Online global brokerage TD Ameritrade used to be popular among Singapore investors, especially those who were introduced to it through various investment trainers or trading course providers. However, investors received a shock last week when TD Ameritrade announced that their brokerage platform – Thinkorswim – will no longer be serving retail investors in Singapore. If you’re among those affected, here’s what you can do.

PSA: Get out of Thinkorswim now

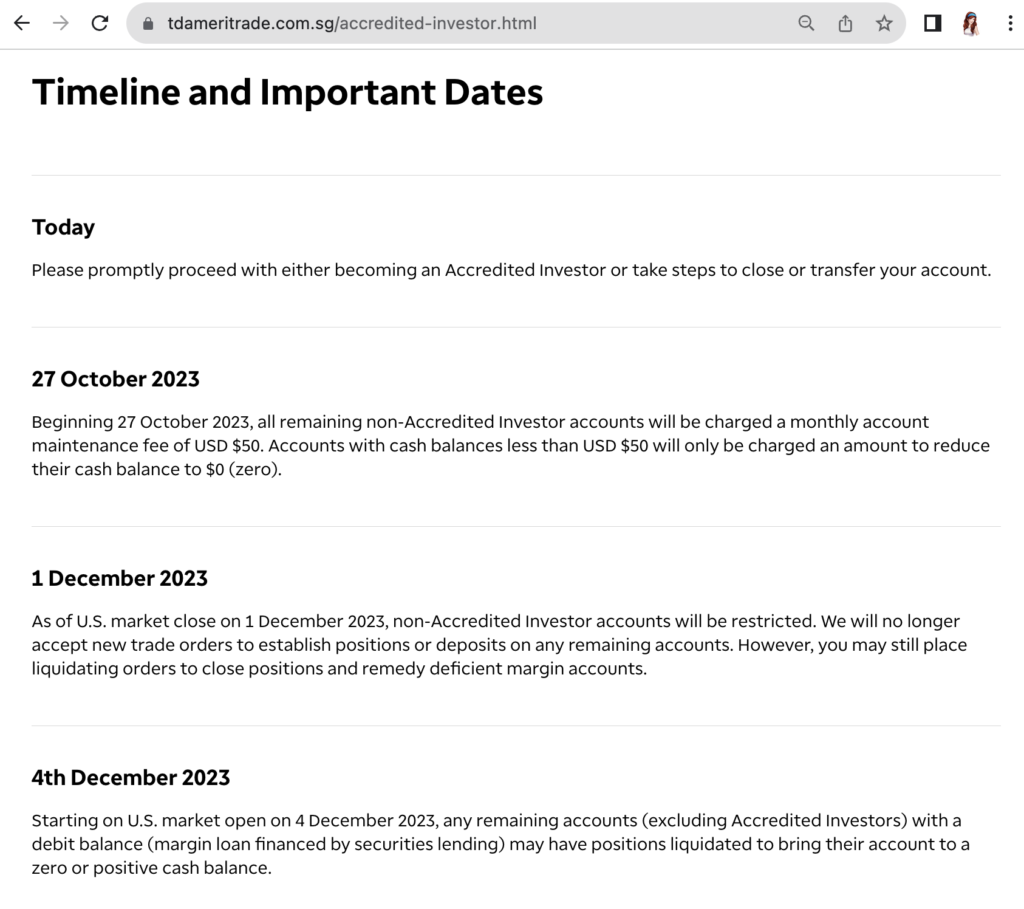

TD Ameritrade Singapore has stated that you will need to either (i) proceed with becoming an Accredited Investor with them, or (ii) take steps to close or transfer your account by the following deadlines:

- The deadline to act is 27 October 2023, after which a monthly charge of USD 50 will be automatically deducted from your account until your cash balance is zero.

- The final deadline to close your account is 31 December 2023.

To avoid paying USD 50 for essentially nothing, please take action now before 27 October 2023.

Should I become an Accredited Investor?

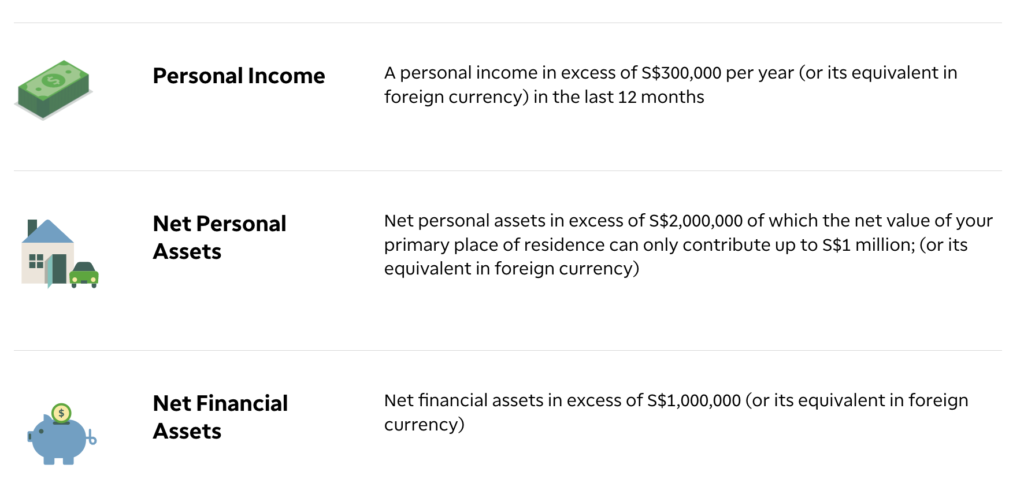

Firstly, even if you meet MAS’ criteria and qualify to become an Accredited Investor (AI), you will need to manually opt-in with TD Ameritrade if you wish to continue using the TOS platform. The good news is, your financial assets held in a different bank can be combined to hit the assets threshold.

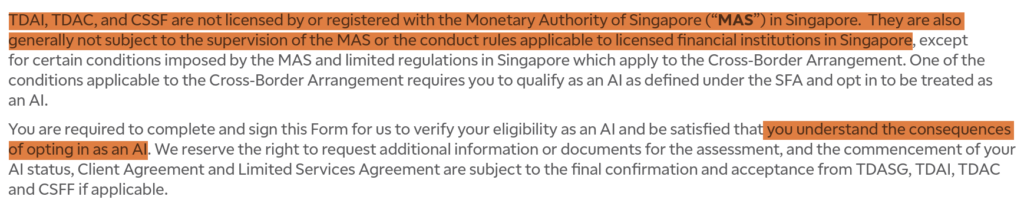

However, should you register as an accredited investor with TD Ameritrade? That is a different matter altogether, as you’d have to weigh the benefits and consequences to decide whether it makes sense to you. More importantly, as an Accredited Investor customer, you would no longer fall under certain Singaporean customer protection rules. Read more about the trade-offs here.

For those who do not qualify or do not wish to register as an AI, you will now need to move your assets and switch to another broker.

What about my assets on Thinkorswim?

For cash, you can simply request for a wire transfer to withdraw the cash into your bank account.

For equities and/or options, you can decide whether you prefer to

- Close (sell) your existing positions and reopen them again (buy) on your next broker. This is the easiest and fastest method, as you are completely in control of the process and do not have to wait for any approvals. Your trade will normally take up to two (2) business days to complete on TOS; once your funds are cleared, you can proceed to withdraw them to your bank account and over to your new broker.

- Hold your open position and transfer them to your new alternative broker instead. I wouldn’t recommend this unless you’ve decided to switch to Interactive Brokers, as the transfer method is much slower and comes with several limitations. To transfer your account assets, you will need to initiate the Transfer of Assets (TOA) on your new brokerage which may then require you to complete their forms (either an Automated Customer Account Transfer Service (ACATS) transfer, or a DTC / DRS transfer).

Do note that there is a US$75 fee for ACAT transfers from TD Ameritrade Singapore to other brokers, but the good news is that TD Ameritrade is waiving any transfer or wire fees you incur this year only for entire account transfers and/or wire withdrawals. In other words, you’ll have to do everything all at one go.

For non-ACAT transfer requests e.g. DTC or DRS, the process has a longer processing time and excludes non-securities items i.e. cash, options and fractional shares. During that period, you will not be able to trade on some of your securities positions either, so to make things simpler, go for either (i) an ACAT transfer, or (ii) liquidate and simply restart anew on another broker.

Best Alternative Brokerages to Thinkorswim

Which brokerage to choose really depends on what features and support you prioritise, or find valuable. For instance, if you insist on having all your Singapore stocks in your CDP account (like I do), then you may prefer to pay more for a local bank brokerage or opt for either FSMOne or POEMS to transact your local investments. Maybe you’re an experienced investor who trades across the US, Australia and London markets, in which case you would likely already be on Interactive Brokers, POEMS or Saxo. Some people value investing only in brokerages that have a local presence (i.e. with local hires (Singaporeans) and organising local events), so they prefer Moomoo SG or FSMOne.

Sometimes, when you started investing also matters, because the brokerage options available to you then would have been different. Many older investors who started in the early 2000s would likely still be with their bank brokerages (e.g. DBS Vickers, OCBC Securities or Standard Chartered) or they’d be on FSMOne, which was Singapore’s first online-only discounted brokerage then.

As a newbie investor, you may be tempted to simply go for the lowest-cost brokerage in Singapore. However, as someone who has been watching the scene evolve over the last decade, let me tell you why that isn’t ideal: because the brokerages have changed their fees over time.

- Prior to 2000, the cheapest was a close fight between POEMS and Standard Chartered (non-CDP).

- In the early 2000s, the cheapest brokerage was FSMOne.

- In the 2010s, DBS Vickers gave FSMOne a run for its money for CDP investors when it lowered its fees for cash upfront trades.

- In 2020, Tiger Brokers entered the scene and became the cheapest online broker.

- In 2021, Moomoo SG launched and beat Tiger Brokers with even lower fees.

- In 2022, Webull entered Singapore and became the cheapest for US & HK stocks. In 2023, it removed its minimum funding requirement and is now currently giving away the most generous welcome sign-up rewards to attract new users over to its platform.

Disclaimer: These are all based off my own memory, so if you were investing during this same period and spot any errors, please let me know so that I can correct it. Thanks!

If you choose your brokerage solely based on the cheapest fees, you may be setting yourself up for disappointment in the future as or when your broker amends its charges.

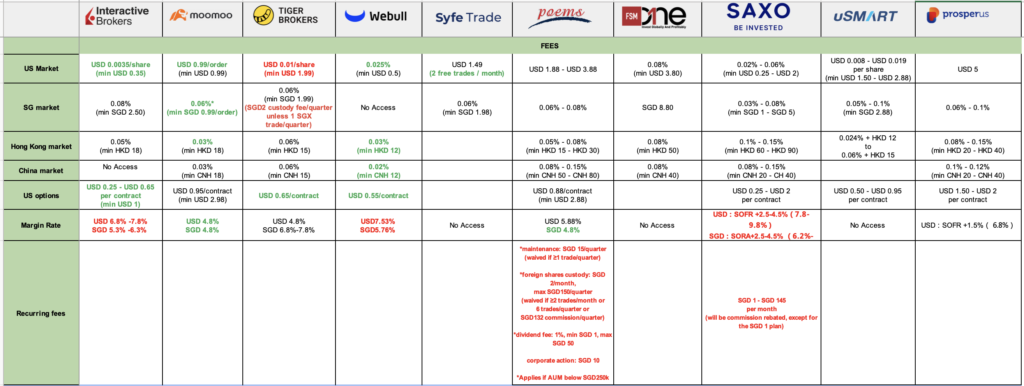

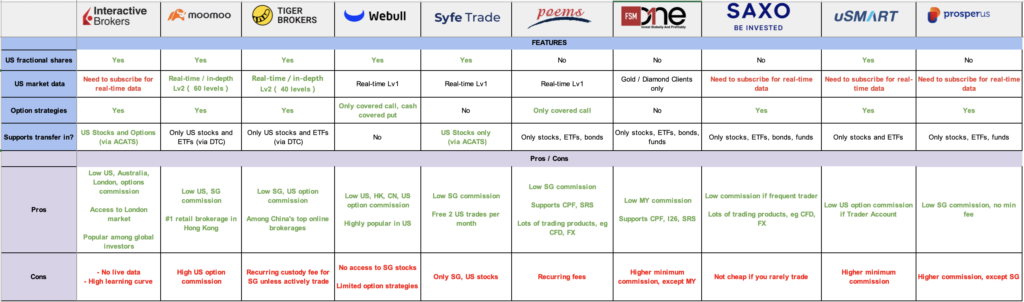

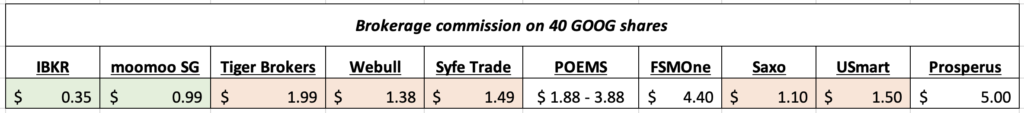

However, you should definitely still compare so that you clearly know the pros and cons of each brokerage – that will help you make a more informed decision as to which account to open. My friend Kelvin helped work on a comparison table across all the low-cost brokerages in Singapore, which you can also view in full on his Youtube channel here (support him with a like, or you can tip him here!)

I’ve zoomed in on aspects I recommend focusing on, which would be the different features and Pros vs Cons of each brokerage:

Which online brokerage do you recommend?

Again, which brokerage is best for you is a personal decision that only you can make because what you value may be different from mine. I invest and trade only in the US, SG and HK markets, so features like access to Malaysia stocks (Saxo, ProsperUs) do not make any difference to me.

Nonetheless, here’s my general experience and stance on how I chose between brokerages:

- Singapore stocks or ETFs – I only use CDP-linked brokerages, and my platform of choice is FSMOne because I started investing in the 2010s when Tiger Brokers and Moomoo did not exist here.

- Automated investments / Regular Savings Plans – If you hold a RSP (also known as RSS), I like FSMOne. However, some folks prefer to invest via their bank for the convenience, in which case DBS Invest Saver (or digiPortfolio) or OCBC would be a decent choice. Moomoo SG also offers 5.8% p.a. guaranteed returns on Moomoo Cash Plus with no lock-up periods.

- London-domiciled ETFs or stocks – Interactive Brokers is the cheapest.

- US stocks – I started with Tiger Brokers, then I opened with Moomoo SG when they launched, so I’m currently have my stocks in both brokers. Right now, one is for buy-and-hold and money market funds, while another is used for more some opportunistic trades. For Moomoo SG, the $0.99 commission fee per order means the higher the transaction amount, the more I save on fees.

Let me also disclaim that I do not have direct experience with ALL the brokerages here - and naturally so, because I'm not a fan of opening more accounts than I deem necessary and having my personal financial details shared with so many institutions.

You can also read the reviews that I’ve done here (in alphabetical order) to decide which is best for you:

Best low-cost online brokerages (according to Budget Babe)

If you’re starting out today or looking for a new account to start afresh on, here’s my personal verdict on how I would classify the various low-cost online brokerage platforms:

Many of you have told me that you prefer a low-cost broker that

- Offers an easy-to-navigate user interface, even for beginners.

- Has local support, including a local hotline and organises local events where you can actually speak to real human beings or experts to ask questions about the app / your portfolio. Best if it also has educational outreach efforts (such as courses) to help beginners.

- Is used and trusted by many fellow peers and Singaporeans.

- Must be safe and unlikely to wind up, or close its Singapore operations.

- Allows one to invest in Singapore, US and Hong Kong stocks.

- Can be used for options trading.

- Offers yield on your uninvested, idle cash parked in your brokerage account.

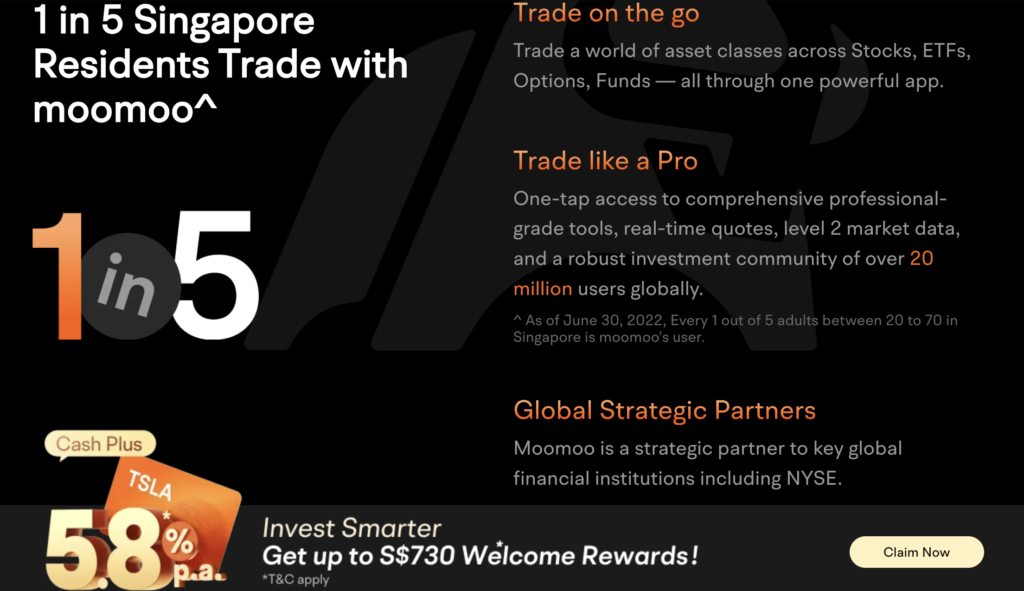

If that sounds similar to your own criteria, then you might want to check out Moomoo SG.

The following advertisement is brought to you by Moomoo SG.

I’ve written extensively about Moomoo SG offerings over the years, including the attractiveness of their money market funds for idle cash and how I use their app to analyze a company while I’m on the move. In the aftermath of Robinhood’s saga with the SEC over their controversial Payment for Order Flow (PFOF), I questioned if our zero-commission brokerages here use the same practice, and was relieved when Moomoo SG officially said no here.

Thanks to the various events and investment conferences that Moomoo SG has held in Singapore, I’ve also gotten to know their team better and had the privilege to ask them about their plans and commitment to the Singapore market, as well as how safe they really are, as an online discounted brokerage.

Today, Moomoo SG has grown to become one of Singapore’s top choices of brokerages and expanded to become one of the most impressive brokerage apps I have on my phone.

Whether you’re a retail investor affected by the Thinkorswim closure, or simply thinking of switching to a more reputable brokerage like Moomoo for your long-term needs, you can now take advantage of Moomoo SG’s ongoing promotion and get up to S$1,000 of rewards when you transfer in your eligible assets from another broker.

If you’re transferring from TD Ameritrade, you can refer to this page for specific instructions on how to do a DTC transfer of your assets over to Moomoo SG.

Click here to learn more and get started with a Moomoo SG account today!

Disclaimer: All views expressed in this article are the independent opinions of SG Budget Babe. The review statements are an expression of personal opinion and preference, and not to be taken as a fact in determining which brokerage is the best. Neither Moomoo Singapore or its affiliates shall be liable for the content of the information provided. This advertisement has not been reviewed by the Monetary Authority of Singapore.