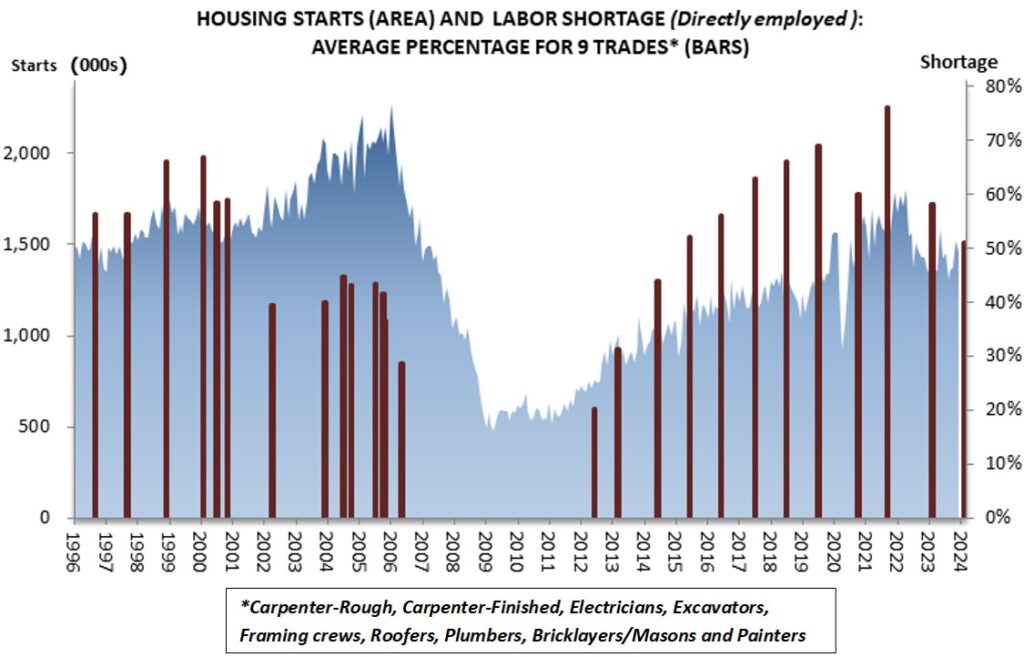

With home building volumes lower, labor shortages have eased considerably since record levels set in 2021 but remain relatively widespread in a historic context, according to results from the latest NAHB/Well Fargo Housing Market Index (HMI) survey.

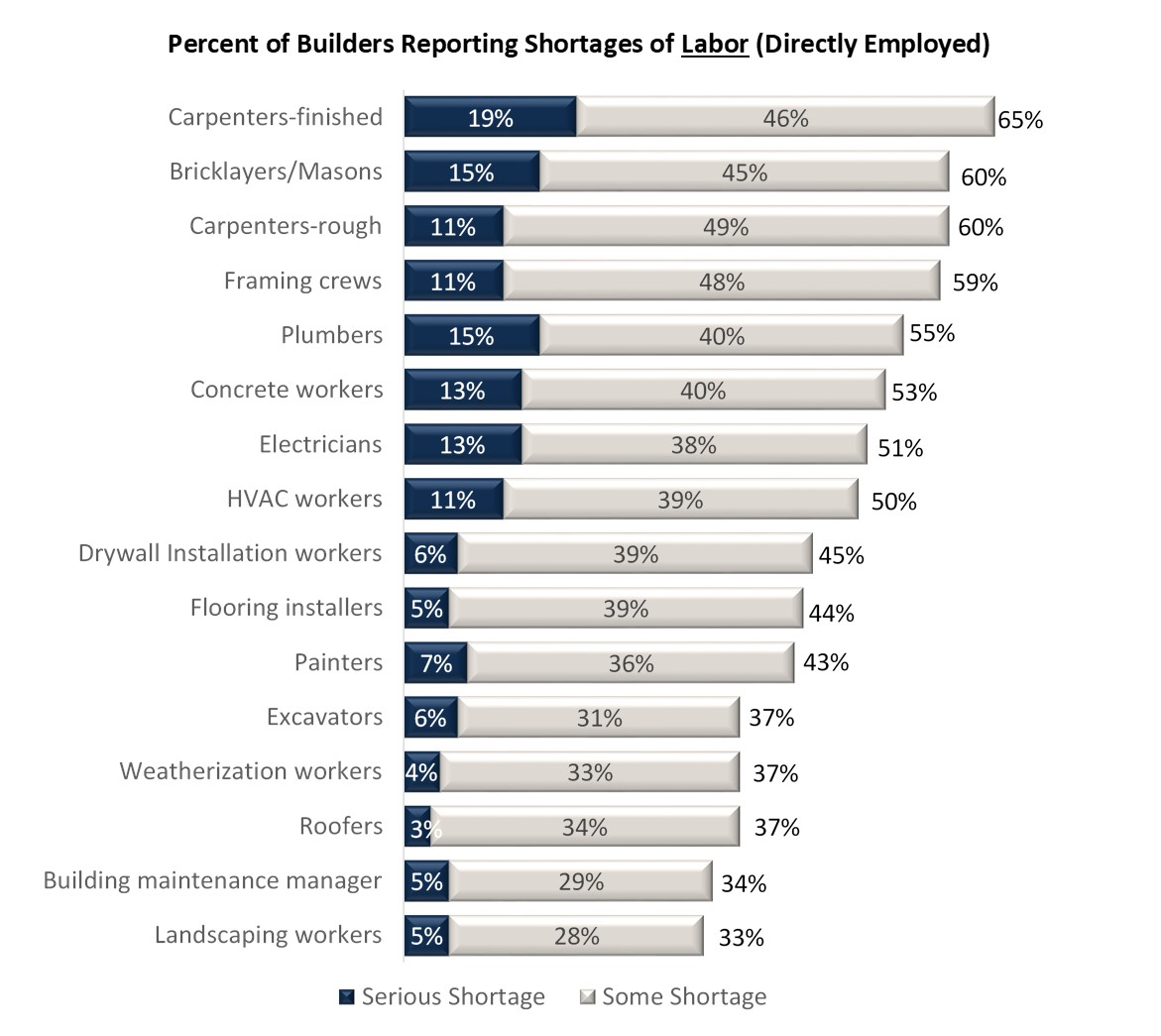

The February 2024 HMI survey asked builders about shortages in 16 specific trades. The percentage of builders reporting a shortage (either some or serious) of labor they employ directly ranged from a low of 33% for landscape workers to a high of 65% for those performing finished carpentry.

The finished carpentry shortage was down from 72% in 2023 and an all-time high of 85% in 2021 but remains higher than it was at any time during the 2004-2006 housing boom (when it reached a temporary peak of 58% in July 2005). Most of the labor shortage percentages in the above figure follow a similar historic pattern.

In the typical case, most of the physical work required to build a home is performed not by laborers employed directly by the builders, but by subcontractors. As a 2020 NAHB study showed, builders on average use two dozen different subcontractors and subcontract out 84% of their total construction costs to build a single-family home.

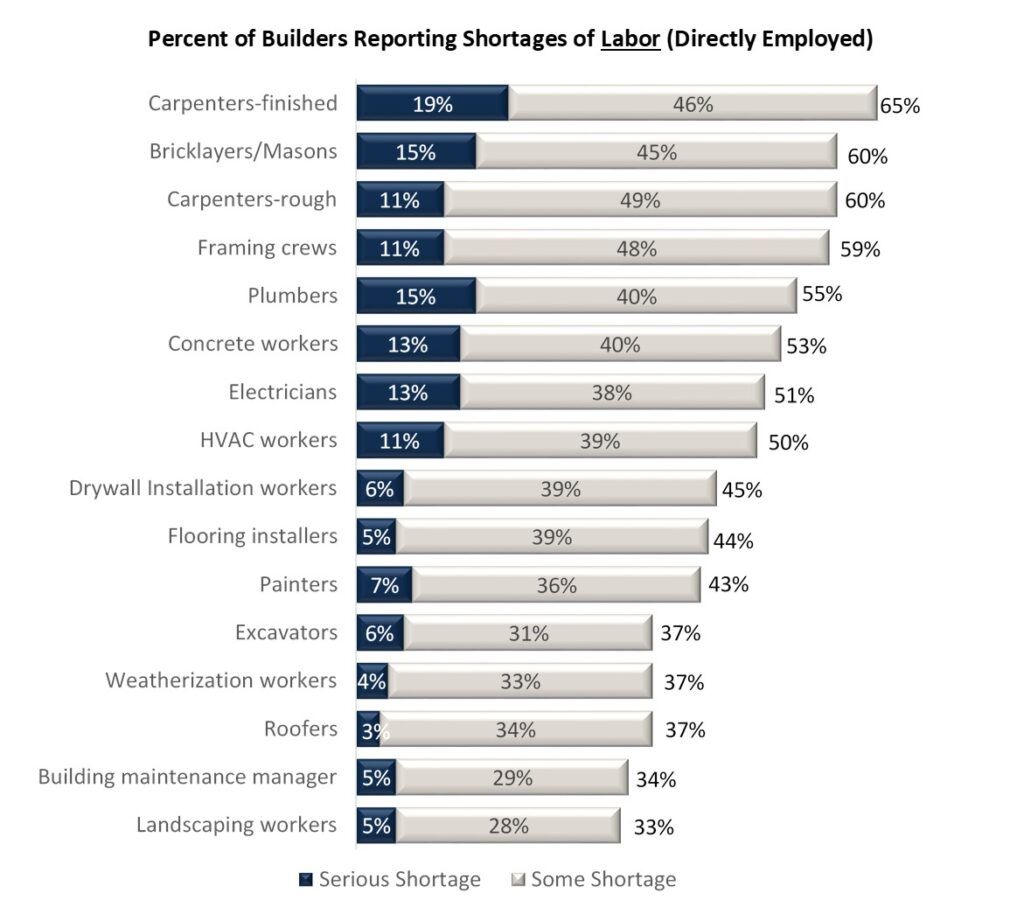

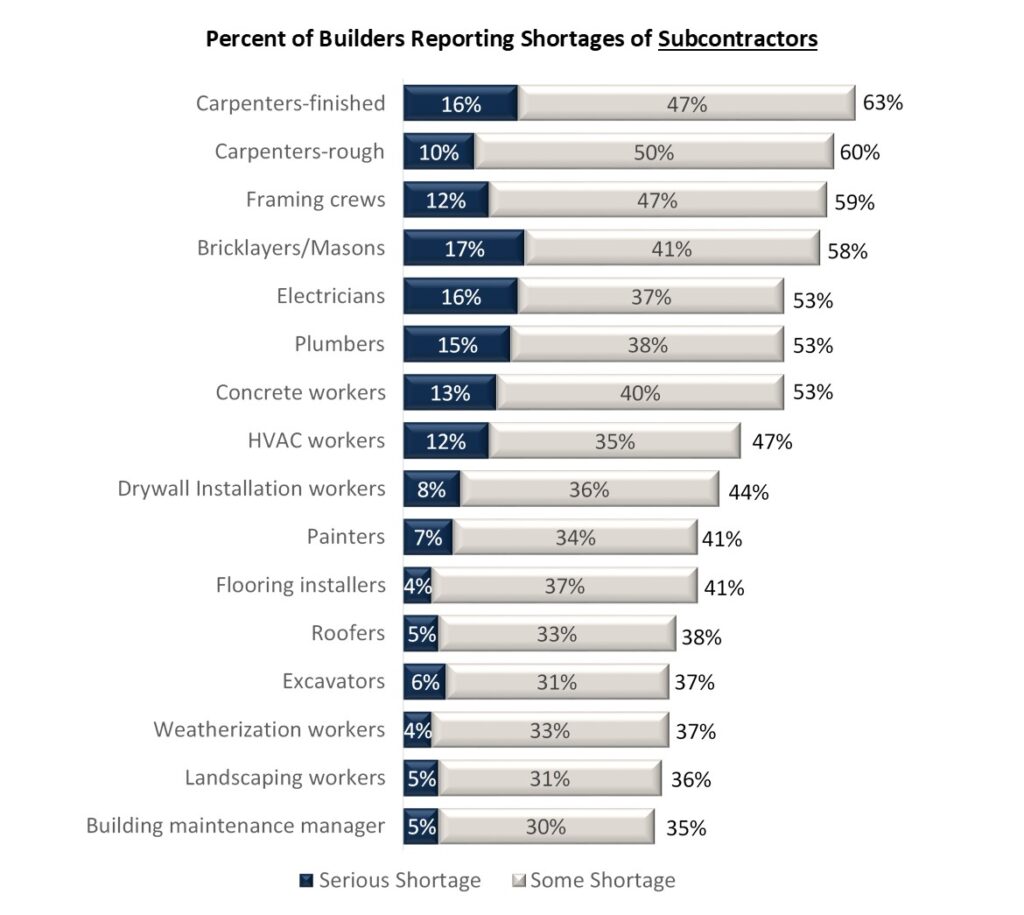

The February 2024 HMI survey also collected information about shortages of subcontractors. The percentage of builders reporting a shortage of subcontractors ranged from 35% for building maintenance managers to 63% for finished carpenters.

For all 16 trades, the shortage percentages for subcontractors and labor directly employed were fairly similar. Averaged over the nine trades that NAHB has covered in a consistent way since the 1990s (carpenter-rough, carpenter-finished, electricians, excavators, framing crews, roofers, plumbers, bricklayers/masons, and painters), the share of builders reporting shortages in February 2024 was 52% for labor directly employed and 51% for subcontractors.

The two numbers have not always been this close. After 2012, as housing markets started to recover from the Great Recession, a 5- to 7-point gap opened up between the 9-trade average shortage of subcontractors and labor directly employed by builders, with the subcontractor shortages being consistently more widespread. NAHB’s analysis at the time indicated that workers who were laid off and started their own trade contracting businesses during the Great Recession started returning to work for larger companies—improving the availability of workers directly employed by builders while shrinking the pool of available subcontractors. After persisting for a decade, the subcontractor-direct labor gap finally narrowed in 2023 and disappeared entirely in 2024.

The current 9-trade average shortage of 52% for labor directly employed is down from 58% in 2023 and a record-high 77% in 2021 but remains elevated in historical perspective—especially when considered relative to housing starts.

During the boom period of 2004-2006, total housing starts were consistently over 1.8 million annually—as high as 2.0 million in 2005. Despite this high rate of construction, the 9-trade shortage percentage never exceeded 45% during the boom. In comparison, the current shortage percentage of 52% occurred against a backdrop of 1.4 million starts in 2023 and an annual rate of 1.3 million recorded so far in January of 2024.