We’ve had a good run with the amaze card, which was THE best overseas card to use for anyone wanting to earn miles but yet unwilling to pay 3% – 3.5% of extra fees (on top of lousy bank exchange rates). Locally, the amaze card was also a great way for us UOB cardholders to circumvent UOB$ merchants (which offers discounts but with the trade-off being a terrible rewards earn rate).

As of yesterday, 1 October, UOB has officially nerfed the amaze hack.

DBS first did this in 2022, and now UOB is the next kid on the block to follow suit.

But all is not lost.

There remains a few options that we can still use to pair with the amaze card, namely:

- Citi Rewards

- OCBC Rewards / Titanium

Both cards will still yield you 4 miles per dollar (mpd) and here’s how you can use them.

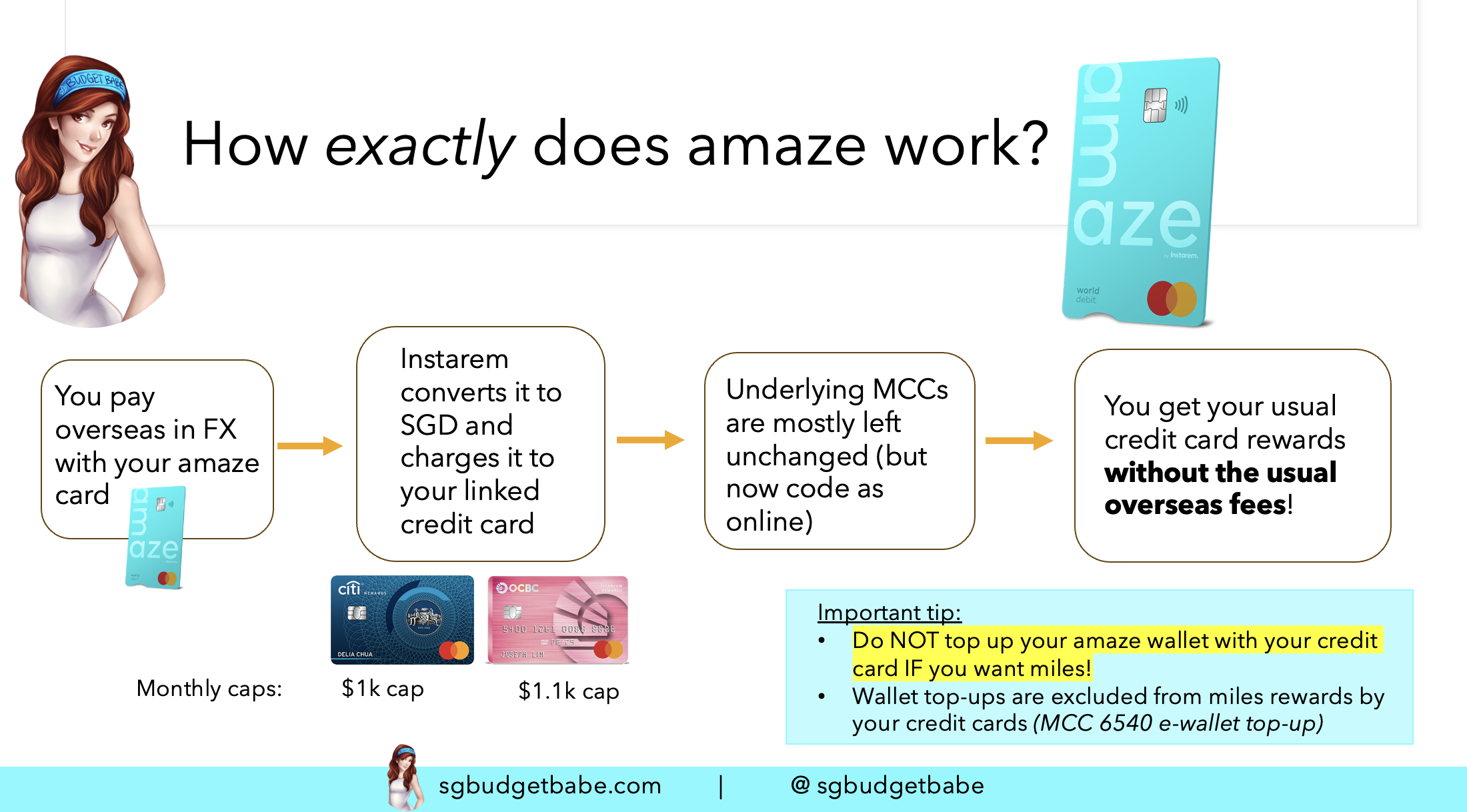

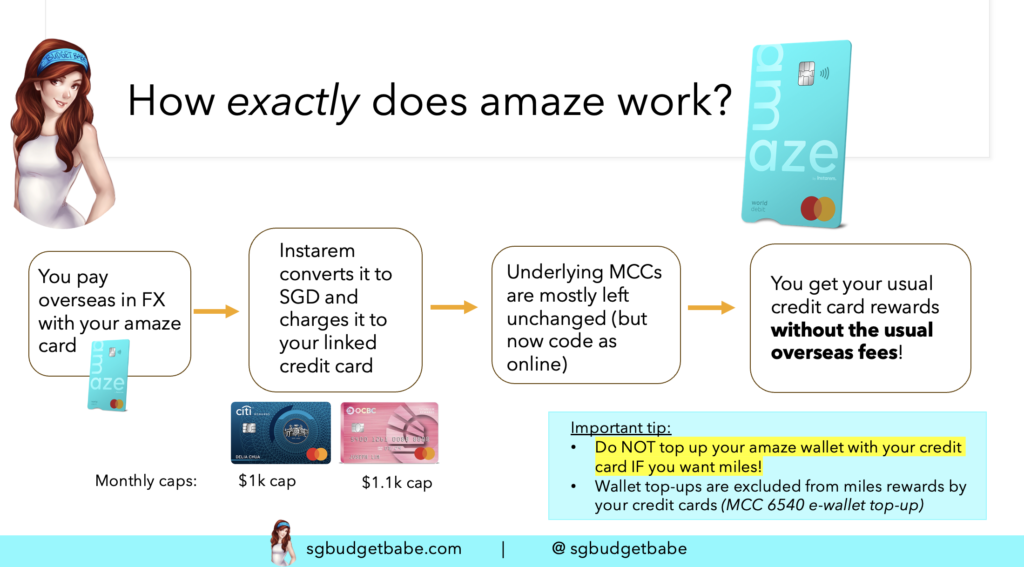

Note that when you pair your credit cards with amaze, it let you save on the FCY transaction fees but since amounts are converted into SGD, your rewards will be based on the local SGD earn rate instead.

Between paying the ~2% markup on amaze and earn at the local mpd rate, vs. paying ~3.5% in FCY conversion fees and a lousy exchange rate for overseas mpd earn rates, the former is mathematically a better option.

Click here to read about pesky FCY fees when you use your credit card to pay abroad.

Using the naked Citi Rewards card on its own will only give you 4 mpd for online transactions. Unfortunately, this meant that tapping your physical card and using mobile in-app payments (Apple Pay, Google Pay, Samsung Pay) would not qualify.

But there’s a loophole: you can simply link your Citi Rewards card with amaze, and tap your amaze card or use it to pay with your mobile in-app payment.

This allowed Citi Rewards cardholders to earn 4 mpd on even local spend, such as in-person dining, groceries, shopping and transport (e.g. taxis and ride-hailing).

Amaze converts all transactions into online spend, which means that when paired with the Citi Rewards Card, you can earn 4 mpd – capped to your first S$1,000 per month.

The only exception is for travel-related transactions (such as air tickets, hotels or rental cars), which are specifically excluded from earning the 4 mpd rate by Citi.

OCBC Rewards x amaze

Note: The former name is OCBC Titanium, if you’re a legacy cardholder like me.

OCBC Rewards gives 4 mpd for certain shopping-related transactions like department stores. Pairing it with the amaze card then makes it a perfect combination for paying at overseas departmental stores – such as Lotte Duty Free, or even shopping merchants such as Lululemon or Louis Vuitton – whenever we travel.

I’ve used this combo to earn plenty of miles on my US and Korea trips, for instance.

The only thing you gotta watch out for is to make sure the shopping merchant you’re spending at falls under the whitelisted list or categories for your OCBC Rewards cards. For instance, you might be inclined to think that you’ll earn 4 mpd with this card when you sohop at IKEA, Best Denki, Courts or Harvey Norman…but that’s not the case.

Don’t have the amaze app (or card) yet? Sign up here to get yours!

Workaround solutions for overseas spend

The simplest way to deal with this would be to use the following cards in this order:

- amaze x Citi Rewards: for almost everything except travel-related transactions (so don’t use this to pay for your hotel or train tickets!)

- amaze x OCBC Rewards: for all my shopping (make sure you check that the merchant is not within the exclusion category first!)

- Your best general spending FCY card, such as the UOB PRVI Miles (2.4 mpd) or DBS Vantage (2.2 mpd).

If you want to maximise your miles further, you could also consider adding these 2 cards into your stack:

- UOB Visa Signature Card: if you can hit at least S$1,000 in FCY in that month. Note that this card is only for the richer folks, due to its min. income requirement of $120k to apply.

- Maybank World Mastercard: only if you can clock a min. of S$4,000 per month, for an uncapped 3.2 mpd on FCY spend

I personally wouldn’t bother, since I don’t travel often enough or spend that much in FCY each year to justify the extra hassle of getting 1 – 2 more new cards just for this workaround. However, if you travel often for work or holidays, and you’re rich enough to meet the minimum income threshold or hit the minimum spend, then this might be worth considering.

Youtrip vs. amaze: which is better? Click here to read! Spoiler: amaze for miles, Youtrip if you don’t care about earning rewards or you tend to use cash while overseas.

Is the amaze card still worth keeping?

For now, my answer is still a yes – I won’t be cancelling my amaze card yet. There isn’t a strong enough reason to do so, since you can use it with Citi Rewards and OCBC Rewards to still clock $2,100 and get 8,400 miles each month.

The issue is that I used to rely heavily on the amaze x UOB Lady’s combination to pay for all my overseas food and drinks, as well as the amaze x UOB Krisflyer pairing for any big ticket spending or my leftover expenses once my other spending caps have been hit. These will no longer work from now.

We’ve had a good run with amaze, and it’s worth keeping an eye out to see if any banks get inspired to follow UOB and DBS in their treatment of amaze.

The worst nerf that could happen next would be if Citibank decides to nerf amaze too. If that takes place, then it might very well kill off amaze, which will leave us consumers worse off.

I certainly hope not.

With love,

Dawn