You may have heard of target date funds as the popular choice for retirement savers in the US. So, why are they not the default here? The new Retirement digiPortfolio by your neighbourhood bank is about to change that, but guess what’s even better? It goes above and beyond what a target date fund can offer, since you can personalise your own retirement age instead of having to stick to the fund’s preset ending year. It doesn’t have to end there either – if you want, you can even opt for DBS to continue managing the portfolio for you through your retirement (whether it’s 20 / 30 / 40 years of it!)

Robo-advisors are a popular solution for among both the young and working adults who wish to get started with investing but

- Don’t really know how to invest for retirement

- Too busy with work, not much time left to study the markets

- Want professional help…but don’t want to pay for the active management fees and sales charges associated with human advisors

However, after the closure of independent robos Smartly and then MoneyOwl, the reputation of robo-advisors in Singapore has suffered a hit. To avoid a similar fate, some investors would rather go for robo-solutions offered by banks, which are perceivably safer and doesn’t leave the portfolio entirely in the hands of preset algorithms and robots.

There’s only 3 to choose from right now, and one of the most accessible is the DBS/POSB digiPortfolio, which is available in-app for the millions of DBS and POSB customers in Singapore.

Many of you may already be invested in a digiPortfolio because it helps you earn more bonus interest on your DBS/POSB Multiplier account 🐰.

Message from DBS:

We created digiPortfolio to democratise access to wealth to everyone, as part of our bank’s mission towards financial inclusivity.

Such curated portfolios were previously only accessible to high net worth (HNW) customers with investments of S$500,000 and above.

With a simple-to-understand, ‘hands-off’, ready-made portfolio, starting at an affordable S$100, you don’t need to hold off on investing anymore.

For those of you who remember, when DBS/POSB first launched their hybrid-human robo-advisory solution i.e. digiPortfolio back in 2019, they made the unexpected move of opening up access to DBS investment team’s expertise which was previously limited to the bank’s high net worth clients only. Since then, they’ve grown their options from 2 to 5, so you can now choose or even set up different portfolios to fit your investing objectives.

I’ve previously reviewed the other 4 portfolios here (Asia and Global) and here (SaveUp and Income), so you can check those out.

Overview of Retirement digiPortfolio

Remember target date funds? It is an age-based investment strategy where you take more risk when you’re younger, and get more conservative as you near your target retirement year. Similarly, DBS/POSB Retirement digiPortfolio follows the same glidepath strategy (that’s why you see the ad with the surfer gliding the waves!), but this is where the similarities end and Retirement digiPortfolio comes out superior.

TLDR: TDFs are cohort-based where all investors invest according to the TDF’s pre-determined end date. For example, a 2030 TDF’s glidepath is fixed for all its investors and will de-risk from today to 2030.

Retirement digiPortfolio, on the other hand, is more flexible and lets you set your own retirement age rather than end date. What’s more, if an individual wants to tweak their retirement age later on, the portfolio will automatically calibrate the asset mix to the individual’s life stage and retirement timeline at any time.

There’s more! After retirement, Retirement digiPortfolio allows investors to automate their drawdowns via a decumulation withdrawal plan according to their retirement income needs.

Sounds good, but how exactly does this work?

In this article, I’ll be diving into their latest Retirement Portfolio to understand how it works, who it is good for (and who isn’t), and why.

How should your investment portfolio look like?

A holistic portfolio typically has a mix of different asset classes (e.g. stocks, bonds, property, cash), with the proportions adjusted accordingly to the investor’s needs.

The best portfolio is one that allows you to sleep well at night while compounding over time for long-term gains.

To achieve this, any savvy investor will tell you that you need to design and adjust your portfolio as your age and risk appetite changes.

- When you’re younger without much financial commitments or dependents (children / elderly parents), you can usually afford to take on more risks with a greater exposure to equities and stocks. This enables you to capitalise on long-term growth and compounding over the next few decades.

- As you move into your next life stage, your financial responsibilities increase and you suddenly cannot afford to risk so much anymore, lest you lose money meant for your mortgage or children’s university school fees.

- As you inch closer to retirement, you have less time left to capitalize on market growth, so you start caring more about having stable, fixed income. Your heart can no longer take as much volatility as you did in your early career years.

An easy way to think about it would be to allocate differently based on age.

For example:

In your 20s – 30s: 80% stocks, 15% fixed income, 5% cash

In your 40s – 50s: 60% stocks, 35% fixed income, 5% cash

In your 60s – 80s: 15% stocks, 80% fixed income, 5% cash

Note: These are not prescribed percentages. You may wish to adjust your own based on your preferences and risk appetite.

This is also known as a glidepath strategy, and you can then manually rebalance your portfolio as you age so that you protect your gains and reduce the odds of losing the retirement funds you painstakingly compounded over the years…in the event of an untimely market crash.

But…what if you could automate it instead?

DBS Retirement digiPortfolio review

This is exactly what you can do with the DBS Retirement digiPortfolio.

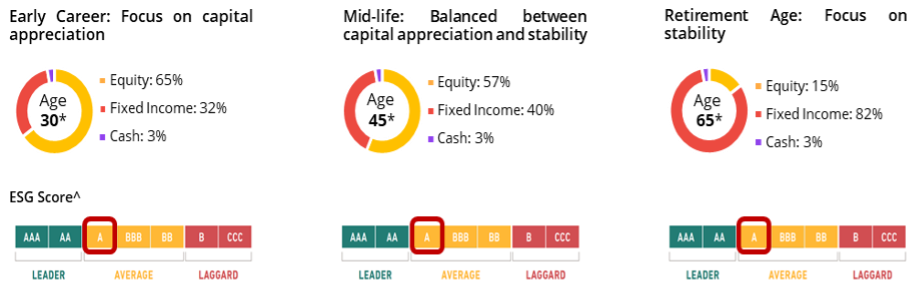

DBS has designed this portfolio based on the concept that investors should only take on risk appropriate to their life stage (defined as Early Career, Mid-life, and Retirement).

It factors in how far away you are from your desired retirement age, and adjusts every year through an automatic rebalancing on your birthday.

The above shows an illustrated example of how an investor’s asset allocation in DBS Retirement digiPortfolio can change through the years. Note that your actual portfolio allocation is based on your indicative years to retirement.

- When you’re younger and have a longer investment time horizon, the portfolio will allocate a greater exposure to equities vs. fixed income while keeping 3% in cash.

- Every year as you get closer to your retirement age, the portfolio will “glide” with you and de-risk accordingly to reduce your exposure to equities, while putting a heavier emphasis on fixed income so you are cushioned against market volatility.

That way, even if you’re so suay to witness a 50% market crash when you’re just 1 year to retiring, your $1,000,000 retirement portfolio won’t be affected to the extent that it suddenly drop to just $500,000 overnight, eroding the money that was otherwise meant to see you through your non-working years.

What’s more, the DBS Retirement digiPortfolio does not stop even after your preset retirement age or when you start withdrawing from it. DBS has said that the portfolio will continue to be managed on your behalf, to ensure that it remains updated to the bank’s investment team’s latest investment views.

How it really works

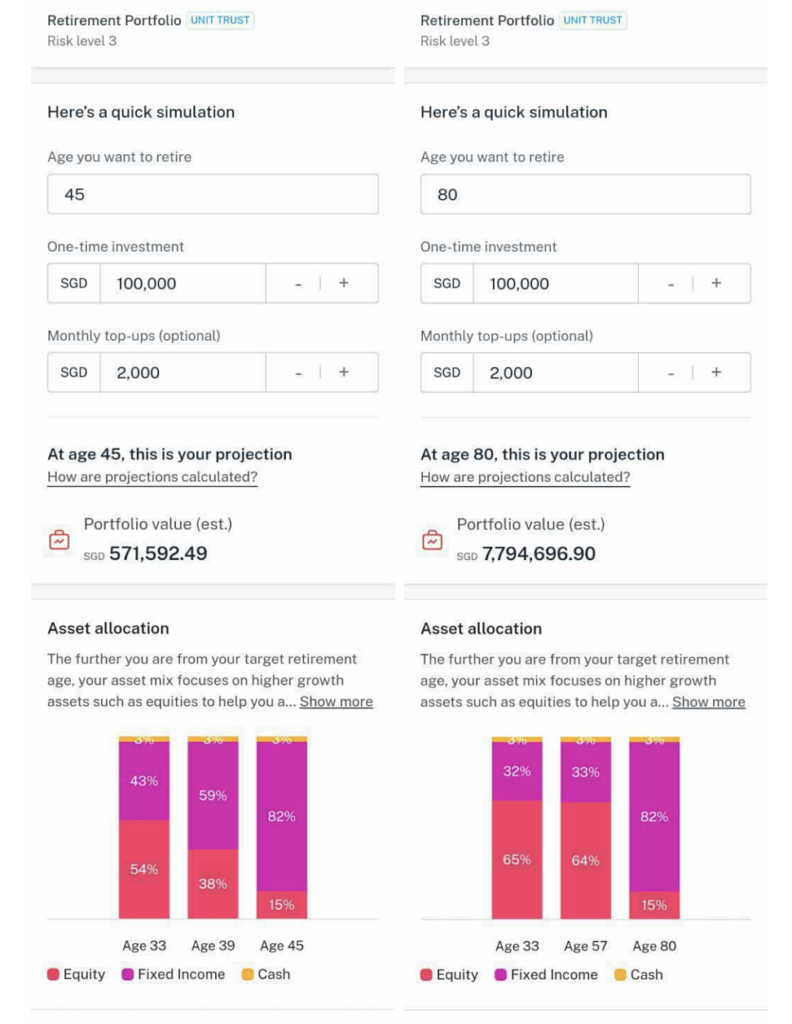

Let’s say you have a sizeable pile of cash savings now which you want to invest so you can retire at 60, 80…or maybe earlier at age 45.

The tool shows that if you were to start now and diligently add $2,000 to the portfolio every month, with over 4 decades to compound before you retire at 80, you could end up with an estimated $7.7 million for retirement.

But if you wish to retire even earlier (35 years ahead of schedule), then the same capital injections is estimated to end up at ~$570k when you turn 45.

In contrast, trying to time the market with a $100,000 lump sum without the subsequent top-ups in a disciplined manner could leave you short of the $571k projection.

Notice how the asset allocation changes based on how far away you are to the desired retirement age entered?

- Retire at 45: 54% equities, 43% fixed income, 3% cash

(shorter time horizon to retirement) - Retire at 80: 65% equities, 32% fixed income, 3% cash

(longer time horizon to retirement)

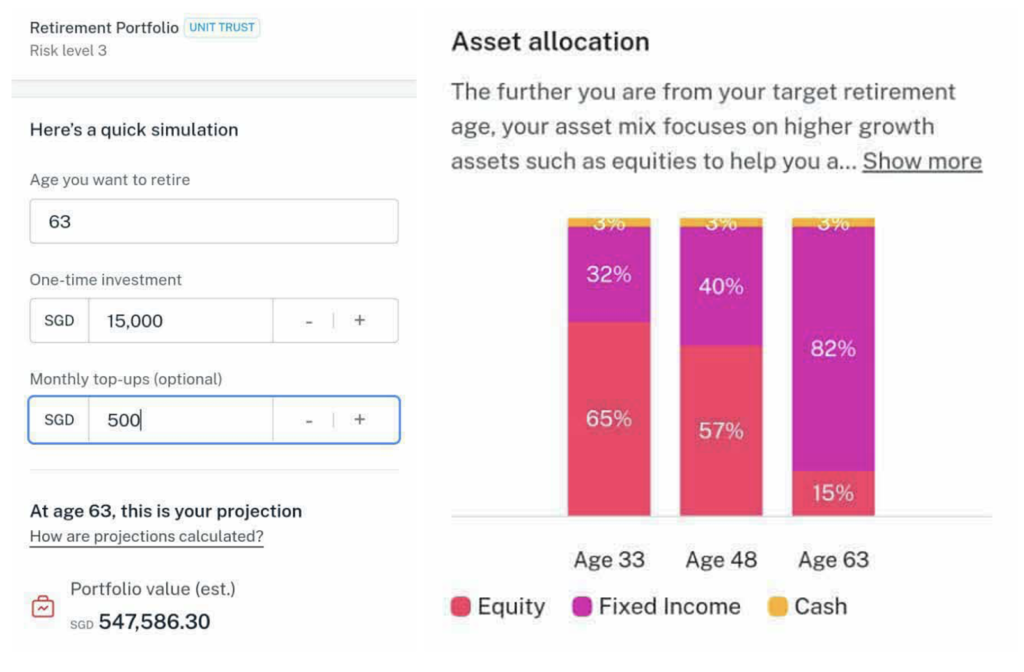

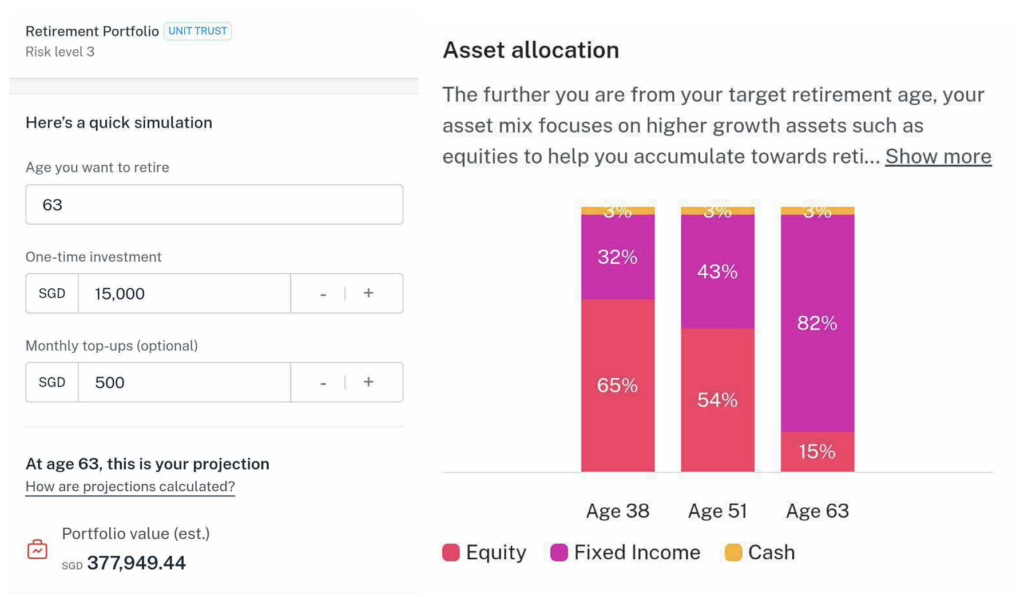

Now let’s look at what if you have less cash and want to commit to investing $500 a month instead, while retiring at Singapore’s official retirement age (currently 63)?

Here’s what the result would look like for an investor aged 33:

vs. someone 5 years older:

The portfolio models and the ‘glidepath’ will be professionally managed by DBS, guided by views from the DBS Chief Investment Office and J.P. Morgan Asset Management. DBS says this is an extension of its years-long effort to lower barriers of entry to investing and democratise retail investors’ access to wealth management services.

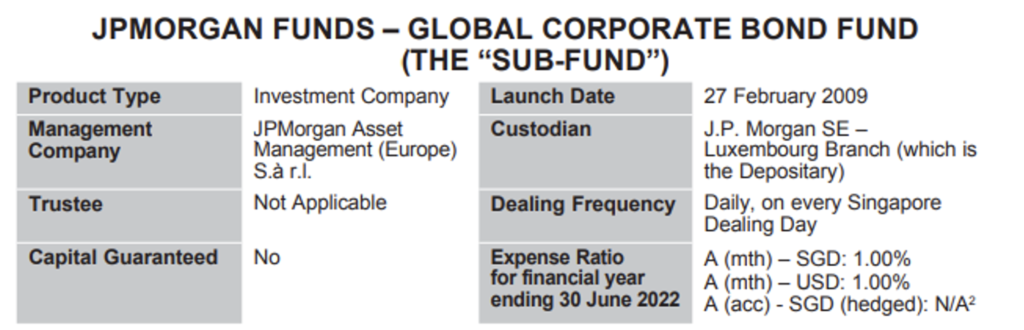

Since this retirement portfolio is created in collaboration with J.P. Morgan Asset Management (JPMAM), so as you might expect, all of the underlying holdings are in JPMAM funds:

In summary, for equities, your money will go into a US Large-Cap fund, an Asia Growth fund, a Japan fund and a Europe fund. The exact allocation will vary depending on the years you have left to retirement – see below for an example:

| Investor who’s 30 years from retirement | Investor at retirement | |

| US equities | 30% | 6% |

| Europe equities | 15% | 4% |

| Asia ex-Japan equities | 15% | 3% |

| Japan equities | 5% | 2% |

| Government bonds | 12% | 27% |

| Corporate bonds | 10% | 40% |

| Emerging markets debt | 10% | 15% |

For fixed income, your money will get invested into units of an Emerging Market bond fund, a Global Corporate bond fund, and a Global Government bond fund.

Based on the glidepath strategy, the exact mix of these equity and fixed income funds will change every year to de-risk gradually towards retirement.

How much are fees?

As a DIY investor, buying into funds and rebalancing them each time incur frequent transaction and switching costs. For those who see value in having full-time investment teams monitor and adjust strategies according to changing market situations, you’d probably appreciate how DBS is not charging anything for the transaction costs that you would otherwise incur on your own when you buy and sell directly into these individual underlying funds.

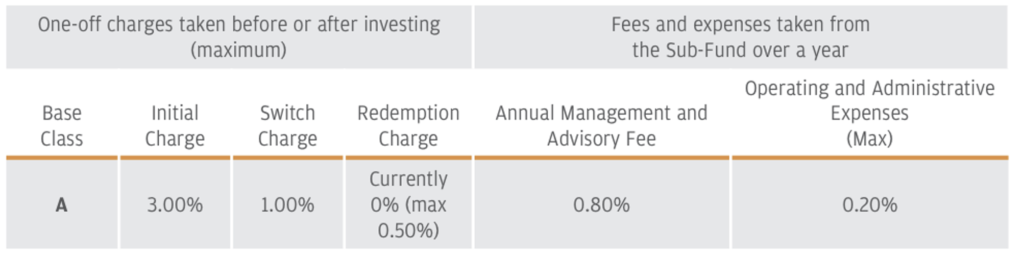

As a DIY investor, buying into funds and rebalancing them each time incur frequent transaction and switching costs. Here’s an example of the “Initial Charge” and “Switch Charge” in the table below, which are fees that DIY investors who choose to buy these funds directly may incur. This is taken from just 1 out of the 7 funds. You should, however, note that these 2 classes of fees are NOT applicable to digiPortfolio.

For those who see value in having full-time investment teams monitor and adjust strategies according to changing market situations, you’d probably appreciate how DBS is not charging anything for the transaction costs that you would otherwise incur on your own when you buy and sell directly into these individual underlying funds.

In fact, outsourcing this to Retirement digiPortfolio gets it done automatically for you at a flat 0.75% annual management fee.

What’s more, to make the portfolio even more accessible and affordable for investors with retirement in mind, fees will fall even further to just 0.25% p.a. (instead of 0.75% p.a.) once you hit your selected retirement year.

Now that you understand how the product works, let’s dive into who it might be suitable for, and who wouldn’t.

Who this portfolio is for vs. who it isn’t

Who it might be for

Knowing all of the above, you can consider the Retirement Portfolio if:

- You want to invest to build your wealth for retirement over the years

- You’re busy with your career or personal life, and really don’t have the time to actively monitor markets

- You feel safer with the reassurance of experts helping you on your portfolio, but also want to pay a lower fee for it

- You intend to reduce your risk exposure from growth to stability as you get closer to your target retirement age. Doing it yourself will be more tedious and you need to be prepared incur quite a bit of fees when you sell and buy different holdings in order to de-risk your portfolio

- You wish to supplement your other retirement plans (e.g. CPF Life) to achieve your desired retirement goals

Who it might not be for

But if you’ve already set up your own investment portfolio on another platform and prefer to continue actively managing the entire portfolio by yourself, then this solution may not seem as attractive to you. Outsourcing it to DBS will incur 0.75% p.a. flat fee for the portfolio management, so for folks who prefer to DIY 100% and are not keen on diversifying outside of it, you may not find this as compelling.

For investors also prefer to invest in passive exchange-traded funds tracking the market instead of professionally-managed active unit trusts and mutual funds, you may then not appreciate such a portfolio.

This is also not suitable for those who want to use their joint account to fund and invest towards their joint retirement portfolio, because DBS currently only accepts funding from individual accounts. You will need to use your own single account to fund or receive income from this digiPortfolio instead.

And for couples who want to use this to invest towards their joint retirement portfolio, this might not be suitable for your needs as the portfolio was designed based on the investor’s age to retirement. Plus, I can see why this would be a hard task for DBS/POSB to fulfil (i.e. even my husband and I aren’t the same age, and we certainly won’t be retiring in the same year!)

The workaround solution would be to invest separately – not difficult since DBS has made it such that you can set up within just a few taps on your digibank app.

Conclusion

The DBS Retirement digiPortfolio is a welcome addition to the bank’s robo-advisory offerings because it finally offers an all-in-one portfolio solution for folks wanting to invest for retirement and comes with no lock-ins or penalty charges.

Prior to this, your only other option was to DIY or to use another robo (mostly not backed or owned by the banks).

Of course, if your focus is only on lowest fees, then you should note that from a cost perspective, DIY almost always wins.

The bigger question is whether YOU can successfully DIY. If you can, great!

Most investors, unfortunately, fail to stick to the plan and make emotional decisions such as staying out of the markets when it crashes, or piling in due to FOMO when the markets are rallying (like now). If that’s what you have been doing too, then maybe you need a different solution.

Also remember that if you were to trade or top up your investment often, every single transaction will incur a fee. On the other hand, a plan like DBS digiPortfolio adopts a fee structure where customers can top up, withdraw, or practise dollar-cost averaging multiple times throughout the month and still only incur the 0.75% p.a. fee – nothing more.

With digiPortfolio, it makes it easy for you automate your investments so you can invest through dollar-cost averaging and stay invested in the market to build your long-term wealth.

After all, actively managing your portfolio and manually rebalancing it can be time intensive. It requires you to track changing asset values, and manually make decisions to buy or sell. If you don’t enjoy the work (like I do), it can be hard to stay the course.

TLDR: DBS Retirement digiPortfolio is worth considering for your long-term investment objective of retirement, as it can be automated to

- take care of your portfolio asset allocation and de-risks gradually each year towards your retirement

- helps you dollar-cost average

- ensures your discipline and that you stay invested

- removes emotional decision-making that might negatively affect your long-term investment returns

and more importantly, free up time so you can do what you love, while knowing that your long-term retirement needs are being taken care of.

Sponsored Message

Trying to invest for your retirement but don’t know how?

Tap on “Invest” in your DBS/POSB digibank app and select digiPortfolio to check out the DBS/POSB Retirement portfolio today!

Disclosure: This article is brought to you in collaboration with DBS, who helped to ensure that everything I write here is factual and accurate. All opinions are of my own.

Disclaimers:All investments come with risks and you can lose money on your investment. The Retirement digiPortfolio consists of funds which may be subject to market fluctuations and other risks.

This article is written in collaboration with DBS Bank Ltd, Company Registration. No.: 196800306E ("DBS”), an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore and is for general information only and should not be relied upon as financial advice. This publication may not be reproduced, or communicated to any other person without prior written permission.

It does not take into account the specific investment objectives, financial situation or needs of any particular person. Before entering into any transaction involving any product mentioned in this publication, where applicable, you should seek advice from a financial adviser regarding its suitability for your own objectives and circumstances. If you choose not to do so, you should make an independent assessment and do your own due diligence on the product. This advertisement has not been reviewed by the Monetary Authority of Singapore.

The information herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation.

This advertisement has not been reviewed by J.P. Morgan Asset Management. Neither J.P. Morgan Asset Management nor its affiliates makes any representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose and accordingly, takes no responsibility for the accuracy of the contents of this publication nor accepts any liability for any statement or misstatement made in this publication.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. The value of the units in the funds and the income accruing to the units, if any, may rise or fall. Before investing, you should read the prospectus and Product Highlights Sheet for the funds in the Retirement digiPortfolio, which may be obtained from the digiPortfolio tab in DBS digibank.