Despite record high inflation rates, rising interest rates, and worsening housing affordability, young adults continued the post-pandemic trend of moving out of parental homes in 2022. The share of young adults ages 25-34 living with parents or parents-in-law declined and now stands at 19.1%, according to NAHB’s analysis of the 2022 American Community Survey (ACS) Public Use Microdata Sample (PUMS). This percentage is a decade low and a welcome continuation of the post-pandemic trend towards rising independent living by adults ages 25-34.

Traditionally, young adults ages 25 to 34 make up around half of all first-time homebuyers. Consequently, the number and share of young adults in this age group that choose to stay with their parents or parents-in-law has profound implications for household formation, housing demand, and the housing market.

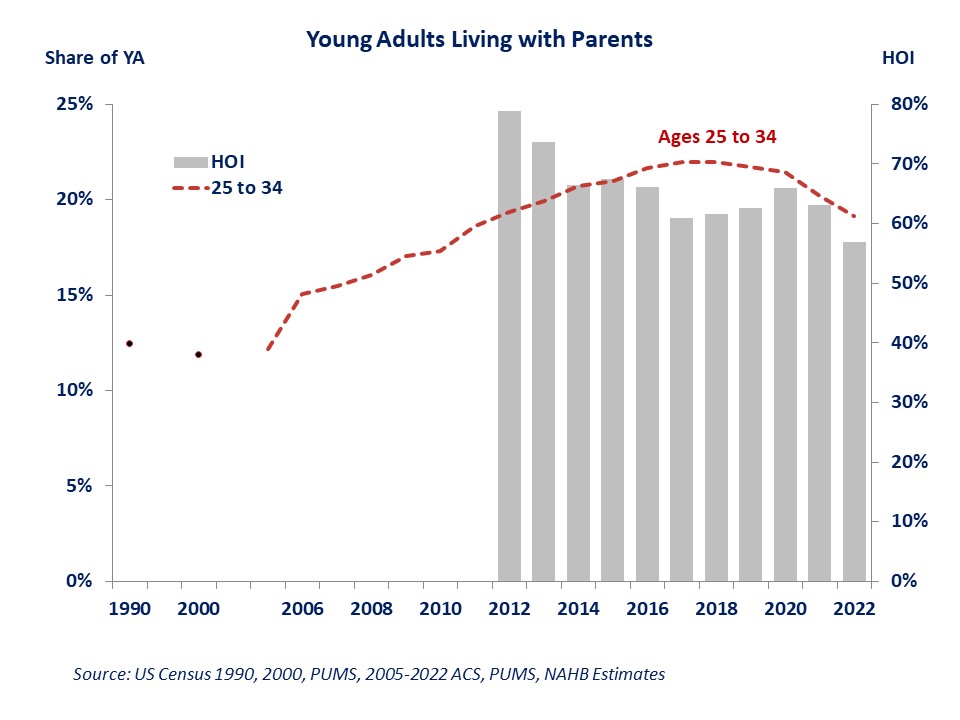

The share of adults ages 25 to 34 living with parents reached a peak of 22% in 2017-2018. Even though an almost three percentage point drop in the share since then is a welcome development that the housing market has been waiting for, the share remains elevated by historical standards, with almost one in five young adults in parental homes. Two decades ago, less than 12% of young adults ages 25 to 34, or 4.6 million, lived with parents. The current share of 19.1% translates into 8.5 million of young adults living in homes of their parents or parents-in-law.

Stacking our estimates of the share of young adults living with parents against NAHB/Wells Fargo’s HOI data reveals that until the pandemic, the rising share of young adults living with parents had been associated with worsening affordability. Conversely, improving housing affordability, had been linked with a declining share of 25–34-year-old adults continuing to live in parental homes. The strong negative correlation disappeared in the post-pandemic world, with young adults continuing to move out of parental homes despite worsening housing affordability and rising cost of independent living.

The “excess” savings accumulated early in the lockdown stages of the pandemic, when spending opportunities were limited, undoubtedly helped finance the move-out trend. Will the trend continue once young adults drain their “excess” savings? The NAHB forecast highlights strong labor market conditions and expectations for receding mortgage rates that should improve housing affordability in the near future. Combined with the desire for more spacious, independent living heightened by the COVID-19 pandemic, these factors should help sustain the trend towards rising independent living of young adults even after their excess savings are depleted.