NAHB’s Cost of Housing Index (CHI) highlights the burden that housing costs represent for middle and low-income families. In the second quarter of 2024, the CHI found that a family earning the nation’s median income of $97,800 must spend 38% of its income to cover the mortgage payment on a median-priced new single-family home. Because a typical existing home in the second quarter was more expensive ($422,100) than a typical newly built home ($412,300), the CHI for existing homes was higher, at 39%.

Low-income families, defined as those earning only 50% of median income, would have to spend 77% of their earnings to pay for a new home and 79% for an existing one.

The latest results reveal that affordability has worsened for existing homes. A typical family needed 39% of its income to pay for a median-priced existing home in the second quarter, up from 36% in the first quarter. A low-income family needed 79% of its income vs. 71% in the previous quarter. In contrast, the CHI and low-income CHI for new homes remained unchanged between the first and second quarters of 2024, at 38% and 77%, respectively.

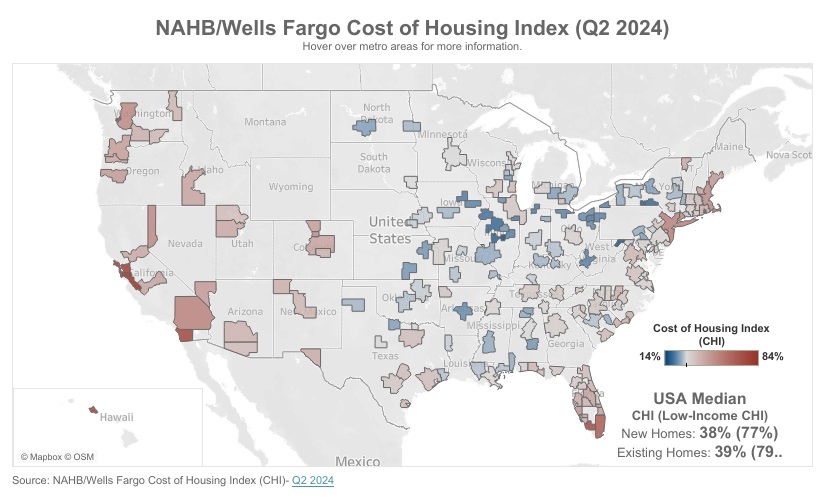

Additionally, CHI is produced for existing homes in 176 metropolitan areas, breaking down the percentage of a family’s income needed to make a mortgage payment in each area based on the local median existing home price and median income. Percentages are also calculated for low-income families in these markets.

In 14 out of 176 markets in the second quarter, the typical family is severely cost-burdened (must pay more than 50% of their income on a median-priced existing home). In 89 other markets, such families are cost-burdened (need to pay between 31% and 50%). There are 73 markets where the CHI is 30% of earnings or lower.

The Top Five Severely Cost-Burdened Markets

San Jose-Sunnyvale-Santa Clara, Calif. was the most severely cost-burdened market on the CHI during the second quarter, where 94% of a typical family’s income is needed to make a mortgage payment on an existing home. This was followed by:

• San Francisco-Oakland-Berkeley, Calif. (79%)

• San Diego-Chula Vista-Carlsbad, Calif. (76%)

• Urban Honolulu, Hawaii (76%)

• Naples-Marco Island, Fla. (74%)

Low-income families would have to pay between 147% and 188% of their income in all five of the above markets to cover a mortgage.

The Top Five Least Cost-Burdened Markets

By contrast, Decatur, Ill., was the least cost-burdened market on the CHI, where families needed to spend just 15% of their income to pay for a mortgage on an existing home. Rounding out the least burdened markets are:

• Cumberland, Md.-W.Va. (17%)

• Springfield, Ill. (18%)

• Elmira, N.Y. (18%)

• Peoria, Ill. (19%)

• Binghamton, N.Y. (tied at 19%)

Low-income families in these markets would have to pay between 30% and 39% of their income to cover the mortgage payment for a median priced existing home.

Visit nahb.org/chi for tables and details.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.