With direct funds being introduced nearly 11 years ago, it’s time to analyze Direct Mutual Funds vs Regular Mutual Funds in India 2024.

It is common knowledge that direct funds do not involve middlemen, allowing investors to benefit directly with lower expense ratios. For instance, when comparing the expense ratio of the ICICI Pru Bluechip Fund regular plan at 1.49% to the direct plan at 0.9%, there is a significant difference of 0.59%. Although this percentage may seem small, it can make a substantial impact, particularly for long-term investors.

The reason I chose to feature ICICI Pru Bluechip Fund in this post is due to its status as the fund with the highest AUM among the oldest regular funds. The oldest fund is the UTI Large Cap Fund (37 years), followed by the Franklin India Bluechip Fund (30 years). However, when considering the oldest fund with the highest AUM, ICICI Pru Bluechip Fund stands out. Therefore, I have selected this fund for my example. Why focus on the fund with the highest AUM? I aim to demonstrate how even with a high AUM fund (where the expense ratio will naturally decrease due to regulatory restrictions), the impact it can have is significant when comparing regular and direct funds.

Direct Mutual Funds vs Regular Mutual Funds in India 2024 – 11 Years Comparison

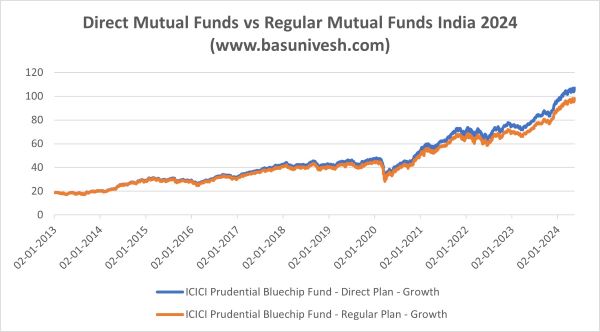

Let us fist compare the NAV movement of ICICI Pru Bluechip Fund direct vs regular funds from 2013 to 2024.

It should be noted that the distinction is not apparent for approximately 5-6 years. Subsequently, it becomes gradually noticeable after 5-6 years, and the disparity significantly increases after a decade.

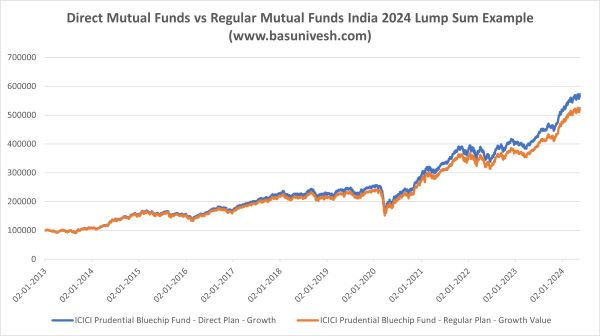

Assuming an individual invested a lump sum amount of Rs.1,00,000 on January 2nd, 2013, in both regular and direct funds of ICICI Pru Bluechip Fund, what would be the resulting variance in final value?

The two graphs look the same at first glance, with no noticeable differences. However, when we compare the percentage variance in returns between them, a clear difference emerges.

Hence, let us compare the % difference between direct vs regular funds.

The difference between direct and regular funds is growing each year, with the current gap at around 8.3%. As expenses also compound, this gap is expected to widen even more in the future.

The Net Asset Value (NAV) of direct plans will continue to outperform that of regular plans. This is not because they are more expensive, but rather because direct plans have a lower expense ratio, allowing their NAV to increase more quickly. As a result, the NAVs of direct plans are higher and will continue to grow at a faster rate compared to regular plans. Although you will receive fewer units when purchasing direct plans, the rapidly increasing NAV will lead to improved returns and accelerated growth of your portfolio.

Investing in direct funds may result in receiving fewer units compared to regular funds due to the higher net asset value (NAV). However, it is important to note that the performance of the fund is what truly matters, not the NAV. Therefore, it is advisable to avoid the misconception of solely seeking lower NAV funds or new fund offers (NFOs).

Conclusion – I am aiming to emphasize the difference in returns between Direct Mutual Funds and Regular Mutual Funds, should you decide to invest in either one. However, if you consider this difference to be unimportant or if you value the distributor’s role in managing your funds and therefore prefer Regular Mutual Funds, you are welcome to proceed with that option. It is crucial to understand that switching from Regular to Direct Mutual Funds, even within the same fund, will result in taxes. Hence, it is essential to make a deliberate decision based on your personal needs and preferences.

“Investors need to understand not only the magic of compounding long-term returns but the tyranny of compounding costs; costs that ultimately overwhelm that magic.”

? John C. Bogle, The Clash of the Cultures: Investment vs. Speculation