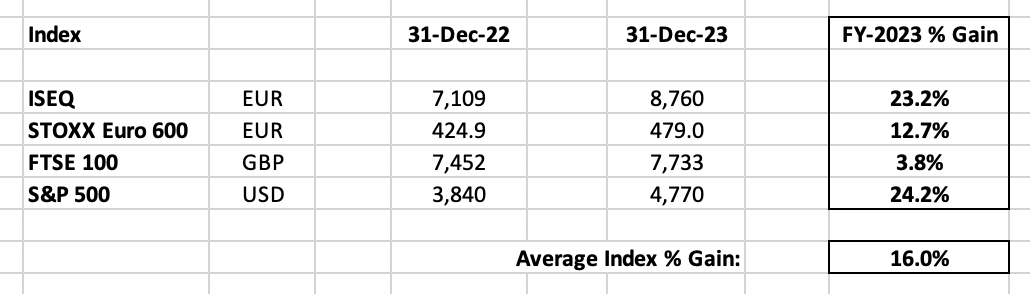

Well, 2023 obviously proved (once again) that nobody knows anything, so let’s skip the waffle & jump right in – my FY-2023 Benchmark Return is still a simple average of the four main indices that best represent my portfolio, which produced a benchmark +16.0% gain:

The respective index rankings for the year were actually pretty typical. The S&P 500 was the clear winner, obviously driven by the Magnificent Seven & a general recovery in technology stocks (from a bear market that stretched as far back as early-2021), as confirmed by a spectacular +44% gain in the Nasdaq. Both the ISEQ & the STOXX Euro 600 were led by the US, with the former enjoying a particularly excellent return, actually benefiting (perversely) from large-cap revaluations as they prepared to delist from the Irish market. Of course, the FTSE 100 was the perennial under-performer, while UK smaller companies didn’t look any better on average, with the FTSE 250 scraping out a +4.4% gain while the AIM All-Share somehow managed a further (8.2)% decline. [The Russell 2000 also under-performed, but still posted a very nice +15% gain in absolute terms]. Otherwise, going out the risk curve, the MSCI Emerging Markets USD Index enjoyed a +9.8% return, the MSCI Frontier Markets USD Index was up +11.6%, while crypto blew the lights with a +108% gain in total market cap (driven primarily by a +156% gain in Bitcoin).

Of course, the backdrop to all of this was the unexpected revival of a Goldilocks scenario for the US economy/market. The inevitable recession (for generally undefined reasons?!), as predicted by 9 out of 10 economists, never arrived…first they delayed it, and now even the economists seem to be giving up on it (it’s an election year, after all). Instead, we have robust US growth & full employment, while inflation spiked right down again to a reasonable 3.4%, and the market eagerly started anticipating Fed cuts in 2024. Which can all be summed up by the 10 Year UST round-tripping to end the year down a single basis point at 3.87%! Regardless, Biden continues to spend like a drunken sailor, still running $2-$3 trillion budget deficits, with the US national debt now surpassing $34 trillion. [Just to be non-partisan, both parties are fiscally incompetent today & both share the blame for the debt with only two Presidents running an actual (rounding error) budget surplus in the last century!]

But like I said, nobody knows anything…you really are better off ignoring macro 99% of the time, and devoting 99% of your time instead to your portfolio. The only macro ‘conspiracy theory’ I want to share is to again debunk the recent/ridiculous notion that Powell is somehow an inflation-busting incarnation of Volcker. I don’t think that’s true at all, I think he’s Biden’s whipping boy. Yes, the aggressive Fed hikes were obviously necessary to suppress the increasingly unpopular inflation spike, and to try offset some of Biden’s continued fiscal incontinence – the quid pro quo was that Biden wouldn’t question/fight higher rates – but this was also just a typical mid-cycle tactic of Presidents & politicians, and they bet on the inflation spike being a temporary post-COVID supply chain & welfare boondoggle/minimum wage hike phenomenon (& actually won the bet!).

So why does this matter…because now I think the Fed put is back! While lowering rates may prove risky, and will obviously be path-dependent, it’s clear from the rhetoric (& tactics) already ratcheting up that this is an all-or-nothing election year…and Powell stands ready to do whatever it takes. So the US is still place to be, but post-election I suspect there’ll be a compelling case to consider aggressively re-allocating & diversifying your portfolio risk/exposure, i.e. globally, and by (niche) sector/asset class. [Unfortunately, US investors will mostly ignore this strategy]. That’s my game plan…but as always, it’s a strong conviction loosely held.

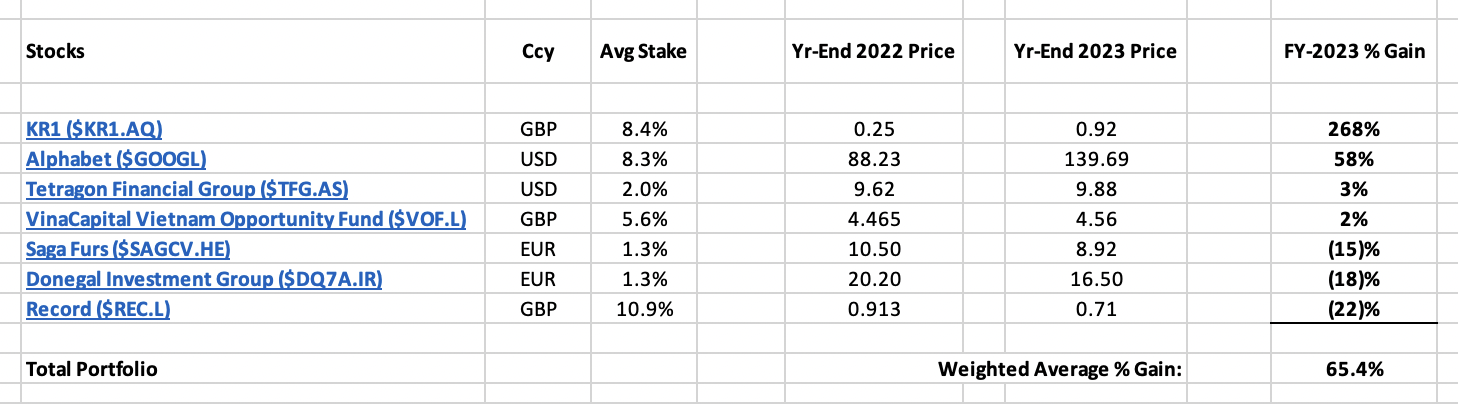

So let’s move on – here’s my own Wexboy FY-2023 Portfolio Performance, in terms of individual winners & losers:

[Gains based on average stake size (NB: NO actual changes in holdings, except for an imperceptible increase in TFG due to its DRIP) & end-2023 vs. end-2022 share prices. All dividends & FX gains/losses are excluded.]

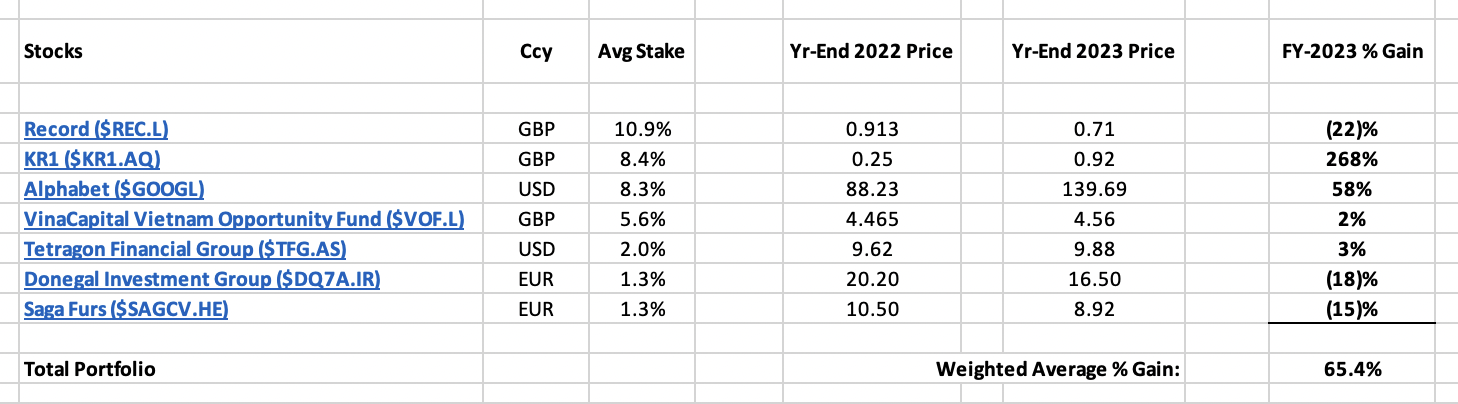

And ranked by size of individual portfolio holdings:

And again, merging the two together – in terms of individual portfolio return:

I’m delighted to report a fantastic overall +65.4% gain for my (disclosed) portfolio in 2023…it’s been quite the (roller-coaster) ride!

Of course, I must immediately cut off the usual reply/whatabout-guys, who’ll want to specifically exclude my KR1 gains here as some kind of lucky once-off (but obviously KR1 should be included in the bad years!), and focus instead on my 2022 losses & do their usual gotcha attempt at some fancy yoy/cumulative return math. But so what…every year, I continue to monitor & tweet about my portfolio, and do the same comprehensive year-end review as I always do, regardless of whether it was a good or bad year. And in so doing, I’ve now built up – and shared with any interested investor out there – a 12+ year public/real-time/auditable investment portfolio & track record, probably one of the only such (free) blogs left on the planet. I still await the reply-guy who’s done anything remotely like that!?

And as Bessembinder reminded us, this is the reality of most successful long-term track records & the overall market itself…most of your gains will actually come from a small minority of stocks, or even a single stock/two. This is something to (hopefully) be embraced – as I’ve said, the challenge isn’t finding potential multi-bagger stocks, the real challenge is figuring out how to actually hang on to them! [Which is frankly all about EQ, not IQ]. And that’s how I’ve hung on to a huge multi-bagger like KR1, and some other disclosed (& undisclosed) multi-baggers in my portfolio…by focusing on the quality & trajectory of the business itself, rather than its stock price, and having the conviction & the stomach to expect & actually endure some horrible & inevitable downside volatility along the way.

And that’s it, I think my contribution at this point is mostly the zen practice of doing almost nothing…and I hope 2023 is a perfect example, as most investors might intuitively presume a +65.4% annual gain would require frenetic trading & aggressive macro/sector calls, but in reality I did NO buys/sells in my disclosed portfolio, and precious little in the rest of my portfolio either. The (in-) frequency of my blog posts also now reflects this, plus the fact I diversify more & buy/average into more/smaller positions (a venture-capital approach) if I think they offer substantial upside potential (a small holding’s all you need, if it turns out to be a multi-bagger!). And I no longer watch any financial media (or talk to brokers, unless I have a specific request), as I can obviously gather all the news/data I need online (on my terms), I can tweet/interact in a controlled manner on Twitter, and I’m still always delighted to engage IRL instead with management & other investors, fund managers & family offices.

Of course, the proof is in the pudding, as is the conviction to do less & actually resign yourself to significant drawdowns in the belief superior long-term returns are the ultimate prize…and it’s all tracked here in detail on the blog, my three year portfolio return (again, excluding dividends) is now a +113% gain, while my five year return is a +284% gain.

With that, let’s move on to my portfolio:

FY-2023 (15)% Loss. Year-End 0.8% Portfolio Holding.

Another tough year…at least for Saga Furs’ share price. The business itself did great, chalking up its second-best results in the last five years. Not that investors actually noticed last year, despite the company’s periodic auction reports – a reminder how frustrating micro-cap value investing can be! It took a positive profit warning early this month to finally warm up sentiment…with FY results now released, the stock’s up +20% YTD, more than reversing last year’s decline.

FY-23 auction sales came in at €352 million, turnover at €47M & EPS at €1.39/share, with a proposed €0.66/share dividend due in the next few months. At €10.70/share, this leaves Saga trading on a 7.7 P/E & a prospective 6.2% yield. As always though, the absolute EPS doesn’t necessarily matter, it’s the multiple investors are willing to apply…which remains low, as long as investors see no clear revenue/earnings trajectory here. On the one hand, Saga’s on a cheap 6 P/E versus an average €1.77 EPS over the last three years – but on the other, it’s on an expensive 19.5 P/E vs. an average €0.55 EPS over the last five years. [Albeit, mitigated by a 0.4 P/B, vs. €25+ equity/share, which I believe is fully realizable]. Clearly, opinion remains divided here…

And meanwhile, the more obvious upside potential would come from a sale (say, to a PE/Asian buyer). Or a wind-down of the company, albeit there’s little sign of that…despite all the headlines, consumers have NOT rejected fur, and Saga actually sold 13 million pelts last year & an average 10M pelts pa over the last five years. But if it could string two good years together, that might prove a real inflection point. Investors can hope that Denmark’s national mink cull & Chinese farm capacity reductions during COVID continue to support pelt prices (unless China ramps back up). And if/when rival auction house Kopenhagen Fur is finally wound up – this was announced in late 2020, but auctions are still scheduled for 2024 – that could also add obvious scale & momentum to Saga Furs, as an effective global fur auction monopoly.

ii) Donegal Investment Group ($DQ7A.IR)

FY-2023 (18)% Loss. Year-End 0.8% Portfolio Holding.

A year of inactivity at Donegal Investment Group, with no fresh news re its last remaining seed potato division…hence, the steady share price decline, mostly from boredom (rather than actual selling, with precious little trading volume). Turnover did hit €30 million, the highest (by a small margin) in five years, but it’s the kind of business that gets sold based on average turnover & margins, plus the value of the R&D pipeline – so it’s all about finding the right buyer, sooner rather than later. But it’s two+ years now since management sold its penultimate Nomadic Dairy division, so this delay in a final sale/liquidation is obviously frustrating.

On the other hand, it’s been a fantastic long-term investment, and any deal delay is arguably mitigated by continued seed potato profitability. And this limbo hurts larger shareholders more: De facto CEO Ian Ireland, Chairman Geoffrey Vance & the rest of the board own an aggregate 6.4% stake (worth a multiple of their ongoing compensation), while Nick Furlong/Pageant Investments own a much larger 12.6% stake & obviously haven’t shied away from taking a more aggressive activist role in the past when required.

Donegal cash is now at €6.9 million, reflecting a final €3.3M contingent consideration for Nomadic Dairy, while sundry property & investments, seed potato profits & some further normalization of receivables should add another €1-2M+ net. Versus today’s €25M market cap, that’s a sub-€17M/0.6 P/S valuation for the seed potato division. Which is cheap…yes, operating profit was held back this year (to a 6% margin), but the division enjoys 7-10% operating margins in good years. And this includes full absorption of remaining HQ/listing/board expense, so the division’s underlying margin is much higher again, not to mention its pipeline of R&D spending/new varieties. All told, this would imply a significantly higher valuation in the hands of the right acquirer – arguably, somewhere between a 1.0 & 2.0 P/S multiple, bearing in mind Nomadic’s 1.8x sale multiple (for similar reasons). This offers attractive/event-driven upside potential for investors…and meanwhile, we apparently have a new floor at €16.50/share, with management recently resuming (small to date) open market share buybacks.

iii) Tetragon Financial Group ($TFG.AS)

FY-2023 +2.7% Gain. Year-End 1.6% Portfolio Holding.

We’re also stuck in a holding pattern with Tetragon – albeit, my actual return last year (including a 4.4% dividend yield) was a reasonable +7.3%, i.e. not far off TFG’s longer-term net +9-10% pa total returns. YTD NAV/share return (to end-Nov) has been weak at +1.8%, but let’s await the next factsheet (due Jan-31) which usually sees a nice bump (an average +8.7% gain in the last three years) from the TFG Asset Management year-end valuation process & crystallization of underlying incentive fees. Management’s maintained a $0.11 quarterly dividend & periodic tender offers (totaling $60 million last year), and have returned $1.6 billion+ to shareholders since the 2007 IPO. This looks far less impressive though, when you realize last year’s $0.1B total payout comes from a $2.8B balance sheet.

On the other hand, Tetragon’s evolved into a more compelling proposition – TFG Asset Management is a portfolio of 100%/majority-owned alternative asset managers (now at $42 billion AUM & continuing to enjoy a secular fund-raising tailwind), which now amounts to nearly 50% of total NAV. In fact, TFGAM’s now worth 160% of TFG’s current market cap (with a $1.5B investment portfolio thrown in for free!). As for its legacy governance/fee structure, it hasn’t stopped TFG producing net +9-10% pa NAV/share returns & I see no reason this can’t continue…so if the 66% NAV discount doesn’t close, investors can still hope to make the same returns, while if it does start closing (or gets eliminated) then shareholder IRRs potentially go exponential. Alas, prior/disgruntled shareholders can never seem to grasp this math…to the benefit of new investors.

The real problem here is management: Principals & employees own a 38% stake, but Reade Griffith is (by far) the dominant stakeholder, and he & Paddy Dear still own TFG’s external management contract. As with many owner-operators, the share price & valuation are pretty irrelevant ‘til they finally want to exit…meanwhile, they’re highly compensated to maintain/grow total NAV, with NO sign of an IPO or sale. Which appears to reflect them wanting to retain their external management contract, and/or stay on to manage the AUM, which doesn’t fly in an IPO/sale…so management’s literally the poison-pill here. This combo. of control & greed also leaves us with an alternative asset manager stapled to a $1.5B investment portfolio – it’s neither fish nor fowl & investors don’t want/value that combination highly (in response, listed asset managers have generally reduced their level of invested capital vs. AUM).

In fact, investors may not even want a portfolio of alternative asset managers (& I’d disagree strongly with this), judging by Tetragon’s closest peer – Goldman-backed Petershill Partners ($PHLL.L) which also trades on a wide 46% NAV discount. Consequently, a piecemeal sale of TFG’s asset management businesses & portfolio now seems the best route to realizing value, though God knows when this might happen. But management’s left a huge amount of money on the table here…and is missing out on an incredible opportunity to enhance value, as I believe TFG could easily raise $0.5 billion+ of liquidity in a month/two to fund a tender offer. Even at a premium, TFG could buy its own business/portfolio at 40 cts on the dollar – no other investments, new or old, remotely match that pay-off (regardless of what Paddy Dear claims on every investor call!).

But I have to admit, Tetragon’s portfolio is heating up…its 75% stake in infrastructure PE manager Equitix alone accounts for 87% of its current market cap, and it now looks like a compelling target (on a cheap valuation) in the wake of Blackstone’s Global Infrastructure Partners deal & General Atlantic’s acquisition of Actis in the last few weeks. Ripple preferred stock accounts for another 10% of TFG’s market cap…this has already been marked up 50%+ YTD in 2023 & could add some pixie-dust if this crypto rally goes exponential. In summary, nothing’s changed with TFG’s management & discount, but Equitix & Ripple may (finally) persuade me to consider adding to my current holding…

iv) VinaCapital Vietnam Opportunity Fund ($VOF.L)

FY-2023 +2.1% Gain. Year-End 4.6% Portfolio Holding.

It was a pretty normal year for the Vietnamese market…which is unusual, as it can flat-line for months & even years at a time & then explode higher (or lower!). [Same is true of VOF]. The VNI was up +12% last year – one of the best-performing markets in SE Asia – albeit, mitigated by a near-(3)% weakening in the dong (vs. the dollar). VinaCapital Vietnam Opportunity Fund again outperformed with a +17% total return (in dollar terms), aided by its share buyback programme (which retired 3.25% of o/s shares last year). Unfortunately, VOF itself only saw a +2.1% increase…inc. dividends, my total return was just +4.5%. However, this shortfall can mostly be attributed to ‘noise’, which tends to wash out over time, i.e. a 5%+ strengthening of the pound (vs. the dollar, note VOF’s priced/trades in sterling), and a 3% widening in the fund’s NAV discount (~18% as of year-end).

Big picture though, nothing’s changed: Vietnam’s an attractive economy/market to invest in, with a young/educated workforce that’s still cheap versus the rest of the world (& more importantly, vs. China), but is more than capable of moving up the value-add export curve. And the #NewChina investment thesis is as compelling as ever – Vietnam still enjoys an accelerated growth trajectory, it’s a primary market for Chinese outsourcing, and it has a strong & growing trade relationship with the US. It also presents little of the political risk investors face with China…in fact, continued US-China tensions may add a significant tailwind, with US re-allocation of sourcing to Vietnam & the back-channeling of Chinese production/exports via Vietnam.

Therefore, with emerging markets investment generally neglected & becoming more problematic (with China being a dominant component of the MSCI index), I continue to cherry-pick Vietnam as a best-in-class market…one that offers 6%+ GDP growth, average 3.3% inflation (last year), expected +10-15% earnings growth in 2024 (& a 0.70 PEG ratio), and a 30% public equity valuation discount vs. regional peers. [Here’s VinaCapital’s 2024 Vietnam Outlook]. I also consider VinaCapital to have the best long-term track record, while the multi-asset nature of the fund (public equity, private investment in public equity, OTC/pre-IPO stocks & real estate) is essential for what is still a frontier market. A 19% NAV discount today, some activist grumbling & the investment manager’s $23 million/2.6% stake in VOF are all persuasive too. Technically & fundamentally, I’m firmly convinced there’s a 100%-150%+ rally ahead of us here in the next few years…the VNI breaking free & clear of 1,200 would signal a decisive inflection point.

FY-2023 (22)% Loss. Year-End 6.7% Portfolio Holding.

Record was my most disappointing loss in 2023 – though fortunately, a monster 7.4% dividend yield reduced my total return to a (16.5)% loss – with the market reacting negatively to a transition year, amidst a highly impressive medium-term growth trajectory. This kicked off with a Capital Markets Teach-In, where the next generation of management was introduced. Founding Chairman Neil Record then announced his retirement (Jul-2023), followed by CEO Leslie Hill (end-March 2024) & then CFO Steve Cullen (Summer-2024). [To be replaced by Richard Heading – currently, Group Finance Director at £2.7 billion IG Group – who should bring valuable investor relations experience, and can hopefully attract a new institutional shareholder/two]. This will come as no surprise to existing shareholders, though the timing may have been accelerated in what’s proved a year of consolidation, after earnings more than doubled in the last two FYs.

This consolidation became more apparent in mid-2023, with a tough comp vs. a surge in FY-2023 performance fees (to £5.8M), and was reflected accordingly in the share price. Subsequently, this was acknowledged by management after disappointing interims, citing a lower level of performance fees & delays in regulatory approval (of its continued diversification into new fund products/launches). [NB: Performance fees (from active duration hedging) are actually more consistent now, but even in a blockbuster FY-23 they still only amounted to 13% of total revenue]. Again, this may have accelerated Hill’s retirement decision – the logic being the new CEO Jan Witte & team need to ‘own’ the medium-term targets she set after becoming CEO. But as I previously stressed, the only target that slipped is FY-25 timing – remember, REC’s FY-25 starts this April – Record remains confident of its £60M revenue/40% operating margin targets. And given the doubling in EPS to 5.81p/share in the last two FYs, and an implied EPS target of ~10p/share, I see no wavering in conviction of longer-term focused shareholders (like me) if delivery’s potentially delayed by a year/two here.

But on Friday, we got Record’s Q3 trading update…and it was a monster! AUME was up +18%/$15 billion in the quarter to a new $99.5B record high, driven by $7.9B of net inflows, while performance fees were at £3.5 million (that’s £5.0M YTD, just shy of last year’s £5.8M). That puts average AUME YTD at $89.5B, which will increase to $91.5B by end-Q4 (all else being equal), up +10% versus $83.1B last year…but since Record’s a UK business, so we need to focus on average sterling AUME which is homing in on £72.8B, up +6.5% vs. £68.4B last year (sterling’s stronger yoy). The consensus EPS drop this year (to sub-5.2p/share) now looks wildly off & matching last year’s 5.81p EPS is definitely back on the cards. And this Q3 momentum – which looks like it’s continued into Q4, along with an expected new infrastructure fund launch (& ideally a new crypto fund launch with Dair Capital) – is persuasive evidence Record’s revenue & operating profit targets are actually within reach. I leave it to the new CEO to set a new/revised target date, if he wishes.

Meanwhile, REC trades on a 12.3 P/E & an ex-cash 10.5 P/E. Which looks pretty damn cheap vs. its recent/prospective earnings trajectory – remember, over the last 3-5 years, Record’s AUME/net inflows, revenue/earnings & share price have all massively outperformed, against the back-drop of a vicious & unrelenting bear market in the UK-listed asset management sector. And it will continue to be an owner-operator business, with the new management team recruited internally/already steeped in the culture, while Leslie Hill & Neil Record will still own (& monitor) an aggregate 37%+ stake despite their respective retirements…albeit, this does raise the distinct possibility of an ultimate sale, or takeover approach!?

FY-2023 +58% Gain. Year-End 9.9% Portfolio Holding.

Wow, what a spectacular annual gain for a mega-cap like Alphabet! An obvious key driver was the inevitable recovery from a price-drives-narrative 2022 bear market (in the wake of a lower quality/tech stock bear market since early-2021), a great reminder to focus less on price & more on a company’s fundamental KPIs & trajectory if you ever hope to HODL it longer-term. And an essential warning to ignore the more grandiloquent #FinTwit accounts, who insisted Alphabet was a short & even a zero after ChatGPT’s Nov-2022 release!? In reality, and I think many misremember this now, $GOOGL actually bottomed (at sub-$85/share) almost a month BEFORE ChatGPT was released (as did $META), and rose slowly but steadily in the following months, before accelerating higher in Mar & Jun-2023. Even the infamous $100 billion+ dump in early-Feb, when Bard was demoed & it made a small factual flub (rather quaint, considering the hallucinations ChatGPT/LLMs are capable of!), is now barely discernible on the price chart.

But the more fundamental drivers of Alphabet’s gains last year were two-fold: Firstly, after a 2022 slowdown in the wake of a spectacular COVID-driven +75% gain in revenues (vs. 2019), plus a restructuring of the company’s expense/employee bloat, Alphabet began to steadily accelerate again from a Q1 +3%/+6% cc revenue gain to a +13% revenue gain in Q4. Second, it slowly became apparent to the average investor that Alphabet was NOT caught out/short re AI…which was obvious to longer-term shareholders, who were already very familiar with the same cautious/incremental approach to autonomous driving at Waymo. As Yann LeCun noted at the time: ‘If Google (& Meta) haven’t released ChatGPT-like things, it’s not because they can’t, it’s because they won’t!’. But all credit to Sundar Pichai – recognizing the investor disconnect, he cracked the whip & opened the floodgates, kicking off a string of products/events: Bard, PaLM, a merger of Google Brain & DeepMind, SGE, Assistant with Bard, Duet AI, Google Lens, Vertex AI, Gemini, etc. This makes Alphabet the obvious (software) AI play for me – as opposed to Nvidia, a hardware AI play – building on the foundations of Google Search (plus DeepMind), which I still consider was & is the best/most valuable AI on the planet. And now it’s becoming clear LLMs are relatively open-source & require huge investment & cloud/energy resources to really scale up, it’s Alphabet’s user-base that can & will cement its dominance…ie the real value lies in the application & exploitation of AI in users’ daily lives & companies’ daily operations, for which Alphabet is ideally suited with 15 products that already have 500 million+ users, and 6 of those now boasting 2 billion+ users!

Of course, there’s enormous value to be tapped elsewhere in Alphabet’s portfolio – Waymo’s opening more cities up for autonomous (taxi) vehicles, Ruth Porat will soon move from her CFO role to CIO of its Other Bets, and YouTube is still in Beast mode! In fact, it increasingly appears to be a two-horse race between YouTube & Netflix now – it has a new CEO Neal Mohan, it’s successfully bridged between streaming & a (less controversial) form of social media, its Shorts rollout has been spectacular (70 billion daily views, 2B+ signed-in users each month), it’s far bigger than Netflix (YouTube total revenues hit close to $40B a year ago, including $11B of subscription revenues which already amount to a third of Netflix’s revenues) & a better business model too (i.e. UGC, with a primarily contingent expense base). Of course, YouTube (& other divisions/investments) could potentially achieve much higher multiples spun-out, and Porat will map out a master-plan for that, but right now that’s a tailwind management can still comfortably wait to release/rely on in the future.

Meanwhile, $GOOGL is setting new all-time highs, but still trades on a 23 P/E. [I’m ignoring the Q4 after-hours (5.8)% decline right now, as its seems like an over-reaction to an overall beat & minor ad revenue miss]. And when I factor in its balance sheet cash/investments, the capitalization of Other Bets losses (in expectation of future/much larger payoffs), and its continuing investment in the core Google Search/YouTube businesses & Google DeepMind, Google Cloud, Waymo, etc., its underlying core multiple looks much the same to me today as it did in my original writeup. Taking that & its relentless compounding of revenue/earnings into account, plus the potential for further (AI-driven) revaluation, I remain highly confident in Alphabet as a Top 2 portfolio holding…and I eagerly await $200/share as a new target/milestone to re-evaluate its continued fundamental trajectory & new upside potential target(s).

FY-2023 +268% Gain. Year-End 23.8% Portfolio Holding.

Yes, the crypto-winter’s well & truly over…and it was a fantastic year for KR1 shareholders! Per my estimate, KR1’s NAV was up +179% to end the year at 110p/share, with the share price out-performing as its (absurd) NAV discount gradually narrowed from a 20-40% range to a 0-20% range. [Alas, it’s wider again this year, with negative sentiment unfairly spilling over from the most recent crypto-miner collapse]. Not that you’d know it from the team, who stuck to their knitting & avoided the media/investor relations spotlight, focusing instead on making nine new seed & follow-on investments, at a cost of $4 million. [Including two new DAO/early-stage VC fund investments, which helps spread their seed investment access/potential even wider]. KR1 now boasts 100+ investments over the last 7.5 years…obviously a uniquely diversified portfolio, versus the typical listed crypto stock/fund. During the year, KR1 also ticked off two more investor relations/corporate governance objectives: i) It extended the executive services agreement to late-2030 – a critical/valuable ‘lock-up’ of the core KR1 team for the exclusive benefit of shareholders, and ii) it finally starting publishing a monthly RNS (one month in arrears), detailing a precise NAV/share, its monthly staking income & its current Top 10 portfolio holdings – e.g. here’s the Nov NAV RNS, it’s a simple snapshot that also allows more engaged shareholders to quickly/easily track the NAV & portfolio on a real-time basis.

The big excitement for the team came end-Oct with Celestia‘s mainnet launch. [In fact, they’d highlighted Celestia in two separate paragraphs in the interims…which is actually them jumping & down with excitement, as long-term shareholders will know!] An original $75K seed investment in Strange Loop Labs – the legal entity behind Celestia – granted them 7.5 million TIA tokens, initially worth $17M & now worth $137 million just three months later. That’s an astonishing 1,800-bagger+ return in less than three years, amongst many other mega-multibaggers the team has scored to date. [Note these are locked up ‘til the first/second anniversary of mainnet…on the other hand, as Celestia becomes more valuable, we may also speculate how much additional value potentially still resides in KR1’s equity stake?!] Not to mention, the team could stake TIA immediately (at a 21%+ APR, now 16%+), so we saw a huge step-up in monthly staking income from £395K in Oct to £939K in Nov, and this income will be higher again in Dec & Jan as the $TIA price has continued to climb.

In fact, we’re now looking at a $28 million+ pa staking income run-rate. [And no, this isn’t some once-off bonanza – over the last three years, KR1 actually earned an average £16.5M pa in staking/parachain income!] And KR1 enjoys a 98% net margin on this income…and I mean actual net margin, not some absurd ‘adjusted’ margin crypto-miners cite to fool investors. I call it the ZERO investment thesis…since KR1 eschewed Bitcoin & proof-of-work from day one, focusing instead on proof-of-stake, it now boasts zero hardware, zero energy use, zero debt, zero dilution & zero capital required (not to mention a zero Isle of Man tax rate). Therefore, that 98% net margin is actual net profit, with no incremental G&A, hardware/energy costs, interest, or taxes. [NB: This income may incur a 20% performance bonus, since NAV surpassed its prior high-water-mark earlier this month, but only if it’s crystallized at end-2024 (dependent on the overall portfolio)].

Of course, the long-standing complaint here is the silence/lack of obvious progress re an up-listing to the LSE/AIM, plus the continued absence of a consistent professional investor relations function. Alas, a common complaint with owner-operators – the team own 25%+ of KR1 (& don’t require fresh capital), so the share price/valuation is pretty irrelevant ‘til they finally seek an exit, plus they tend to believe they should ‘focus on the business & the share price will take care of itself’. Which is absolutely true: Because as of year-end, KR1’s NAV/share & share price have BOTH compounded at an extraordinary +98% pa since Jul-2016 (that’s +16,327% vs. +16,040% to date!), so clearly its Aquis listing has proved NO impediment, and once again we’re reminded (per Charlie Munger!) that a compounder’s share price return will inevitably converge with its actual return on capital.

That being said, there’s LOTS of money being left on the table here – e.g. $RIOT, $MARA & $BRPHF trade on a much higher average 2.6 P/B, despite mediocre long-term shareholder returns – and the KR1 team hurt themselves the most (arguably leaving $70 million+ on the table personally!). The IR function can be easily solved with a team hire, on a reasonable salary & variable bonus tied to share price/valuation – that’s the quid pro quo shareholders generally expect from a $0.2 billion company, and in return for team bonuses to date & today’s compensation structure. As for an up-listing, noting its incredible success on Aquis, maybe the London Stock Exchange should be marketing KR1 re a (dual) listing at this point?! And noting the SEC’s finally approved US Bitcoin ETFS, plus the UK PM/government’s pro-crypto stance, we need a more positive & proactive stance from the FCA too. Obviously, KR1’s been incredibly successful to date, it deserves to be championed as an investor in UK (& European) crypto start-ups, and a far larger pool of investors should have quick & easy access to buy its shares.

As always, I recommend any investor should now consider a 3-5% crypto allocation in their portfolio, ideally via KR1’s unique diversified portfolio & track record…in particular, UK investors who have NO other viable UK peer stocks to consider investing in (& they can’t buy the new US Bitcoin ETFs either). So again, I urge all shareholders to contact/keep in touch with the team to push for an up-listing & a professional IR function. Meanwhile, KR1 trades on a 0.63 P/B & a 6.6 P/E, and I believe it can & will continue to compound value for shareholders & should trade on a multiple of its current valuation…especially now, when AI is digital abundance, crypto is digital scarcity, and the world needs both.