I have known Josh for nearly 15 years.

Despite his writing in public that entire time, hosting two weekly shows on our YouTube channel, and showing up on CNBC three times a week, you don’t know him. Public persona aside, he is surprisingly private. I know him as well as anyone besides Sprinkles and maybe Batnick.

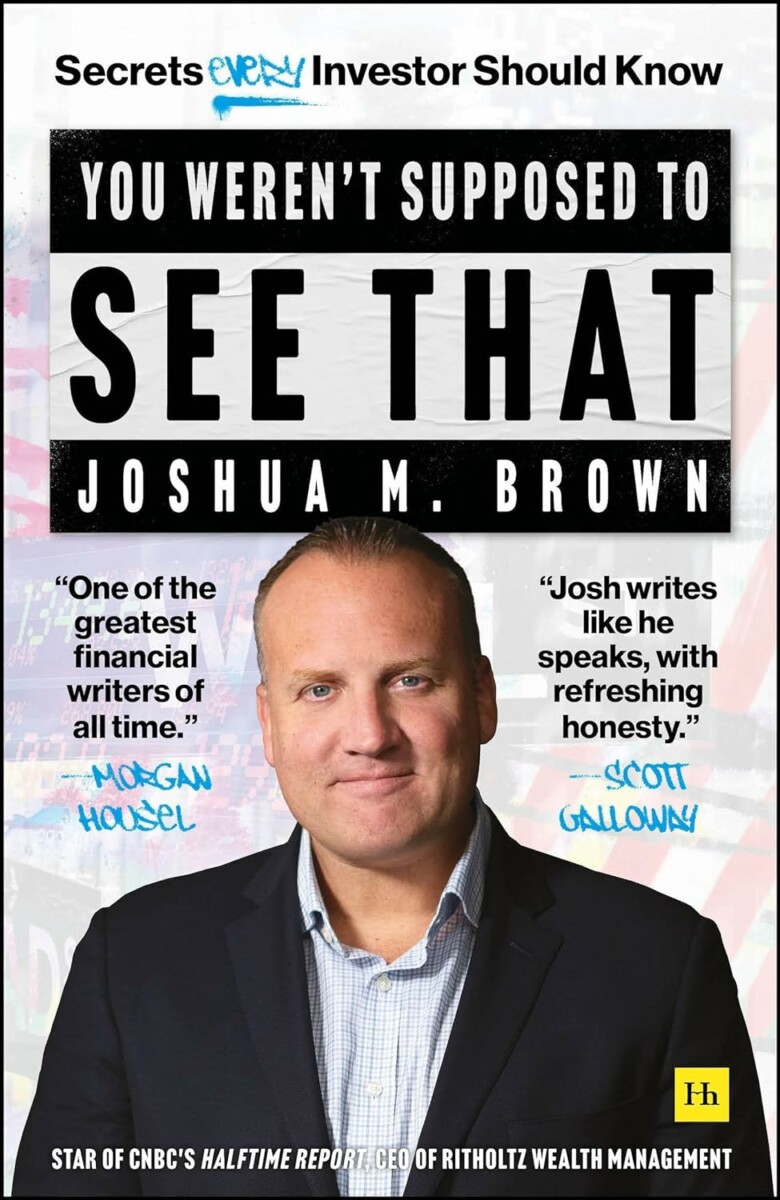

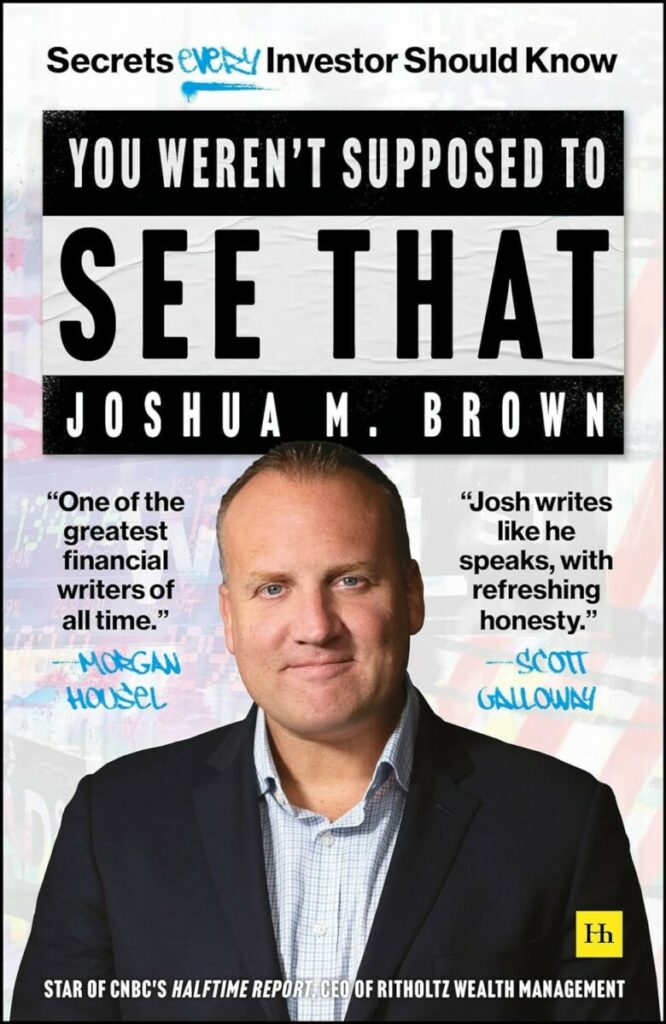

I am going to share three things about Josh that you don’t know. I’m comfortable outing him because he already outed himself in his fabulous new book, “You Weren’t Supposed To See That.”

It’s unlike any other finance (fin-nance?) book I have ever read: Compulsively devourable, beautifully written, and quite revealing.

Rather than write a straight up review, I’m going to use quotes from his book as an excuse to share three things about my partner you should know.

1. He is an extraordinary historian of Wall Street and the financial services industry:

There are few people that have a better understanding of this industry than Josh. Not just because of his personal experiences as a stockbroker or an advisor, or as a manager of once a brokerage firm and now an RIA – but because of his deep curiosity about what makes this industry tick.

He sees what others miss – he dives into the data, understands the personalities, and is an astute student of human behavior. All of that comes through in the book.

In the chapter “When everything that counts can’t be counted,” he explains why buying ever more expensive stocks is both the key to outperforming — and why no mutual fund manager is capable of doing it:

“You don’t go home to Greenwich from your Park Ave office in a good mood when the market makes it a point to remind you of how vestigial your skills have become day after day.”

He explains the impact of free capital, the subtle shift from value to growth, away from hard assets and towards intellectual property.

But it’s the data that drives how changing business strategies impact our understanding of market behavior. From “The Relentless Bid” comes the first explanation that resonates as to how and why the market’s character changed so much in the 2010s:

“Morgan Stanley wealth management took in a massive $51.9 billion in fee only asset flows for the full year 2013; 37% of Morgan Stanley wealth management’s total client assets are now in fee based accounts a record high.

Bank of America Merrill Lynch’s wealth division had similarly astounding results: $48 billion in flows to long term AUM in 2013; the brokerage reported that 44% of its advisers had half or more of their client assets under a fee=based relationship.

Wells Fargo Advisors said at the end of 2013 it had $375 billion in managed account assets, roughly 27% of the $1.4 trillion in total AUM…”

As he observes, it wasn’t the shift from active to passive – that had been ramping up for decades – rather, it was the changeover from transactional commission business to a fee-based fiduciary model that made all of the difference.

Josh shares even deeper insights into the investing industry, in “8 Lessons from Our First Year.” We were all a little overwhelmed in year one, but he was clear-eyed about the challenges ahead. This also gets reflected in his presentations on Wall Street – if you ever get a chance to see one, Don’t-Walk-Run to be in that audience. Not only are his decks hilarious, but you will leave so much more informed about this industry than you can imagine.

2. Josh has one of the highest EQs of anyone you’ll ever meet. (This matters a lot).

This manifests in a couple of interesting ways: First, he has zero tolerance for bullshitters, charlatans, assholes, and anyone trying to separate honest investors from their money. (We all share this trait in common). But he has an uncanny ability to see into people’s souls and judge them for who they really are deep down inside.

This is an enormously helpful skill when you are hiring people. I’ve lost count of the number of times that 30 seconds into an interview, I’ve gotten a side-eyed glance from him that says “Loser. I’m out.” It’s uncanny. Over the years, I’ve learned to trust his instincts as he has invariably been right.

Second, his EQ is revealed in who he is willing to trust: Guests he has on The Compound & Friends, the affiliates we associate with, and various firms we do business with.

“In every market moment, there is one man – and it is always a man – who is deified by his peers and the media; an anointed one in every sense of the term. His every word is hung on, his pronouncements are the day’s discussion, his off-the-cuff remarks become the business press’s front page headlines the following day. David Tepper now occupies this place in the firmament, wholly and completely…

All of his insight into who is worthy of your time (or not) is on display in the book; oh, and he names names:

“David Tepper is becoming today’s Hedge Fund God. He’s younger than Soros and Cooperman, less cantankerous than Loeb and Icahn, can claim higher returns than Einhorn and Ackman, carries none of the regulatory taint of Steve Cohen, and has all of the garrulous authenticity that almost none of his peers possess when in a public setting.”

I can get starry-eyed about somebody’s big media profile or history at legendary firms like Goldman Sachs, Merrill Lynch, or Morgan Stanley. He suffers from none of that. If you are worthy, he lets us know; if you are an asshole, you cannot hide from him.

“Hard pass, next candidate.”

3. He is an anguished poet, not a finance bro.

This is the deepest, darkest secret I am sharing with you today. And it’s his worst-kept secret, because all you need to do is read the beautiful, elegant prose that flows from his pen. It is not merely the insights but his eloquence that is unmatched in financial writing. Ignore the Long Island accent and the TV persona – just read the words he writes.

From The New Fear & Greed:

“Livermore had rivals and counterparties you saw as the enemy, but it was small and it was close quarters. A knife fight. This thing today is nuclear war. No survivors. It’s a Squid Game event on a global scale. Millions of nameless, faceless strangers in an online environment that literally knows no spatial or geographic limitations. It’s an environment in which the wealthiest most successful players like Chamath and Steve Cohen could be publicly—daily—accosted by the mob throwing fistfuls of horseshit at them from the alleyways. I don’t know if the heuristics Livermore played the game by would be so easily applied…”

Brutal honesty.

To really see where the poet flourishes, check out the shortest chapter in the book: “I Did Everything I Was Supposed To Do.” Rather than reiterate the active versus passive debate, he tells the story from the perspective of the losing side of that debate, the real person who is getting steamrolled by the Relentless Bid:

“I could explain how people don’t care about the opportunity to outperform by 100 basis points every year. How the SPIVA scorecard calls us assholes every 90 days. So do the bloggers, but they don’t wait 90 days, they just go in all day long. I could tell her how all the brokers that used to sell our funds switched careers, they’re all financial advisors now, they don’t send client money into anything they might have to defend. Cover your own ass. No one ever has to defend an index. It’s an absurd proposition. It’s like having to defend the weather. Nobody ever has to answer for the weather. The S&P 500 is the weather…”

Most of us don’t think about the poor bastard on the other side of our trades, calling his wife to tell her he just got sacked. Josh does.

~~~

Do yourself a favor, and get yourself a copy of this book. Read it slowly. You won’t regret it.