Tax refunds involve the amount of taxes you pay from your paycheck throughout the year. Knowing how they work can give you more control over your money and avoid any surprises once tax season rolls around.

What is a tax refund?

A tax refund is money that the government gives back if you paid more in taxes throughout the year than you owed. This overpayment results from employers withholding too much money from your paychecks.

Instead of waiting for a yearly refund, you can adjust your tax withholding to avoid overpaying your taxes and keep more of your paycheck month-to-month. We’ll explain how below.

How do tax refunds work?

While a tax refund may seem like a pleasant financial surprise, it’s just the government returning the extra money you paid them in taxes. In other words, money that could have been in your pocket throughout the year.

Here’s a breakdown of how tax refunds work:

- Income taxes: When you earn money, your employer sends a portion of your paycheck to the IRS to cover the income taxes you owe.

- W-4 Form: As an employee, you specify the amount of taxes you want withheld from each paycheck on your W-4 form.

- Annual tax filing: Once you file your taxes, ensure your annual tax return accurately details your earnings, deductions, and credits.

- Calculating tax liability: The government calculates how much you owe in taxes based on the information you provided in your tax return.

- Comparing withheld amount: The IRS compares the amount you withheld to your actual tax liability.

You’ll receive a tax refund if you’ve paid too much in taxes. You may owe the IRS additional taxes if you’ve underpaid.

While a tax refund may seem like a pleasant financial surprise, it’s just the government returning the extra money you paid them in taxes. In other words, money that could have been in your pocket throughout the year.

Here’s a breakdown of how tax refunds work:

- Income taxes: When you earn money, your employer sends a portion of your paycheck to the IRS to cover the income taxes you owe.

- W-4 Form: As an employee, you specify the amount of taxes you want withheld from each paycheck on your W-4 form.

- Annual tax filing: Once you file your taxes, ensure your annual tax return accurately details your earnings, deductions, and credits.

- Calculating tax liability: The government calculates how much you owe in taxes based on the information you provided in your tax return.

- Comparing withheld amount: The IRS compares the amount you withheld to your actual tax liability.

You’ll receive a tax refund if you’ve paid too much in taxes. You may owe the IRS additional taxes if you’ve underpaid.

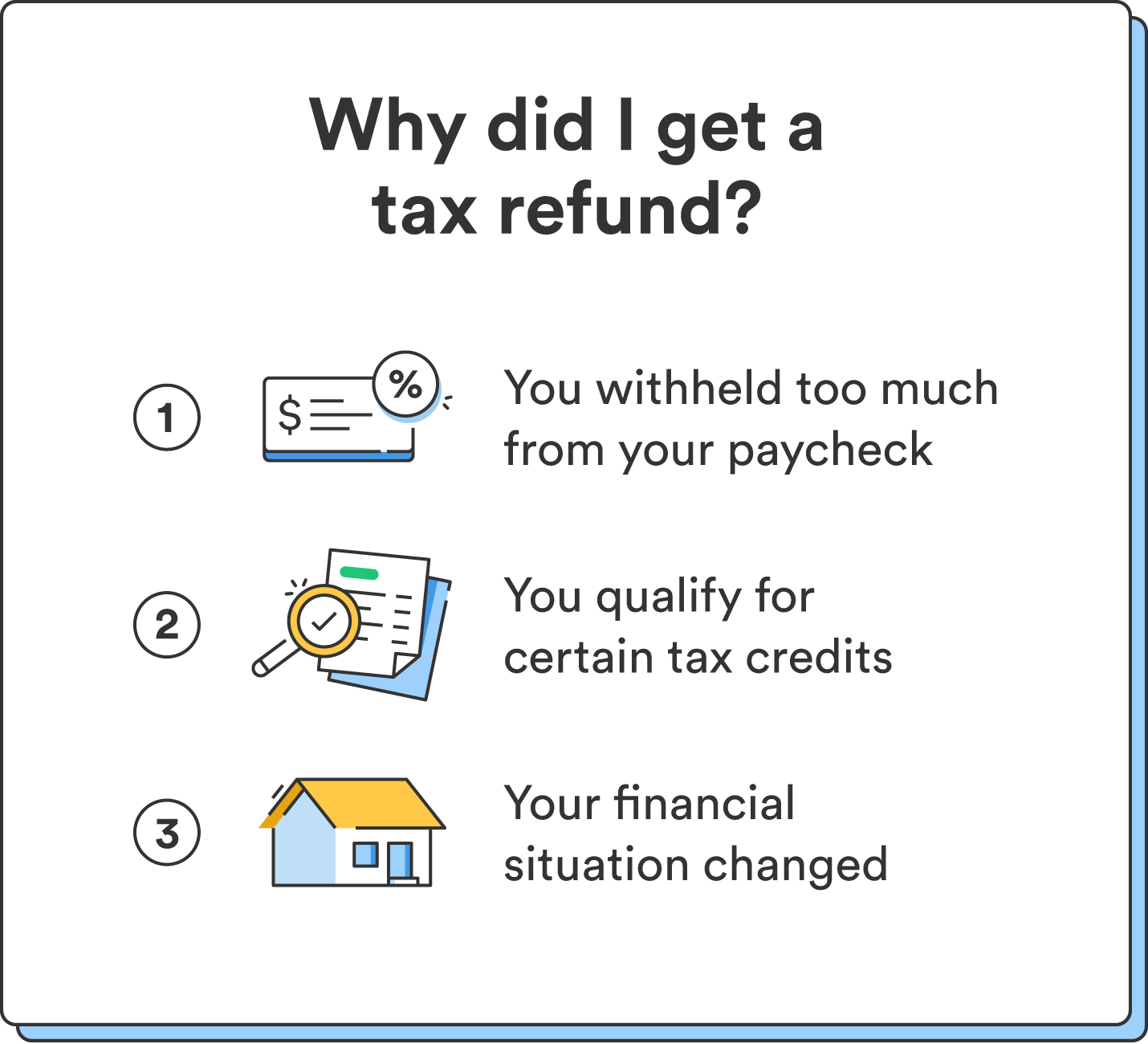

Reasons you may receive a tax refund

Here are three common scenarios that can lead to receiving a tax refund:

- Withholding too much from your paychecks: If you filled out your W-4 to have a higher withholding amount that exceeds how much you owe in taxes, you may have more money taken from each paycheck than necessary, resulting in a tax refund.

- Receiving refunds for tax credits and deductions: “Refundable” tax credits and deductions, like the Earned Income Tax Credit (EITC) or the Child Tax Credit, can lead to a refund even with low tax liability.1 For example, if you qualify for a refundable tax credit of $1,000 but only owe $800 in taxes, the IRS returns the extra $200 as a refund.

- Experiencing changes in your financial situation: Significant life changes, like getting married, having a child, or buying a home, can impact your tax situation. These changes may lead to additional tax credits or deductions, increasing the likelihood of a refund.

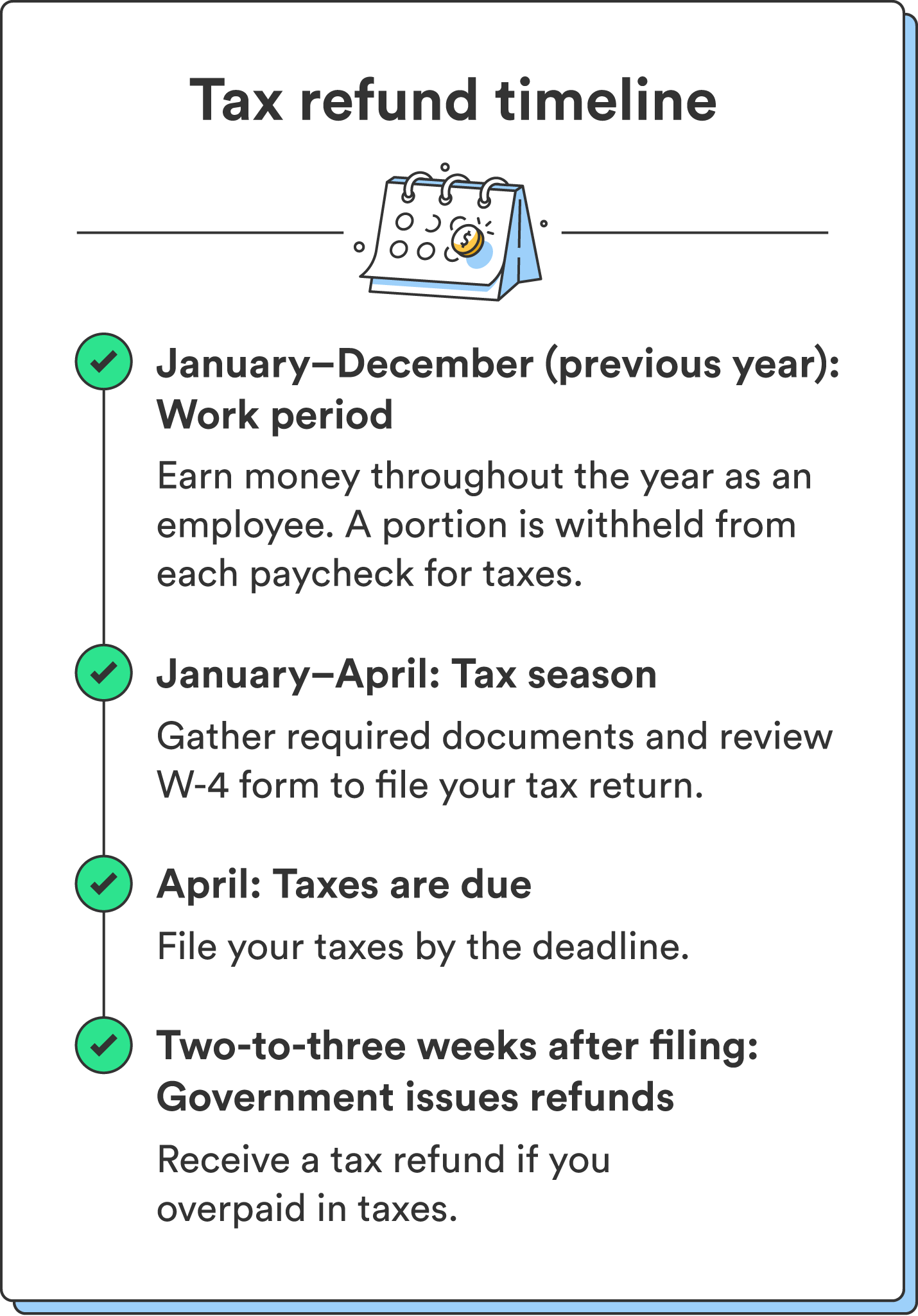

When will I get my tax refund?

The exact time frame for receiving your tax refund varies, but you can expect to receive your refund within 21 days if you file your taxes online and request direct deposit.2 This timeline can change depending on the IRS’s workload and any issues with your return.

How to update your tax withholding amount

Instead of waiting for a yearly refund, you can adjust your tax withholding to avoid overpaying your taxes and keep more of your paycheck month-to-month.

In the past, that would mean adjusting the information you entered for Allowances on your W-4. However, the IRS redesigned Form W-4, and it no longer includes this section. The updated format automatically matches your withholding to your actual tax liability.³

That said, you can enter an additional withholding amount in Step 4(c) of Form W-4 if you prefer your employer withhold more taxes than necessary from each paycheck.³

You can also use the IRS Tax Withholding Estimator tool to determine the most accurate withholding for your situation.

Take the stress out of tax season

Instead of waiting for a yearly tax refund, learning the ins and outs of how tax refunds work can help you keep more of your hard-earned money throughout the year (read about how much of your paycheck you should save). Utilize tools like the IRS Withholding Estimator and, if necessary, update your W-4 to match your financial situation.

When you’re ready to file, find out if you can pay your taxes with a credit card.

FAQs about tax refunds

Still have questions about tax refunds? Find answers below.

How do I check the status of my tax refund?

To check the status of your tax refund, use the IRS’s Where’s My Refund? tool. You can use this tool beginning 24 hours after the IRS receives your tax return if you filed online or four weeks after mailing a paper return.4

What should I do with my tax refund?

If you receive a tax refund, consider using it strategically to further your financial goals. Whether building an emergency fund, paying down debt, or investing in long-term savings, your refund can contribute to a more secure financial future.

Does everyone get a tax refund?

Not everyone receives a tax refund. It depends on factors like income, deductions, and tax credits. While some may get a refund, others might owe additional taxes or have a balance that breaks even.

The post What Is a Tax Refund, and How Does It Work? appeared first on Chime.