If you have money in any of the local 3 bank accounts, congratulations, you can now activate a “money lock” feature to lock up a portion of your funds so that it cannot be transferred or withdrawn. The new security move was formalized in December 2023 as part of enhanced banking security measures in Singapore, but the bad news is, if you’re on DBS / UOB, you’ll have to think about whether you’re willing to give up your (higher) interest in exchange for this additional security.

Background: enhanced security needed to thwart scammers

The rise in banking scams here in recent years have led to many Singaporeans losing their lifelong savings, or retirement funds. Last year, more than S$330 million was siphoned out of victims’ bank accounts here, with Singapore victims losing the most to scammers globally. What’s more, the profile of victims have changed as it is no longer the elderly who fall prey, and according to the Singapore Police Force, young adults are now the most likely to be cheated in scams.

This has been heavily discussed in Parliament, with a beneficial outcome being that our 3 local banks have now moved to launch a “money lock” feature on deposits. This allows customers to “lock up” their funds so that they cannot be transferred out, thus safeguarding depositors’ hard-earned monies even as scammers continue to evolve their scam tactics to cheat more unwitting victims.

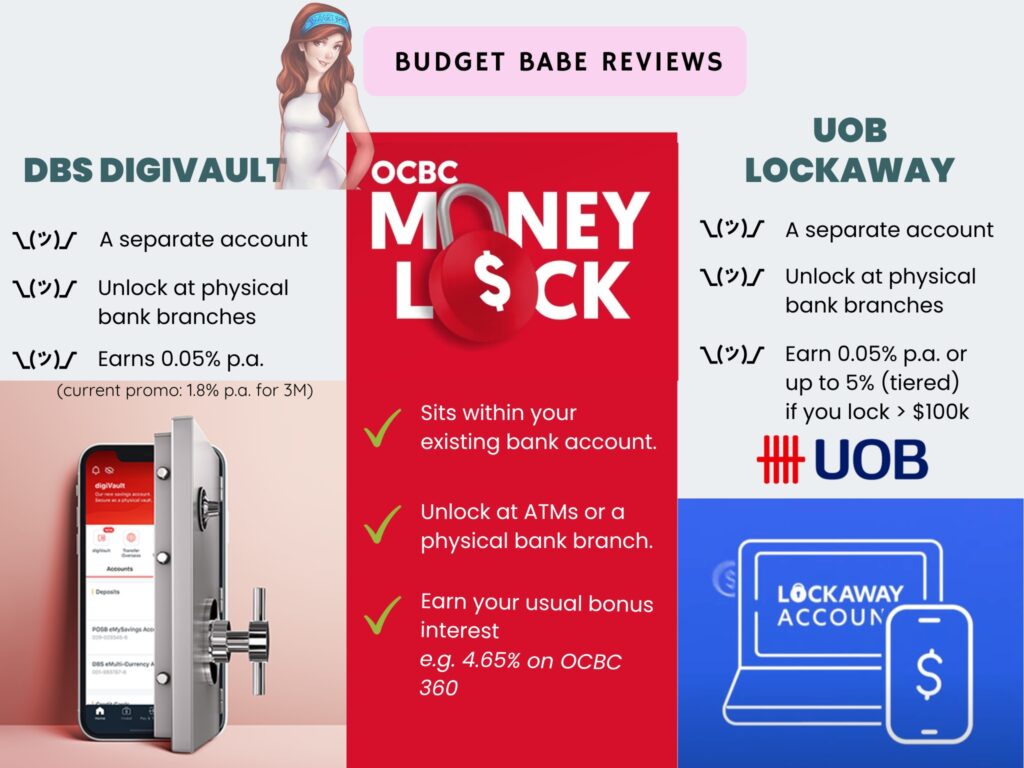

In recent weeks, all 3 local banks have launched their “money lock” feature, although each comes with different executions. The most significant difference perhaps boils down to how much interest your “locked” funds will earn – and the rates aren’t pretty for some of the banks.

It is pretty telling that in Singapore, out of the 47,000 accounts and $3.8 billion that has reportedly been locked, OCBC owns the majority share at 33,000 accounts and $3.2 billion locked (~85%).

In this article, I dive into the differences between each bank’s money lock feature, and question why, by choosing to lock up our monies and protect them from scams, we consumers have to forfeit (higher) interest rates that we could otherwise earn in our default High-Yield Savings Account.

Here’s how each of the 3 local banks fare:

Unlike OCBC, where your locked funds continue to qualify and earn bonus interest, both DBS and UOB have opted for a completely different approach, resulting in their customers having to choose between greater security (by locking up their funds) or higher interest (without locked funds).

So before you decide to lock up your funds or which bank to lock it up with, please read to understand how each of them work, and the trade-offs involved in each method:

DBS digiVault

Customers of DBS/POSB who wish to lock up their funds will need to open a digiVault. Simply put, digiVault is a My Account with added security where deposited funds cannot be digitally transferred out.

To access funds in your digiVault, you will need to personally visit a DBS/POSB branch to raise a request and verify your identity before you can “unlock” and transfer funds back to your personal account to liquidate them.

| How to lock? | – Open up a digiVault and deposit your funds into the account. – Funds in digiVault cannot be digitally transferred out. |

| How to unlock? | You will need to visit a DBS/POSB branch in-person and verify your identity before you’ll be allowed to “unlock” your funds and transfer them back to your other DBS/POSB accounts where they can be used. |

| How much interest do I earn? | 1.8% p.a. (capped at $50,000 per customer) for 3 months as long as you open before 29 February 2024.

After that, your funds will only earn 0.05% p.a. |

You can open up multiple digiVault accounts (e.g. for your savings vs. your fixed deposits). However, only the first digiVault account will be eligible for the bonus additional interest.

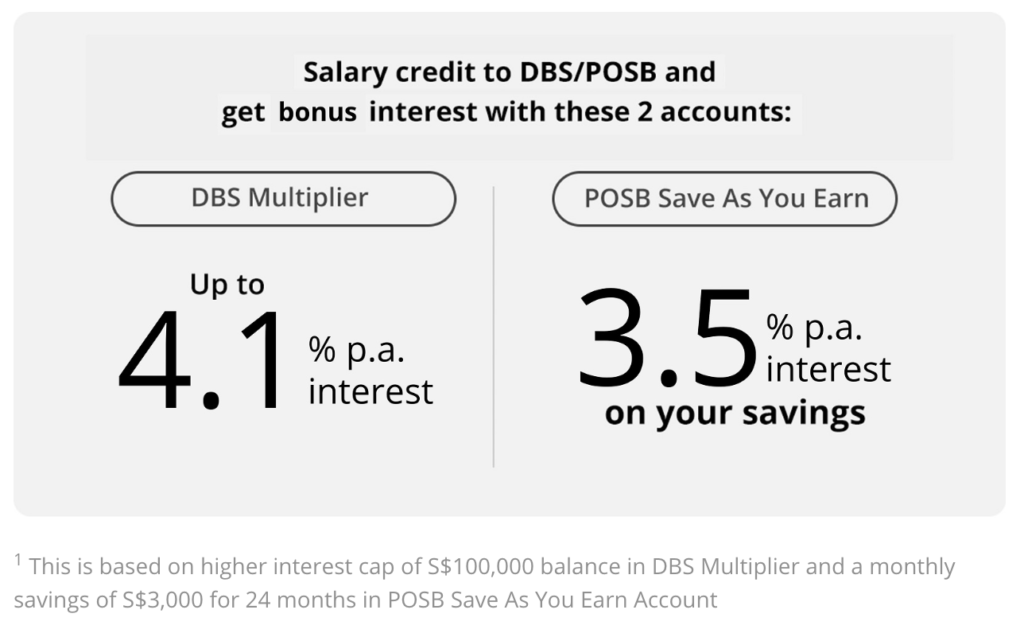

The 1.8% p.a. interest looks good on paper – until you realize that this lasts only for 3 months and that this drops back to the standard 0.05% p.a afterwards (since this is technically a DBS My Account). Contrast this to what you could be getting if you kept your funds in your DBS Multiplier and/or POSB SAYE account instead.

Lock up your funds for greater security but settle for a lower interest payout, or ignore the money lock feature entirely and stick to your existing DBS high yield savings account(s)? You’ll have to decide.

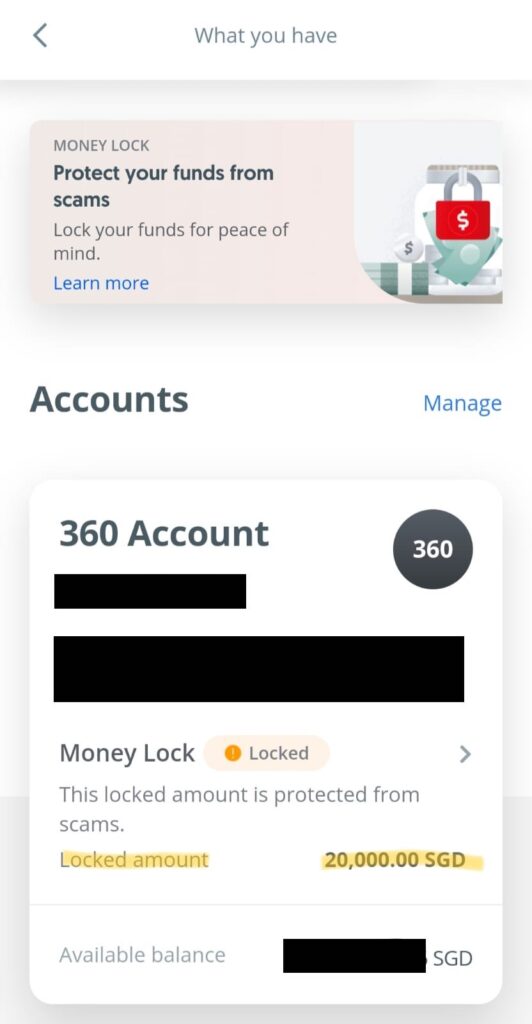

OCBC Money Lock

In contrast, OCBC customers have it much easier because you do not need to open a new bank account to use OCBC Money Lock, since the feature is available to all new and existing OCBC current and savings accounts. I simply tapped on the “Money Lock” on my OCBC app and my funds were locked up in under a minute.

Funds locked in the chosen account are aggregated with the funds that are not locked to calculate the interest to be earned. As a result, this means you will not miss out on the bonus interest earned on your account balances for performing everyday banking transactions, especially for those of us on the OCBC 360 Account!

| How to lock? | Tap on “Money Lock” and choose which account funds you wish to lock. |

| How to unlock? | At any physical OCBC ATMs (with your card) or bank branch. |

| How much interest do I earn? | The interest that you would otherwise earn on your OCBC account e.g. 2.80% on Bonus+ or up to 4.65% – 7.65% for OCBC 360. |

And if you urgently need your funds, unlocking is also a breeze as it can be done at any OCBC ATM simply by using your physical ATM debit or credit card, and your PIN. And if you’re overseas, you can submit a request via the Secured Mailbox in the OCBC Digital app or Internet Banking for a customer service representative to contact you instead.

UOB LockAway

Similar to DBS, you will need to open a new account – UOB LockAway – and transfer in your funds that you wish to lock up. Account opening can easily be done online or via the UOB TMRW app, whereas unlocking the funds requires you to go down to a UOB bank branch in-person with your NRIC or passport. UOB will not be issuing any debit card or ATM cards for UOB LockAway accounts.

| How to lock? | – Open a UOB LockAway account online or at their branch. – Transfer in your funds to be locked. |

| How to unlock? | You will need to visit a UOB branch in-person and verify your identity before you’ll be allowed to “unlock” your funds and transfer them back to your other bank accounts where they can be used. |

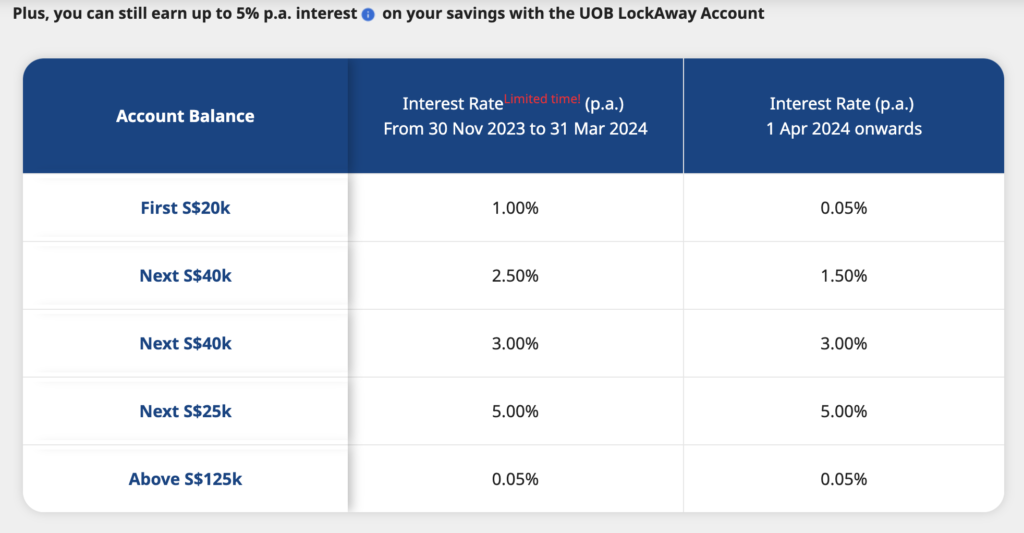

| How much interest do I earn? | 0.05% – 5% p.a. (tiered), depending on how much funds you lock. |

UOB advertises their rates as “up to 5% p.a.”, but that’s mostly boosted by the ongoing promotional interest rate, which ends on 31 March. Thereafter, your first $20,000 locked earns you only a mere 0.05% p.a. And even if you were to lock up a sizeable sum (more than $125k), the maximum Effective Interest Rate (EIR) on the LockAway Account is still only 2.45% p.a. for deposits of S$125,000 (from 1 April 2024 onwards):

The Budget Babe take:

Why should customers be made to choose between locked security vs. higher interest?

While I can understand that from a commercial standpoint, this might seem like an opportune moment for the banks to have an excuse to pay us lower interest rates in exchange for greater “locked” security…but that doesn’t mean I like it. It may be better for the banks, but less so for us consumers.

Since OCBC can pull it off, I really don’t see why DBS and UOB couldn’t do the same and allow customers to lock their funds while continuing to enjoy their bonus interest rates.

Why can’t DBS/POSB customers lock their funds and continue to earn the (higher) interest rate from their DBS Multiplier or POSB SAYE accounts? Why can’t UOB customers continue to earn their UOB One’s bonus interest of 3.85% – 7.8% p.a., while locking up their funds locked from scammers at the same time?

Must we really choose one over the other?

Personally, I refuse to settle for lower interest rates as a consumer – so it is probably a good thing I have all of the above-listed High Yield Savings Accounts, making it easy for me to lock my funds up with OCBC for the following reasons:

- It is super fuss-free (I really don’t want to have to manage and deal with yet another bank account)

- I can still enjoy my high interest on my OCBC 360 account.

- I can easily “unlock” my funds at any ATM without having to waste time queuing up in-person at a bank branch, if I needed to.

With the Monetary Authority of Singapore (MAS) now working with other major retail banks to introduce the money lock feature as well, I can only hope that the other banks will take a leaf out of OCBC’s books and roll it out in such a way so that their customers do not have to choose between maintaining their higher interest vs. locking up for greater security.

But if they don’t…well, at least there’s still OCBC we can use.

With love,

Budget Babe