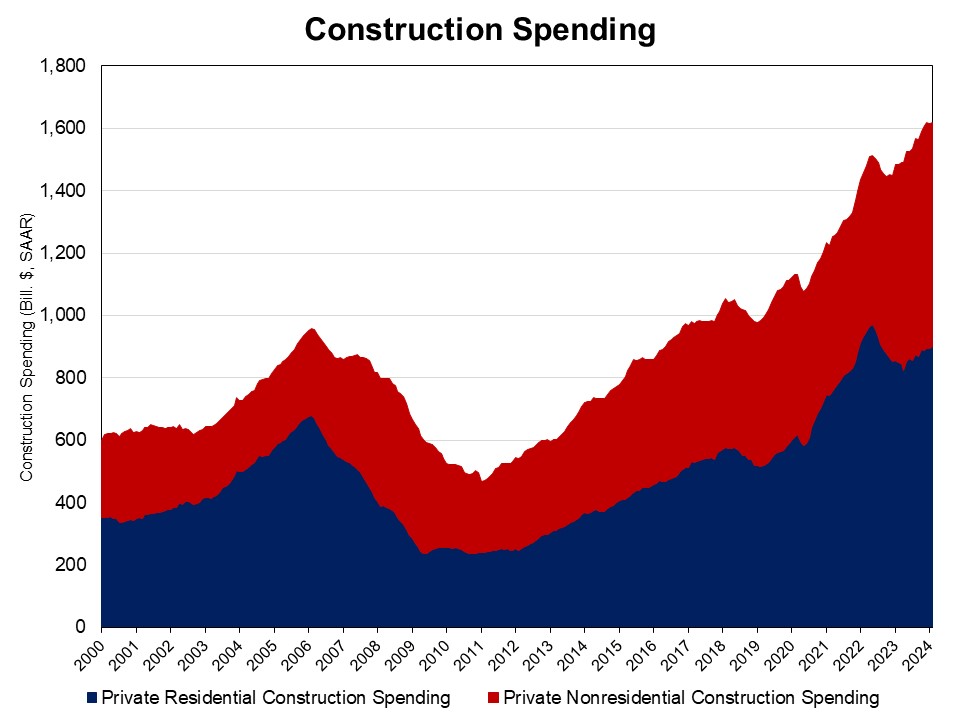

NAHB analysis of Census data shows that private residential construction spending rose 0.7% in February, the third month of gains in a row. It stood at a seasonally adjusted annual pace of $901.1 billion.

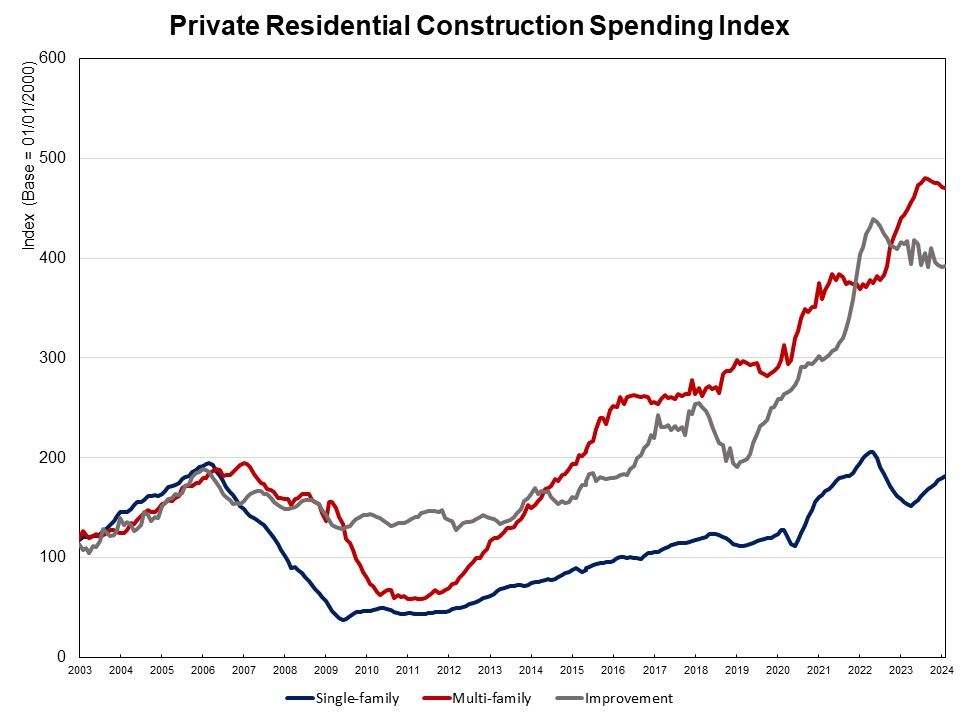

The monthly increase in total construction spending is attributed to more single-family construction and improvements. Spending on single-family construction rose 1.4% in February. This marks the tenth straight month of increases since April 2023. The gain for single-family construction is aligned with the strong reading of single-family starts and rising builder sentiment, as the lack of existing home inventory and strong demand are boosting new construction. Compared to a year ago, spending on single-family construction was 17.2% higher. Multifamily construction spending went down 0.2% in February after a dip of 0.8% in January. However, spending on multifamily construction was 6.1% higher than a year ago, as a large stock of multifamily housing is under construction. Private residential improvement spending inched up 0.2% in February but was 5.3% lower compared to a year ago.

The NAHB construction spending index is shown in the graph below (the base is February 2000). The index illustrates how spending on single-family construction experienced solid growth since May 2023 under the pressure of supply-chain issues and elevated interest rates. Multifamily construction spending growth stayed almost unchanged in the last three months, while improvement spending has slowed since mid-2022.

Spending on private nonresidential construction was up 12.6% over a year ago. The annual private nonresidential spending increase was mainly due to higher spending for the class of manufacturing ($53.7 billion), followed by the power category ($0.7 billion).