium and reap high benefits.

In this post, let’s understand about the ‘lock-in period’ on various saving & investment options and its applicability on the unfortunate demise of an investor (during the lock in period).

Lock in Period of various popular Saving & Investment Options

The short-term Fixed Deposits offered by banks are the ones that come with the least lock-in period, can be as low as 7 days or a month.

Most of the Tax saving schemes come with lock-in period. When it comes to the best tax saving option with the shortest locking period, ELSS (Equity Linked Savings Scheme) ranks at the top of the list.

Let’s have a look at all the popular saving and investment options in India and their lock-in-periods. (For some of these schemes, maturity period is their lock-in period. Most of these schemes allow the investors to make premature withdrawal or premature closure of accounts, but on certain criteria and/or penalty.)

| Saving (or) Investment Option | Lock-in-period | Premature withdrawal Allowed? |

| Bank / Post Office Fixed Term Deposits | 7 days (Minimum) | Yes (with penalty) |

| Mahila Samman Savings Certificate | 2 years | Yes (after 6 months) |

| Equity Linked Savings Scheme (Mutual Funds) | 3 years | No |

| National Savings Certificate (NSC) | 5 years | No |

| Unit Linked Insurance Plan | 5 years | Yes (with charges) |

| Tax Saving Fixed Deposit | 5 years | No |

| Post Office Monthly Income Scheme (PO MIS) | 5 years | 1 year (with charges) |

| Senior Citizen Savings Scheme (Sr CSS) | 5 years | 1 year (with charges) |

| Section 54EC Capital Gain Bonds | 5 years | Yes (exemption gets revoked) |

| Govt of India (RBI) Floating Rate Bonds | 7 years | Yes (after 4/5/6 years for senior citizens with penalty) |

| Sovereign Gold Bonds (SGB) | 8 years | Yes (from 5th year) |

| Tax Free Bonds (TFB) | 10 years | Can be redeemed via Secondary market |

| Public Provident Fund (PPF) | 15 years | 5 years (Partial withdrawal) |

| Sukanya Samriddhi Girl Child Scheme (SSS) | 21 years (maximum) | Yes (for Education/Mariage) |

| National Pension System (NPS – Tier 1) | 60 years (age) | 3 years (partial withdrawal) |

| Non-Convertible Debentures (NCD) | 90 days (minimum) | Can be redeemed via Secondary market |

| Company Fixed Deposits | 1 year (minimum) | Yes (with penalty) |

Can lock-in period apply on death of the Investor / Holder?

Let us now understand the rules & guidelines pertaining to ‘lock-in period’ and whether nominee/legal-heir(s) can withdraw the investments before the lock-in period ends?

Public Provident Fund

- The lock-in period on PPF account is 15 years.

- Premature withdrawal is allowed in case of unfortunate demise of the PF subscriber.

- The legal heirs or nominee can withdraw the entire balance available in PPF account, but have to produce certain documents to make a death claim. So, the nominee(s) can withdraw PPF deposits during the lock-in period.

- The HUF account will not be closed before maturity on the death of the Karta but it will continue by the new Karta appointed by the HUF.

- If the subscriber dies during a year, his executors cannot deposit any sum from the income of the deceased to his PPF account after his death. If they do so, the amount deposited shall neither carry interest nor shall this amount be eligible for tax rebate. This amount will be refunded without interest to the nominee/legal heir, as the case may be, at the time of closure of the account.

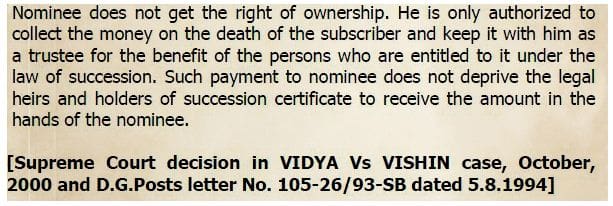

- Kindly do note that the Nominee does not get the right of ownership. He/she is only authorized to collect the money on the death of the subscriber and keep it with him as a trustee for the benefit of the persons who are entitled to it under the law of succession.

National Savings Certificate (NSC)

NSCs have a lock-in period of 5 years. However, premature encashment is permitted under Sec. 16(1) only on the following three contingencies:

- On the death of the holder or any of the holders in the case of joint holders

- On forfeiture by a pledgee being a Gazetted Government Officer when the pledge is in conformity with these rules (or)

- When ordered by a court of law.

In case of the holder’s death, the nominee can encash the NSC before or after the maturity (i.e. 5 years). The amount payable is at a proportionate rate.

5 year Tax Saving Fixed Deposit

Tax saving FDs have a lock-in period of 5 years. However, in case of death of the depositor before the maturity of term deposit, levy of penalty would be exempted and nominee/legal heir will be allowed premature payment even before the lock-in-period.

Related article : Premature withdrawal of Joint Account deposits on the demise of one of the Account holders

54EC Tax Saving Bonds

54EC Bonds have a lock-in period of 5 years. To avail the benefit under Section 54EC of the Income Tax Act, 1961, the investment made in the Bonds needs to be held for a period of at least five years from the Deemed Date of Allotment. The Bonds are for tenure of 5 years and are ‘Non-transferable & Non-negotiable’ and cannot be offered as a security for any loan or advance.

However, Transmission of the Bonds to the legal heirs in case of death of the Bondholder/Beneficiary to the Bonds is allowed. But, they have to be held for the entire 5 years term, interest income is taxable in the hands of nominees/legal heirs.

Related Article : Capital Gains Tax Exemption Options on Sale of House or Plot | Latest Rules

ELSS Tax saving Mutual Fund Schemes

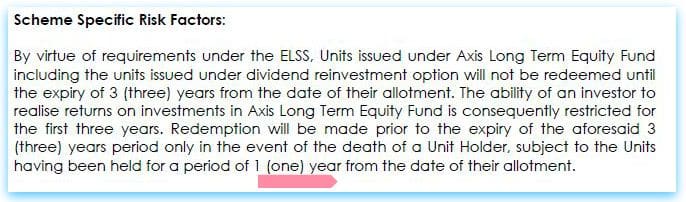

ELSS mutual funds have a lock-in period of 3 years. In the event of death of the investor, the nominee or the legal heir can withdraw the amount, only 1 year after the date of allotment of units to the deceased (original investor / unit-holder).

For example : If the investor dies eight months after purchasing the units, the nominee has to wait for at least four more months to be able to sell the units (if he/she wants to redeem..).

Kindly note that nominee can get the units transferred to him/her much earlier but can’t sell those until 1 year is over. Essentially, the lock-in period goes down from 3 years to 1 year in the event of demise of the original investor. This information can be found in any of the ELSS funds ‘scheme information documents’.

Senior Citizen Savings Scheme

Sr.CSS has a maturity period of 5 years. However, in the unfortunate event of death of the deposit holder, the account can be closed immediately (if no joint ac holder exists) and the nominee can receive the deposit amount as per the rules. Same is the case with Post office Monthly Income Scheme.

Sukanya Samriddhi Account

The maturity period under this scheme is 21 years from the date of account opening. The account can be prematurely closed, in case of the unfortunate death of the girl child (account holder), the parent or legal guardian can claim for the accumulated amount along with the interest accrued on the account. The balance would be immediately handed over to the nominee of the account. (Read : ‘Sukanya Samriddhi Deposit Scheme – Review‘)

National Pension System (NPS)

The exit age under NPS is 60 years (subscriber’s age). However, in the event of death of the contributor, the entire accumulated pension wealth would be paid to the nominee/legal heir of the subscriber and there would not be any purchase of annuity/monthly pension.

Sovereign Gold Bonds

The nominee/nominees to the bond may approach the respective Receiving Office with their claim. If the bonds are in demat form, nominee can contact the respective depositary participant.

Govt of India (RBI) Floating Rate Bonds

These bonds have a maturity period of 7 years. On the demise of the bond holder, they can be transferred to nominee’s name but payable after maturity period only.

Company Fixed Deposits & NCDs

The maturity period (lock-in period) may vary for different Deposit Schemes/Issues. It may be noted that deposit amount will be payable only on the date of maturity and not earlier on the date of death of the investor. However, the surviving person or the legal heir can request the company for a premature payment of the deposit and this is the prerogative of the company to accept or decline such request. It depends on the specific Issue/Scheme’s terms & conditions.

Mahila Samman Savings Certificate

In the event of the account holder’s death, the account can be closed prematurely. In the case of an early closure due to the aforementioned circumstances, interest at the scheme’s usual rate will be offered.

Continue reading:

(Post first published on : 14-Aug-2023) (Invitation to join our Telegram Channel..click here..)