I recently did a YouTube video talking about the types of insurance one should consider getting in their 20s. And as much as I wish insurance could be a one-time effort, the truth is that your insurance needs will change as you move through the different stages of your life.

The function of insurance is to protect against large financial risks – especially those that could wipe out your savings or even land you into debt overnight. This is a fundamental money habit outlined even in the POSB Money Habits guide.

The POSB Money Habits teaches you how to inculcate 4 money habits – namely Save, Protect, Grow and Retire – in your financial journey.

Personally, I recommend reviewing your overall insurance needs every 2 – 3 years, or as and whenever your financial commitments change e.g. when you welcome a new baby or when you buy a new home, etc.

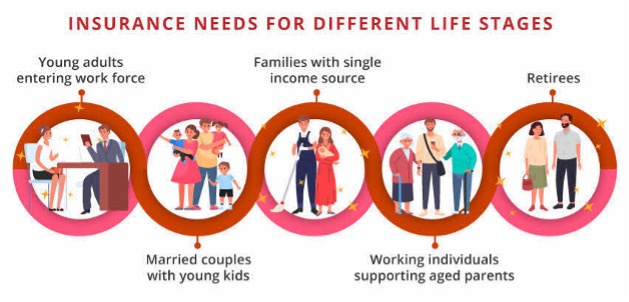

For those of you who aren’t quite sure how your insurance needs will evolve over your different life stages, here’s a quick rundown.

Young working adults

As you step into the workforce, hospitalisation insurance will probably be one of the first few insurance policies that you buy. With rising medical inflation, a single hospitalisation stay could easily set you back financially by several years if you have to dip into your own pockets to pay for the bill.

Getting health insurance is one of the most important steps you can take to build up your financial defences. While all Singaporeans and PRs are covered with the basic MediShield Life for B2/C wards in government hospitals, you may want to look at enhancing your coverage with an Integrated Shield Plan (IP) to have the option of choosing your own doctor and ward type, especially if you think you may wish to seek treatment in a private hospital in future.

Even if you’re lucky enough to have an employer that covers you under their group insurance plans, remember that you will lose the coverage once you leave the job. This was why I chose to get my own, and view any insurance coverage by my employer as a bonus instead.

With the generational shifts in cancer risks and more young people getting cancer in Singapore and around the world, critical illness insurance is fast becoming a necessity. While you’re still young and healthy, this is the best time to lock in your coverage without any pre-existing conditions holding you back.

Other plans to look at in your 20s would be personal accident insurance, disability income replacement and term life coverage.

The sandwiched generation

My husband and I got our HDB apartment a year after our first child was born. With a mortgage and a new dependent, our financial situation had now changed drastically and it prompted us to purchase more insurance coverage to cater to our (new) needs.

In our case, we increased our death coverage by layering on an additional term life plan and home insurance, and bought critical illness insurance for ourselves and our kids. Given that premiums are cheaper when we’re younger and still healthy, we also decided to add long-term disability plans to complement CareShield Life so that we don’t have to worry about becoming a financial burden to our kids as we get older.

How much insurance do you need? POSB experts recommend 9x annual income for Hospitalisation, Death & Total Permanent Disability coverage and 4x annual income for Critical Illness coverage. View more details here at the POSB Money Habits guide.

At this stage, it is important to plan for the financial security of your family and outsource your financial risks to an insurer in the event your livelihood is affected.

We did not buy whole life insurance for our kids because not only are the costs out of our budget, I’m also mindful that with inflation and rising costs of living, any life coverage we secure for them now will be insufficient for our kids in 2 – 3 decades anyway.

Being part of the sandwiched generation, we also felt it was crucial to ensure that both our elderly parents and young kids were all covered as well, especially for medical bills and critical illness conditions. Otherwise, relying on our savings would leave us in a precarious situation and affect our ability to become a caregiver for them if they need us.

“As a general guideline from POSB, spend no more than 15% of your take-home pay on insurance protection. However, bundled products (e.g. Whole life insurance) may exceed this cap as they contain both protection and investment elements.”

Retirees

The last stage that I’ve planned for is when we hit our retirement years.

As Singaporeans are living longer, I feel it is difficult to completely rely on our savings to cover our entire retirement years – especially in the event of any unexpected medical situations. Hence, I intend to use insurance to cushion the cost of treatment without having to dig into our retirement funds.

In about 20 years’ time, both of our kids should already be working and no longer need to rely on us financially, so our insurance needs will no longer be as high as they are during our 30s to 50s. And as the premiums for term life plans significantly increase after age 65, we intend to let go of these once our kids enter the workforce.

Hospitalisation insurance premiums have also risen significantly last month, with some double-digit increases by private insurers seen last month and even for the national MediShield Life scheme. I expect that these premiums will cost even higher by the time our white hairs start appearing and the expense could likely bust our budget then, so we intend to downgrade our coverage or remove our riders when that time comes.

Conclusion: Review your insurance needs regularly

As your life circumstances evolve – from entering the workforce to supporting a family and eventually entering retirement – your insurance coverage needs to match up so that you’ll always be well-protected against any of life’s unexpected events.

Instead of waiting for an insurance agent to prompt you, I recommend that you review your insurance policies every 2 – 3 years to ensure you have sufficient coverage even as your needs change over time and close up any gaps.

Check out what DBS and POSB has to say about insurance needs for different life stages here.

Remember, even though all of us should be saving regularly and putting aside some cash reserves for emergencies, you want to avoid a situation where your entire savings get wiped out because you failed to protect yourself against life’s largest financial risks with insurance.

Once your downside risks have been taken care of, you can focus on the other remaining money habits to get you closer to retirement. More importantly, you’ll be able to invest with a peace of mind without worrying about having to sell your assets prematurely or dip into your investment portfolio to pay for any major, unexpected bills.

The POSB Money Habits guide has these aptly summed up as Save, Protect, Grow and Retire.

Start your journey with the POSB Money Habits Tracker here and transform your finances!

Disclosure: This article is sponsored by POSB. All views and opinions expressed in this post are from SG Budget Babe.

Disclaimers:

The content here is for informational purposes only and should NOT be taken as legal, business, tax, or investment advice. It does NOT constitute an offer or solicitation to purchase any investment or a recommendation to buy or sell a security. In fact, the content is not directed to any investor or potential investor and may not be used to evaluate or make any investment. Do note that this is not financial advice. If you are in doubt as to the action you should take, please consult your stock broker or financial advisor.This advertisement has not been reviewed by the Monetary Authority of Singapore.