As an investor you now have a plethora of investment options available, ranging from Fixed income securities like bank fixed deposits, bonds to Gold, Mutual Funds, Stocks and to Cryptocurrencies.

Each and every investment you make has to go through three different stages i.e.,

- Investment (or) Contribution stage

- Income Earning Stage (or) Growth phase

- Withdrawal or redemption or consumption phase.

For example: Let’s say you would like to book a 5 year Bank Fixed Deposit for tax-saving purpose. The investment in FD is eligible for tax deduction under section 80c. This is in the investment phase. Your capital earns ‘interest income’ for the next 5 years. This is the income earning phase and its taxable in this case. When you redeem the FD on maturity, the withdrawal amount is tax-free (given that tax is paid at the ‘growth or income earning stage’ itself).

Tax Treatment of Saving & investment options

Under each stage of the investment cycle, earnings can either be Taxed (T) or Exempted (E) from the taxes. So, we can have 6 possible combinations of Es & Ts for three different stages as below;

- EEE : Exempt –> Exempt –> Exempt (meaning you can avail tax deductions at the time of investment, the income earned on this investment is tax exempted & even the maturity amount is tax-free)

- EET : Exempt –> Exempt –> Tax

- ETE : Exempt –> Tax -> Exempt

- TEE : Tax –> Exempt – > Exempt

- TET : Tax –> Exempt -> Tax

- TTE : Tax –> Tax -> Exempt

Generally most of us tend to pick best investments based on the tax treatment or the tax benefits available at the investment stage only. However, we need to be aware of the taxation rules applicable in all the three stages.

Continuing with the above Tax-saving Bank FD – What type of tax treatment does it belong to? Is it EEE or ETE?

The answer is, it belongs to the ETE (Exempt – Taxable – Exempt) tax regime. You get Tax-exemption (E) when you invest, the interest earned on FD is taxable (T) and the maturity amount is exempted from taxes (E).

In this post let’s identify the best risk-free, safest and tax-free investment options. Are there any best saving avenues that are safe, do not have risk associated with them and also are tax-free, during all phases of investment cycle?

Best Risk-free, Safest & Tax-free Investment Options

If we have to pick saving and investment options that are totally risk-free, come with tax benefit and are also tax-free on maturity, not many such options exist.

And the avenues that meet our criteria and fall under EEE category are as below;

- Public Provident Fund

- Sukanya Samriddhi Scheme

- Employee Provident Fund

- Traditional Life Insurance Policies

Public Provident Fund

PPF is one the most popular saving options that fall under the Exempt-Exempt-Exempt tax classification. This small savings scheme is supported by the Central govt and hence comes with least possible risk. Hence, it is the safest, risk-free and best tax-free option that one can find.

- You can invest up to Rs 1.5 lakh every financial year and can claim income tax benefit under section 80c.

- The interest earned on such contributions is tax-exempted.

- The withdrawable amount on maturity is tax-free i.e., after the 15 year lock-in period ends.

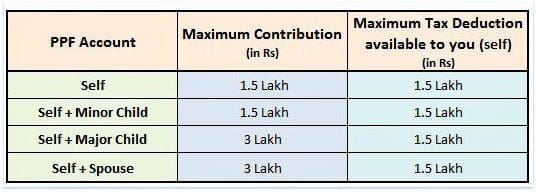

- You can invest in PPF in your name. You can open only one PPF account in your name.

- You can also open PPF accounts in name of your spouse or children. However, kindly note that parents (father/mother) cannot open two separate PPF accounts in the name of same child.

- You can invest a maximum of Rs.1,50,000 in your name and minor kid’s name.

- You can also invest maximum of Rs 1.5 Lakh in your spouse’s name but do remember that you can claim Rs 1.5 Lakh only as tax deduction.

- If you invest in name of your spouse, due to clubbing of income your need to add the interest earned on spouse’s PPF account to your income. But note that PPF account cannot be jointly held.

- You can also invest in your Major child’s name. For example : You can invest up to Rs 3 Lakh in two PPF accounts (self Rs 1.5 Lakh + major child PPF A/c Rs 1.5 lakh). You can claim tax deduction of Rs 1.5 Lakh. If the major child has taxable income, he/she can treat the other Rs 1.5 lakh as gift and can claim tax deduction on his/her income.

Sukanya Samriddhi Scheme

Sukanya Samriddhi has similar features as that of PPF but it has slightly longer lock-in period and the contributions can be made in the name of Girl child only. Like PPF, the Sukanya Samriddhi Scheme also fall under Exempt->Exempt->Exempt classification. The Sukanya Samriddhi Yojana comes with a sovereign guarantee (govt. backed small deposit scheme).

- You can invest up to Rs 1.5 lakh every financial year and can claim income tax benefit under section 80c.

- The interest earned on such contributions is tax-exempted.

- The withdrawable amount on maturity is tax-free.

- The contributions have to be made by parent / guardian of a girl child. Girl child is the beneficiary under SSA Scheme.

- The contributor (parent) can claim the tax deduction on the contributions made to SSA account.

- A depositor can open and operate only one account in the name of same girl child under this scheme.

- The depositor (or) guardian can open only two SSA accounts in the name of two children.

- SSA can be opened in the name of a girl child from the birth of the girl child till she attains the age of ten years.

- The scheme would mature on completion of 21 years from the date of opening of the account, with an option of keeping the account till marriage. So, the maturity of the account is 21 years from the date of opening of account or if the girl gets married before completion of such 21 years (whichever is earlier).

- The contributions are allowed upto 14 years from SSA account opening date but the SSA savings account can be operated till the completion of 21 years from the account opening date.

Related article : Sukanya Samriddhi Scheme Vs Public Provident Fund (SSA Vs PPF)

Employee Provident Fund

Employee Provident Fund, popularly known as the EPF, is a very popular savings option among the salaried class. The EPF scheme is also managed by the government. Hence, it offers the highest safety.

Until the financial year 2022-23, the EPF was comfortably placed under the tax category of EEE. We can still classify it under the EEE regime but with certain conditions attached to it.

- Effective 1 April 2022, any interest on an employee’s contribution to EPF and VPF of upto INR 2.5 lakhs per year is tax-free and any interest earned on a contribution over and above INR 2.5 lakhs is taxable in the hands of the employees. (VPF is Voluntary Provident Fund)

- You (employee contributions) can claim tax deduction of up to Rs 1.5 lakh under EPF scheme.

- You can earn interest that is tax-free (provided you meet the Rs 2.5 lakh threshold limit). So, if your contributions ot the EPF scheme is more than Rs 2.5 lakh in a FY, EPF falls under the E-T-E category.

- The entire EPF balance on maturity is a tax-free income.

- But kindly note this point – If an employee who is a member of EPF scheme, quits or retires from his/her employment and continues holding the accumulated PF balance, he/she has to pay tax on interest from the date of unemployment.

- Further, from FY 2020-21, if the employer’s contributions to EPF, NPS and the superannuation fund on aggregate basis exceed Rs 7.5 lakh in a financial year, the excess amount will be taxable in the hands of the individual concerned. Any interest, dividend, etc earned on excess contribution will also be However, the maturity amount remains tax exempt.

- Hence, we can say that as long as the employee’s and employer’s contribution threshold limits are not breached, the EPF enjoys the EEE tax status.

Traditional Life Insurance Policies

Ideally, we should not mix insurance and investment, they should never be combined. It is so especially in the case of traditional life insurance plans, as the expected returns on these are abysmally low. (We are not discussing on ULIPs as their returns are market-linked and come with certain amount of risk.)

Nevertheless, life insurance plans do fall under the category of Exempt, Exempt and Exempt status but with certain exceptions;

- You can claim a tax deduction of up to Rs 1.5 lakh u/s 80c on the premiums paid on your life insurance policy.

- The income earned on such plans, like the survival benefit (or) bonuses is a tax-free income.

- The policy maturity amount is also tax-exempted, subject to certain conditions as below;

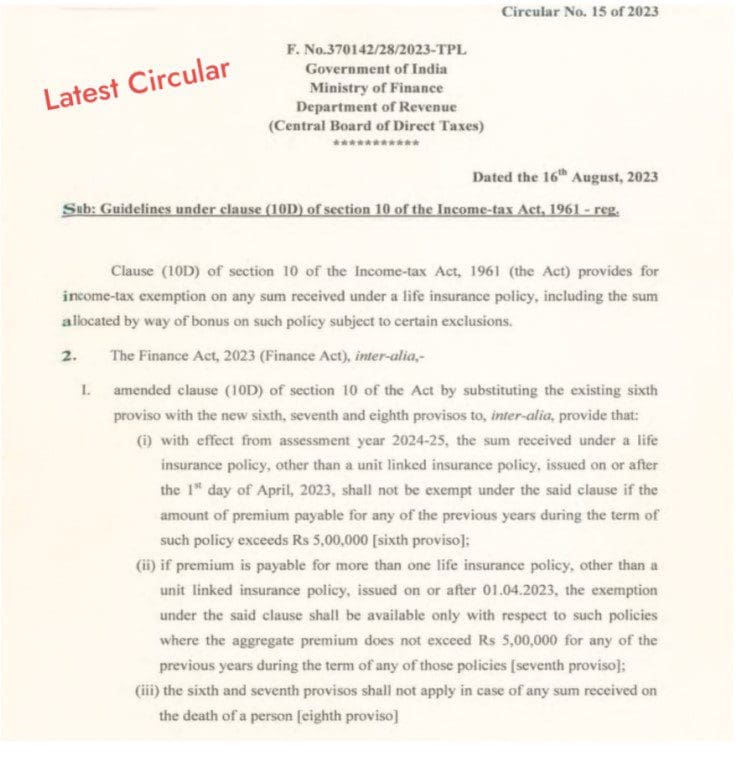

- If the premium paid on life insurance policies, except ULIPs, exceeds Rs 5 lakh in a financial year, the maturity proceeds will be taxable. However, exemption will be available in case of death of the policyholder. The new taxation law will come into effect from April 1, 2023, i.e., FY 2023-24.

- In respect of life insurance policies issued after 1st April 2012, the maturity proceeds received are exempt only and only if the premium payable in respect of such insurance policy does not exceed 10% of the sum assured during the premium paying term.

- In case the premium paid was more than 10% of the sum assured the difference between the maturity value and premium paid only will be taxable and not the whole of such maturity proceeds

If you are aware of the tax implications at various investment stages, you will be in a better position to pick tax-efficient investment options. Tax efficiency is a measure of how much of an investment’s return is left over after taxes are paid. It is essential in order to maximize net returns on your investments.

Sometimes, it is OK to pay taxes when you cannot save or cannot invest in right financial products. But, do not invest just to save TAXES. The cost of buying wrong financial products may outweigh the cost of taxes. Tax Planning is not a goal but a tool. Remember “Tax Planning alone is not Financial Planning.”

Continue reading:

(Post first published on : 30-Aug-2023)