It’s November!

Had you noticed?

That means so many things, so many changes. It’s the onset of The Golden Quarter, aka Fourth Quarter Holiday Retail Season when an inexplicable sense of panic and social obligation separates consumers from their gold.

It’s the beginning of what traditionally has been the kindest season for stocks, with higher returns and lower volatility than in the warm months.

It’s the end, please dear Lord, of the presidential election season.

And it’s the beginning of festivity. The days shorten, our time outside contracts, the weather cools, and travel shifts toward family gatherings. For much of human history, it’s the beginning of a dark and uncertain chapter in the story of the year. In the face of this, historically we have chosen to gather and rejoice rather than to withdraw into ourselves. It’s a healthy impulse. Perhaps our healthiest. And so, Chip and I, in November plan trips to New Orleans and Minneapolis, and in December trips to see family. We will find cause to celebrate the simple delight of being together. And, of being with our families, crazy though they are. And, of good food.

We hope you do likewise.

In this issue of the Observer

Our colleague Devesh has moved to a new role: Writer Emeritus. More on that below.

Our colleague Lynn Bolin shares two essays this month (and a thousand thanks for them!). The first, “Living Paycheck to Paycheck,” draws on Lynn’s experience working with the non-profit Neighbor-to-Neighbor that seeks to help people navigate the financial consequences of loss of employment, unexpected health issue, divorce, loss of a loved one, rent inflation, or an accident. It offers suggestions on how to manage expenses and stress. The second, “Top Performing Multi-Cap Core Funds,” tries to help you answer the question, “How simply can we invest without getting too simple?” An excellent question! Lynn has chosen to focus much of his portfolio on three multi-cap core funds, just as I’ve invested in two flexible portfolios ones. Lynn helps folks understand the differences between such funds and how to assess the best.

I share the first take on two new funds. AlphaCentric Real Income Fund is, in theory, a name change for their three-year-old Strategic Income fund. It appears to be far more than that with a new management team (CrossingBridge), a new focus (on real estate and real property securities), and a new primary investment strategy. Given CrossingBridge’s record, it’s worth discussing.

Bridgeway Global Opportunities is a more complicated story. Bridgeway is a purely quant fund manager in Houston with an entirely admirable culture (50% of their profits go to charity, everyone at the company invests in their funds, their founder’s salary is tied to his lower-paid staff, they’re obsessive about minimizing the expenses borne by their investors) but a distinctly inconsistent performance record. A lot of that is driven by a combination of distinctive funds (Ultra Small Company invests in the smallest of the small companies and closed hard after drawing its first $27 million) and unwavering discipline (“value” means “deep value and no wavering when the market hates it”). They’re excited about Global Opportunities, which will be a global market-neutral fund that draws on decades of success that lead manager Jacob Pozharny had at QMA and TIAA.

And, as ever, The Shadow notes a raft of new ETFs and fund-to-ETF conversions from major industry players, a new wave of closures to new investment, some strategic repositioning of funds, and only a handful of liquidations. All that, and more, in Briefly Noted.

Devesh’s farewell

Our colleague Devesh Shah has been (nominally) retired for several years but has remained active – both intellectually and with the financial community – throughout that time. His keen intellect and good judgment have remained in demand and this past month he received an offer that he couldn’t refuse. He has agreed to join the Equity Risk Management team at Millennium Management, a $69 billion hedge fund manager that has one strict rule: “Don’t lose money.”

One understandable consequence of his decision to join them is that he must necessarily leave us. Devesh asked that we share these parting reflections with you.

The arrival of an appropriate professional opportunity in the financial sector motivated my intellectual interests and I have started work in New York. I will not be able to contribute further monthly columns.

Writing for MFO has been a rewarding endeavor for me. I’ve learnt a lot from the reader community, from the many contributors on the discussion board, and from those who chose to write me privately. Along with this healthy reader feedback, support from various fund managers, from David Snowball, and Charles Boccadoro was the oxygen needed to serve as your columnist. For this I am grateful.

On the auspicious day of Diwali, the Hindu festival of lights, I wish you all good luck, health, and prosperity.

We wish him, his new firm, and his investors the greatest of good fortune. Those curious about the firm might enjoy the Wall Street Journal’s September 2024 profile of it, “The Giant Hedge Fund That Hates Risk and Still Wins” (paywall).

Reaching beyond the printed word: MFO in pod and graphics?

One of Devesh’s final discoveries with us was the presence of an AI app that could turn essays into podcasts. Not “the app reads your text aloud” podcasts but “two lively young hosts who discuss arguments in your essay, banter about and occasionally add their own examples” podcasts. Devesh’s thought was that people often listen to podcasts at times when they can’t read: while at the gym or walking, for instance.

Chip, not to be outdone, introduced me to Napkin.ai, an app that converts articles to graphics.

Dear Lord.

Help us figure out whether the spoken word (in the format of an AI-generated podcast) is useful to you. If it is, we’ll extend the experiment in December.

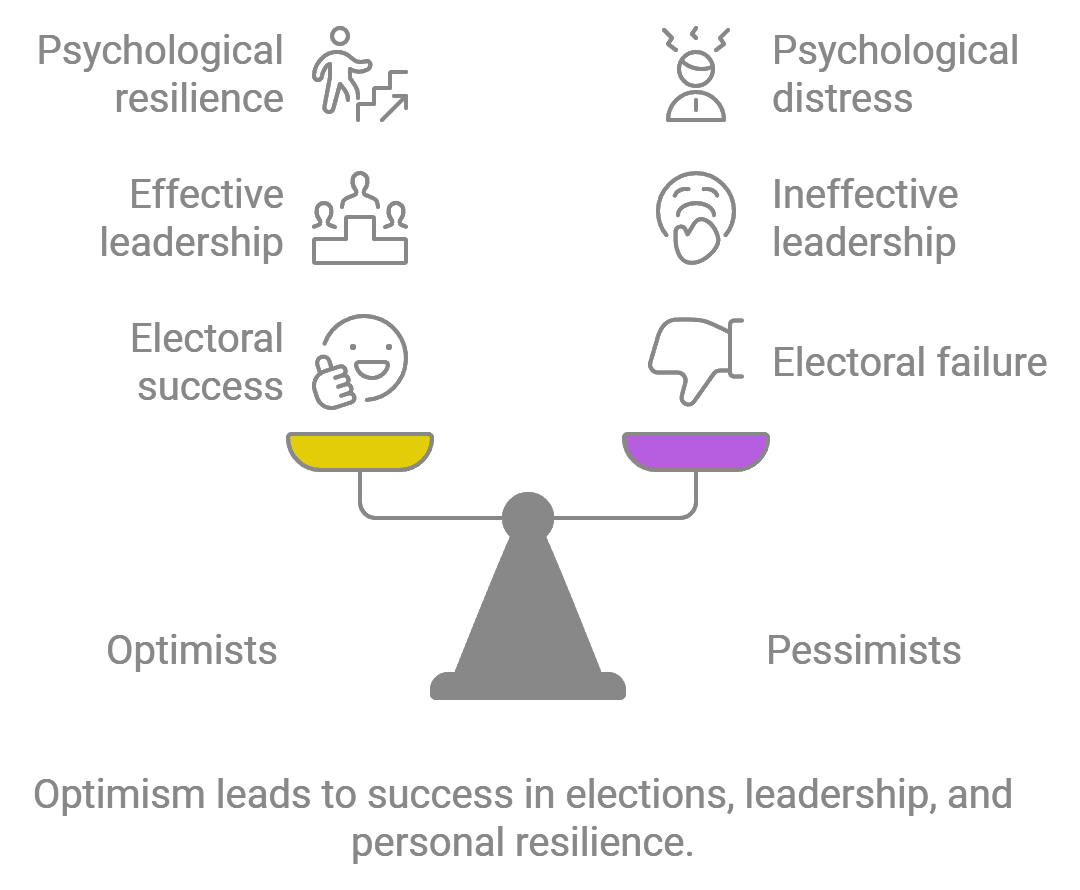

I recently published an article on LinkedIn about the relationship between optimism and success. It’s titled “Rallying Hope Against Dark Words: America’s 2024 Optimism Test.” It draws on a bunch of scholarly research to establish four points:

- Historically, optimists win elections. Roughly 90% of the time in US presidential elections.

- Historically, presidents speak far more optimistically than the rest of us. Whether they personally feel optimistic, they’ve seen a call to “the better angels of our nature” critical to their ability to rally Americans to face, address, and overcome challenges.

- Historically, our preference for optimism is rooted in “American exceptionalism.” Simply put, “American exceptionalism” is the notion that we’re not “just another country, like the rest.” Optimistic exceptional rhetoric peaks in presidential election years, when candidates for national office speak about the aspirations of the nation.

- Optimism works, pessimism fails. Challenges are universal. In the face of them, pessimists find enemies, optimists find opportunities. The psychological research on the effects of optimism is stunning.

My LinkedIn article concludes by asking, given the historical and psychological patterns, why the 2024 election polls don’t reflect a landslide for the optimistic candidate. A short discussion of fearmongering as a profit center for news and social media follows.

Here’s what Napkin.AI thinks that looks like:

And here’s what Notebook LM thinks that sounds like as a podcast about optimism and success. I hope you find it engaging and useful, if slightly weird. Two notes: (1) you appear to need a Google/Gmail account to use the service and (2) you may hit the message “you’re not allowed in.” If so, simply open a private browser tab and you will be allowed in.

Let us know – by email or by a note on the discussion board – whether you find the podcast format interesting enough that we should share the podcast version of one story each month. If it helps you, we’ll make it happen!

Curb Your Enthusiasm

In “The Charts that Scare Wall Street,” Bloomberg’s Emily Graffeo and Vildana Hajric offer insiders’ concerns about “sky-high stock valuations, super-concentrated markets, and the US government’s enormous interest bill.” On the former, they quote Emily Roland, co-chief investment strategist for John Hancock as saying, “We are at the third-highest valuations on the S&P 500 in modern history only behind 1999/2000 and 2021. If this valuation upside continues, it leaves forward-looking returns less compelling.” With the S&P 500 up 35% in the past twelve months, regular investors seem not to be pulling back.

Corporate insiders, on the other hand, have been reluctant to snap up shares of their own companies. Of all US companies with a transaction by an officer or director in July, only 15.7% reported net buying of company shares … which was the lowest level in 10 years. (“Corporate Insiders Sit Out Stock Rally,” WSJ, 10/7/2024, p 1)

The number ticked up in August and down in September, remaining below its average. As a concern, it’s complemented by Mr. Buffett’s decision to build cash, and the decisions of Mr. Bezos and Mr. Zuckerberg to sell unusually large slices of their companies’ stock. The Journal quotes Nejat Seyhun of the University of Michigan as saying, “Insider trading is a very strong predictor of aggregate future stock returns.”

Which might or might not be auspicious for the launch of Tweedy, Browne’s first-ever ETF. Tweedy, Browne is a 104-year-old value-oriented investor with $8.6 billion under management. Of that amount, $1.6 billion are insider investments made by the managers, directors, employers and their families (as of June 30, 2024). Tweedy has filed to launch, likely in the next 30 days, an actively managed ETF: Tweedy, Browne Insider + Value ETF (COPY). The fund targets U.S. and non-U.S. companies that Tweedy, Browne believes are undervalued and where the company’s “insiders” have been actively purchasing the company’s equity securities and/or the company is conducting opportunistic share buybacks. The investment process is largely quantitative and decision-rule-based.

Which might or might not be auspicious for the launch of Tweedy, Browne’s first-ever ETF. Tweedy, Browne is a 104-year-old value-oriented investor with $8.6 billion under management. Of that amount, $1.6 billion are insider investments made by the managers, directors, employers and their families (as of June 30, 2024). Tweedy has filed to launch, likely in the next 30 days, an actively managed ETF: Tweedy, Browne Insider + Value ETF (COPY). The fund targets U.S. and non-U.S. companies that Tweedy, Browne believes are undervalued and where the company’s “insiders” have been actively purchasing the company’s equity securities and/or the company is conducting opportunistic share buybacks. The investment process is largely quantitative and decision-rule-based.

We’ll follow them for you.

In Memoriam, Jim Oelschlager (1942‐2024)

James D. Oelschlager, a titan of the investment world and a beacon of resilience, passed away peacefully at his home in Bath on September 29, 2024, at the age of 81. As the founder of Oak Associates and the mastermind behind the phenomenally successful White Oak Fund (1992-2024), Jim left an indelible mark on the financial industry during his 55-year career. Despite battling Multiple Sclerosis for over five decades, Jim’s unwavering optimism and indomitable spirit never faltered.

Mark Oelschlager, now manager of the very fine Towpath Focus Fund, shared two reflections about his dad’s life and times.

Jim grew up in Pittsburgh, attended Denison University in Ohio, earned a law degree from Northwestern, and worked in Chicago before landing a job as the portfolio manager of Firestone’s pension fund in Akron, despite having no experience. He proved to have an unbelievable knack for investing, and the fund flourished under his leadership. After 15 years there, and despite being diagnosed with MS, he left the security of Firestone and started Oak Associates, where he continued to generate strong returns for many years.

Jim was naturally optimistic and, unlike the doomsayers, always thought the world was getting better and would continue to get better, not worse. He saw the best in people, sometimes to a fault. His predisposition to positivity led to a willingness to take calculated risks, which was one of the factors in his success. If it isn’t optimism, Jim’s defining attribute may be his generosity. He was not born into wealth, but when he became financially successful later in life, he recognized his good fortune and used it to try to help as many people as possible. He gained attention for some of his large charitable gifts (he always declined to put his name on a building), but there were countless instances that nobody knew about of him privately helping those in need.

His professional acumen was matched only by his generosity and commitment to improving lives. Jim’s legacy extends far beyond the boardroom, encompassing educational scholarships, the establishment of the Oak Clinic, and substantial charitable contributions to Akron hospitals and Ohio universities through The Oelschlager Foundation. His life serves as a testament to the power of perseverance, innovation, and philanthropy. He is survived by his devoted wife, Vanita, his children, and grandchildren.

We celebrate Mr. Oelschlager’s rich life and wish his family peace.

Thanks, as ever

To David Moran, talented editor, a long-time contributor to the Discussion Board, and now … quote investigator. At the beginning of our October issue, I shared a quote with a half-apology. I’m fastidious about not using “quotes from the Internet,” a famously unreliable source in which mistakes and misattributions struggle for preeminence. My epigram and half-apology:

So, celebrate, while we can, “Autumn…the year’s last, loveliest smile.”

(The phrase is often attributed to the poet William Cullen Bryant (1794-1898) though I can’t for the life of me find it in the original.)

David could, and promptly did: “The ‘loveliest smile’ phrase appears in a poem by WC’s brother John H Bryant,” with a direct link to “The Indian Summer.”

The year’s last, loveliest smile,

Thou com’st to fill with hope the human heart,

And strengthen it to bear the storms awhile,

Till winter’s frowns depart.

Thanks, good sir! The past has been updated to reflect the present, which is to say Chip edited the intro to the October issue.

For those interested in the larger challenge of unreliable quotes on the internet, drop by The Quote Investigator for the story of “Buy land, they’re not making it anymore” and other tales.

To Melissa Hancock and her legal team at Schnell + Hancock, PC, for stopping an extortion attempt dead in its tracks. Shortly after we published October, we began getting threatening letters from a sort-of law firm representing an internet copyright troll. The business model is simple: the troll launched a reverse-image search bot to crawl the web 24/7, looking for images that might be used without a license. The law firm then sends threat letters, reportedly thousands a month, to site owners demanding money.

In MFO’s case, it was a thumbnail image at the end of a five-year-old guest essay which, as it turns out, wasn’t stolen and to which neither the troll nor the law firm had any demonstrable right. Nonetheless, in the absence of a cool and thoughtful team, a lot of folks simply give in and write a check to make the threat go away. In a “millions for defense, but not a cent for tribute” (Robert Goodloe Harper, if you care. I checked) sort of way, we asked Melissa to address the threats. She did and now they’re being very, very quiet. We’re grateful.

To our faithful “subscribers,” Wilson, S&F Investment Advisors, Gregory, William, William, Stephen, Brian, David, and Doug, thanks!

And to Craig from Knoxville and Rae of Ohio, thanks for the support and the kind notes. (Augie just lost to Illinois Wesleyan. (sigh)) Thanks also, to John from Pensacola!

To the 800,000 poll workers who toil long hours for negligible pay, and who are approaching the 2024 election with elevated anxiety. Thank you. In a literal sense, without you, the American democracy would not work. Thank you. You matter in the work that you do and the example that you set.

One last reminder, gentle reader: Vote. Our civic obligations do not end with voting, but they surely begin there. Vote, knowing that you matter. Vote, knowing that the children are watching. Vote, proudly.

With good thoughts for us all,