One way financial advisors can add value for retiring clients is to estimate how much they can spend sustainably during their retirement years without depleting their investment portfolio. Advisors in this position have several options to help them determine a client’s initial spending level, from ‘static’ approaches like the 4% Rule to more dynamic approaches that allow for higher initial withdrawal rates (but introduce the possibility of spending cuts during retirement).

One method introduced by Jonathan Guyton and William Klinger in 2006 is the “guardrails” framework. With this approach, an initial portfolio withdrawal rate is selected and, if market returns are strong (and the withdrawal rate falls 20% lower than the initial rate), dollar withdrawals are increased by 10% (providing more income than would a static withdrawal approach). On the other hand, in a time of weak market returns (that resulted in the withdrawal rate rising 20% higher than the initial rate), dollar withdrawals would be reduced by 10% (to avoid exhausting the portfolio). Compared to static withdrawal strategies, this approach not only provides an explicit plan for adjustments to keep retirees from spending too much or too little, but also gives retired clients an idea of what spending changes they would need to make if a market downturn were to occur.

Nonetheless, Guyton-Klinger guardrails have several serious shortcomings. For instance, this strategy assumes that retirees will target steady withdrawals throughout retirement, whereas portfolio income needs often vary over time (e.g., to cover retirement income needs before claiming Social Security benefits). Perhaps more importantly, this method can result in sharp reductions in retirement income that would be unfeasible for some retirees. Additionally, these income reductions tend to overcorrect for market losses, meaning that far more capital is often preserved than necessary at the cost of severe reductions in the retiree’s standard of living.

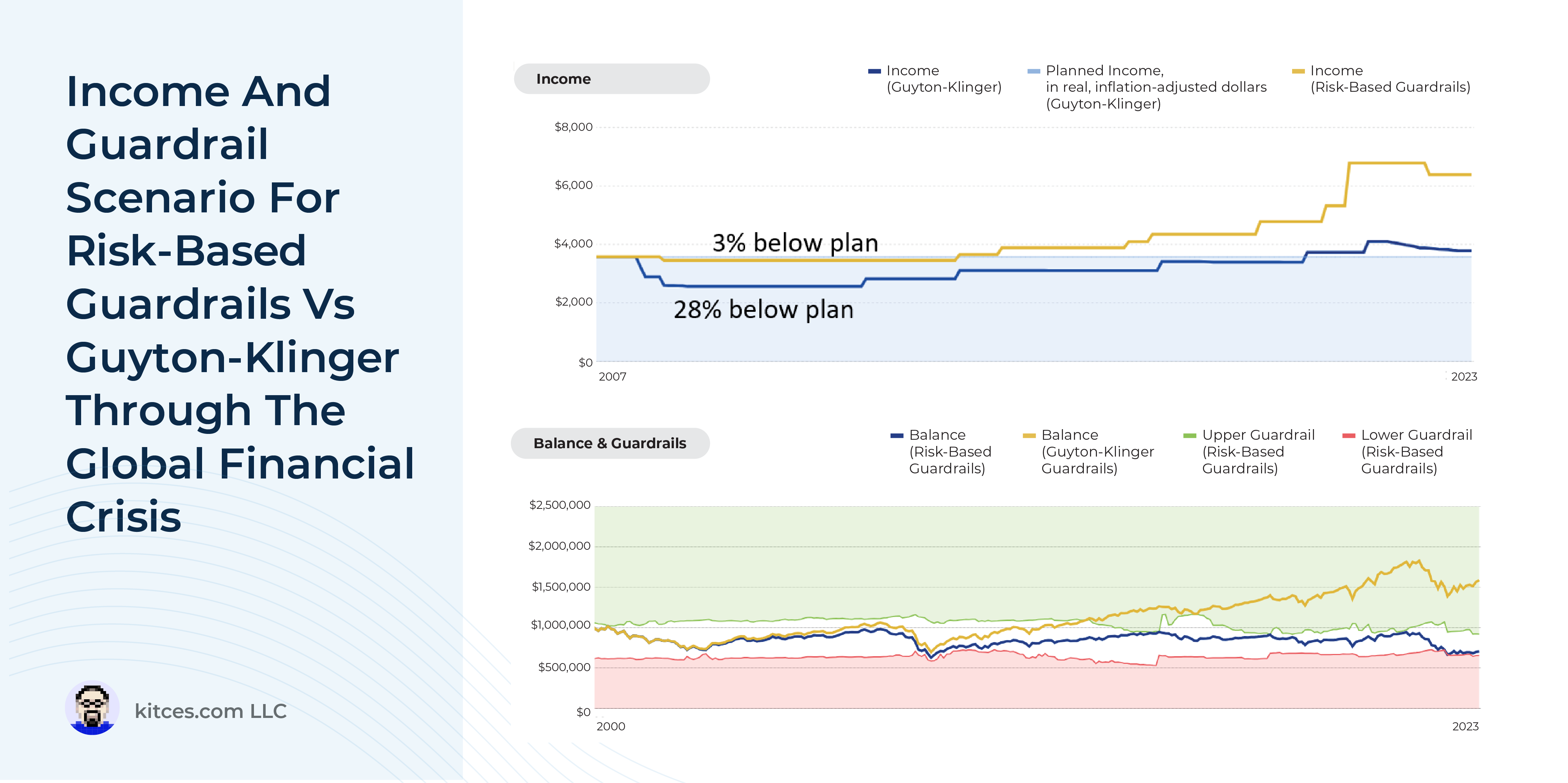

As an alternative to the Guyton-Klinger guardrails approach, a risk-based guardrails strategy that relies on a financial plan’s probability of success, as determined through Monte Carlo simulations, can be used to determine the initial dollar withdrawals and the need for (and magnitude of) upward or downward adjustments. An examination of how a retirement portfolio would have performed using this method reveals that much smaller income reductions would have been required, relative to the classic guardrails system, to prevent exhausting the client’s portfolio. For instance, those retiring just before the Global Financial Crisis would have only seen a 3% income reduction from the initial withdrawal rate using risk-based guardrails, compared to 28% for the classic Guyton-Klinger guardrails approach, and those retiring before the Stagflation Era would have experienced a (still painful) 32% reduction, compared to 54% for the original approach!

Ultimately, the key point is that while Guyton-Klinger guardrails have offered a simple yet innovative framework to introduce dynamic spending adjustments during retirement, a future market downturn could leave clients (and potentially their advisors!) surprised at the depth of spending cuts called for by this approach. Instead, implementing a risk-based guardrails system can help mitigate the need for and size of downward spending adjustments while ensuring that a retiree’s portfolio supports their lifetime spending needs!