Most of us already know by now the importance of outsourcing our biggest financial risks in life i.e. to an insurer. However, the dilemma as to what to buy and from who still remains a puzzle, especially when the information remains mostly opaque, and the benefits and terms of policies keep changing over time.

The situation today

Everybody understands the importance of insurance, but most people just don’t like the buying process because of fear of being oversold, pressured, or misled. We have also gotten used to acquaintances calling us up out of the blue in the guise of wanting to “catch up”, only for the session to be a sales pitch to try and get us to buy insurance from them.

These are very real pain points of consumers today, often arising from the conflicts of interest due to the commission model of the industry. Unless an agent sells something to you, they don’t earn anything, so there’s always an incentive to get you to commit to a policy, especially those that pay a higher rate of commission.

Since 2014, I’ve long advocated on this blog that one should use insurance primarily for protection, rather than for savings or investment. What’s more, we ideally want to pay the lowest premiums possible while securing as much coverage as possible.

However, the problem is that not every insurance salesperson today shares these same beliefs. Not everyone joins the insurance industry wanting to protect lives and help people; some are in it for the money, while others are drawn by the incentives as seen on social media – think lavish lifestyles, usually in the form of a overseas trips for the adviser and their partner, business class flights or a new, shiny car.

Instead, agents who sell policies generating the most revenue for the company are the ones get rewarded and clinching MDRT, COT or even TOT titles*. Is it any wonder that whole life policies, endowment savings and investment-linked plans are repeatedly sold year after year to ignorant customers? The industry’s current business model rewards those who sell the most, but that can quickly line the agent’s pockets so they can give their families a better life, this can often come at the expense of the consumer.

MDRT = million dollar roundtable; COT = court of the table (3x MDRT); TOT = top of the table (6x MDRT).

Many consumers do not realise that even though they get “free” financial advice, the “advice” given to them is often swayed by commissions and layers of sales incentives that they are not privy to (read this post to understand). The outcome is that unbeknownst to them, the vast majority of consumers end up paying high fees over the next few decades on their subpar policies (thanks to the hidden and embedded commissions)…while still ending up with an inferior plan that does not fully cover their protection needs.

In recent years, paying an upfront fee for financial advice (i.e. the fee-paying model) has started to gain traction overseas. Countries like the UK and Australia now have a large number of fee-paying advisors, and over in the US, my friend Jeremy recently launched his insure-tech firm Nectarine, where you pay an average of $150 – $250 per hour to book licensed financial planners in the United States to get advice, particularly on insurance and investing.

However, in Singapore, the fee-paying model has yet to take off, and there is only one firm that practices this model: Providend.

Sadly, Singaporeans have gotten so used to getting “free” advice from insurance agents (who now go by the title “financial advisors”) that we are probably a few decades away before the commissions-model declines and fee-paying models become mainstream. Unfortunately, the “free” advice you get is not really free, because the salesperson is getting paid by the insurer, the broker, or the fund house benefiting from the policy; this commission is taken out from the money that YOU pay.

For as long as this model doesn’t change, then we consumers need a better way to be able to distinguish between the black sheep and the good agents. I’ve written here about some starter questions to ask your insurance agent, but even then, that’s hardly enough.

Is Havend the solution for better, unbiased insurance advice?

After my recent article where I revealed how insurance commissions can influence the “advice” that you’re getting from your agent, the folks over at Havend reached out to me for a chat and shared about their business model and philosophy.

In case you’ve never heard of Havend, they are formed by the same team that brought you DIYInsurance, which was Singapore’s first life insurance comparison portal started in 2014 (even before MAS launched compareFIRST). DIYInsurance gave consumers the ability to get the insurance they needed at a lower cost, without having to go through an agent, and the portal did very well before it was acquired by MoneyOwl, in a joint venture with NTUC Enterprise. The original folks behind DIYinsurance went back to Providend (the original “parent” company), and has now branched out as a subsidiary known as Havend.

I’ve worked closely with Providend, DIYInsurance and MoneyOwl on multiple occasions before, so I’m familiar with their work ethics and their philosophy towards insurance. So when the team at Havend invited me down to review their services for myself and give my feedback, I said yes.

And as it turned out, I enjoyed my experience so much that I’m now pleased to share I can wholeheartedly recommend you guys to go and check them out for a review, too.

Review: My experience with Havend

I’ve been managing our family’s insurance policies all this while, consulting with 3 trusted advisors-turned-friends every 1-2 years as I review our household coverage. As it stands, I’m usually the one proactively reaching out to them with my questions, or to ask for a review – especially each time we cross a new life milestone (such as when we became parents, or when my kids were born).

My insurance agents often tell me I’m one of their few clients who approach them for a review rather than the other way round, lol. It ain’t easy to gain Budget Babe’s trust, much less her business – given that my work exposes me to hundreds of insurance agents whom I could choose to work with at anytime!

Nonetheless, I was open to see what advice Havend’s insurance specialists would give me on our portfolio, so I went down for a InsureWell assessment to hear their professional opinion.

Prior to the session, I was asked to (i) go through a Goalsmapper analysis online, and (ii) fill up an Excel spreadsheet with details about our insurance policies. These were sent to the insurance advisor(s) assigned to our case to review before giving us any feedback or advice.

We opted for an in-person session, which started with an introduction to Havend’s insurance philosophy – one I was glad to see aligned very much with my beliefs. Then, they went into their 3 Ps framework: Purpose, and Payout vs. Premiums. I was asked about my Purpose(s) then for choosing the plan(s) we had, while Havend advised on the value i.e. Payout vs. Premiums.

After meeting with countless of agents who have tried to talk me out of term insurance (vs whole life) and convince me into getting an ILP (read: why I cancelled my ILP), it was a breath of fresh air to meet with Si Jin and Mike, who did not try to pull any tricks on us.

As someone who does most of my family’s insurance planning myself, it was reassuring to see that even the experts at Havend agreed with my approach and strategies. And even when we disagreed on the 3Ps for some plans – such as how our Personal Accident plans cost us double of what Havend could get for us on a different insurer – the specialists at Havend took the time to hear us out and agreed that there was a case for paying higher premiums as long as we were satisfied and getting value out of it.

For instance, while I’ve always known that putting our family under AIA’s Personal Accident plans cost us a lot more than if we had stuck with Sompo (which we had up till 2021), this decision was not made lightly – but we felt the higher premiums was worth it because our AIA agent is great at what he does, and has helped us claim for several hundreds of dollars every year without fail.Our AIA agent (Bran) takes the effort to follow our lives on social media and is often in the know when our children get ill or my husband gets into a bike accident. During a 2-week episode last year when HFMD struck both our kids and my husband, we were too frenzied to even remember that our PA plan covers for HFMD. If not for our agent, who messaged us to remind us to send him our medical receipts and filed the claims, we would probably have gone through the entire season without getting a payout…because we were too caught up to remember our entitlements. This is why we are willing to pay (a higher) premiums for our family’s PA plans, as long as it continues to be serviced by him.

The session mostly validated my thought process and financial planning approach, and I was also able to discuss my concerns with them as to whether we might be underinsured for critical illness coverage despite buying a few additional online policies to layer our protection in recent years.

All in a safe space, without any pressure to buy or look at new policies.

In fact, the recommendations were only sent to my email after the session.

How does Havend mitigate the conflicts of interest?

To be clear, conflicts of interest will always exist in the industry due to the nature of insurance sales. Even though Havend’s advisers are all salaried, paying a monthly salary alone cannot entirely eliminate conflicts if the employee’s variable pay depends on how much commission or annual premiums they bring in.

Hence, Havend has put together five controls to make sure that these conflicts of interest are strongly mitigated:

| Problem | Solution |

| Advisers may be tempted to sell expensive plans to you to earn more commissions | Focus on lives changed, not sales.

The adviser’s variable compensation is based on the number of lives they advise, and not on the commissions they bring in. |

| Advisers may be swayed to sell products that pay extra incentives in addition to earning commission. | Sales incentives are retained by the company and are not given to Havend’s insurance specialists to prevent any product bias. |

| Not knowing if the product being recommended is suitable or because it pays a lot of commissions. | Be transparent enough to tell you how much commissions they will receive from the plans recommended to you. |

| Without a clear planning philosophy to anchor on, you may end up buying policies not the most appropriate to your needs but one that pays more to the advisers. | A clear insurance planning philosophy: Havend publicly makes known why it considers certain insurance products suitable or unsuitable based on sound principles, and not on the commission amount the salesperson might receive. |

| No assurance if the best practices in insurance advisory is being carried out for you because advisers have full autonomy in how they run their advisory business. | Havend has institutionalized a process where every client receives the same advice, which ensures every piece of advice given is consistent to the company’s process and insurance philosophy, and is not dependent on the insurance specialist’s own preference. |

On top of that, they are offering a Money Back Guarantee; in the event that there is any overselling of insurance to you, Havend will offer a refund of the excess insurance premiums you have over-paid.

Should I go to Havend for insurance advice?

Over the years, many of you guys have come to me seeking insurance advice. Due to MAS regulations, my response has always been the same: I am not a licensed financial advisor and cannot give you licensed advice.

Some of you have asked me to join the industry, while others have tried to recruit me; this is a “no” for me because I feel that the value of the work I do here on my blog impacts far more lives than I can if I became an agent. I wouldn’t be able to write articles like this, this or this, for instance. My agent friends have also been told by their agencies or compliance teams to remove posts they made on their own social media, including content around which credit card is the best to use for paying your insurance premiums (my answer here).

After having gone through a Havend advisory session myself, I can wholeheartedly say that the advice given by Havend is the exact same that I would give to my readers.

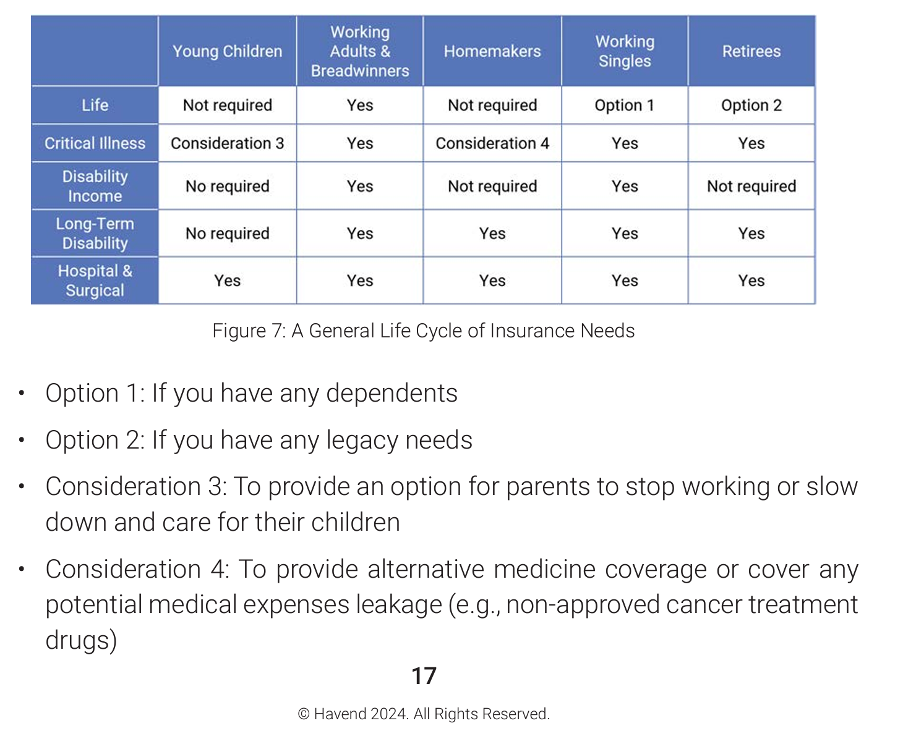

Their insurance philosophy first focuses on insuring us against 5 core areas of financial risks:

Followed by a discussion into your personal circumstances, needs and budget, so that you know what you should have or whether some plans are unnecessary. This follows the institutional framework adopted by their parent company, Providend, which mostly serves the wealthier groups as a trusted adviser to get a second opinion.

Today, at Havend, the average man on the street can now benefit from the same institutional advisory process.

When you choose Havend, you can expect

- a dependable insurance advisory experience and trust that you won’t be oversold.

- Get reliable advice on how to be adequately covered, without having to overpay.

The second point is a big problem for most consumers in Singapore, and while many agents are quick to point out to you about how being under-insured can quickly lead to financial ruin should a life crisis strike, fewer will admit to you that you might be over-insured.

Being over-insured also comes at a price – the premiums you pay are eating into monies that could have otherwise been invested for your future wealth or retirement.

So if you have any of these concerns, talk to the experts at Havend to get advice on your financial situation. They will critically review your insurance policies for you and give you their unfiltered take on whether it is worth it or not. And in the event that you disagree with they gave you or feel they oversold you into any policies, make use of Havend’s Money Back Guarantee (and drop me an email, as it determines whether I continue recommending them to my readers in future).

Havend was created to ensure you and your family are always sufficiently and suitably covered. Should you have any doubts or find yourself unsure about your insurance portfolio, I encourage you to reach out to Havend and get a second opinion on your insurance policies.

In partnership with Havend, you can use my referral code SBBTCL01 to get a complimentary InsureWell assessment.

You will also receive $20 cashback for every policy that you decide to purchased through Havend after the assessment.

Disclosure: This article was written in partnership with Havend, but they had no say in influencing my opinions stated here. In full transparency, you should also know that I stand to receive an introducer fee (affiliate) from the company in the event that you decide to purchase a policy through Havend’s advisors.

Editor’s note: I review and update my recommendations from time to time. If you go for a Havend InsureWell assessment and for any reason, feel that it was unsatisfactory, please email me with your feedback – this will help me to decide whether to continue recommending them to my readers. So far, my experience (and that of my friends) have been extremely positive, which is why I agreed to write this article and encourage you guys to check them out for yourself as well.