In this article, Anand Vaidya shares how his investment portfolio has evolved one year after he retired. Anand has written several articles for freefincal (linked below), and this is a sequel.

Opinions published in reader stories need not represent the views of freefincal or its editors. We must appreciate multiple solutions to the money management puzzle and empathise with diverse views. Articles are typically not checked for grammar unless necessary to convey the right meaning and preserve the tone and emotions of the writers.

If you would like to contribute to the DIY community in this manner, send your audits to freefincal AT Gmail dot com. They can be published anonymously if you so desire.

Please note: We welcome such articles from young earners who have just started investing. See, for example, this piece by a 29-year-old: How I track financial goals without worrying about returns. We also have a “mutual fund success stories” series. See: How mutual funds helped me reach financial independence.

I have already shared my financial freedom journey through this article: My journey: From Rs. 30 bank balance to financial independence. I decided to stop working in mid-2023, and I thought I should share my experience and plan for a safe and comfortable retirement. Probably a sort of follow-up to Pattu’s article on retirement income, Elements of a robust retirement portfolio.

Also by Anand Vaidya:

The objective of sharing this article is the hope that it will be of some use to those nearing retirement or provides a different way of doing thing than what is popular.

I benefit too, since my thoughts are clarified while writing in text form, rather than just seeing the numbers in a worksheet. I hope the comments, both positive and negative will be useful to me.

Here’s my current status:

- Since I managed my own business, the word “retirement” is probably not appropriate, just that I stopped accepting new business contracts.

- No lumpsum, pensions, gratuity received as part of “retirement” (self-employed, duh!)

- Retirement fully self-funded from accumulated retirement corpus.

- Income is needed only for me and my spouse, possibly for the next 35 years. Only son is working and independent.

- I have many interests, but I am not planning to earn anything from them.

- No loans or financial commitments such as children’s education, marriage etc

- Fully paid, self-occupied homes, other real estate, gold in the form of jewellery and miscellaneous assets are not included in this article. Only financial investments are considered.

Here’s my Retirement Income Plan:

Protection:

- No term insurance since we don’t need it

- Health insurance of Rs 11 lakhs through my son’s employer.

- I maintain a corpus dedicated for medical expenses. So I should be able to mobilise around Rs 15L/year for medical expenses without sweating. (I hope never to spend a dime on medical expenses, though!)

- I reserve about 1.5X in liquid funds for urgent medical or other needs. (to be topped up from equity gains, when there are outsized gains)

I feel that health insurance claims are an hassle and paying from pocket is simpler. I’d rather put the premium in my dedicated medical fund yearly and let the corpus grow. My focus and expenses have been geared towards preventive health care rather than post-disease treatment. And it seems to be working well so far.

My go-to method has been Regular testing, acting on test results, regular doctor visits and supplementation (B12 and D3), cleaning up food habits, regular exercise and a good sleep routine (can improve there). So far, it has worked out beautifully with our annual medical expenses for three < 20K – that too spent mainly on preventive lab tests and eyeglasses.

Also, I plan to take a floater super top-up of 50L to 1Cr soon. This one has been pending for quite some time.

Expenses: After my son completed his education and started working in another city, some of our expenses have reduced (college fees, petrol, books, clothes, travel costs, extra courses, digital gadgets etc)

I noticed that the grocery expenses which should have gone down by 33% has either stayed the same or slightly increased. Food inflation, maybe? More premium products? Probably.

The biggest expense that rose post-retirement was travel, due to the ample availability of another expensive resource: time. More money is spent now on travel, books, gardening tools, seeds and saplings.

I keep two numbers for expected expenses.

- Normal Expenses: Spend freely without any restrictions. This will be referred to as “X” in this article, and all my planning is based on this number.

- Crisis Mode Expenses: These could be activated when a crisis such as COVID-19 or 2008 hits, and we need to curtail expenses and take all the losses that the equities will deliver.

My estimate for this number is about 65% of Normal Expenses. Quality of life expenses are retained, but we will either reduce or eliminate the following expenses (temporarily):

- Travel.

- Capital Gains Tax. (No MF redemptions.)

- Gifts and charitable donations.

Inflation and Returns Expectations:

Average inflation ~ 6-7%, with some categories at much higher rates. (Medical, replacement of large equipment such as treadmills, fridges, Solar system parts, in-person services, travel etc)

Returns expected from Debt at 5-7% (Currently at 8.9% with Debt MF)

Returns expected from Equity: 10-12% but all calculations done with 8-9% only (Currently at 23% 2020-2024)

Planning Retirement Corpus:

The goal is to invest sufficiently for both current income and future growth, maybe even leave behind a good amount to the inheritor.

I realised that rules like 30:70 or 40:60 (Equity:Debt) are not very useful. The dilemma I faced is, if I pick a random E:D pair:

– I could underperform (too little equity where I have the capacity to take on more risks) or

– I might be taking on too much risk (equity) and could be hit during a market crash

I experimented with various E:D ratios and bucket strategies in Excel but settled on my own plan, which I am comfortable with.

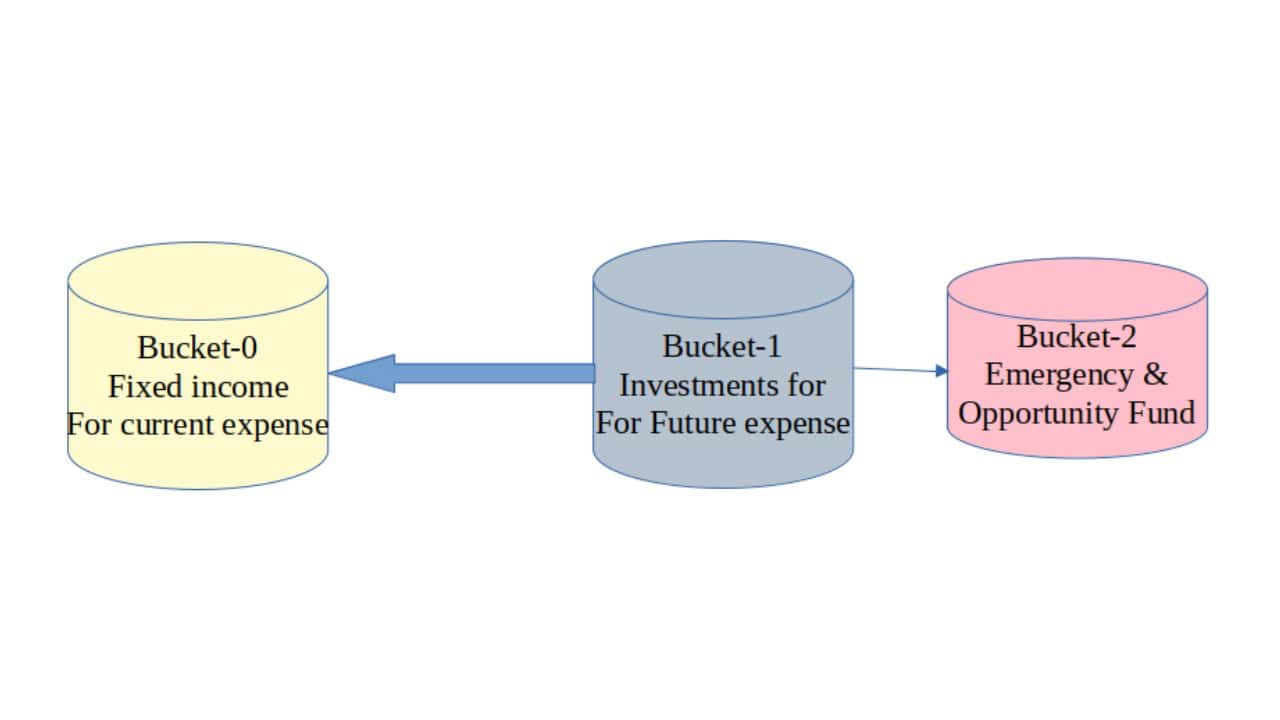

I chose a very simple three bucket strategy as follows, instead of the more extensive bucket strategy suggested by Pattu: How to create retirement buckets for inflation-protected income.

I have allocated my pile of money as follows:

|

With “normal” annual Expenses being= |

1X |

| Emergency and Medical fund (no return expectations (Kotak BAF @17%)) | 4X |

| Liquid Cash aka Opportunities fund (no return expectations (UST funds @7%)) | 3X |

| Debt component for regular income (7.6% for the next few years) | 33X |

| Equity component for future growth (Min 8-9% returns expectation) | 31X |

| Total | 71X |

Note:

Debt: Investment that generates income includes FD, NCD, Gov/RBI Bonds and also Conservative Hybrid funds but excluding Emergency and Opportunity funds

Equity: I fix my requirement for Debt and invest whatever is leftover in Equity, as seen in the table above. Equity investment primarily for growth and topping up of Income & Emergency buckets,

Equity funds include index funds (Midcap, smart beta), BAF, Aggressive Hybrid and Flexicaps. I count all hybrids that suffer equity taxation as pure equity funds. My Equity PF is dominated by Largecap and zero smallcaps.

Some Ratios: 45% Equity, 55% Debt . My comfort level is between 40%-50% equity. Probably will move towards 50% Equity in the next few years. (Is that number affected by the current bull-run euphoria??)

- Ratio of Largecap to Midcap: 70% : 30%

- Ratio of Financial: Physical assets: 60% : 40%

So you can see that my Equity portfolio is quite conservative, though one would think the allocation to Equity is a bit too high (at 45%), however, hybrid MF schemes have lower equity holdings and my BAF investments are 50% less volatile than pure equity funds.

Reducing Tax Outflow:

Since the corpus is shared between me and my wife, potentially, we can derive tax-free income as follows:

- Debt: 7Lakh+7Lakh at slab rate

- Equity: 2×1.25Lakh (the exemption offered by ITDept for equity) ie at least Rs16.5L is available tax-free thus earning the full coupon rate.

- Tax-free bonds, adds to this tax-free base income

Some necessary redemptions from liquid Debt MF get added to the slab-rate taxation.

I pay tax without grumbling on whatever income exceeds the tax-free limits, while trying to minimise unnecessary redemptions.

PPF interest, miscellaneous insurance policy bonus (accrual only) add to this income but are not considered in any calculation.

Substantial portion of debt component invested in Gilt and Conservative Hybrid are anyway taxable only upon redemptions and hence tax hit only when redemption is needed.

The excess leftover from fixed income interest/coupon received is directed at further equity investments, and occassionally debt. I don’t have strict rules on rebalancing or Equity:Debt ratio for this. Probably E:D 50:50 is what I am comfortable with.

Further Comments: What helped the corpus’ accelerated growth is definitely the post-covid bull run. And I did make up for the lost time (not much invested until 2015) by aggressively investing during 2020-2023. I have slowed down only in CY2024. I ran out of money

I have done calculations for 40 years (2011-2050) assuming realistic inflation numbers ie. whatever inflation we experienced during 2011-2023 living in India.

My equity is largecap dominated, about 70%. Midcap is about 30%. Whatever negligible smallcap stocks exist, they do so in the flexicap funds (about 2%)

I have exited Smallcap funds (Franklin Smaller Co. and Kotak Smallcap) and not very keen on holding SC funds after reading Pattu’s articles. E.g.:

We plan to live on the returns generated and leave behind a corpus for our son and his family. With an instruction to donate about 50% to charity after we pass away.

I am also expecting to shift home atleast once, change the car twice during my retirement.

Currently, about 8-10% of expenses are charitable donations. I hope we can keep up the rate.

List of my favourite charities:

Let me take this opportunity to list my favourite charities:

1. Akshayapatra: mid-day meals for kids (ISKCON)

- Usha Kiran Charitable Trust: performs free eye surgery for kids from poor families.

- Veda Shastra Poshini Sabha: Support Sanskrit students

- Nele Foundation: Supporting destitute girl children (education & residence)

- Smaller temples that have no source of income

- Occasionally, Armed Forces (Flag Day, Bharat Ke Veer, Army Welfare Fund Battle Casualties, warwounded.org etc)

Please consider donating if you are financially well off. You can pick from the above list or maybe you have your own favorite charities…Do share their names.

Lessons Learnt:

- I log all my expenses in a spreadsheet by category (food, junk, internet/mobile, taxes, utilities, etc.). It hardly takes 30 seconds per day. It has helped me immensely in reviewing past expense trends, where to cut (junk food, income tax), and also predicting the expenses that will go away(school fees), those that will persist and whether specific cateogory will increase (travel etc) or reduce (petrol). And most important: I know my personal rate of inflation, by category.

- It is wrong to think expenses in retirement will reduce drastically, no, it may actually increase due to frequent travel and spending on hobbies.

- Investing aggressively in equity during sharp falls (2015, 2016, 2020, 2022, 2023 for me) helped increase the total corpus aided by the subsequent sharp rise in markets. When the bull-run comes, stay calm and ignore the noise. Stay invested. Don’t watch TV or influencers or join telegram/WA channels.

- Exiting Smallcap and reducing Midcaps reduced my potential returns but I guess also reduces my risk levels and increases peace of mind.

- We need to dig deep into retirement planning, customise our investments to suit our situation, and temperament. Read a lot atleast 3-5 years ahead, build worksheets and models and see how comfortable you feel, considering your own situation.

- The portfolio needs to be long term, low maintenance and should have a good balance between current income generation and future growth. Maybe, we will not have the capacity to do Excel wizardry in our 70s/80s, so a low maintenance portfolio will help a lot.

- Avoid all unnecessary products such as IPO, NFO, ULIP, Insurance-for-income, trading, direct stocks, sectoral, thematic and hyped-up MF schemes. Buy only well regulated products (rules out crypto, P2P, teak farm etc)

- Investing in US Equities has been disappointing when compared to Indian equities due to stupid government rules, so-so returns (about 15%), tax policy changes etc. Probably will avoid in future, thankfully, I have no investments in global/Europe or China funds

- High income and reasonable savings rate (>50%) can get one to FIRE safely. So young people should focus on improving skills and increasing income and lead a comfortable life rather than penny pinching and feeling sad later in life about not having lived well in their younger years. Most young people are distracted (Instagram, Whatsapp and other irrelevant apps) sadly.

I appreciate you spending time to read my article and please send thoughtful responses. I really appreciate it.

Reader stories published earlier:

As regular readers may know, we publish a personal financial audit each December – this is the 2022 edition: Portfolio Audit 2022: The Annual Review of My Goal-based Investments. We asked regular readers to share how they review their investments and track financial goals.

These published audits have had a compounding effect on readers. If you would like to contribute to the DIY community in this manner, send your audits to freefincal AT Gmail. They could be published anonymously if you so desire.

Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle!

Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle!  & join our community of 7000+ users!

& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

Podcast: Let’s Get RICH With PATTU! Every single Indian CAN grow their wealth!

You can watch podcast episodes on the OfSpin Media Friends YouTube Channel.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit ‘reply’ to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Most investor problems can be traced to a lack of informed decision-making. We made bad decisions and money mistakes when we started earning and spent years undoing these mistakes. Why should our children go through the same pain? What is this book about? As parents, what would it be if we had to groom one ability in our children that is key not only to money management and investing but to any aspect of life? My answer: Sound Decision Making. So, in this book, we meet Chinchu, who is about to turn 10. What he wants for his birthday and how his parents plan for it, as well as teaching him several key ideas of decision-making and money management, is the narrative. What readers say!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. – Arun.

Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: letters {at} freefincal {dot} com (sponsored posts or paid collaborations will not be entertained)

Connect with us on social media

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)