Non-compete clauses are common features of employment agreements around the business world and are often used to dissuade companies from ‘poaching’ another’s employees, and/or to prevent employees (at least for a certain time period) from taking the knowledge gained from working at one company to a competitor. Which can allow companies to protect the ‘investments‘ they have made in their employees and maintain continuity amongst their staff.

However, these agreements can also be unduly restrictive towards employees, limiting their ability to advance within their chosen industry, which is especially problematic in skilled professions that might have required years of education and training just to enter in the first place. Further, critics of non-compete agreements argue that they restrict dynamism in the overall economy by making it harder for businesses to hire (as the pool of applicants will be smaller in industries where non-competes are prevalent), and for employees subject to non-competes to start new companies.

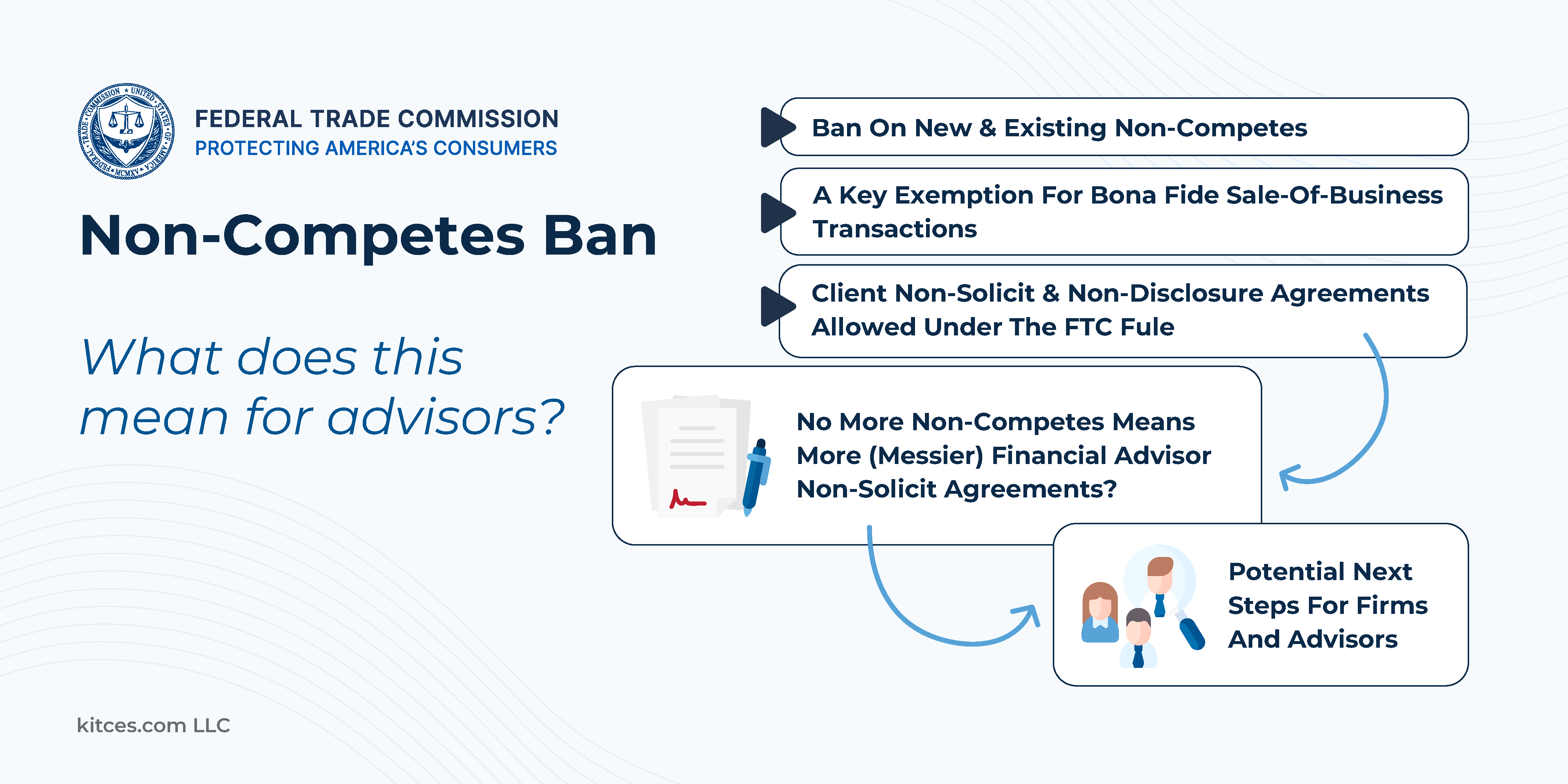

With these factors in mind, the Federal Trade Commission (FTC) in April of 2024 announced a final rule banning most non-competes nationwide that is expected to take effect (pending legal challenges) on September 4, 2024. To comply with the rule, employers are required to provide written notice to relevant workers (which include employees and independent contractors, among other categories), letting them know that their non-compete agreements are unenforceable and will not be enforced.

Notably, the ban includes exemptions for “senior executives“ who previously had signed a non-compete (new non-competes are banned for all employees, including senior executives) and in the case of a “bona fide sale of a business entity, of the person’s ownership interest in a business entity, or of all or substantially all of a business entity’s operating assets“. This latter exemption means that financial advisors with an ownership interest in their company (even a very small one) could still be subject to a non-compete as a term of the sale of their stake (which could impact how they value receiving an ownership interest in their firm).

Furthermore, the regulation does not prohibit non-solicit agreements (which restrict a departing employee from soliciting the clients of their former employer for a specified time period), which are more common than non-competes in the financial advice industry, meaning that non-solicit agreements can remain in place, and might even become more prevalent amongst firms that are no longer able to enforce non-competes. But because enforcing non-solicits can be less clear-cut than enforcing non-competes (given that it is more difficult to tell whether an individual is actively soliciting their former employer’s clients compared to obtaining a job at a competitor or starting their own business), the number of legal battles over non-solicits could increase as their use rises. Which could make it more advantageous for firms and advisors alike to consider a more equitable, cooperative approach than strict on-competes or non-solicits to deciding which clients an advisor can solicit if they do eventually leave the firm.

Ultimately, the key point is that the FTC’s ban on non-competes may provide advisors with increased flexibility to move amongst firms within the financial advice industry, while also offering the opportunity for both financial advisory firms and their advisors to revisit their employment agreements… not only to ensure that they comply with the FTC’s final rule, but also so that they better meet the needs advisors and their firms!