Single-family construction held steady in October as high mortgage rates depressed demand but more buyers turned to new homes because of a lack of existing inventory.

Overall housing starts increased 1.9% in October to a seasonally adjusted annual rate of 1.37 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

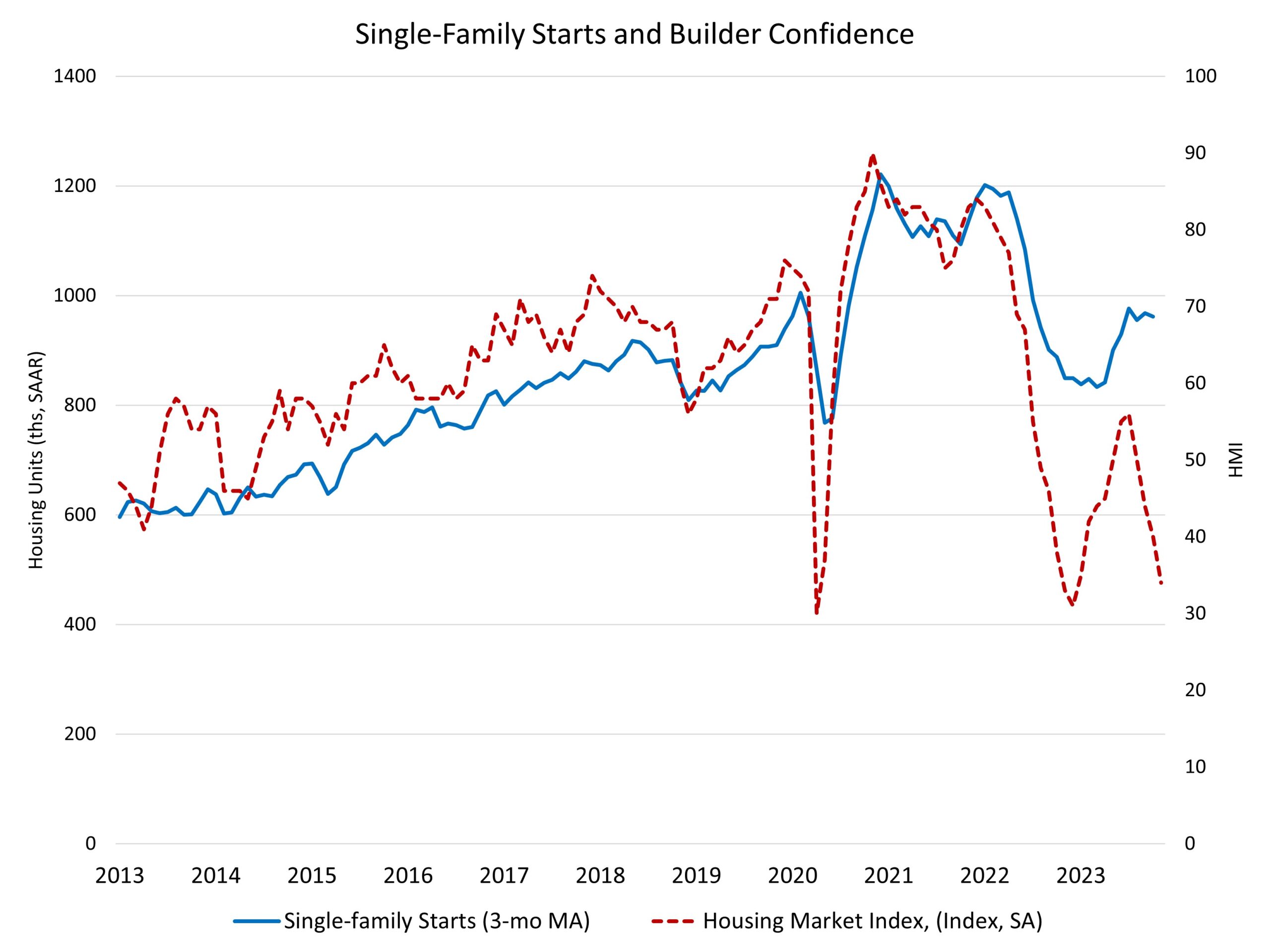

The October reading of 1.37 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts increased 0.2% to a 970,000 seasonally adjusted annual rate. However, single-family starts are down 10.6% year-to-date. Despite higher interest rates in October, the lack of existing home inventory supported demand for new construction in the fall. NAHB is forecasting improving conditions for single-family home building, as the 10-year Treasury rate has returned to near 4.5%, with an outright gain for single-family starts in 2024.

The multifamily sector, which includes apartment buildings and condos, increased 6.3% to an annualized 402,000 pace. However, multifamily construction 5-plus unit starts are down more than 12% on a year-to-date basis with additional weakness in the forecast ahead. NAHB is forecasting a decline for multifamily construction in 2024.

On a regional and year-to-date basis, combined single-family and multifamily starts are 22% lower in the Northeast, 11.2% lower in the Midwest, 7.8% lower in the South and 15.3% lower in the West.

Overall permits increased 1.1% to a 1.49 million unit annualized rate in October. Single-family permits increased 0.5% to a 968,000 unit rate. However, single-family permits are down 10.6% year-to-date. Multifamily permits increased 2.2% to an annualized 519,000 pace.

Looking at regional permit data on a year-to-date basis, permits are 19.5% lower in the Northeast, 16.7% lower in the Midwest, 11.3% lower in the South and 15.8% lower in the West.

There are currently 669,000 single-family homes under construction, down almost 15% from a year ago. In contrast, there are more than one million apartments under construction, near the highest total since 1973. This number will decline in the months ahead as permits weaken due to tight financing conditions.

Related