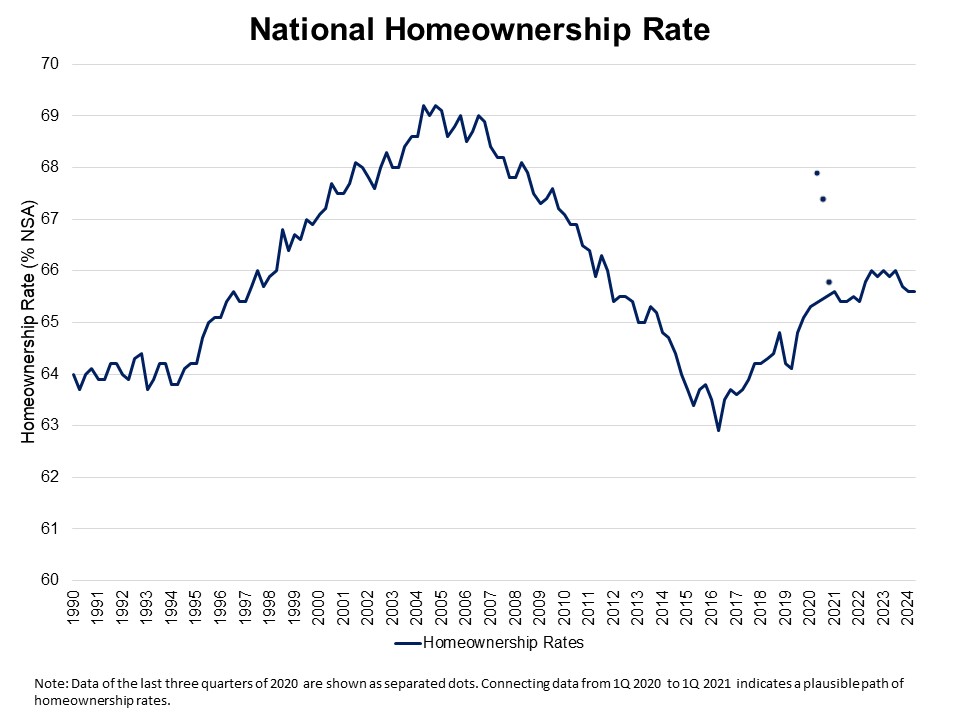

The U.S. homeownership rate was 65.6% in the second quarter of 2024, unchanged from the first quarter of 2024, according to the Census’s Housing Vacancies and Homeownership Survey (HVS). However, this marks the lowest rate in the last two years. The homeownership rate is below the 25-year average rate of 66.4%, due to a multidecade low for housing affordability conditions.

The homeownership rate for the head of households (householders) under the age of 35 decreased to 37.4% in the second quarter of 2024. Amidst elevated mortgage interest rates and tight housing supply, affordability is declining for first-time homebuyers. This age group, who are particularly sensitive to mortgage rates, home prices, and the inventory of entry-level homes, saw the largest decline among all age categories.

The national rental vacancy rate stayed at 6.6% for the second quarter of 2024, and the homeowner vacancy rate inched up to 0.9%. The homeowner vacancy rate is still hovering near the lowest rate in the survey’s 67-year history (0.7%).

The homeownership rates for householders under 35, between 35 and 44, and 65 and over decreased compared to a year ago. The homeownership rates among householders under 35 experienced a 1.1 percentage point decrease from 38.5% to 37.4%. Followed by the 35-44 age group with a 0.9 percentage point decrease from 63.1% to 62.2%. Next, were households with ages 65 years and over, who experienced a modest 0.3 percentage point decline. However, homeownership rates for the 45-54 age group inched up to 71.1% in the second quarter of 2024 from 70.8% a year ago. The homeownership rate of 55-64 year olds edged up to 75.8% from a year ago.

The housing stock-based HVS revealed that the count of total households increased to 131.4 million in the second quarter of 2024 from 130 million a year ago. The gains are largely due to gains in both renter household formation (855,000 increase), and owner-occupied households (515,000 increase).

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.