Life has become very unpredictable. It is OK to PAUSE or to postpone your investment decisions temporarily. But it can be very risky if you postpone buying an adequate Life / health insurance cover. Being under-insured or un-insured can be financially very risky to you and your family.

“If Life is unpredictable, INSURANCE can’t be optional.“

The only and the best way to get sufficient life insurance cover at affordable premiums is to buy a Term Life Insurance Plan. If you have already taken a term plan with adequate life cover, you have done a great favor to your family.

In case, you have been planning to buy a Term life insurance plan and doing your homework to identify the best term plan, you may chance upon a seemingly attractive version of plain vanilla Term plan called as Return of Premium Term Insurance plan.

Who does not want to get a life cover and on top of it, also get back all the premiums paid? We want something tangible in return for our money. After all, it’s our hard-earned money right!

It looks like a win-win situation for both the insurers and the prospective buyers. But does it really make sense to buy a Term Life insurance Plan with Refund of your premium option?

In this post let’s understand – What is a pure Term Life insurance plan? What are Return of Premium Life Insurance Plans? How do they work? Is it good to buy a Term Plan with return of Premium?

What is a Term Plan?

Term insurance is the simplest and most fundamental insurance product. These insurance plans are designed to ensure that in the event of the policyholder’s death, the family gets the sum assured (the cover amount). Term plan provides risk coverage for a certain period of time (policy term/duration). If the insured dies during the time period specified in the policy and the policy is active – or in force – then a death benefit will be paid. It is the cheapest form of Life insurance in terms of premium.

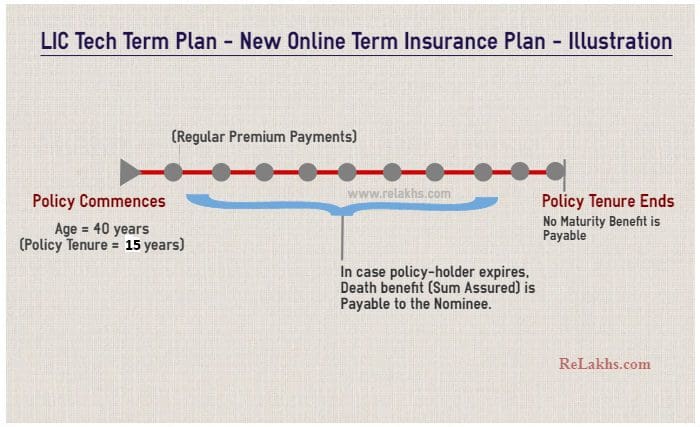

Regular Term Insurance Plan – Example

Let’s understand how a term plan works by taking a popular online Term Life insurance plan called – LIC Tech Term Plan. This is a plain vanilla term life insurance plan with NO return of premium option.

Let’s consider an example – A 40 year Saral buys LIC’s Tech Term insurance plan (online mode) for Rs 1 crore level Sum Assured, with 15 year term, premium payable @ Rs 14,863 p.a., opts for regular premium payment for 15 years and selects ‘lump sum’ death benefit option. (Total Premium with GST is Rs 17538 (Rs 14,863 + GST Rs 2,675.)

In case, the policy holder expires anytime during the policy tenure (15 years), his/her nominee will receive the death benefit of Rs 1 cr as a lump sum amount and the policy gets closed. In case, the policy holder survives the term then the insurance cover ceases, and nothing is payable to him/her.

What are Return of Premium Life Insurance Plans

A return of premium Term Plan provides for a refund of the premiums paid on a term life insurance policy if the policyholder doesn’t die during the stated term.

So, it’s a type of term insurance plan that offers a benefit to your family in case your death happens during the term, plus a survival benefit to you, should you outlive the term. The survival benefit in this case, is a return of all the premiums you pay through the entire policy duration.

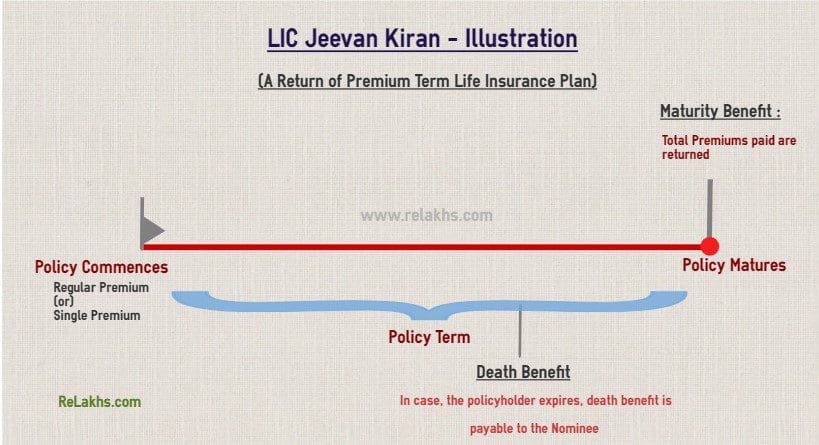

Return of Premium Life Insurance Policy – Example

Let’s now understand how a term plan with refund of premium works by taking the latest LIC plan called – Jeevan Kiran, a Term Plan with guaranteed return of premium. This is a term life insurance plan with return of premium option.

Let’s consider an example – A 40 year old Anvesh planning to buy LIC’s Jeevan Kiran Policy for Rs 1 crore lakh Sum Assured, with 15 year policy term, premium payable @ Rs 90,301 p.a., opts for regular premium payment for 15 years and selects ‘lump sum’ maturity benefit payment option. (Total payable premium is Rs 94,365 (Rs 90,301 + GST Rs 4,064 for 1st year and Rs 2,031 GST from 2nd year onwards.)

In case, the policy holder expires anytime during the policy tenure (15 years), his/her nominee will receive the death benefit of Rs 1 cr as a lump sum amount and the policy gets closed.

In case, the policy holder survives the 15 year tenure then the insurance cover ceases, and he/she receives the maturity benefit of Rs 13,54,515 (15 years X Premium i.e., 15 X 90,301). This maturity benefit is called as guaranteed ‘return of premium’ (total premiums paid).

Do note that Total Premiums Paid means total of all the premiums paid, excluding any extra premium, any rider premium and taxes.

Comparison of Premiums on Regular Plain Term Plan Vs Return of Premium Term Plan

| Type of Term Life Insurance Plan | Yearly Premium (exclusive of Taxes) | Particulars |

|---|---|---|

| Plain or Regular Term Plan (LIC Tech Term Plan) |

Rs 14,863 | Saral has to pay Rs 14,863 yearly for 15 years for Rs 1 crore cover. He does not get back anything at the end of policy tenure. |

| Return of Premium Term Plan (LIC Jeevan Kiran) |

Rs 90,301 | Anvesh has to pay Rs 90,301 yearly for 15 years for Rs 1 crore cover. He does get back all the premiums paid i.e., Rs 13,54,515 (excluding taxes paid). |

Is it good to buy a Return of Premium Term Life Insurance Plan?

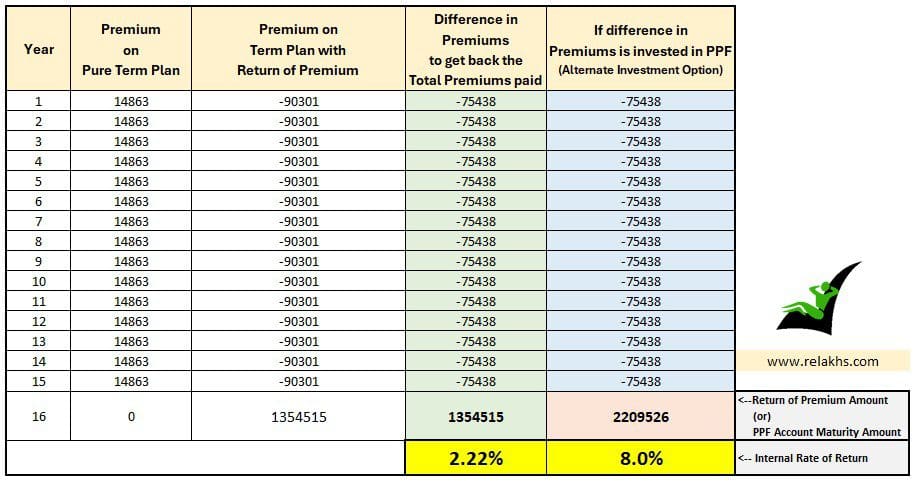

If you notice the premiums on a Term Plan with return of premium are costlier than a term plan with no return of premium. In fact, the difference between the two premium quotes is HUGE i.e., Rs 75,438.

Both of them Saral and Anvesh, are getting the same life cover which is Rs 1 crore but look at the premiums payable by both of them. In our view, it’s a foolish thing to pay such high premiums just to get back all the premiums paid.

- As per the above illustration, Saral pays Rs 14,863 but gets back NIL at the end of the policy tenure.

- Anvesh gets back Rs 13,54,515 by paying extra Rs 75,438 (Rs 90,301 – Rs 14,863). That means, to get Rs 13.5 Lakh, Anvesh has to pay the extra premium of Rs 75,438 on a Rs 1 cr term plan.

- By paying Rs 75,438 extra, Anvesh gets Rs 13,54,515 at the end of the 15th year (16th year beginning). If we calculate Internal Rate of Return on this payment schedule, it is a meagre 2.22%.

- Remember, you have to also bear the taxes (GST) on the premiums and that is not refundable, so the actual IRR can be less than 2.22%.

- If Anvesh realizes that a Term plan with return of premium is a high-cost arrangement that favors only the Insurers then he can pick an alternative like Public Provident Fund (PPF), which is a risk-free, safe and tax-free saving option.

- If Anvesh deposits the same differential amount of Rs 75,438 in a PPF account, he can withdraw a maturity amount of around Rs 22 lakh after 15 years (assuming a 8% rate of interest).

- In case, he invests in a risk-oriented Equity fund(s), he may make much more money in long-term.

- Do note that longer the policy tenure, the lower would be the Rate of return on Term plans with return of premium option.

Below are the key points to ponder over before buying a Term Plan with return of premium;

- ‘Return of Premium’ comes with a Cost : There is nothing ‘free’ in this world. Everything has a cost attached to it. As this plan offers you ‘the return of premium’, the quoted premiums are higher than the plain vanilla term life insurance plans (without return of premium option).

- Comparison : If you compare the premiums of Return of Premium term plans with pure term plans, the premiums are on the higher side.

- Psychological Factor : The main reason, for policy holders choosing return of premium policies, is the perception that they are not losing any money by getting their premiums back. Most of us only tend to see the absolute amount of net cash flow paid to the insurance company without taking into account the time value of money of those cash flows.

- No Compounding Effect : The exact amounts of premiums you pay are returned by the insurance company on the maturity of the policy and these amounts do not earn any interest. Further, this premium amount is not even adjusted for inflation and excludes the taxes you paid.

Our Take : In our opinion, even if you can afford to buy a term plan with return of premium, you should purchase a pure term plan and cover the financial risk of your life. Invest the balance amount (Pure term premium minus return of premium policy premium) in any other financial instrument that will give you better real rate of return. After-all, it’s your hard-earned money and we want something tangible in return for our money. Am I right?

Continue reading:

(Post first published on 01-Sep-2023)