With so many different types of critical illness (CI) insurance plans, how does one go about choosing?

We eventually reach a stage of life where we realise that when critical illness strikes, it doesn’t really care about your family history, how many dependents you have to support, or whether you’ve been eating clean and exercising regularly.

Learning from the experience of friends around me, I soon learned that the ones with the right CI protection plans had a much easier route to recovery since they didn’t have to worry about the financial stress. But for the ones who failed to get their CI protection in time, they had to bear the costs – and as such, stopping work was no longer an option.

Background

In the past, settling one’s critical illness insurance was a much simpler affair – we only had to decide whether we wanted the coverage to be tagged to our whole life plan or as a standalone CI term policy. But as medical diagnostics advanced and allowed for more critical illnesses to be identified at an earlier stage – together with a higher survival rate – it changed the insurance scene as well.

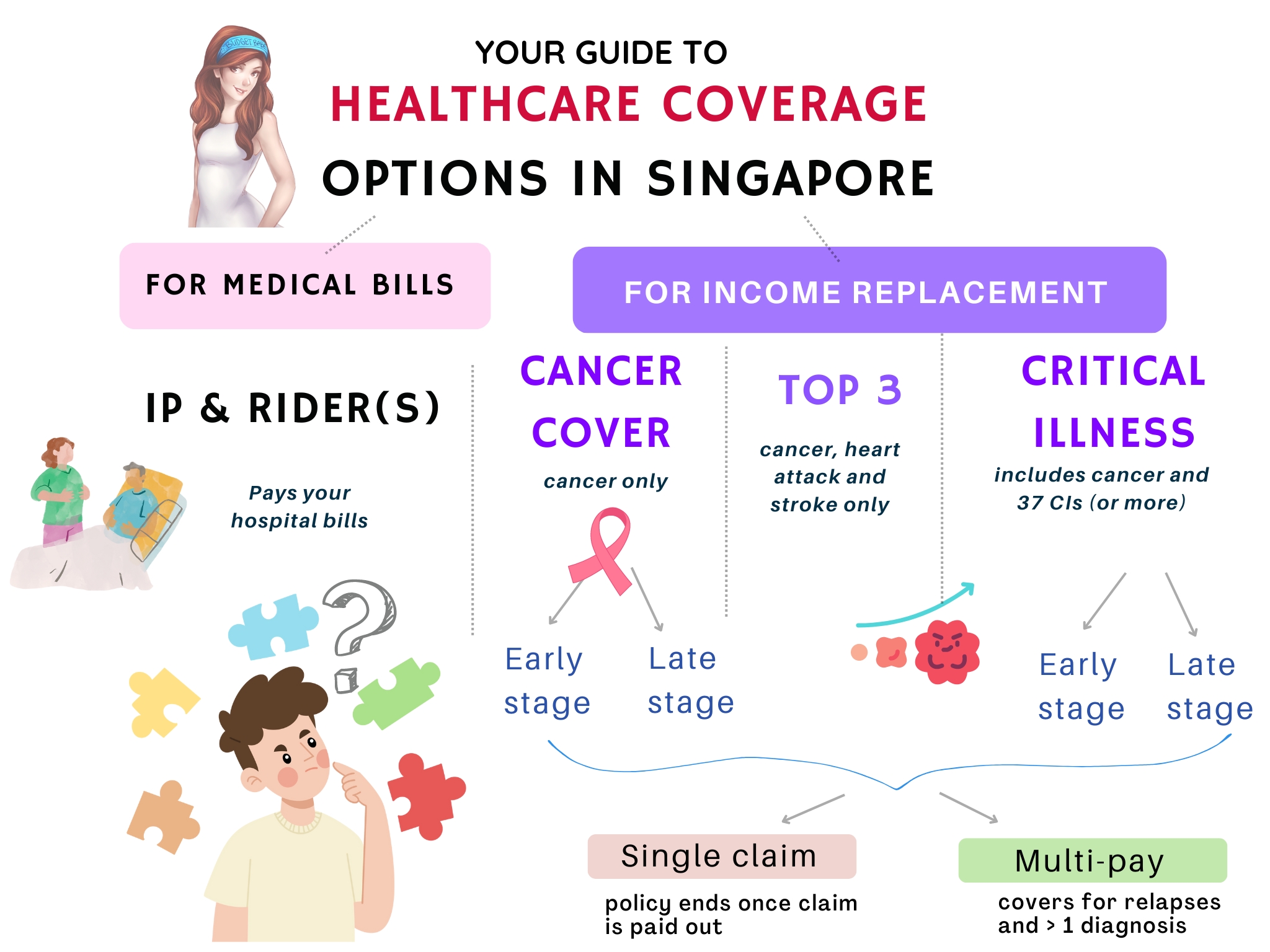

Consumers can now choose from the following options when it comes to getting critical illness coverage:

The problem is, with too many choices, many people also end up not knowing which to pick.

If you’re feeling lost by now, don’t worry – you’re not the only one.

The different types of CI coverage today

To simplify things, I’ve summarised the various types of CI insurance plans in the market today:

The cost of healthcare medical treatments for critical illnesses could get covered by your Integrated Shield Plan (IP) (including MediShield Life) and riders that help reduce the cash amount you need to pay.

Depending on the severity of your condition, most people either take time off work to recuperate, or they leave the job / retrenched due to long periods of absence. The problem is, our mortgage and other bills (e.g. living expenses for your elderly parents, children school fees, etc) still need to be paid for even if you get hospitalised! Even if you were to stop your job temporarily and redirect your physical energy towards a quicker recovery, you still need a source of income to pay for the non-medical bills. Your Integrated Shield Plan (IP) and riders will not cover that.

That’s where insurance policies that provide lump sum cash payouts can come in handy.

In the event of a critical illness claim, you can use the payouts from your critical illness insurance, top 3 CI plan, or your comprehensive CI policy to help pay for these other non-medical bills, as well as any outpatient treatment medical costs (that are ineligible for claims under your Integrated Shield plan).

And unlike your IP policy (you can only hold and claim from 1 Integrated Shield plan), you can claim from all your CI policies upon the diagnosis of CI.

Just note that this is subject to the overall claim limits and the CI definition in your policy contract. Terms and conditions apply, where applicable.

How to pick the right CI plan?

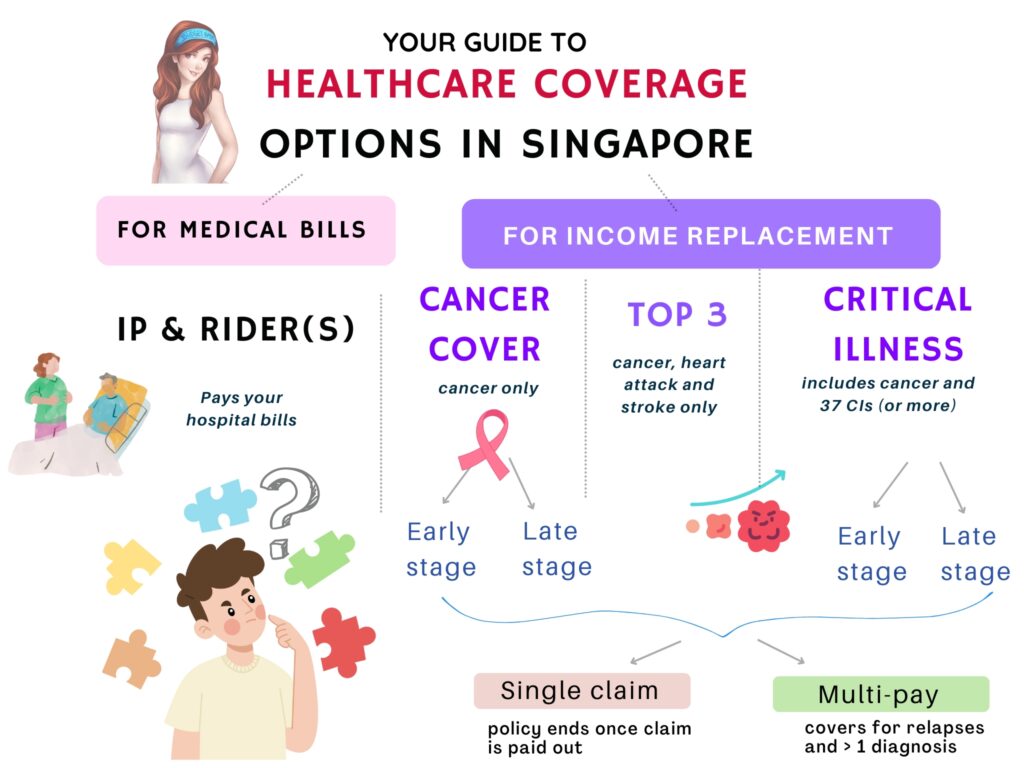

The most ideal critical illness insurance, in my view, would be one with the following features:

- No exclusions – all conditions (including pre-existing) are covered.

- No need to pay higher premiums even if you have a pre-existing condition (idealistic, but not always feasible in the modern world)

- Lifetime coverage – up till age 100, or until we die.

- Have cash value if no claims are made – some folks prefer a plan with cash value such as a life plan because they don’t like the idea that they “paid for nothing” when they made no claims.

- Multiple claims allowed – to cover for relapses, or any other subsequent diagnosis

- Highest coverage amount to cover even any unexpected future needs

Unfortunately, we live in the real world where money is a real consideration, if not the most important factor that determines what and how much coverage we can get.

“As such, you need to manage your expectations together with your budget.”

Budget Babe

While you never want to be in a position where your cost of insurance is so high that it hinders your quality of life in other areas, you also want to avoid being in a situation where you’re under-covered financially and unable to pay for your healthcare bills.

Tip 1: If budget is your biggest limiting factor, go for a term plan rather than a whole life policy.

A whole life plan with critical illness coverage costs significantly more upfront to secure your coverage for life, especially if the plan often offers cash value or premiums refunds in the future.

Term plans, on the other hand, are payable every year to maintain your coverage, but generally do not offer any cash value at the end of the policy term.

The cost difference is usually 4-digit (whole life) vs. 3-digit (term) in premiums, which of course also varies and depends on your age, gender and lifestyle i.e. smoker or non-smoker.

Tip 2: Get a comprehensive CI policy before your health changes.

Ideally, you’d want to secure your financial protection against as many critical illness conditions while you are still healthy and eligible for coverage. A good foundational plan to cover your bases first would thus be a comprehensive CI policy which:

- covers you for 37 CIs (or more),

- pays out even at early-stage diagnosis of some illnesses, and

- comes with the option for multiple claims (in the event of relapse or future CIs).

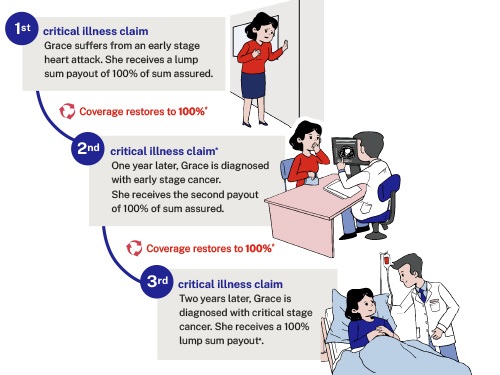

For example, a plan like GREAT Critical Cover: Complete with Protect Me Again rider ticks all of these above criteria right now. With a 100% lump-sum payout upon the diagnosis of CI at any stage(s) for each claim, and up to 3 claims, it covers 53 different CIs – more than the usual 37.

But what if you cannot afford a comprehensive CI plan?

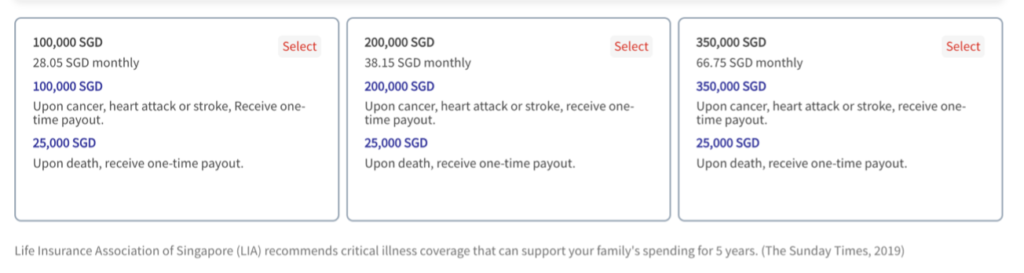

Tip 3: Cheaper options exist for covering the top 3 CI only.

Thankfully, you now have an option for getting coverage for the top 3 CIs as well. These did not exist a decade ago when I was a fresh-faced working adult buying insurance!

While covering for only 3 critical illness types may not sound ideal, the fact is that 90% of CI claims are for these conditions.

So, if you want to insure yourself against the conditions with statistically highest odds, then consider a plan that covers for at least cancer. Even better would be a plan that covers for cancer, heart attack and stroke.

Such plans can be used for basic protection or supplementary coverage, especially if you feel your current coverage levels are insufficient to cope against the rising costs of chronic illness and living expenses. In that case, you can consider having critical illness/cancer insurance to help plug the gap.

If you’re worried about the costs of cancer, check out GREAT Cancer Guard which can protect you – up to age 85 – across all stages of cancer. The best part? Your premiums do not change with age^, so you don’t have to worry about paying more to maintain your coverage as you get older. P.S. GREAT Cancer Guard comes with 5 types of plans for you to choose your coverage amount till age 85 (next birthday).

Tip 4: How much coverage amount should I get?

“With rising medical costs and cost of living, we can only make best-guess estimates for what we think we will need in the future.”

Budget Babe

Right now, most plans allow you to choose from as little as S$50k. LIA recommends for critical illness protection of ~4 times of one’s annual income, but of course, some patients may be able to recover faster and resume work earlier. Ultimately, how long it takes will also depend on your physical health, how well your body responds to the drugs and treatments, as well as the severity of your medical condition.

If 4X of your annual income translates into hefty insurance premiums that you cannot pay for, then let your affordability determine which level to go for.

Tip 5: Consider if you need a multi-claim policy.

When I asked my friends who survived cancer on what their biggest fear was, most of them said they were worried about a relapse and not having enough money for it. Remember, multi-claim policies did not exist as an option prior to the period before the 2010s.

What’s more, new data has emerged to show some cancer types have a higher recurrence rate e.g. ovarian cancer recurs in 85% of patients, while half of those with bladder cancer develop recurrence after cystectomy.

After seeing several of my friends suffer from a relapse, I’m starting to see the appeal of having a multi-claim / multi-pay policy. However, multi-claim plans naturally cost more than their single-claim counterparts, so you have to factor this into your budget.

For example, plans like GREAT Critical Cover Series offer the option to add a Protect Me Again rider, which then insures you against recurrence risk (of being diagnosed with another critical illness) so that you remain insured even after a diagnosis, for up to two critical illness episodes after your first claim.

Conclusion

As you can see, getting covered for critical illness is no longer a simple affair. With all the different types of options available today, it can become quite perplexing to choose.

However, one thing remains the same: the more comprehensive your coverage, the more you will have to pay for insurance premiums.

Which is why the best insurance policy for you and your family is the one that you can afford and covers your needs accordingly.

To figure this out, you can use the guiding questions below to help you:

- What are the different types of CI coverage I can choose from today?

- What are my financial responsibilities?

- How much budget do I have?

- Can I afford to pay for a comprehensive critical illness policy which covers at least 37 (or more) critical illnesses?

- If not, can I at least afford to insure myself against the statistically highest odds of cancer, heart attack and stroke?

- Or even just cancer alone?

If you already have existing CI coverage, then you can ask yourself these questions instead:

- How much CI coverage do I currently have?

- Does my (older) insurance plan cover me against early-stage CI claims, or is it limited to late-stage claims only?

- Do I need to add on a multi-claim policy?

- Are there any protection gaps in my portfolio now where standalone cancer or top 3 CI plans might be able to fill?

Getting yourself protected against the costs of critical illness does not always have to be expensive.

Check out Great Eastern’s range of plans, including standalone plans for CI and cancer:

| Critical illness | Cancer protection | ||

| GREAT Critical Cover: Complete | GREAT Critical Cover: Top 3 CIs | GREAT Cancer Guard | |

| Number of CIs covered | 53 | 3 (cancer, heart attack, stroke) | 1 (cancer) |

| Type of coverage | All stages | All stages | All stages |

| Sum Assured | 50K – 350K | 50K – 350K | 50K – 300K |

| Payout | 100% lump sum | 100% lump sum | 100% lump sum |

| Number of claims allowed? | Up to 3 times, 100% lump sum per claim (with Protect Me Again rider) | Up to 3 times, 100% lump sum per claim (with Protect Me Again rider) | 1 time, 100% payout |

| Death benefit | 25K | 25K | Nil |

| Entry Age (Age Next Birthday) | 1 – 60 for Policy Term up to age 85; 1 – 55 for Policy Term up to age 65; | 1 – 60 | 17 – 55 |

| Policy term (up to, Age Next Birthday) | 65 or 85 | 85 | 85 |

| Premium structure | Does not increase with age^ (level) | Yearly increase | Does not increase with age^ (level) |

| Underwriting needed? | Full underwriting | 3 Health Questions | 3 Health Questions |

| Where to buy? | Via Great Eastern Financial Representatives only | Online or via Great Eastern & OCBC Financial Representatives | Online or via Great Eastern & OCBC Financial Representatives |

They also have some current promotions which you can use to help you save more on your cost of insurance:

Disclosure: This post is a sponsored collaboration with The Great Eastern Life Assurance Company Limited ("Great Eastern"). All opinions are that of my own, and information accurate as of March 2024.

^For GREAT Critical Cover: Complete and GREAT Cancer Guard: The premium amount is determined at the age of entry and does not increase with your age. For GREAT Cancer Guard, the premiums are inclusive of and subject to prevailing GST. Premium rates of GREAT Critical Cover: Complete, GREAT Critical Cover: Top 3 CIs and GREAT Cancer Guard are not guaranteed and may be adjusted based on future experience of the plan. Adjusted rates, if any, will be advised prior to policy renewals. As these products have no savings or investment feature, there is no cash value if the policy ends or is terminated prematurely. This is only product information provided by Great Eastern. The information presented is for general information only and does not have regard to the specific investment objectives, financial situation or particular needs of any particular person. You may wish to seek advice from a qualified adviser before buying the product. If you choose not to seek advice from a qualified adviser, you should consider whether the product is suitable for you. Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs. If you decide that the policy is not suitable after purchasing the policy, you may terminate the policy in accordance with the free-look provision, if any, and the insurer may recover from you any expense incurred by the insurer in underwriting the policy. Protected up to specified limits by SDIC. This advertisement has not been reviewed by the Monetary Authority of Singapore. Information correct as at 6 March 2024.