Stubbornly high mortgage rates that have climbed to a 23-year high and have remained above 7% for the past two months continue to take a heavy toll on builder confidence, as sentiment levels have dropped to the lowest point since January 2023.

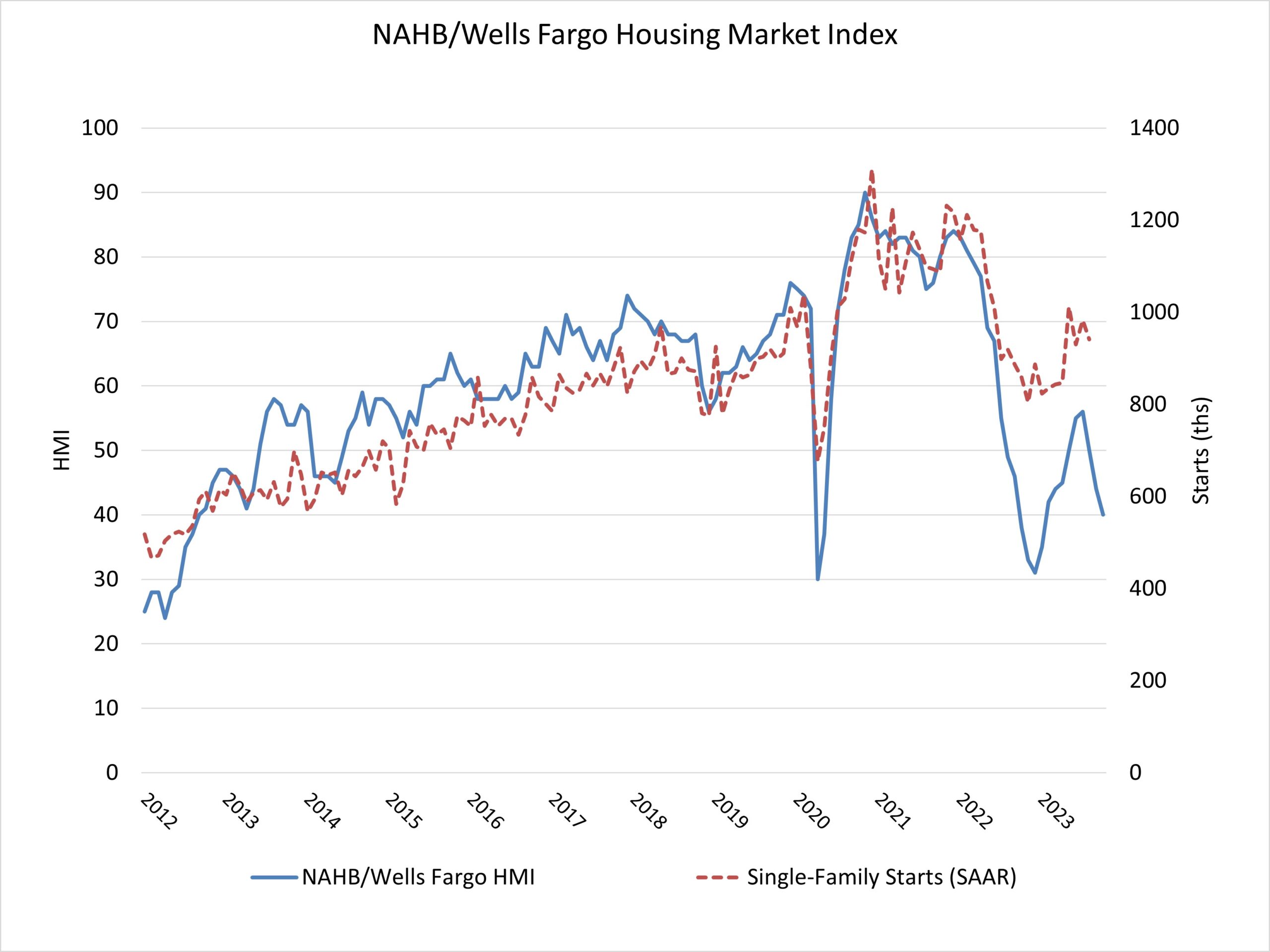

Builder confidence in the market for newly built single-family homes in October fell four points to 40 from a downwardly revised September reading, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). This is the third consecutive monthly drop in builder confidence.

Buyers continue to be priced out of the market at these levels of interest rates, particularly younger households. Additionally, elevated rates are also increasing the cost and decreasing the availability of builder development and construction loans, which harms supply and contributes to lower housing affordability.

Since late September, mortgage rates are up nearly 40 basis points to 7.57%, according to Freddie Mac. Interest rates have increased on the Federal Reserve’s apparent higher-for-longer monetary policy stance, better than expected macro growth during the third quarter and longer-term concerns over government budget deficits.

The housing affordability crisis can only be solved by adding additional attainable, affordable supply. Boosting housing production would help reduce the shelter inflation component that was responsible for more than half of the overall Consumer Price Index increase in September and aid the Fed’s mission to bring inflation back down to 2%. However, uncertainty regarding monetary policy is contributing to affordability challenges in the market.

As a result of the extended high interest environment, many builders continue to reduce home prices to boost sales. In October, 32% of builders reported cutting home prices, unchanged from the previous month but still the highest rate since December 2022 (35%). The average price discount remains at 6%. Meanwhile, 62% of builders provided sales incentives of all forms in October, up from 59% in September and tied with the previous high for this cycle set in December 2022.

Derived from a monthly survey that NAHB has been conducting for more than 35 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three major HMI indices posted declines in October. The HMI index gauging current sales conditions fell four points to 46, the component charting sales expectations in the next six months dropped five points to 44 and the gauge measuring traffic of prospective buyers dipped four points to 26.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell four points to 50, the Midwest dropped three points to 39, the South fell five points to 49 and the West posted a six-point decline to 41.

The HMI tables can be found at nahb.org/hmi.

Related