Cash, we use it to meet our daily living expenses, we use it to acquire assets, we use it to meet any unforeseen contingencies in life and some of us may use it to own depreciating assets or for paying off loans.

Some of you might be earning a very high income, yet can be finding it very difficult to make ends meet. And some of us might be earning very low, yet very determined to make it very big and aim to be wealthy one day, with effective cash-flow management.

I have personally seen some of the super-rich with lot of assets face the problem of cash crunch. They make investments either in lot of unproductive assets and/or acquire assets with lot of loans. This does not mean they are poor and broke, but they might be over-leveraged and need to convert their assets into cash-generating ones.

So, how we use the cash (read income) available to us determines a lot about our financial health and where one’s financial life is heading. Do you agree with me?

In this post let us understand – What is Cash Asset Quadrant? Where do you fall in the Cash and Asset Quadrant? What is the path that leads to becoming wealthy in life?

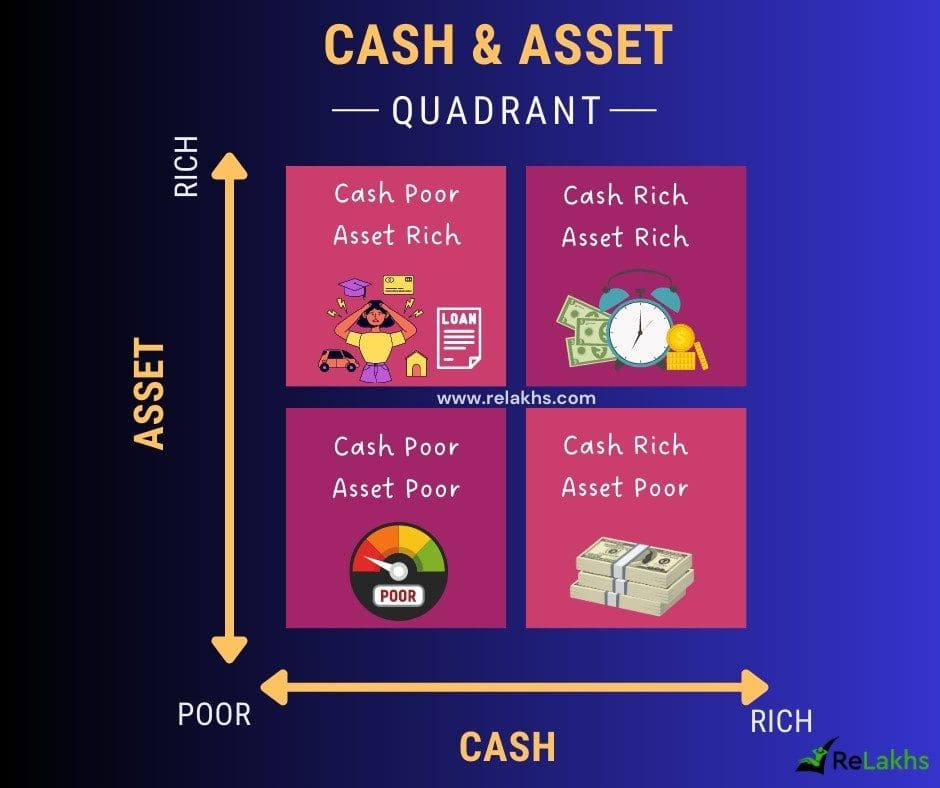

The Cash Asset Quadrant

In the above info diagram, one one Axis we have CASH and another Axis represents ASSET. We may either have lot of Cash (rich) or less Cash (poor). Similarly, your NetWorth may have lot of Assets (rich) or your may not own many Assets (poor).

This representation gives us the four phases of one’s financial life with respect to Asset and Cash combination;

- The Cash poor & Asset poor Phase

- The Cash rich & Asset poor Phase

- The Cash poor & Asset rich Phase &

- The Cash rich & Asset rich phase

As we move through life we also move across these phases and our financial status will be a function of time & the decisions we take. Your starting point can be very different to mine.

So, my friend, where do you fall in these four blocks of asset-cash quadrant? Let’s think, analyze and plan the cash-flows..

The Cash poor & Asset poor Phase

You may be an youngster on your first job with limited income or just started your business as an entrepreneur. During this phase of your financial life, your income might be just enough to meet your monthly living expenses. Sometimes, you may even end up falling short of the required monthly cash due to any unforeseen circumstances. You may not be in a position to maintain a sufficient cash fund i.e., an Emergency fund to meet any personal or health emergencies.

“Life is not a straight line leading from one blessing to the next and then finally to heaven” – John Piper. You may kindly read related article @ What is an Emergency Fund? | Why, Where & How much to save?

The main aim that you need to have during this phase is to accumulate some cash and keep it as an Emergency Fund. You may also try to have some sort of Health Insurance coverage for self and family. You can look at the possibility of getting yourself enrolled in subsidized health insurance schemes offered by your employer or state govt’s health ministry.

Be clear in your mind that you got to make MONEY. Once you start receiving your fixed salary or business income, start accumulating cash fund, stay focused on where to spend, upgrade your skills and build your professional network.

Do not get carried away by your neighbor’s lifestyle or your colleague’s spending habits. It’s ok not to have any assets. But don’t forget, your short-term goal should be to build CASH and long-term goal is to be wealthy.

The Cash rich & Asset poor Phase

You may now be getting a decent salary with a pay hike (or) may have double income at home. Your business may be performing well and generating decent cash-flows. Once you have beefed up your emergency fund, you start seeing the monies sitting idle in your pocket or bank account.

“Cash is the wealth you have available to spend right now. “

As a financial planner, I believe this is the most important phase of anyone’s financial life. And this is also the phase where most of us commit Personal Finance Mistakes.

Related article : 5 Personal Financial Mistakes that I have committed…!

- Some of us use the cash to acquire depreciating assets like bike or car and consumer goods. It’s ok to acquire any of these assets if there is a necessity. But, buying a car when you actually needed a bike may not be advisable.

- For most of the bankers, the families who are in this phase are the primary targets for selling their loans. Given your improved cash levels, you can afford and may be eligible to take loans, but do exercise caution and do not take unwanted loans.

- To save on rentals, most of us end up acquiring a real-estate property during this phase. Kindly ensure that your monthly EMI to the Bank does not exceed 25% to 40% of your salary. The lower you can make it the better.

- In case, you take too many loans, you may end up working for two bosses for most part of your working-life, one with your Employer and another one, your Banker!

- As you do not own any assets until now, your primary aim is to build your assets that appreciate over a period of time. Acquire assets that can generate cash-flows in the years to come and also beat the inflation. Plan your investments towards your life’s financial goals.

- Also, get yourself a decent life insurance cover through a term-life insurance policy.

The Cash poor & Asset rich Phase

- “Cash-rich, Asset-rich” means that you have locked most of your wealth in assets, like real estate, that are difficult to convert into cash. You may own a Rs 10 crore worth self-occupied property but may be facing a severe cash crunch to service home loan EMIs. That could be the worst part of being asset rich and cash poor. “This is where the phenomenon of people being asset rich and cash poor comes from : people own houses that are worth a lot of money. But they cannot use that house to generate cash.”

- Another scenario can be, you may have taken lot of loans like home loan, education loan, car loan etc., and use your surplus income to pay EMIs of these loans.

- I have seen some investing heavily in unproductive asset like Gold and hesitate to take gold loan when cash is required.

- Being Asset rich is anytime better than being Asset poor. Your main aim during this phase is to check if it’s possible to convert any of your assets to cash-generating assets. You may re-model your self-occupied house to a partially let-out one (or) you may take a reverse-mortgage on your own house.

- It’s possible you are overspending in certain areas when you shouldn’t be. Consider revisiting your monthly budget and find areas to cut down on expenditures.

- You can also acquire new career skills and try to aim for other sources of income.

- Ideally, you want a balanced portfolio with liquid cash in your bank and strong assets that are likely to appreciate over time and also give you some additional source of income.

- Being asset-rich may surely qualify you as a wealthy person, but it depends on how well you manage or monetize your assets to generate positive cash-flows. Remember, being asset rich and cash poor may not be a forever phase!

Related article : Different types of Income to increase your Cash Flow!

The Cash rich & Asset rich phase

- This is the phase that each one of us would like to be in. You are now a wealthy person, with multiple sources of income (active & passive). You have time to be yourself and be your own boss.

- You now have a steady flow of positive cash flows (cash rich) and also own assets (mostly with no or manageable liabilities).

- You can re-invest the surplus cash/profits in suitable investment options and multiply your wealth.

- You may aim at giving back something to the community by way of donations, NGO work (or) even establish a business empire and provide some employment opportunities to the job-less.

Life is a journey that is full of opportunities and challenges. You may start your financial life journey being cash-poor and asset-poor but may end up as Cash-rich and Asset-rich. The vice-versa can also happen.

So, be grateful, embrace the opportunities, save and invest a lot consistently, keep things simple, stay healthy and the most important thing ‘live within your means’.

Continue reading:

(Post first published on : 28-Aug-2023)