For many countries, the economic impact of the COVID-19 crisis has been steep. The U.K. saw its largest drop in GDP since 1710, and the U.S. hasn’t seen a GDP decline this large since 1946. China, on the other hand, managed to eke out a little growth. So, what does all this mean for investing in a post-pandemic world?

From an investment standpoint, a bulk of the easy money has already been made, since the equity markets have factored in much of the reopening trade. This means investors should be selective as economies recover and fundamentals catch up with valuations. Here are five investing themes for the post-pandemic world to keep in mind.

1) A Less China-Centric Supply Chain

For the past four decades, globalization has been one of the world’s most powerful economic drivers. China has become a critical element in most global supply chains, resulting in the “Chinaization” of global trade. But strains between China and the rest of the developed world reached a high during the pandemic. As companies and countries deglobalize, they may retreat from a reliance on China’s supply chains—but not from the rest of the world. Some supply chains might get reshored, while others may move to other shores.

2) Not Much Room to Run in Tech

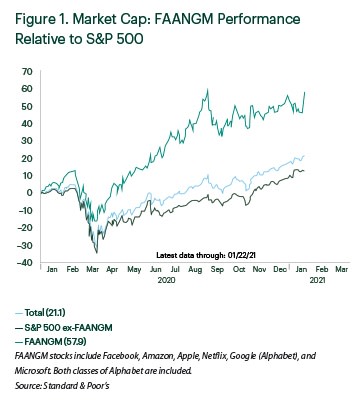

The substantial growth of large technology companies (e.g., Facebook, Google, Amazon, Tencent, and Alibaba) makes them a powerful part of the economic ecosystem. And COVID-19 only reinforced outperformance by these index heavyweights. Easy monetary policy and pandemic-related winning products and services elevated their profitability, justifying their share price gains. It’s possible that additional positive developments for these companies will exceed expectations, leading to further appreciation of their stock prices—but these will have to be unexpected changes not yet accounted for in the current stock prices (see chart below).

Here, it’s important to remember that tech companies are regular targets for debate about consolidated power and regulatory scrutiny. Investors should be mindful that potential increased antitrust enforcement, high valuations, and increased leverage and trading caused by financial innovations such as Robinhood could be signs that mega-cap technology stocks are overvalued.

3) Growth of “Feel-Good” Investing

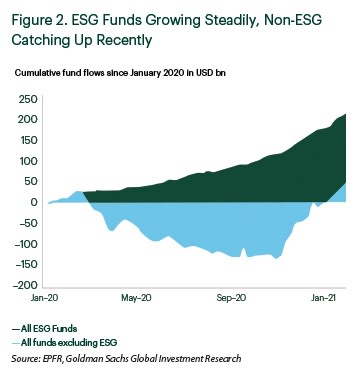

Environmental, social, and corporate governance (ESG) investing saw an exponential rise in interest during the pandemic. Since January 2020, ESG funds have received $215 billion net inflows from mutual fund investors globally (see chart below)—a trend that’s likely to continue. Starting this year, all Principles for Responsible Investment signatories must incorporate ESG considerations into at least 50 percent of their AUM, which totals around $100 trillion (as of March 31, 2020).

The popular MSCI ACWI ESG Universal Index outperformed the mainstream MSCI ACWI Index by approximately 1.5 percent through the third quarter of 2020, and ESG-centric investment strategies generally performed well. It could be argued that the ESG funds were merely loading up on other well-established factors that also did well into the downturn (e.g., quality or low leverage). In time, a detailed risk attribution will be needed to reveal whether there was any true “alpha” in ESG or if ESG was just borrowing returns from other factors.

4) The Growth Vs. Value Conundrum

Before the recent market downturn, the valuation dispersion between growth and value was very wide, as is characteristic of a bubble period. Past recessions saw a pivot from momentum-winners into value names where there was support from dividend or book value. This time around, performance of value factors was very poor early in the cycle, and the valuation dispersion widened further during the downturn, reaching an all-time peak. Resolution of several uncertainties in the latter part of the year led to a rotation into value, with many investors calling this the end of a decade-long onslaught on value.

Certain traditional parts of value are structurally challenged and in a long-term secular decline, so we need to be careful of value traps. Another interesting phenomenon is a simple supply-demand dynamic in terms of the number of value and growth stocks. The growth universe has shrunk in size to historic lows, even as demand for growth stocks from investors is high. This dynamic could translate into higher asset prices for growth stocks and less differentiation among growth managers.

5) New Normal for Consumer Behavior

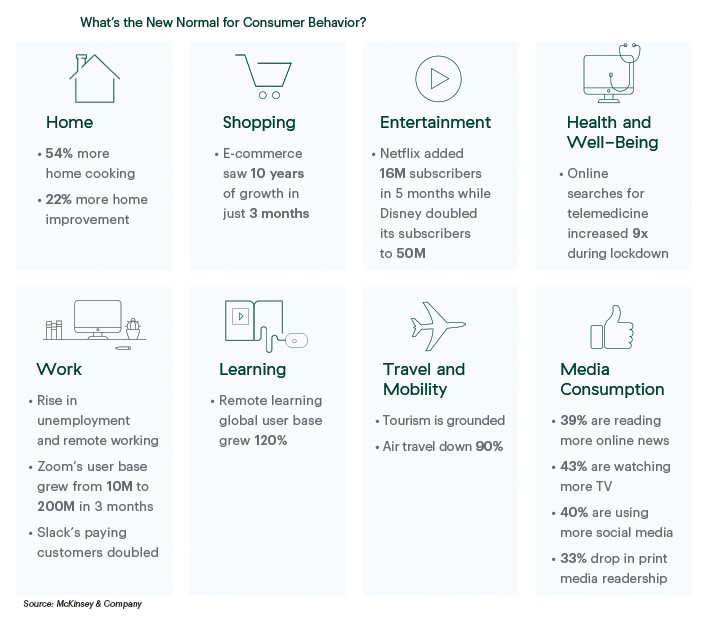

Some of the recent changes in consumer behavior are likely to be sticky and accelerate secular trends that began even before the crisis, such as:

-

People spending more time at home—working from home, learning from home, eating at home, and traveling far less

-

Rapid rise in online alternatives, with increased e-commerce penetration, internet TV adoption, and services such as telemedicine

Of course, pent-up demand could reverse some of these trends as we emerge from the pandemic. But once the initial surge wanes, consumers may return to their pandemic-period habits (see chart below).

So far, tech giants have benefited from these changes with rapid share price gains. These tech giants could also be the enablers for their successors. This shift could benefit smaller rivals not just in the U.S. but also in less developed countries, where the delta of growth is faster and greater.

Opportunities in a Post-Pandemic Age

The pandemic has sparked rapid development and evolution in just about every aspect of people’s lives across the globe, which has opened up new investing opportunities. By paying attention to these investing themes for the post-pandemic world—where companies, investors, and consumers are likely to shift behaviors, for either the short term or long term—you can help position portfolios for whatever lies ahead.

free download

How Commonwealth’s Investment Research Team Can Make a Difference for You and Your Clients

Learn how to put our experts to work for you.