So you’re investing while still living your life as a working adult rapidly climbing your career ladder, or perhaps an overwhelmed working parent juggling your 9-5 job and your childrenon top of it. Or maybe you’re all of the above, just like I am.

In that case, you definitely know how difficult it can be to balance all of your commitments…while still staying on top of the financial markets and your investment portfolio. Because that’s the exact journey I went through –I no longer had the luxury of time to read as much as I used to and hunt for good stock ideas in the wild anymore.

My life changes warranted new solutions and new fixes. And that’s how I (finally) forked out cash to subscribe to several stock investment services to help me cut through all the noise and focus on what’s more important i.e. The Motley Fool, Seeking Alpha and Zacks. I saw these as a way to:

- Save time

- Get curated stock ideas (instead of filtering through dozens to hundreds of companies on free stock screeners)

- Improve my investment skills by learning from other analysts (like how I self-taught my way to an ‘A’ in school by reading other students’ model essays)

Over the years, I’ve terminated the subscriptions that I no longer felt worked for me (Zacks was the first I terminated, followed by a few authors’ paid work on Seeking Alpha), but I continue seek and try out new potential solutions.

The latest being Moby.

Some people call Moby a stock-picking service, while others call it an investment research app. If you asked me, I think it’s all of that – and more.

My first encounter with Moby started when they popped up on my Explore page on Instagram (which is mostly social finance and motivational content, if you had to know), which led to me following their page. Shortly after, they DM-ed me to ask if I’d like to check out their Premium service, so I did.

The idea of being able to track politicians’ trades intrigued me, so I gave it a shot – although in the beginning I was mostly using it to kaypoh their stock picks (and get ideas!) and read their daily newsletters on what happened in the markets.

In just 2 weeks, I knew this would be a paid service I’ll be sticking with – and if I had the budget to pay for only ONE investment subscription service? Moby would be my choice.

While Moby Premium offers multiple different benefits for investors and learners (even beginners) at all stages and styles, I personally used it to help me solve 2 of my most important needs:

Requirement 1: Keep me updated on the financial markets

I don’t have the time or bandwidth to read every single financial news, and if I had to be really critical about it, I’ve realized that in recent years, online media is now so full of clutter and clickbait articles that it takes a lot of effort to cut through the noise and stay grounded.

Reading (too much) news too often can also have an adverse impact on your investing because some articles tend to sway you to either emotional extremes (fear or greed). I don’t blame the media outlets, because that’s what catches eyeballs and attention.

But it doesn’t help ME as an investor.

Moby, on the other hand, delivers me enough financial news and updates that hasn’t played with my emotions yet.

For instance, I learnt about the Iran-Israel attacks and the reason behind Tesla’s overnight 15% gains from just spending 3 minutes on Moby each day. And when Shopify dropped 20% in a single day? I no longer had to spend 10 – 15 minutes Googling and reading for answers as Moby solved that for me within just 3 minutes.

That has been an incredible time saver, and I cannot say enough how that helps me as a working mother with 2 preschool kids and multiple side hustles.

Requirement 2: Give me some decent stock ideas

To make it worth my subscription fees, I demand that every investment service I’m on must have enough good stock picks featured that it adds at least one good stock to my portfolio in a year.

That was why I cancelled my Zacks subscription and 2 authors’ paid services on Seeking Alpha, because I personally wasn’t getting any such value out from them. It is also the reason why I still keep my Motley Fool subscription, because they cover several of the stocks in my portfolio and I’ve added at least 2 new positions (which I wouldn’t have discovered otherwise if I hadn’t read it on their picks).

Although I’ve not acted on any of Moby’s picks yet, I already added a few of their ideas to my watchlist for future research. Here’s 2 recent examples of names I’ve yet to come across anywhere else:

- Embraer: the world’s 3rd largest commercial aircraft manufacturer, right behind Boeing and Airbus

- FTAI Aviation: MRO services of aircraft engines to maintain the safety and efficiency of global commercial fleets

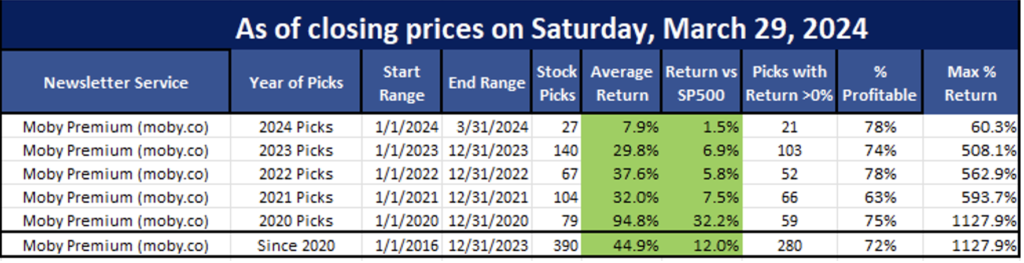

If you’re wondering how their stock picking performance has been thus far, a US blogger went to dig up and tracked their yearly picks and performance since 2020:

Personally, I care more about what their picks do for me than how ALL their picks performed as a whole (since it’s not as though I invest in every single stock they feature), but it is nice to know that someone has done the digging to hold them accountable and that they’ve fared pretty decently here in outperforming the S&P 500.

If any subscription service you’re on doesn’t at least beat the S&P 500, you should be cancelling it ASAP. And if it doesn’t help YOU beat the S&P 500, then you should probably be rethinking whether your money is being well spent.

Moby’s background and competitive edge

Moby’s founding team comprise of seasoned finance folks from Morgan Stanley and Goldman Sachs, as well as senior leaders from Gemini, among others.

But I wasn’t convinced – you guys know me, as someone who was formerly trained in investigative journalism during my schooling years (and later built my career in the investigative background checking industry), so I needed to dig deeper.

I asked Moby more about their data sources and methods, among other things. They agreed to meet with me in their New York office and address all of my questions (when I was up there last month for a NASDAQ site visit), but unexpectedly got ill so we had to reschedule it for an online one instead after I flew back.

During the meeting, I asked deeper questions about their data sources and 20-step stock selection methodology (stuff you can’t find online):

Where does Moby get its data and sources from?

How this works is that Moby buys data from a lot of sources – whether it be scraping web data, B2B API’s, and in-house research algo’s, that all fuel Moby’s proprietary data sources, as the full comprehensive list is of course a trade secret), before using AI to find key points and distill it down. Finally, their own content team then writes the articles and visuals you see to make it jargon-free and understandable for every investor.

What criteria does Moby apply for its stock picks?

Moby’s team of former hedge fund analysts takes a comprehensive approach to stock selection, primarily focusing on the long-term evaluation of publicly traded companies in the US. Here’s a deeper look into their criteria:

- Financial Health and Stability: Moby evaluates the financial health of companies by examining key metrics such as revenue growth, profit margins, debt levels, and cash flow. They prioritize companies with strong balance sheets and consistent financial performance.

- Market Position and Competitive Advantage: The team looks for companies that have a strong market position and a sustainable competitive advantage. This includes industry leaders with a proven track record and innovative companies with the potential to disrupt their markets.

- Growth Potential: Moby identifies companies with significant growth potential. This includes not only established blue-chip stocks with steady growth prospects but also high-growth sectors like technology and biotech, where emerging companies are developing cutting-edge solutions and technologies.

- Management Quality: The quality and experience of a company’s management team are crucial factors. Moby’s analysts assess the leadership’s track record, strategic vision, and ability to execute plans effectively.

- Valuation: Moby performs thorough valuation analyses to ensure that they are investing in companies at reasonable prices. They use various valuation methods, such as price-to-earnings (P/E) ratios, price-to-sales (P/S) ratios, and discounted cash flow (DCF) analysis, to determine a company’s fair value.

- Industry Trends and Economic Conditions: The team keeps a close eye on industry trends and broader economic conditions. They select companies that are well-positioned to benefit from positive industry trends and can weather economic downturns.

- Sustainability and ESG Factors: Increasingly, Moby also considers environmental, social, and governance (ESG) factors in their evaluation. Companies with strong ESG practices are seen as better long-term investments due to their potential for sustainable growth and lower risk.

By applying these comprehensive criteria, Moby aims to build a diversified portfolio that balances stability with growth potential, catering to the investment goals of the millennial demographic.

There’s a lot of features in Moby Premium that not everyone may have the time for. How would Moby recommend the best usage of the app for all the working parents or busy career professionals (similar to Budget Babe)?

If you don’t have a lot of time, the Moby team told me that they’d recommend you to do the following:

- (Daily) read the Morning Newsletter and End of Day Report

- (Weekly) look at their 3 stock picks to get ideas

- (Weekends) explore any other features you’re keen on e.g. the politicians’ trades / hedge funds / crypto research / quant portfolios, etc

Comparison of Moby vs. other services

I’ve tabled the common ones that Moby often gets compared to below:

| Moby | The Motley Fool | Zacks | Seeking Alpha | |

| Price (USD) | $199 yearly | $199 yearly (Stock Advisor) |

$249 yearly | $239 yearly |

| Stock picks | Yes | Yes | Yes | Yes |

| Daily market updates | Yes | No | Limited | Depends on which service |

| Track the politician’s trades | Yes | No | Limited | Depends |

| Any upsell services | No | Yes | Yes | Yes, there are multiple services and different authors paid subs |

As I mentioned, if I only had the budget (or time) for ONE investment subscription service, Moby would be my choice.

If you’re not sure whether Moby is suitable for you yet, I would suggest you sign up to their free newsletter list here first, where you’ll get delivered daily updates on what’s moving the markets. This will help you stay on top of everything in just under 3 minutes a day, especially if you have no time to read the news.

After all, that was how I started – and the emails alone convinced me shortly after to give their Premium services a go. Try it out for yourself!

The Moby team has kindly extended a 50% off discount to Budget Babe readers, so you can now try Moby out for just $99 here.

Given that this immediately unlocks over 100+ unique stock ideas for you to check out, I would say it is totally worth the $99 because there’s almost no way you can’t get at least a few good investible stock ideas from there!

And if you really think it isn’t for you, there’s a 30-day guaranteed refund policy so no harm trying it out.

TLDR Summary of Moby

After having used them myself for 2 months now, I find Moby to be a great research service for beginner to experienced investors who want:

- Something they can digest in just 3 – 5 minutes each day

- Easy to understand; free from too much technical jargon

- Decent stock ideas for their investment portfolio

Having said that, there are some groups of people that Moby won’t be as suitable for:

- Traders: be it in options, stocks or crypto.

- Folks who want to be able to chart or screen on the app

- Folks who wish to sync their portfolios to the app

While some stock investment services offer users the ability to sync their portfolios and create a watchlist of stocks to be notified for, there is currently no such feature in Moby.

However, if your main issue is a lack of time, then Moby will be a great asset to you as an investor. And as long as you can get just 1 – 2 actionable stock ideas from it every year, I’m sure you’ll definitely earn back what you pay for Moby Premium multiple times over.

With love,

Dawn

Disclaimer: This post is not sponsored, but contains affiliate links for if you choose to sign up for Moby Premium. I'm currently using Moby on top of The Motley Fool Stock Advisor and Seeking Alpha Premium, together with a few select Patreon subscriptions from my favourite finance creators, but find Moby to be the #1 that I would recommend to my readers for the reasons detailed above. If you're unsure, I suggest that you give their email newsletter a try first to check if it'll be a fit for you - the newsletter is free (for now) anyway!