Key Highlights

1. ‘Policy continuity’ with no major populist announcement despite election result

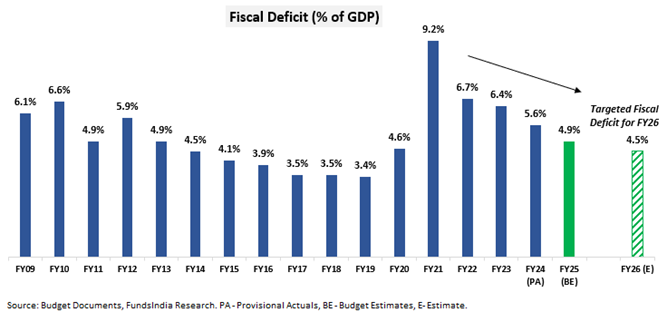

2. Continued focus on fiscal consolidation

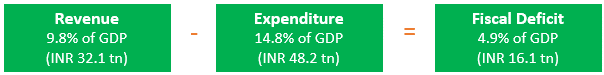

- Further reduction in fiscal deficit target to 4.9% of GDP for FY 25 (vs 5.1% announced in interim budget) – maintaining fiscal consolidation glide path to reduce fiscal deficit to 4.5% of GDP by FY26.

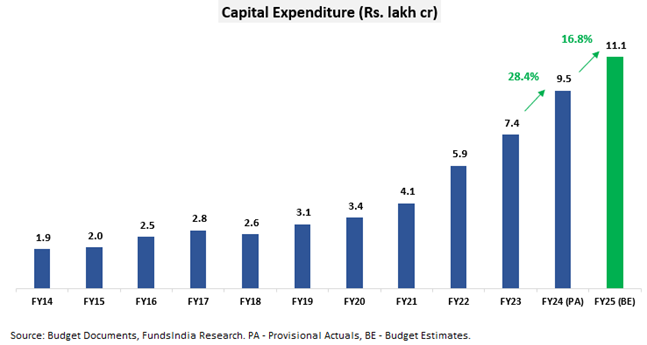

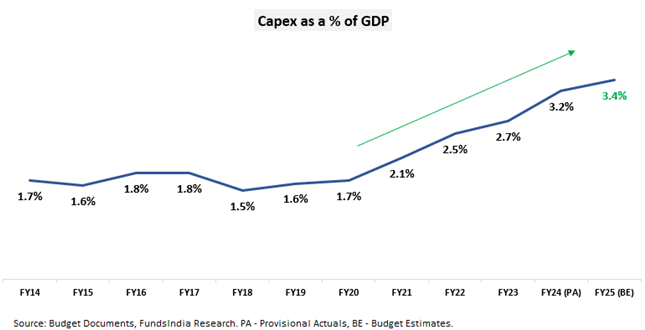

3. Maintains earlier guidance on Capital Expenditure

- Capital Expenditure to increase by 17% to Rs 11.1 lakh cr in FY25 (i.e 3.4% of GDP) from Rs 9.5 lakh cr in FY24 (i.e 3.2% of GDP)

- Major focus is on: Roads & Bridges, Railways & Defence

4. Change in Capital Gains Taxation

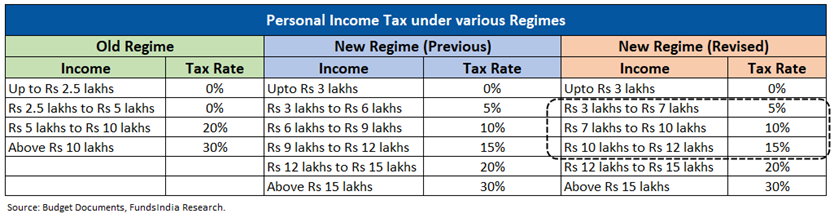

5. Nudge towards New Income Tax Regime with revisions in tax slab and standard deduction

Budget in Visuals

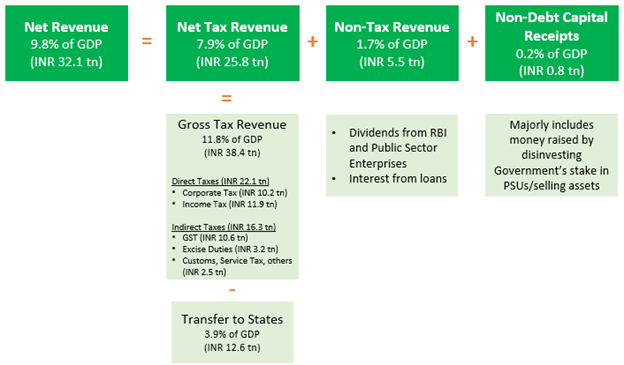

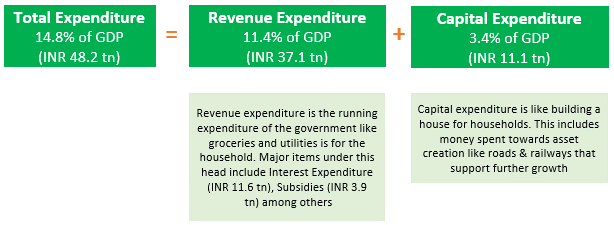

Nominal GDP for FY 25 = INR 326 lakh crores (10.5% growth over INR 295 lakh crores in FY24)

Where does the money come from?

Where does the money get spent?

How much is the deficit between spending and earning?

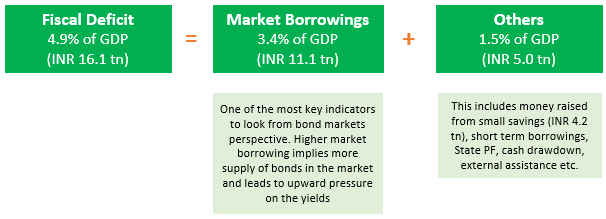

How is the deficit financed?

Fiscal Consolidation On Track..

Tax Receipts as a % of GDP remains stable..

Thrust on Capex Continues..

With a focus on Defence, Roads and Railways..

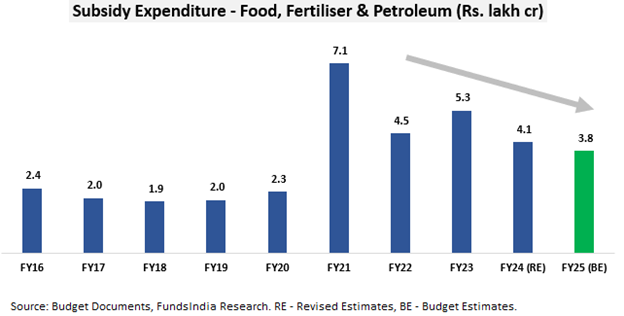

No dilution in quality of spending -> Subsidies at 5 year low

The government’s subsidy bill (Food, Fertiliser, Petroleum etc) is estimated to ease further to 1.3% of GDP in FY25 BE from 1.5% of GDP estimated in FY24 RE, largely led by lower fertilizer and food subsidy bill.

What’s in it for you?

1. Nudge towards New Income Tax Regime

- Old income tax slabs remain unchanged.

- Revision in the new regime income tax slabs:

- Standard deduction increased from Rs 50,000 to Rs 75,000

Standard deduction is a flat deduction in your taxable income (i.e your taxable income comes down by that extent). Available to salaried individuals and pensioners.

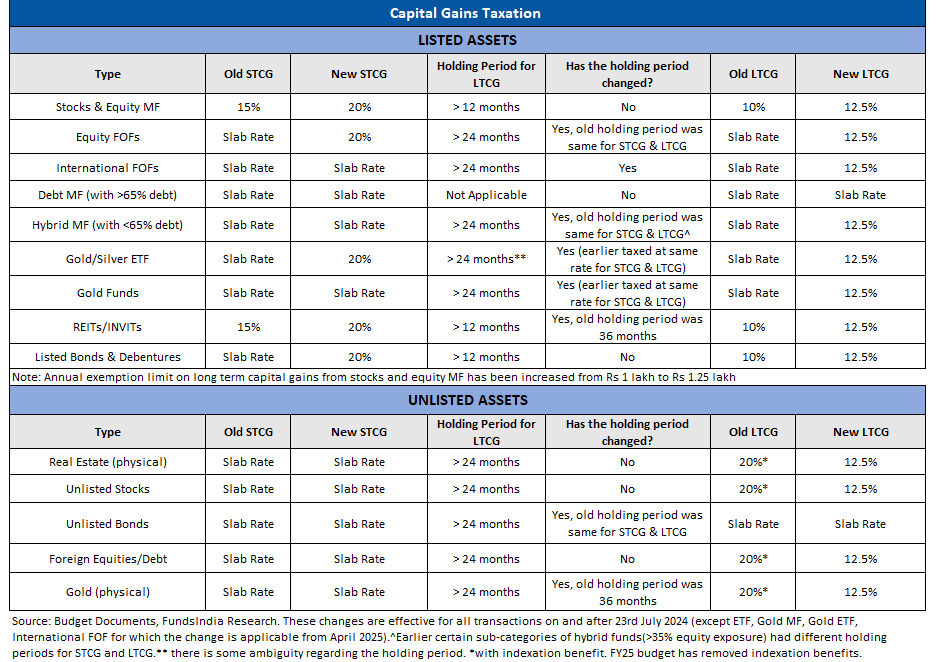

2. Change in Capital Gains Taxation

- Equities

- Capital Gains Tax increased for Equities

- Long Term Capital Gains Tax increased to 12.5% from 10%

- Short Term Capital Gains Tax increased to 20% from 15%

- Long term capital gains tax exemption limit increased from Rs 1 lakh to Rs 1.25 lakh.

- Capital Gains Tax increased for Equities

- Debt Mutual Funds – No change in taxation

- International FOFs, Gold Index/ETFs – Long Term Capital Gains reduced to 12.5% if they are held for more than 24 months (earlier taxed at slab rates)

- Real Estate

- Indexation Benefit on property removed – Long Term Capital gains from the sale of real-estate will now be taxed at 12.5% without indexation benefit (this was earlier taxed at 20% with indexation benefit)

- Change in holding period

- Earlier, there were 3 thresholds to determine long-term – 12 months, 24 months and 36 months. Now, only 12 months and 24 months.

- Threshold to claim LTCG tax:

- 12 months: Listed financial instruments

- 24 months: Unlisted financial instruments + All non-financial assets

Please find below the summary of tax changes across different assets

3. What gets cheap and costly

Other Important Announcements

- Schemes launched for employment linked incentives – 3 new schemes have been launched for employment linked incentives that benefit first timers, job creation in manufacturing sector and support to employers.

- STT on F&O transactions increased – On Futures from 0.01% to 0.02% and on Options from 0.06% to 0.1%

FI Equity View: Policy Continuity – No dilution in quality of spending with focus on fiscal consolidation & capex

The Union Budget FY25 continues with its focus on fiscal consolidation and capex spending reiterating policy continuity. This also addresses the concerns on the possibility of populist announcements post election results. However, the increase in long term capital gains tax for equity investors came as a minor negative surprise.

Overall, we maintain our POSITIVE outlook on Equities over a 5-7 year horizon, anticipating strong earnings growth in the coming years. We believe we are currently in the middle stages of a multi-year bull market.

Our Equity view is derived based on our 3 signal framework driven by

- Earnings Cycle

- Valuation

- Sentiment

As per our current evaluation we are at

MID PHASE OF EARNINGS CYCLE + EXPENSIVE VALUATIONS + MIXED SENTIMENTS

- MID PHASE OF EARNINGS CYCLE

We expect a reasonable earnings growth environment over the next 3-5 years. This expectation is led by Manufacturing Revival, Banks – Improving Asset Quality & pickup in loan growth, Revival in Real Estate, Government’s focus on Infra spending (which continues in FY25 Budget), Early signs of Corporate Capex, Structural Demand for Tech services, Structural Domestic Consumption Story, Consolidation of Market Share for Market Leaders, Strong Corporate Balance Sheets (led by Deleveraging) and Govt Reforms (Lower corporate tax, Labour Reforms, PLI) etc. - EXPENSIVE VALUATIONS

FundsIndia Valuemeter based on MCAP/GDP, Price to Earnings Ratio, Price To Book ratio and Bond Yield to Earnings Yield has reduced from 85 last month to 79 (as on 30-June-2024) – moved to ‘Expensive’ Zone - MIXED SENTIMENTS

This is a contrarian indicator and we become positive when sentiments are pessimistic and vice versa - DII flows continue to be strong on a 12-month basis. DII Flows have a structural tailwind in the form of

- Savings moving from Physical to Financial assets

- Emerging ‘SIP’ investment culture

- EPFO Equity investments

- FII flows have remained muted for the last 2.5 years – FII Flows since Oct-21 at Rs. ~ 14,000 Crs. vs DII Flows at Rs. ~7,16,000 Crs. This is also reflected in the FII ownership of NSE Listed Universe which is currently at its 10 year low of 17.9% (peak ownership at ~22.4%). This indicates significant scope for higher FII inflows. FII flows can improve in CY24 led by 1. Peaking USD and interest rates and 2. Rising significance of India in global markets.

- Periods of weak FII flows have historically been followed by strong equity returns over the next 2-3 years (as FII flows eventually come back in the subsequent periods).

- IPOs – Sentiments has slowly started to revive with most recent IPOs getting oversubscribed. But no signs of euphoria except for the SME segment.

- Past 5Y Annual Return is at 17% (Nifty 50 TRI) – in line with earnings growth and nowhere close to what investors experienced in the 2003-07 bull market (45% CAGR)

- Overall the sentiments are mixed and we see no signs of ‘Euphoria’

FI Fixed Income View: Fiscal Consolidation continues + No change in Market Borrowing -> Positive for Debt Markets

Budget is positive for Debt Markets. Expect interest rates to gradually come down over the next 12-18 months on the back of sustained FPI flows in debt post index inclusion of Indian G-Secs, fiscal consolidation, inflation under control, expected fed rate cuts and the recent S&P sovereign outlook upgrade.

Fiscal Consolidation continues:

The Fiscal Deficit for FY25 at 4.9% of GDP adheres to the fiscal glide path. The finance minister reiterated the government’s commitment to bring it down to 4.5% of GDP by FY26.

Lower Market Borrowing compared to previous year:

Net Market Borrowing in FY25 is lower at INR 11.1 lakh crores vs 12.7 lakh crores in FY24. No major change from what was announced during the interim budget.

Why do we expect interest rates to come down?

- Inflation under control: India’s May-24 CPI inflation at 4.7% is within RBI’s tolerance band (2-6%). Core CPI (excl Food & Energy) remains comfortable at 3.1%. RBI forecasts FY25 inflation to be much lower at 4.5% led by global growth slowdown and broad-based moderation in the domestic core inflation basket.

- Interest Rates well above expected inflation: Repo Rate at 6.50% is comfortably above the RBI’s expected inflation (4.5% for FY25) – leaves the positive real policy rates at an elevated 200 bps giving enough room for RBI to reduce interest rates by ~50-75 bps over time.

- FED expected to cut interest rates: US Fed has already hinted at a few rate cuts this year led by concerns of global growth slowdown & early signs of lower US inflation.

- Favorable Demand-Supply Equation:

- Higher Demand -> Higher FII inflows as Indian Government Bonds have been included in JP Morgan’s global bond market index with expected inflow of ~USD 20-25 bn in FY25 and in Bloomberg’s Emerging Market Index from FY25 + possibility of inclusion in FTSE indices.

- Lower Supply -> Gross Market Borrowing in FY25 is lower at INR 14.1 lakh crores vs 15.4 lakh crores in FY24.

- S&P sovereign outlook upgrade:

On May 29, 2024, S&P Global Ratings revised its India outlook to positive from stable, led by robust growth and rising quality of government spending .

How to invest?

3-5 year bond yields (GSec/AAA) continue to remain attractive.

We prefer debt funds with

- High Credit Quality (>80% AAA exposure)

- Short Duration or Target Maturity Funds (3-5 years)

Consider tactically investing in debt funds with a long duration (>7 years) and high credit quality (>90% AAA) if you have a higher risk appetite to benefit from the expected decline in yields over the next 12-18 months.

Other articles you may like

Post Views:

45