There was a major selldown in the markets over the last 2 trading days, and the VIX touched levels not seen since the pandemic and the 2008 Global Financial Crisis. But how did Japan trigger this massive market meltdown, and how exactly does the yen carry trade work? More importantly, what should investors do in this current market climate?

I woke up to a shock yesterday when I saw the VIX – a measure of the market fear levels – shoot past 65, which has not been seen since March 2020 (COVID pandemic) and the 2008 Global Financial Crisis.

The Nikkei 225 dropped by 13%, sending shockwaves through the Asian markets. The Straits Times Index (STI) was not spared and sank close to 5%; the last time the STI lost more than 100 points in a single day alone was in March 2020 at the outset of the Covid-19 pandemic.

This was largely due to the unwinding of the yen carry trade, but what exactly is that and why did it have such a huge impact?

What is the yen carry trade?

For close to a decade, Japan had negative interest rates – which made borrowing extremely attractive, since you were being paid by the banks to borrow (and not having to pay interest on the loan). As a result, this gave rise to the yen carry trade where investors around the world were borrowing yen (cheap money) and using it to buy currencies or otherwise invest overseas while they kept the spread.

This was a really good deal – borrow at close to 0% and park it in the US / UK where banks were paying 5% interest. So as you can imagine, many big players were leveraging this bananas interest rate environment to literally create money out of thin air for themselves.

What’s more, given the BOJ’s historical policy of low and stable interest rates, the Japanese yen is the default funding currency for the global FX carry trade.

Because the Bank of Japan had yet to raise interest rates, this trade worked fabulously well — it even helped the Japanese companies that export as they were able to rack up high profits based upon a depressed domestic currency.

What could possibly go wrong?

Well, all at once, the conditions that made the yen carry trade attractive have started to reverse, and we saw a series of the following events happen altogether:

- The weak US jobs report revealed unemployment rate climbed to 4.3% in July, which is the highest in 3 years and triggered the so-called Sahm Rule has been triggered. Coined by former Federal Reserve economist Claudia Sahm, it says that when the average jobless rate over three months is 0.5 percentage point above the 12-month low, a recession is coming.

- The Bank of Japan decided raised interest rates to 0.25%, and said that they wouldn’t rule out more hikes in the near future.

In terms of the yen carry trade, this meant that

- those who borrowed / leveraged the yen to invest were now getting margin calls

- to pay the interest rates on their loans, they had to sell off their assets – these were mostly stocks, US equities and cryptocurrencies like Bitcoin – and convert it back to yen to repay their debts

- the selling pressure also triggered a meltdown in the JPY-USD forex markets, sending the yen from 162 to 142

- as a result, the leveraged players had to sell even more assets to raise more funds to repay their debts.

All at once, Japanese equities got destroyed (down 25% in a month!), the yen skyrocketed, and importantly, all of those assets around the world that had been purchased with borrowed, yen-backed money had to be unwound.

This is definitely another one for the history books.

If you prefer to watch me visually breaking down the yen carry trade, here’s my 1+ minute explainer video:

I produced the above video for Moby, a premium investing subscription service which provides bite-sized financial insights to help retail investors like you and me invest better. You can read my review of Moby here to find out why I think the $99 price tag is worth it, or simply sign up for their FREE newsletter here to get a summary of their insights delivered straight to your inbox.

I wrote the below at midnight for my exclusive Patreon community yesterday while the US markets were melting down, and am reproducing here for public education:

So to sum it up, the market meltdown was triggered by 4 main events:

- 1. The unwinding of the “yen carry trade”. Many investors had borrowed yen at virtually no cost to fund investments in other assets (including US assets) as they took advantage of the ultra-low interest rates. With the rate hike, these leveraged positions have become more expensive to maintain, leading to a rush to unwind them. All the leveraged investors got margin calls today so they had to sell their USD investments in a hurry to raise funds. But honestly, unless that is a trade that YOU made, this is all just a temporary event to be endured.

- 2. The Japan’s Nikkei 225 Index dropped 12.4% today, its worst single-day performance since 1987, officially plunging Japan’s stock market into a bear market and wiping out the index’s entire year’s gains. This follows from the above point. Semiconductor giant Tokyo Electron (TYO:8035) (OTC: TOEL.Y) saw its shares crumble by 43% since July 10 while manufacturing conglomerate Hitachi (TYO: 6501) (OTC: HTHIF) is down more than 30% from its high a month ago.

- 3. A crypto crash. There was massive liquidation in the crypto markets as investors sold, causing a 15% outflow in under 24 hours alone! Bitcoin has lost almost 20% from its all-time high, and many altcoins are down 50% or more. With the fears over US market stability, investors are ditching “risk” assets like crypto and flocking towards safe havens like bonds instead.

- 4. Recession fears. This is most likely the main driver of the latest selling pressure. With the disappointing jobs count report last Friday, the unemployment rate in the US is now the highest in 3 years, with signs pointing that a recession could be incoming.

Now, none of yesterday’s meltdown had anything to do with the fundamentals of the affected companies. No one could have seen yesterday’s saga coming, so if what has happened has made you feel dumb, or like you should have known it was coming, you aren’t, and you couldn’t.

To keep up with the financial markets, consider signing up

What should we do as investors?

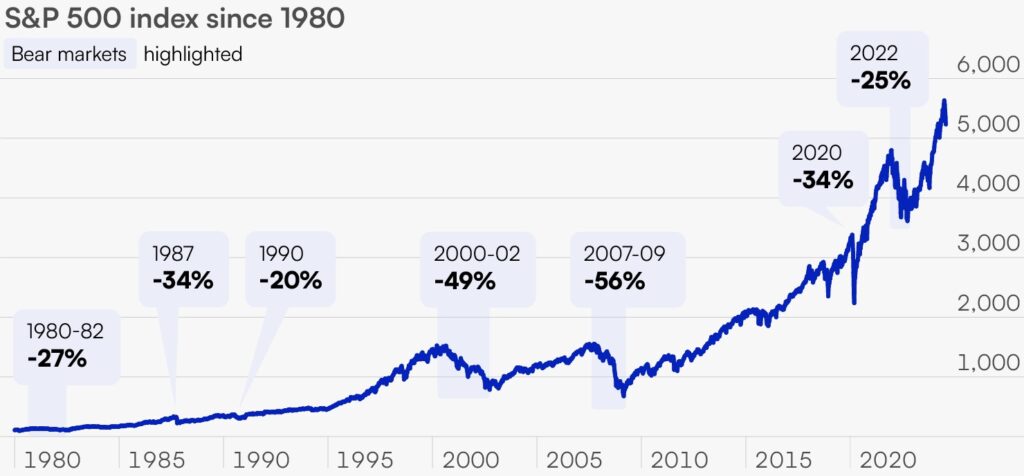

Honestly, there’s nothing to fear at this stage. Sure, for those of you who already have sizeable portfolios, the drop may seem scary – but that’s a feature of the market.

Sell-offs like this are a part of the journey we have to undertake as investors in the stock market. History shows us to expect a 10% market decline approximately once per year on average. We saw four corrections in 2022 and one in 2023. The S&P500 has been too bullish this entire year, which is also what I’ve been pointing out in my Instagram Stories – so I’m not surprised that this is beginning to pullback. If anything, the bullishness of the markets all through this year was making me start to worry, and I’ve confided in my closer investor friends for quite some time now that I was getting vibes reminiscent of the 2021 bull market right before the 2022 crash.

As investors, we’d want to be careful of recency bias as well, where we take recent history and assume that it’ll repeat. For instance, those who lived through the GFC drawdown and the 2020 pandemic crash could very well have fooled themselves into thinking “I’ll pull the trigger and start buying when the S&P falls below 34%” back in 2022. Except that it never did, and they missed the boat completely.

The same thing happened last night – with most stocks down between 3% to 20%, you would have missed the boat if you were waiting for more. Coinbase’s share price, for instance, fell 20% but climbed back up 18% within just 3 hours.

While I got a sense yesterday that it’ll rebound quickly – and I ended up being right, but it could have turned out the other way as well. No one really knows.

For us long-term investors, days like these represent an opportunity to buy the stocks that we haven’t been able to get our hands on. These are the equivalent of a sale in the stock market, so as a net buyer of stocks for long-term gains, this is where we start shopping.

I don’t know about you, but I had quite a number of BUY orders filled up in the last 2 trading days alone – if you’d like to find out what they were and why I invested in them, click here to read my full thesis on each position.

This is what happens when you try to time the markets

If anything, the recent spate of events serve as a good reminder that it is foolish to try and time the markets. Let’s take a quick look:

Day 0 (Wednesday): The Bank of Japan announces that they’ll be raising interest rates to 0.25%, with more hikes potentially to come. Nothing happens in the markets.

Day 1 (Thursday): The Fed gives its clearest signal yet that rate cuts could come in September (17 – 18). Markets spike up. Retail investors buy in, worried they’ll miss out on an incoming rally.

Day 2 (Friday): US jobs data report drops, reveals weakness and a 4.3% unemployment rate, its highest in 3 years. Markets slide, NASDAQ drops 10%.

Day 3 (Monday): The Nikkei abruptly free-falls close to 15% and sends Asian markets sliding down. Investors get spooked by recession fears. The yen carry trade starts to unwind. The VIX spikes to its highest levels not seen since the 2020 pandemic and 2008 GFC. US markets open red, but regain ground before the trading day ends.

We’re now on Day 4 (Tuesday) and most stocks have recovered some ground. The US markets just opened, and my app is now showing a mostly green market for US equities right now.

It’s a great reminder that no one can consistently get market timing right. Any attempt to do so would be futile.

We’ll be better off focusing on companies fundamentals instead – that includes building our watchlist (for discount days like yesterday), looking for companies that consistently demonstrate or outperform profitability metrics, and evaluate for margins of safety before we enter.

Invest in good stocks, and let the markets do its thing.

Stay safe, and let’s invest better.

With love,

Budget Babe