4. Consider how much you can afford to pay your financial advisor

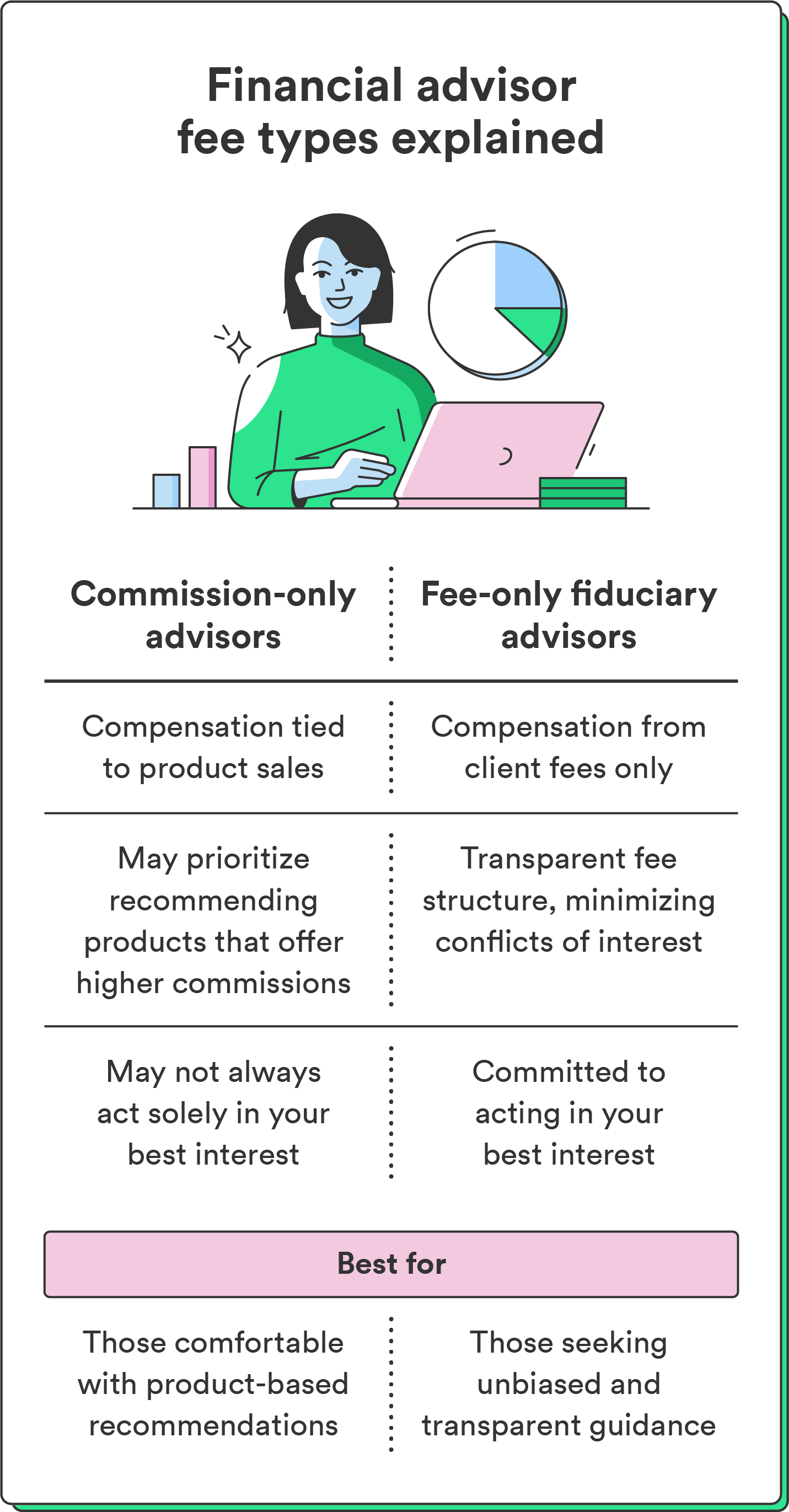

Part of your search for a financial advisor will be checking your budget to see how much you can afford to spend. In general, there are two broad categories of financial advisor fee structures: commission-based advisors and fee-only advisors.

Commission-based advisors earn commissions from selling financial products like investments or insurance. Their compensation is tied to the products they recommend, which can potentially create conflicts of interest.

Alternatively, fee-only advisors charge clients directly for their services. They don’t earn commissions from product sales, promoting transparency and minimizing conflicts. Fees can be hourly, fixed, or a percentage of assets under management.

Here’s an overview of different cost levels across the types of financial advisors:

- Fee-based advisors: Fee-based advisors receive both fees for their services and may earn commissions on certain product sales. This hybrid model combines elements of both fee-only and commission-based compensation.

- Assets Under Management (AUM) advisors: These advisors charge a percentage of the assets they manage for you. This fee structure matches their compensation with your investment performance, incentivizing them to grow your portfolio.

- Hourly rate advisors: These advisors charge clients based on the time spent advising them. This structure suits those seeking specific advice or assistance on particular financial matters.

- Retainer-based advisors: Retainer-based advisors charge an ongoing fee for continuous advisory services. This arrangement provides access to ongoing advice and support as needed.

Knowing how much to spend on a financial advisor depends on both your budget and your financial needs. If you just want to get a small investment portfolio up and running, a robo-advisor can help you at a lower cost than an in-person advisor.

You may need a financial advisor offering more robust services if you have a complex financial situation or need help creating a strategy that accounts for many factors like taxes, retirement, and estate planning.